Arthit Pornpikanet/iStock via Getty Images

A Quandary

I find myself in a quandary with respect to my Sturm, Ruger & Company (NYSE:RGR) shares. Although uncommon for my preferred investment style of staying long, I have traded small positions in RGR shares over the last couple years, buying back into the stock earlier this year when shares were trading in the mid-to-high $60s.

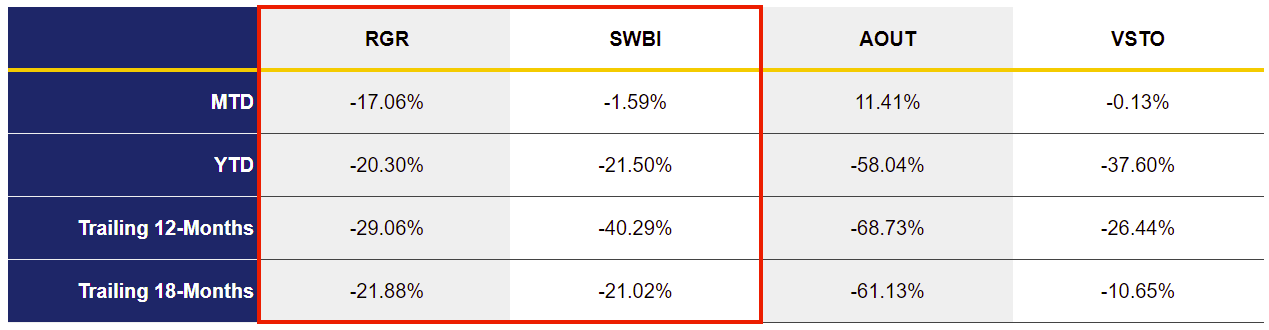

I don’t have to tell readers that this has not been (so far) a good year for firearms manufacturers.

Figure 1: RGR and Selected Competitor Performance (Yves Sukhu)

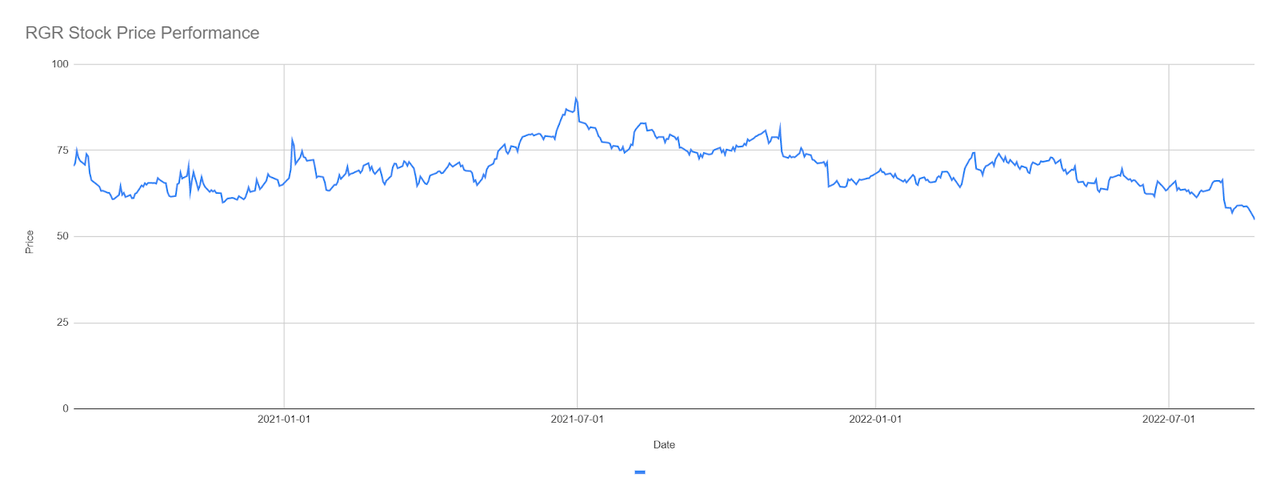

Figure 2: RGR Stock Price Performance (Yves Sukhu)

Notes:

-

Data in Figures 1 and 2 as of market close August 23, 2022.

