Daria Nipot/iStock Editorial via Getty Images

It feels like decades since Amazon’s (AMZN) stock split, and that’s because it has. From 6/1/98 to 9/1/99, AMZN’s shares split three times, with a 2-1 split on 9/1/99 being the last time AMZN’s stock split. AMZN just announced very bullish news, in my opinion, that current and future shareholders should be excited about. AMZN has announced a 20-1 stock split subject to shareholder approval on May 25th and replacing a previous share buyback program with a $10 billion buyback authorization. Many thought AMZN would have announced a split during the 2021 Q4 earnings call, especially since Alphabet (NASDAQ:GOOG) (GOOGL) announced that they would be splitting their stock. It’s never too late, and shareholders just received a double dose of bullish news.

A stock split doesn’t make the company more valuable but it is bullish

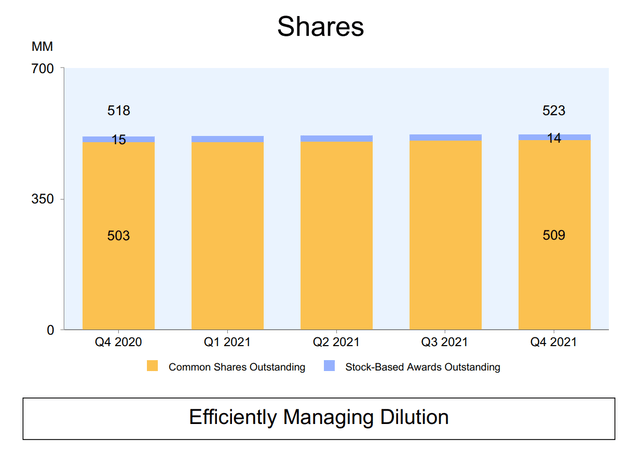

AMZN has 508.8 million shares outstanding as of their last filing date. AMZN doesn’t increase the value of its company by splitting their stock. Today shares closed at $2,785.58, placing their market cap at $1.42 trillion. If AMZN’s 20-1 split was to occur tonight, there would be 10.18 billion shares outstanding trading for $139.8 per share, representing a $1.42 trillion market cap. This also isn’t dilution as your shares would still represent the same percentage of equity in AMZN after the 20-1 split as they did prior to the split.

AMZN just announced the 20-1 split. AMZN’s annual meeting will be held on May 25th, 2021, where the 20-1 split will be voted on. If the shareholder base votes yes and this motion passes, then shareholders of record at the close on May 27th will be provided with 19 additional shares. If you own 1 share of AMZN, you will now have 20 shares, and if you own 10 shares, you will now have 200 shares. This will occur on or around June 3rd, and split-adjusted trading is expected to occur on June 6th.

There are different viewpoints on stock splits. Some people refer to Berkshire Hathaway (BRK.A) (NYSE:BRK.B) as an example of a stock that has never split and is now trading at $488,245 per share. The argument is that the market cap doesn’t change during a stock split, and if a company is going to increase in price, it will just continue to increase. I can’t argue this point because it’s correct. If I have a large pizza with 8 slices and cut them into halves, I now have 16 slices, but it’s the amount of pizza doesn’t change.

I love stock splits and wish companies would split their shares more frequently. If you look back at the 1990’s, it was the golden era of stock splits. AMZN split its shares 3 times, Intel Corp (INTC) split its shares 4 times in the 90s and once again in 2000, Cisco Systems (CSCO) split their shares 5 times in the 90s and again in 2000, and Microsoft (MSFT) split their shares 4 times in the 90s.

There are several reasons why stock splits are welcomed by shareholders and looked at favorably even though the initial value of the companies doesn’t change. Normally when a board of directors declares a stock split, it’s taken as a vote of confidence that its companies share value will continue to increase, which is a bullish indication. AMZN’s share price has reached a level where many investors can’t buy shares as $3,000 for a single share is out of many investor’s price ranges. Too many people look at the share price and not at percentages. A 50% gain is a 50% gain it doesn’t matter if a stock is $30 and goes to $45 or $3,000 and it goes to $4,500. More people would be inclined to purchase 100 shares of a $30 stock because they can acquire more shares instead of buying 1 share of a $3,000 stock. By AMZN splitting its shares 20-1 it makes its shares attractive to retail investors and new investors. With a $140 price tag, volume will increase, which will also increase AMZN’s liquidity in the market as more shares are being traded. Stock splits can also indicate a positive signal to rating agencies which could positively impact the share price.

