Drazen Zigic/iStock via Getty Images

Since my last update on Strategic Education (NASDAQ:STRA), which covered the actual weak results at the time, management provided an encouraging outlook that enrollments were beginning to improve. Following Q2 2022 results reported in late July, management reiterated that stance and provided the critically important news that all three universities are expected to show growth for 2022. That includes the previous elephant in the room of USHE finally inflecting positively:

“We also expect that all three of our universities will have positive new student growth for the full year 2022.”

-CEO Karl McDonnell, Q2 2022 conference call

New student enrollments are the core health measure of STRA’s operating performance, and inquiry volume, which relates to applications, was up. That encompasses the brands of Strayer and Capella University, which are the two largest operating units. They even provided color that Strayer’s recovery occurred one year faster than they had originally anticipated. Its next segment, Education Technology Services, continues to post good growth and its third segment, Australia/New Zealand also posted growth if you normalize the performance based on timing and FX effects. More specifically, their schools only fully reopened in June and the USD has been on an absolute tear in 2022 versus the AUD.

At the very least, this report told us that the core business has at least stabilized and the company will be delivering better results in late 2022 or early 2023.

Slowly Turning

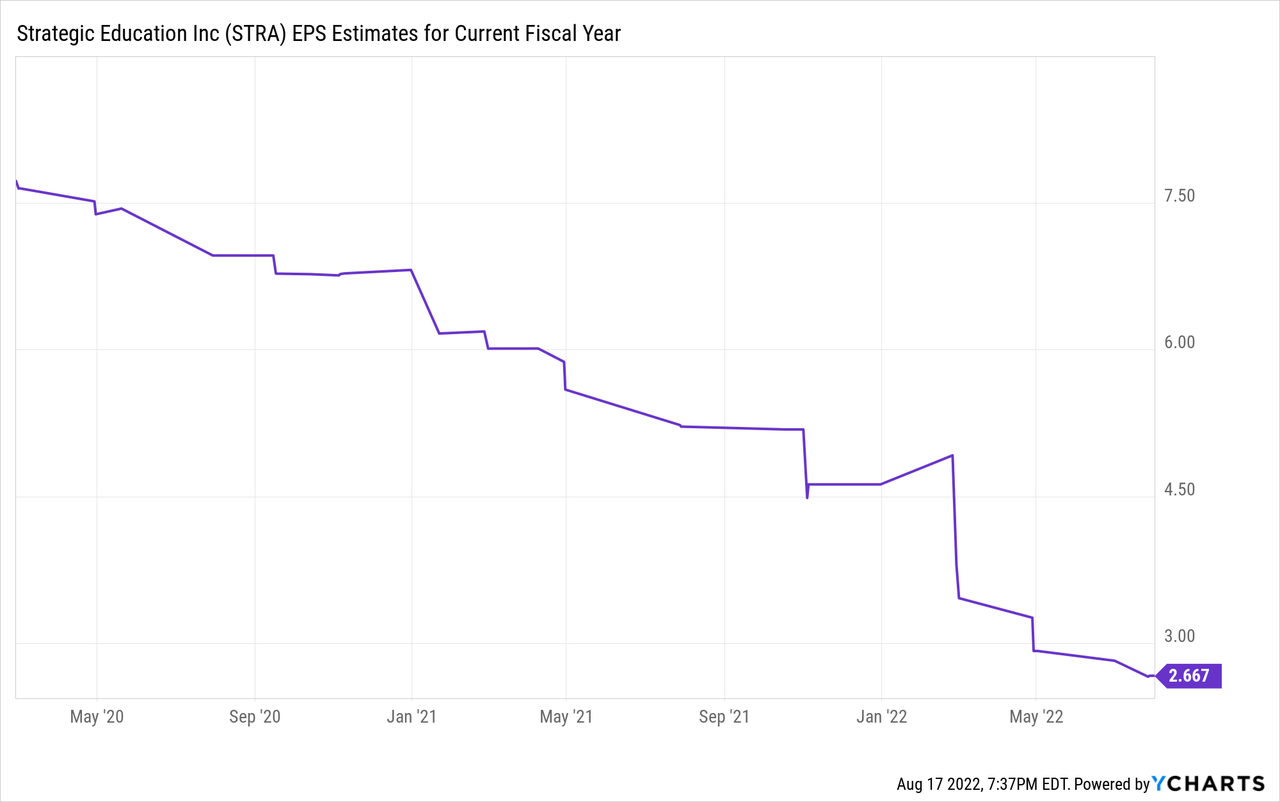

Looking back several quarters, management previously provided an earnings guidance range of $5.20-$5.50 EPS before eliminating that outlook. Analysts have since cut their estimates well beneath that area toward $2.66 today, and so far they’ve been spot on with their dour slant. STRA missed EPS by $0.20 and $0.02 for the Q1 and Q2 reports, respectively.

Although we’ve now reached a point where new enrollments are on the upswing, incremental expense growth should be limited (beyond what was mentioned in Q2 for marketing), and one-time expenses such as merger and restructuring costs are almost fully out of the equation.

Recent enrollment improvement is certainly encouraging and management seems to believe that their marketing initiatives are bearing fruit. I was surprised to see how positive they were on overall performance:

“So the demand environment, the efficiency of marketing, the performance of the campuses at Strayer, all of that is performing very strong.”

While analysts are being consistent with what management is guiding via mid-single-digit enrollment declines for 2022, as embedded in their Q3 and Q4 estimates, I would not be shocked to see STRA beating the $2.67 EPS figure shown today. Not that that’s a high hurdle by any means, but it finally confirms earnings are moving in the right direction. Ultimately, continued enrollment growth will be the indicator that sends the valuation higher.