A Volatile FY ’22

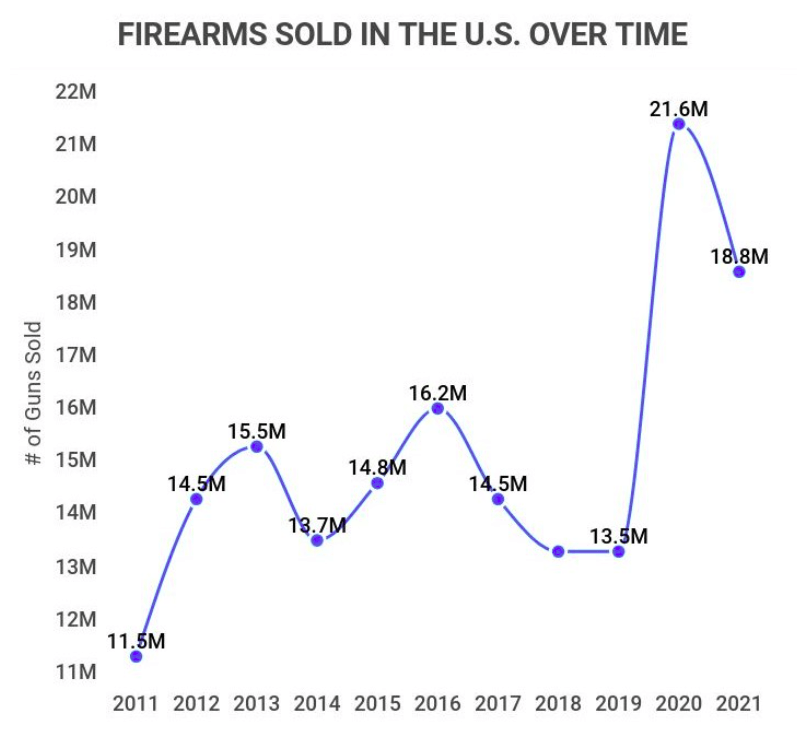

Investors in the firearms industry are, of course, subject to a great deal of volatility given the cyclic nature of gun sales in the United States.

Figure 3: United States Gun Market By Volume 2011 – 2021 (Zippia)

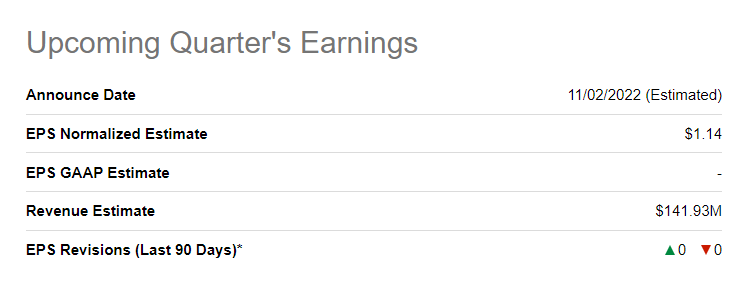

With RGR lapping a particularly strong FY ’21, FY ’22 sales and EPS are expected to be soft, with a similar dynamic likely playing out in FY ’23 as well. The revenue estimate of $141.9M for Q3 FY ’22 would represent a ~(20%) decline versus the $178.2M recorded in the prior period.

Figure 4: RGR Upcoming Quarter’s Earnings (Seeking Alpha)

