damedeeso

Foreword

This article is based on five Kiplinger investing articles aimed at finding ‘the best’:

The 15 Best Stocks For the Rest of 2022

The lesson of the past two years: Be ready for anything. Our 15 best stocks to buy for the rest of 2022 reflect several possible outcomes for the second half of this tumultuous year. By: Charles Lewis Sizemore, CFA, June 21, 2022

The 15 Best Value Stocks to Buy Now

A roller-coaster 2022 has sent a lot of deserving names into bargain territory. Here are 15 top-rated value stocks to buy at the moment. By: Jeff Reeves, April 26, 2022

12 of the Best Stocks You Haven’t Heard Of

The market is peppered with undiscovered gems boasting stable fundamentals and cheap valuations. Here are 12 of the best stocks flying under the radar. By: Lisa Springer, November 2, 2021

10 Best Stocks for Rising Interest Rates

The Federal Reserve has signaled in no uncertain terms that interest rates will head higher in 2022. Here are 10 of the best stocks for this environment. By: Jeff Reeves, April 4, 2022

Four Cool Stocks for Dividends, Defense and Inflation Protection

Soft drink equities could be a great place to hide out amid heightened market volatility and rapidly rising prices. By: Dan Burrows, March 21, 2022

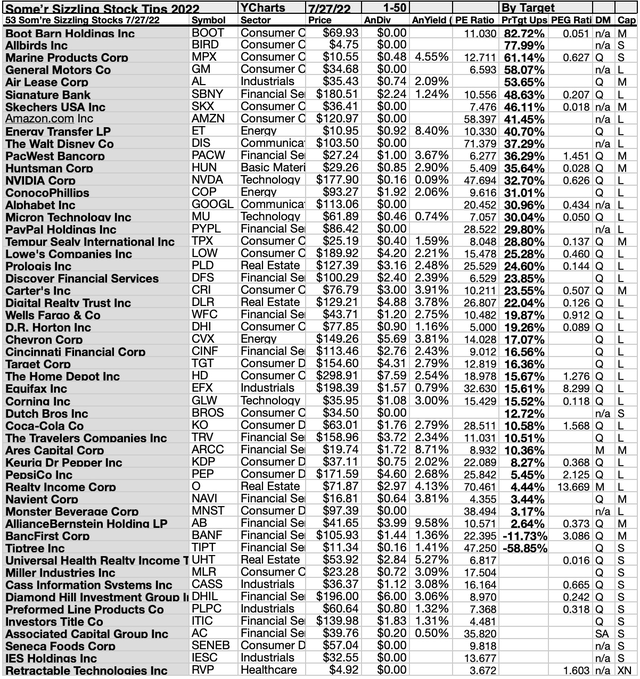

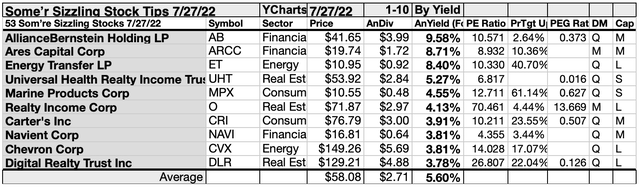

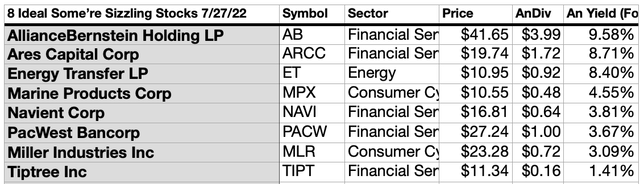

Any collection of stocks is more clearly understood when subjected to this yield-based (dog catcher) analysis, these five Kiplinger articles projecting ‘best’ reliable dividend stocks for investors are perfect for the dogcatcher process. Here is the July 27 data for 40 dividend paying stocks of 53 screened and the 8 living up to the dogcatcher ‘ideal’ in this Kiplinger collection. (Last month there were nine in the ‘ideal’ zone. Hence, the cooling reference in the headline.)

The Ides of March 2020 plunge in the stock market took its toll on stocks over two years and four months ago. However, a continued escalation in prices for these forty dividend stocks made the possibility of owning productive dividend shares from this collection more remote for first-time investors.