I believe companies should split their shares, and Apple (NASDAQ:AAPL) is a perfect example. By AAPL continuously splitting its shares, it’s made the stock affordable, and buying multiple shares of AAPL instead of 1 share of AMZN may have been more attractive to investors. I own shares in both companies, but from a value proposition, I like that AAPL continues to split its shares and, since 2014, has done a 7-1 split and a 4-1 split. By keeping the share price affordable, investors are able to gain single stock exposure to their favorite companies instead of only owning them through an index or total market fund. I also believe that when stocks are affordable, they will see increased volumes, which will ultimately help price appreciation in the future. Today AMZN had 4.13 million shares traded while AAPL had 91.45 million shares traded. I think the split will have long-term positive effects on AMZN’s share price, and I am in favor of making shares affordable for the retail investor.

Amazon replacing its current buyback program with a larger buyback authorization is bullish for shareholders

As much as I love my dividends, buybacks are the best way for companies to reward their shareholders. In 2016 AMZN put a $5 billion share buyback program in place and had purchased $2.12 billion of shares from this allotment. The board has now authorized a repurchase of up to $10 billion and will elect to purchase shares opportunistically. Buybacks are great for two reasons. First, they increase your equity position, and second, they increase how much revenue and earnings per share your shares represent.

If you own 10 shares of a company that has 100 shares, you’re a 10% owner. If the company buys back 20 shares, there are now 80 shares outstanding. You’re 10 shares now represent 12.5% of the equity in the company. Buybacks are extremely bullish because they make your shares more valuable as you own more equity in the company and your shares carry more weight when it comes to voting. From a financial metrics perspective, if the company was generating $500 in sales and $200 in earnings, your shares prior to the buyback would have accounted for $5 of revenue per share and $2 of earnings per share. After the buyback, since there are 80 shares instead of 100, each share would account for $6.25 in revenue per share and $2.50 in earnings per share. Buybacks can help companies manufacture earnings to a degree because, in addition to growing their corporate earnings organically, buybacks can add an additional boost and help widen the margin of an earnings beat.

Buybacks are also the most significant bullish indicator in my opinion, because it’s a sign that the company believes shares are undervalued and represent a good investment. Corporations have several options when they look at allocating free cash flow (FCF). FCF can be used to pay down debt, make acquisitions, pay a dividend, or buy back shares. This is a signal that AMZN feels this $10 billion would be better invested in buying back shares than paying down its debt, allocating it toward an acquisition, or making a strategic investment. AMZN’s management clearly sees value in its shares.

Regardless of Amazon’s stock split and buyback I still believe it’s a great investment as Amazon will probably be the first trillion-dollar revenue company