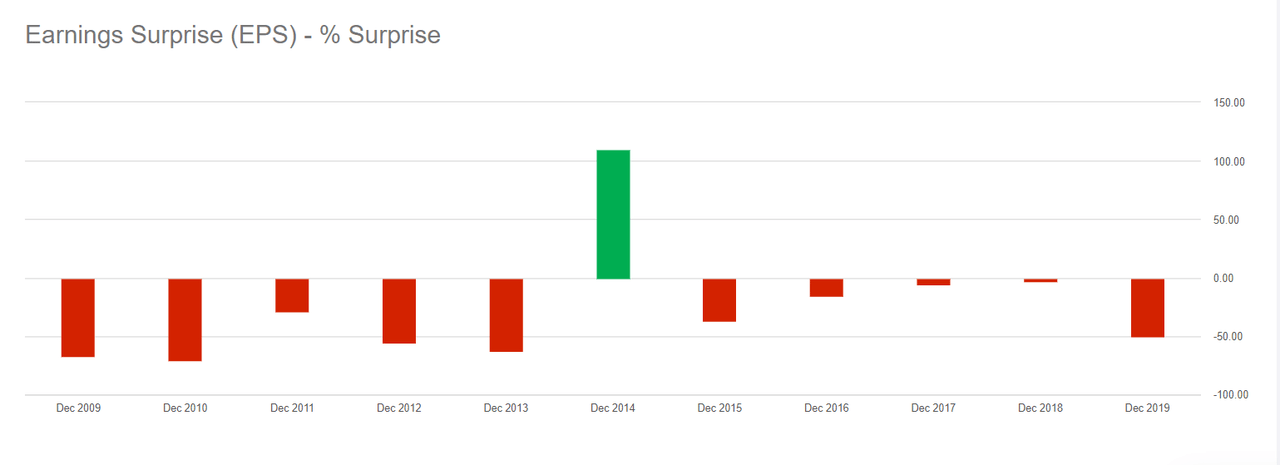

EPS is similarly expected to decrease significantly in the same period versus diluted GAAP earnings of $1.98/share in Q3 FY ’21, noting also that the firm has a lousy earnings surprise history.

Figure 5: RGR Earnings Surprise History (Seeking Alpha)

At this point, it is difficult to imagine shares climbing back above $68/share in FY ’22, the general price level at which shares closed on January, 3, 2022 to start the current fiscal year.

But Still Sturm, Ruger & Company Is A Solid Business

Despite the awful share performance thus far for FY ’22, investors should not lose sight of the fact that RGR is an excellent business characterized by:

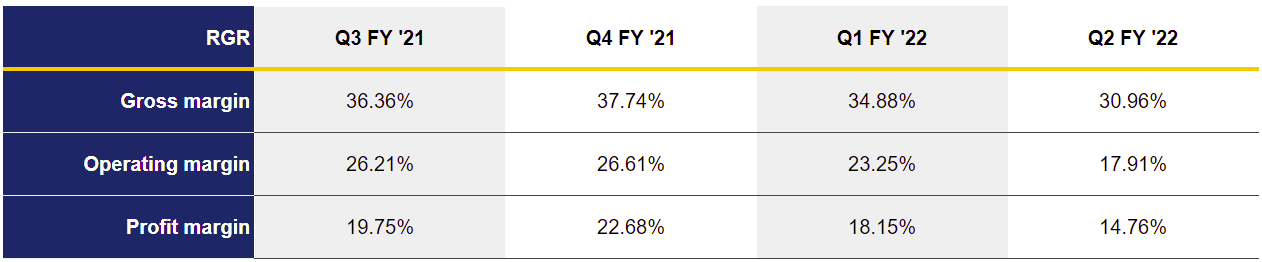

1. Margin strength

Management explains that “… profitability declined in the second quarter of 2022 from the second quarter of 2021 as… gross margin decreased from 39% to 31%. In addition to unfavorable deleveraging of fixed costs resulting from decreased production and sales, inflationary cost increases in materials, commodities, services, energy, fuel and transportation, partially offset by increased pricing, resulted in the lower margin.”

Still, RGR, whose management, past and present, is arguably distinguished by a financial discipline somewhat rare among modern leadership teams, maintains a record of consistent profitability.

Figure 6: RGR Margin Profile Over Last 4 Quarters Q3 FY ’21 – Q2 FY ’22 (Yves Sukhu)

Notes:

-

Last 4 quarters for RGR based on fiscal years ending December 31.

2. (Essentially) No debt

If we ignore RGR’s $2.2M of capital lease obligations, the firm presently has $0 debt, a behavior long championed by company founder Bill Ruger.

3. Legacy, brand, and excellent management

RGR is one of three companies responsible for ~60% of pistol production in the United States, with brand recognition playing an important role in its market dominance. The business as it is organized today has been operating for more than 50 years and sales have been growing steadily, with net sales of $728.1M, $565.9M, and $406.3M for FY ’21, FY ’20, and FY ’19 respectively. As already mentioned, FY ’22 results are expected to soften quite a bit due to reduced market demand. Nonetheless, RGR’s financial condition hints at the quality of its management team with current CEO Chris Killoy running the firm since 2017.

4. Product diversity

As of Q2 FY ’22, management noted that “… Ruger offers consumers almost 800 variations of more than 40 product lines.” Whereas the company is naturally impacted by fluctuations in the overall gun market, their diversity across pistol, rifle, and revolver product lines provides, at least, some insulation against intra-market ebbs and flows.