July 2022 shows a glimmer of light from eight stocks emerging as dogcatcher ideal candidates. They are: AllianceBernstein Holding LP (AB); Ares Capital Corp (ARCC); Energy Transfer LP (ET); Marine Products Corp (MPX); Navient Corp (NAVI); PacWest Bancorp (PACW); Miller Industries Inc (MLR); Tiptree Inc (TIPT). Their prices settled at between $3 and $74 below the annual dividend payout from a $1K investment.

(The author regards that ideal – price coming in lower than the dividends paid from $1k invested – condition as a “look closer to maybe buy for dividends,” signal.) Last month Huntsman Corp (HUN) was included as ideal, this month HUN is $0.26 too pricey to make the list. Another close call is Universal Health Realty Income Trust (UHT) which is $0.62 too high in price to make the grade at this time.

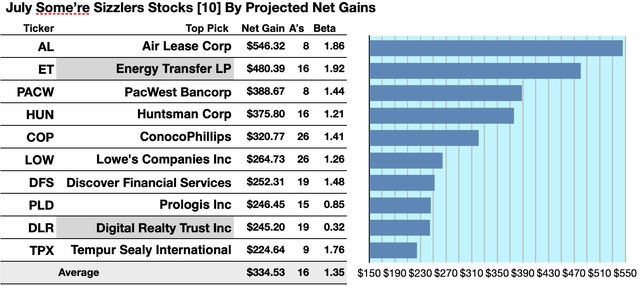

Actionable Conclusions (1-10): Brokers Estimated Top-Ten Kiplinger Some’re Sizzlers Dividend Stocks Could Net 22.46% to 54.63% Gains By July 2023

Two of the tops-by-yield Kiplinger Some’re Sizzlers Stocks (tinted in the chart below) were also the top gainers for the coming year based on analyst 1-year targets. Thus, the top yield dog strategy for this group, as graded by analyst estimates for this month, proved 20% accurate.

Estimated dividend-returns from $1000 invested in each of the highest-yielding stocks and their aggregate one-year analyst median-target prices, as reported by YCharts, created the 2022-23 data points. However, one year target-prices by lone analysts were not counted. The resulting ten probable best profit-generating Some’re Sizzlers Stocks projected to July 27, 2023, by that reckoning, were:

Air Lease Corp (AL) netted $546.32 based on estimates from eight analysts, plus dividends less broker fees. The Beta number showed this estimate subject to risk/volatility 86% greater than the market as a whole.

Energy Transfer LP (ET) netted $480.39 based on the median of target estimates from eighteen analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 92% greater than the market as a whole.

PacWest Bancorp (PACW) netted $388.67 based on the median of target price estimates from eight analysts plus dividends less broker fees. The Beta number showed this estimate subject to risk/volatility 44% more than the market as a whole.

Huntsman Corp netted $375.80 based on dividends plus a median target price estimate from sixteen analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 21% more than the market as a whole.

ConocoPhillips (COP) net $320.77 based on the median of target estimates from twenty-six analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 41% greater than the market as a whole.

Lowe’s Companies Inc (LOW) netted $264.73 based on the median of target prices estimated by twenty-six analysts, plus estimated dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 26% greater than the market as a whole.

Discover Financial Services (DFS) netted $252.31 based on estimates from nineteen analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 48% greater than the market as a whole.

Prologis Inc (PLD) netted $246.45 based on the median of target estimates from fifteen analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 15% less than the market as a whole.

Digital Realty Trust (DLR) netted $245.20 based on the median of target estimates from nine analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 68% less than the market as a whole.

Tempur Sealy International (TPX) netted $224.64 based on the median of target estimates from nine analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 76% greater than the market as a whole.

The average net-gain in dividend and price was 33.45% on $10k invested as $1k in each of these ten Kiplinger ‘safer’ Some’re Sizzler stocks. This gain estimate was subject to average risk/volatility 35% greater than the market as a whole.

The Dividend Dogs Rule

The “dog” moniker was earned by stocks exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. Thus, the highest yielding stocks in any collection became known as “dogs.” More specifically, these are, in fact, best called, “underdogs”.