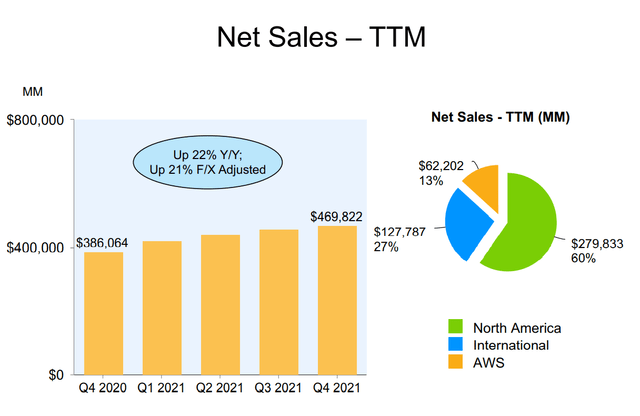

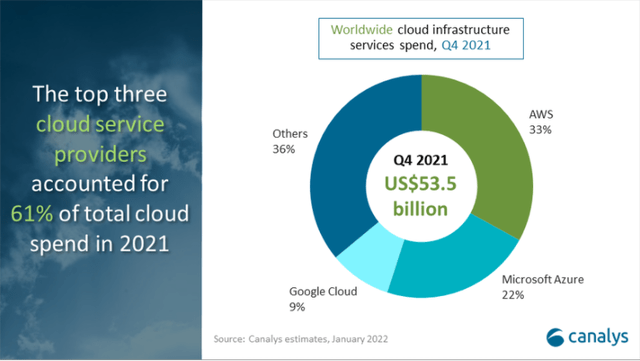

AMZN operates in two of the quickest growing sectors, Cloud infrastructure services, and e-Commerce. While these sectors aren’t new, their future growth has a long runway ahead of them. For the first time worldwide, cloud infrastructure services expenditures exceeded $50 billion in a single quarter in Q4 of 2021. The new spending record in Q4 2021 reached $53.5 billion, growing YoY by $13.6 billion (34%). In 2021, the total cloud infrastructure services spend increased by $49.7 billion to $191.7 billion globally. While Q4 set records and grew 34% YoY, cloud infrastructure services expenditures grew 35% YoY. The global cloud computing market is expected to reach USD 1,554.94 billion by 2030, registering a CAGR of 15.7%, according to a new study conducted by Grand View Research, Inc. In Q4 2021, AMZN’s AWS captured 33% of the global cloud infrastructure spend.

Over the past 4 fiscal years, AWS has grown by 256.3%, adding $44.74 billion in revenue to this business segment. In 2018 AWS generated an additional $8.24 billion in revenue and grew at a 47.2% YoY rate. AWS is still growing at large multiples three years later as AMZN delivered $23.39 billion in additional revenue at a 37.01% growth rate YoY. AWS has the potential to become a $100 billion business segment in 2024 if it just grows at a 20% YoY growth rate. Over the next 8 years, the worldwide cloud infrastructure spend is expected to increase to $1.55 trillion. AMZN currently has 33% of this market. If AMZN can maintain 20% of the market during its expansion AWS would be a $310.99 billion revenue segment in 2030. If AWS maintains its 33% market penetration, it will become a $513.13 billion revenue segment which would be $43.31 billion more revenue than the entire company generated in 2021.

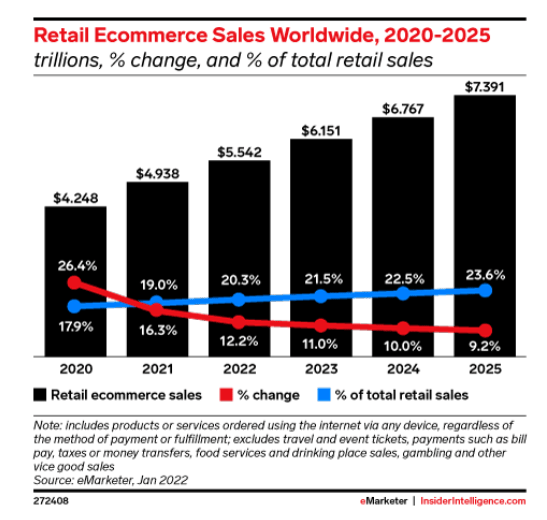

In 2022, e-commerce is expected to break the 20% barrier of total retail sales for the first time. In 2024, e-commerce is expected to only generate 22.5% of total retail sales. Over the next 4 years, e-commerce is expected to grow by $2.35 trillion or 49.67%. In 2022, e-commerce is projected to grow by $604 billion or 12.23%, then by $609 billion in 2023 (10.99%), $616 billion (10.1%) in 2024 and by another $624 billion (9.22%) in 2025. It’s not just e-commerce that will grow. Retail sales, in general, will grow from $26.03 trillion to $31.27 trillion over the next 4 years as well. In 2021 AMZN’s North American sales revenue increased by $43.53 billion YoY as it generated $279.83 billion. Internationally, AMZN’s revenue grew $23.39 billion as it generated $127.79 billion.

Amazon insiderintelligence.com

By 2025 e-commerce sales are expected to increase by $2.35 trillion or 49.67%. AMZN continues to see increased growth YoY, and this isn’t projected to stop. If AMZN can grab 10% of the growth, it would be an additional $235 billion of annual revenue. The scary part is that e-commerce isn’t expected to break 1/4th of total retail sales in 2025, which leaves much organic growth well into the future.

Conclusion

AMZN dominates two of the fastest-growing sectors and is projected to continue its future growth. I see a path to AMZN becoming the first trillion-dollar revenue company. The news about AMZN’s share split of 20-1 and $10 billion buyback makes me even more bullish than I was after Q4 2021 earnings. Splitting the shares will make shares more attractive for retail investors, increase volumes and add liquidity to shares of AMZN. The buyback signals bullishness from management as they see value in the current levels at which AMZN trades. As a shareholder, I am excited about the news and believe that this may be the firepower needed to have AMZN breakout sometime in 2022 out of its consolidating phase.

Be the first to comment