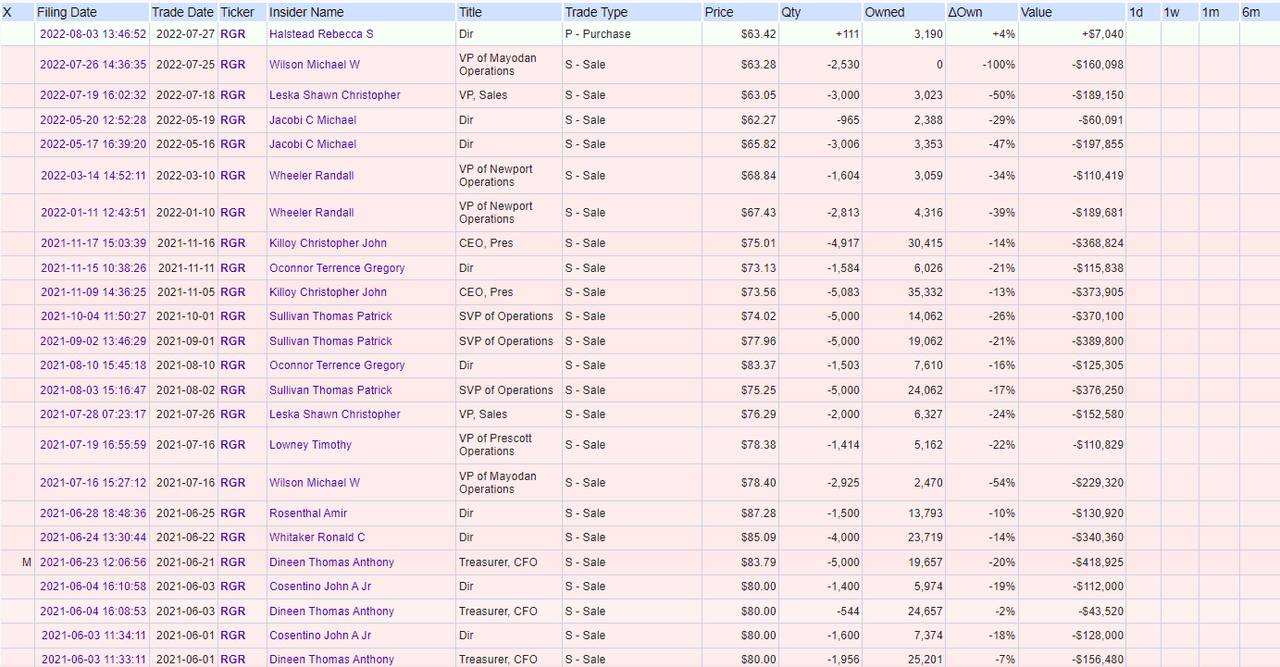

Then Why Are The Insiders Selling?

In spite of the quality of the business, RGR insiders have been doing quite a bit of selling recently.

Figure 7: RGR Insider Transactions (OpenInsider)

While I (personally) don’t think this activity reflects negatively on the condition of, or direction of, the business, it does leave one to wonder why executives have seemingly shown little faith purchasing shares on the open market, particularly at the depressed levels seen over the last couple weeks.

Gambling On A Better Q3 And Q4

As seen in Figure 5, RGR has a tendency to fall short of estimates. On that basis alone, we might expect weak results from 2H FY ’22. However, a couple possibilities give me reason to think that performance might be better than expected in Q3 and Q4.

1. Cooling inflation. Management explained that “… the Company’s finished goods inventory and distributor inventories of the Company’s products increased 49,300 units and 28,200 units, respectively” at the end of Q2 FY ’22. Presumably, many gun buyers deferred purchases due to particularly high inflation during that time period. With inflation cooling off, there is a reasonable chance Q3 and Q4 sales volumes may pick up.

2. November elections. I was scanning FiveThirtyEight‘s election forecast models as I was writing this report. Presently, the site favors Democrats winning the Senate and Republicans winning the House. Of course, it’s hard to know what is going to happen. However, should Democrats outperform during November elections – perhaps a greater possibility with President Biden’s recently announced student loan forgiveness program – then that dynamic, of course, could serve to drive a surge in firearm sales.

Resolving The Quandary

Based on the preceding logic, I’m inclined to “tough it out” a bit longer with my RGR shares. To reiterate, I’m a bit dismayed that insiders seem to show little interest in shares as they have dipped into the low-to-mid $50s. Still, I stand by my belief that RGR is a high-quality firm with excellent management. While I know that firearms are a tricky topic to discuss, and I won’t dare touch the third-rail of gun politics in this report, I tend to think the industry will keep growing in the United States, even under the constant threat of new regulations.

Be the first to comment