Top 50 Some’re Sizzlers Dividend Stock Picks By Broker Targets

This scale of broker-estimated upside (or downside) for stock prices provides a scale of market popularity. Note: no broker coverage or 1 broker coverage produced a zero score on the above scale. This scale can be taken as an emotional component as opposed to the strictly monetary and objective dividend/price yield-driven report below. As noted above, these scores may also be taken as contrarian.

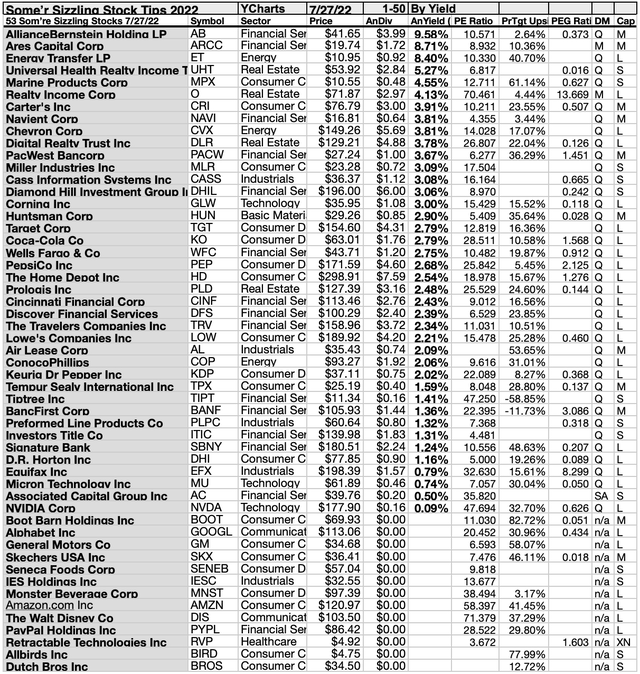

Top 50 Some’re Sizzlers Dividend Stock Picks By Yield

Actionable Conclusions (11-20): Ten Top Stocks By Yield Are The July Dogs of Some’re Sizzlers Dividend Pack

Top ten Some’re Sizzlers Dividend Stocks selected 7/27/22 by yield again represented just four of eleven Morningstar sectors. First place was secured by the first of three financial services representatives, Alliance Bernstein Holding LP [1]. The other two placed second, and eighth, Ares Capital Corp [2], and Navient Corp [8].

Two energy representatives placed third and ninth, Energy Transfer LP [3], and Chevron Corp (CVX) [9].

Three real estate members placed fourth, seventh, and tenth: Universal Health Realty Income Trust [4], Realty Income Corp (O) [7], and Digital Realty Trust Inc [10].

Finally, two consumer cyclical representatives placed fifth, and seventh: Marine Products Corp [5], and Carter’s Inc (CRI) [7], to complete this Some’re Sizzlers Dividend Stock top ten, by yield, for July.

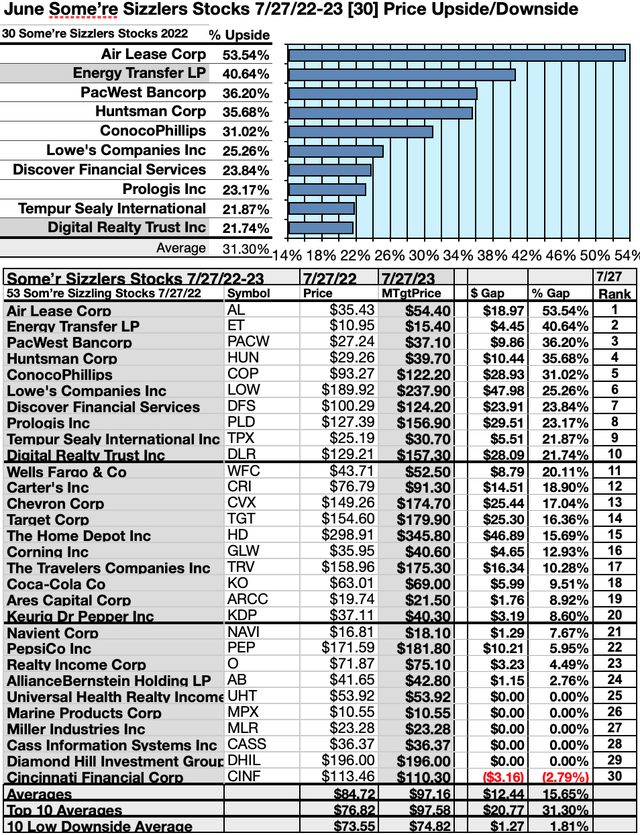

Actionable Conclusions: (21-30) Ten Some’re Sizzlers Dividend Stocks Showed 21.74% To 53.54% Upsides To July 2023, With (31) One -2.79% Loser