Other Thoughts

Clearly, investors pay attention to STRA’s aligned management team and shareholder friendliness. Not only does STRA pay out a decent dividend, but it opportunistically repurchases shares whenever the stock falls beneath management’s estimated intrinsic value. What’s the magic number? Management believes that the company has a long-term performance trend, and right now it’s operating below that level. That’s why I continue to believe shares are undervalued. Although there are certainly different degrees of being undervalued.

Back in November 2021 and February 2022, two executives bought stocks equating to about $1.5 million when shares traded between $58 and $60. The company also bought back about $21 million worth of stock in Q2 when it traded between $59 and $72. If we split it somewhere around $65/share with its Q2 net cash position of $159 million, we approach an enterprise value of $1.39 billion.

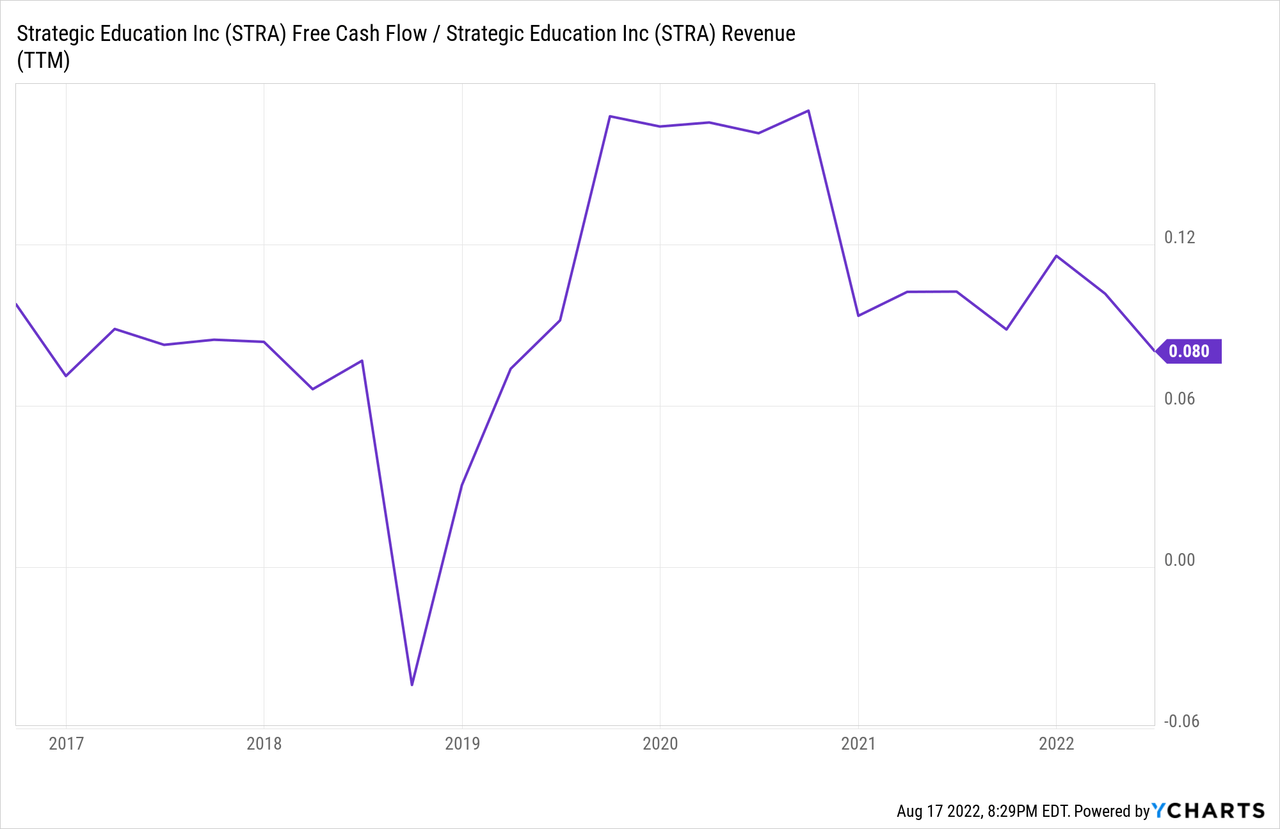

Turning to potential profitability. There’s an immense amount of “fixed” costs (e.g. facilities), and semi-fixed in the sense of being consistent in the normal course of business, that must exist for operations (e.g. teachers, administration, support, etc.). Historically, the business generates a free cash flow margin between 8-12%, but a lot of that has to do with management sustaining flat to positive enrollments.

STRA is expected to generate about $1.17 billion in revenue and depending on your assumptions for FCF margins will give an idea of an appropriate valuation. If enrollment growth remains positive, the stock is pretty cheap. Still, the jury is out as to whether this recent enrollment improvement persists or if it’s temporary before returning to a flattish trend. In a few words, shareholders do have a reason for optimism given management’s view on the conference call but equally have the right to remain cautious.

Bottom Line

Online learning and other cheaper education programs are two real threats to STRA. However, management does have a legitimate strategy of building its corporate business and keeping its tuition as low as possible, while tactically avoiding regulatory risk. I believe the bear thesis is losing steam with new enrollment trends and further momentum would unlock free cash flow growth. While shares are not very exciting here, I would be a buyer in the event the stock trades lower. How do you think STRA will perform? Let me know in the comments section below. As always, thank you for reading.

Be the first to comment