DNY59/iStock via Getty Images

Summit Midstream Partners, LP (NYSE:SMLP) has struggled as it’s back to a market capitalization of just over $160 million. However, despite that weakness, the company still has an impressive portfolio of assets and continues to move forward on consolidating its debt. That strength will result in substantial shareholder returns.

Summit Midstream Partners’ 2Q 2022 Results

Summit Midstream Partners had reasonable 2Q 2022 results in relation to the company’s guidance. The company earned just under $51 million in adjusted EBITDA with just under $26 million in DCF. The company sold Double E related gathering assets for roughly $75 million, and managed to reduce total debt by $82 million with more than $250 million in new liquidity.

Those are incredibly strong financial results for a company with just over $160 million in market cap, but there’s also a lot baked into those numbers financially. It’s also worth noting that the majority of that $51 million to $26 million conversion is the interest expenditures. The company’s interest expenditures cost it almost $90 million annualized.

Summit Midstream Partners’ Asset Base

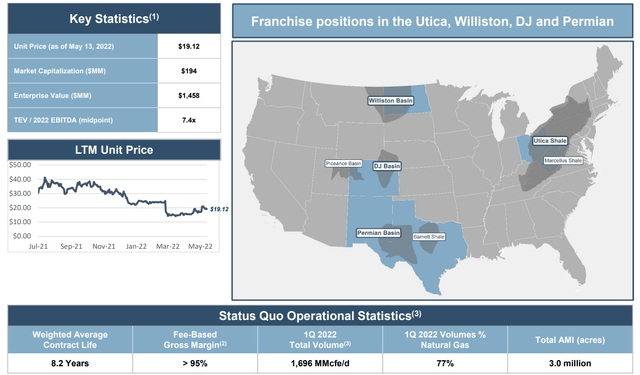

The company has a strong portfolio of assets well distributed.

Summit Midstream Partners Investor Presentation

The company’s enterprise value of roughly $1.5 billion is supported by roughly $1.25 billion in total debt. The company’s assets are spread across a number of major basins in the United States, with a number of the company’s strongest volumes in the northeast. The company has strong gross margins with a >8 year average contracted life.

The company’s gathering & processing assets have numerous customers. The company’s volumes are 77% natural gas, meaning it’s much more dependent on local natural gas demand versus oil. We expect that to help protect the company for the long-term. The company has a total AMI of 3 million acres, with many in heavily producing areas.

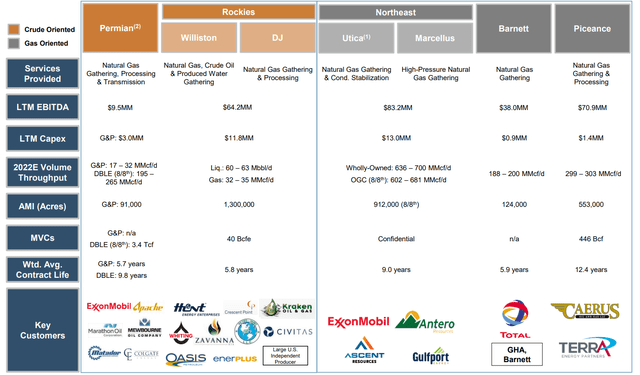

Summit Midstream Partners Investor Presentation

The breakdown of the company’s assets is visible above. The largest source of the company’s strength is in the Northeast where the company’s LTM EBITDA was more than $83 million with a 9 year weighted average contract life. The company’s assets across the boards are contracted to numerous companies with high single-digit years of contract life.

Across the board, the company’s volumes have remained strong and partially recovered, but the company continues to earn roughly $32 million annualized from MVCs, meaning that its customers still aren’t where the company expects them to be.

Summit Midstream Partners’ Growth Potential

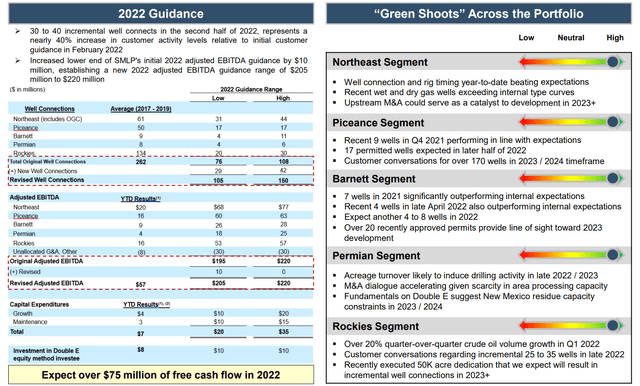

The company has substantial growth potential from recovery in the volumes.