To quantify top-yield rankings, analyst median-price target estimates provided a “market sentiment” gauge of upside potential. Added to the simple high-yield metrics, analyst median price target estimates became another tool to dig-out bargains.

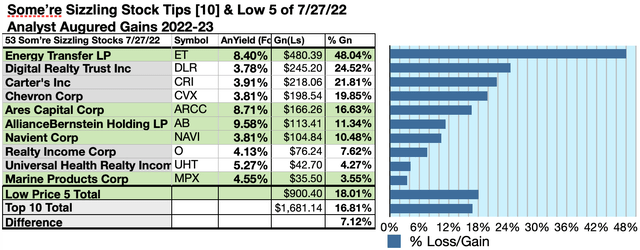

Analysts Estimated A 7.12% Advantage For 5 Highest Yield, Lowest Priced of Top-Ten Some’re Sizzlers Stocks To July 2023

Ten top Some’re Sizzlers Stocks were culled by yield for this monthly update. Yield (dividend/price) results verified by YCharts did the ranking.

As noted above, top-ten Some’re Sizzlers Dogs selected 7/27/22, showing the highest dividend yields, represented four of eleven sectors in the Morningstar scheme.

Actionable Conclusions: Analysts Estimated The 5 Lowest-Priced Of Ten Highest-Yield Some’re Sizzlers Dividend Stocks (33) Delivering 18.01% Vs. (34) 16.81% Net Gains by All Ten by July 2023

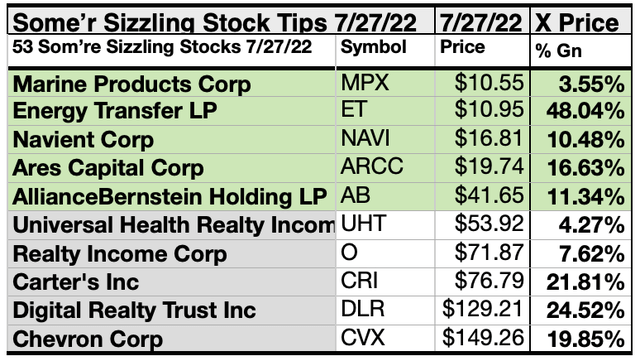

$5000 invested as $1k in each of the five lowest-priced stocks in the top ten Some’re Sizzlers dividend pack by yield were predicted by analyst 1-year targets to deliver 7.12% more gain than $5,000 invested as $.5k in all ten. The second lowest-priced Some’re Sizzlers top-yield stock, Energy Transfer LP, was projected to deliver the best net gain of 46.04%.

The five lowest-priced top-yield Some’re Sizzlers dividend stocks for July 27 were: Marine Products Corp; Energy transfer LP; Navient Corp; Ares Capital Corp; AllianceBernstein Holding LP, with prices ranging from $10.55 to $41.65

The five higher-priced top-yield Some’re Sizzlers dividend stocks for July 27 were: Universal Health Realty Income Trust; Realty Income Corp; Carter’s Inc; Digital Realty Trust Inc; Chevron Corp, whose prices ranged from $53.92 to $149.26.

This distinction between five low-priced dividend dogs and the general field of ten reflected Michael B. O’Higgins’ “basic method” for beating the Dow. The scale of projected gains based on analyst targets added a unique element of “market sentiment” gauging upside potential. It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Caution is advised, since analysts are historically only 20% to 90% accurate on the direction of change and just 0% to 15% accurate on the degree of change.

Afterword

If somehow you missed the suggestion of the eight stocks ripe for picking at the start of the article, here is a repeat of the list at the end:

In the current market advance, dividends from $1K invested in the eight stocks listed above met or exceeded their single share prices as of 7/27/22.

As we are four months past the second anniversary of the 2020 Ides of March dip, the time to snap up those eight top yield Some’re Sizzlers dogs is now… unless another big bearish drop in price looms ahead. (At which time your strategy would be to add to your holdings.)

To learn which of these eight ideally-priced opportunities are “safer” to buy (namely which have ready cash to pay their dividends). Use the last bullet in the Summary above to navigate to my dividend dogcatcher follow-up article after August 8 in the SA Marketplace.

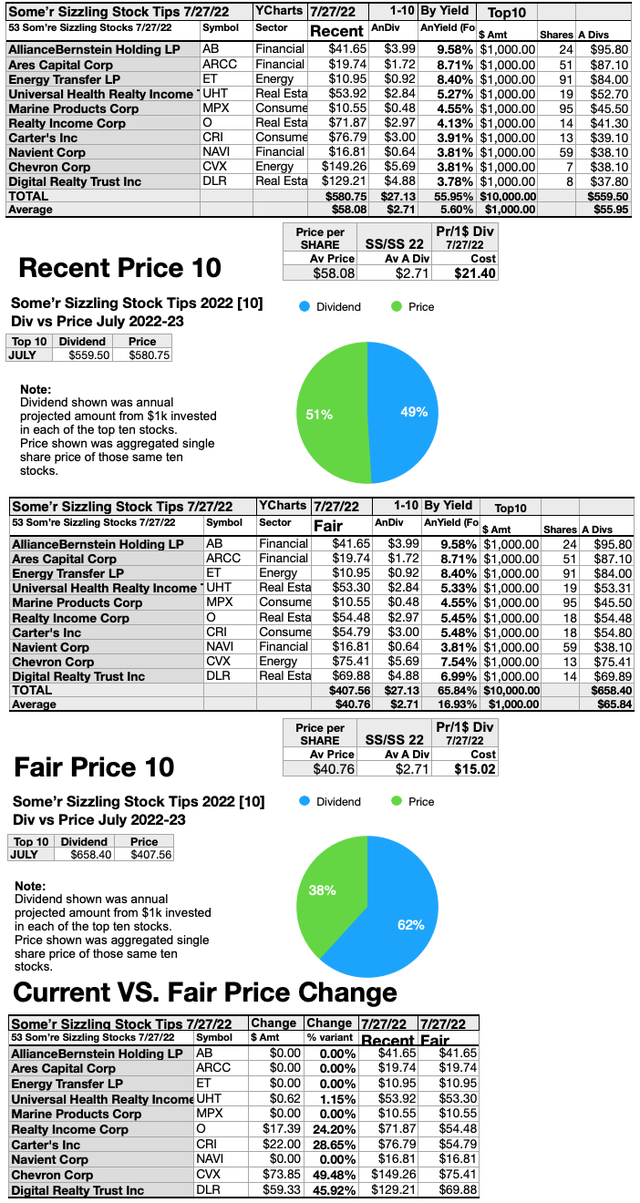

Recent vs Fair Top Ten Some’re Sizzlers Stock Prices

Since five of the top-ten Some’re Sizzlers Dividend shares are priced less than the annual dividends paid out from a $1K investment, the following charts compare the five at recent prices (top chart) with the break-even pricing of all ten (middle chart) concluding with the dollar and percent variants to all ten top dogs conforming to (but not exceeding) the dogcatcher ideal (bottom chart).

The bottom chart is an indicator of how low the five non-ideal stocks must adjust to become fair-priced. Which means conforming the standard of dividends from $1K invested exceeding the current single share price.

The net gain/loss estimates above did not factor in any foreign or domestic tax problems resulting from distributions. Consult your tax advisor regarding the source and consequences of “dividends” from any investment.

Stocks listed above were suggested only as possible reference points for your Some’re Sizzlers dog stock purchase or sale research process. These were not recommendations.

Graphs and charts were compiled by Rydlun & Co., LLC from data derived from www.indexArb.com; YCharts.com; finance.yahoo.com; analyst mean target price by YCharts.

Be the first to comment