Summit Midstream Partners Investor Presentation

The company’s growth potential is based on increasing utilization of the company’s assets. The company has 38% of its total volume capability utilized and out of 3700 MMcfe / day in spare capacity, 2300 MMcfe / day can be utilized with very minimal incremental costs proportional to the company’s activity.

The company expects roughly 35 incremental well interconnects in 2H 2022, or a roughly 40% increase relative to the start of 2022 guidance. With a strong forward pricing estimate, the company expects at least 200 interconnects in 2023. As a result, the company is guiding for at least 10% YoY EBITDA growth.

As long as pricing remains strong, and we do expect a recovery from COVID-19 levels, and demand for natural gas continues, which we also expect, we see strong demand for the company’s assets. In many areas, the company’s JVs are strong companies such as XTO Energy, however, we expect volumes to remain strong.

Summit Midstream Partners’ Financials

At the end of the day, the important thing worth paying attention to is the company’s financials.

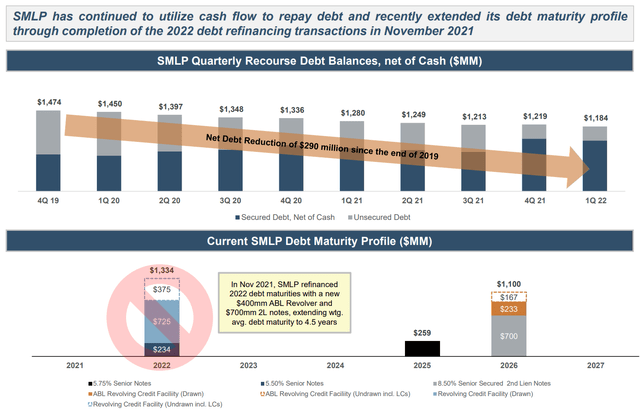

Summit Midstream Partners Investor Presentation

The company has managed to aggressively reduce its net debt, especially supported by discounts to the debt. At the same time, the company has managed to improve its overall financial profile. Those improvements have resulted in a new capital stack for the company for the next 3 years, until it needs to refinance again.

The first is 5.75% senior notes with $259 million due 2025. There’s also $700 million of 8.5% senior secured 2nd lien notes and there’s $233 million in a revolver at Libor +3.25% which has gone from a ~3.3% coupon to ~5.5% coupon. That increase means $5 million in new interest payments for the company, which is disappointing to see.

The Path Forward

The path forward for the company is to solve its debt. It’s the companies hardest task and one that will take years to accomplish. However, the rewards could be significant. Even on an enterprise value basis, the company is undervalued versus peers, and even if the enterprise value doesn’t improve the company could become a 10-bagger.

The company’s 2022 forecast is roughly $100 million in DCF. Going into 2023, growing EBITDA without growing interest could help that number move towards $125 million. At the end of the day all that matters is volume, but we’d like to see that number comfortably remain above $100 million for the company’s future.

The biggest thing for the company to accomplish are to paydown its debt. Exponential debt paydown will save on interest. The company’s annual interest payments currently cost it almost $90 million. For 2023-2025 the company can paydown roughly $350 million of that 8.5% debt, maybe as much as $400 million if it uses the revolver and saves on interest as a result.

That could take the company’s debt at the next refinancing towards $800 million. The company has a lot of volatility in its future, but if the markets remain moderately strong going into the late 2020s, we comfortably see the potential for the company to generate peer-leading returns, highlighting how it’s a valuable investment.

Thesis Risk

The largest risk to our thesis is interest rates. The company has almost $1.2 billion in debt and it will need to refinance again in a few years. At that point it will be susceptible to interest rates and the oil markets again, which could hurt its ability to refinance. That risk could hurt Summit Midstream Partners substantially and potentially bring bankruptcy back to the table.

Summit Midstream Partners is one of the few companies where a moderate downturn in the mid-2020s or late-2020s (as MVCs expire) could easily drive it to bankruptcy.

Conclusion

Summit Midstream Partners has an incredibly strong portfolio of assets. The company continues to struggle with low utilization rates although, optimistically, it looks like volumes are increasing. A record number of wells are expected to be drilled in 2023, the highest number since what was seen in 2019.

The company’s largest risk is debt. Specifically, the company is susceptible to the state of the markets in ~2025 and ~2030. Regardless of how effectively the company spends its cash flow, it can’t avoid that. However, if the markets maintain their moderate performance, we expect the company can become a ten-bagger making the risk-reward worth it.

Management has comfortably proved over the last several years that it’s worth giving them that shot.

Be the first to comment