turk_stock_photographer

Most investors of STORE Capital (NYSE:STOR) were probably surprised to see a 20%+ gain in the stock on the morning of September 15th, and then to learn that it’s being acquired by real estate giants GIC and Blue Owl’s Oak Street in a $14 billion all-cash transaction, equivalent to $32.25 per share.

Shareholders may have mixed feelings about the buyout. On one hand, they may like the instant gratification of a 20% gain in one day, enabling them to deploy the gains into other investments. On the other hand, they may have purchased STOR with the intention of securing a long-term recurring income stream, and the deal takes that away.

Moreover, investors who acquired stock in STOR over the past 12 months must pay tax on their short-term capital gains (taxed at ordinary income rates) and for shares held over 12 months, must pay long-term capital gains of at least 15% (assuming they make at least $40K per year if single). Investors who purchased above $32.25 will simply have to eat a loss presuming that the deal goes through, more on that later.

But as in life, we live with the cards that we are dealt with in the investment world, and it’s important to evaluate the options. This article highlights what shareholders can do now with deal on the table.

STOR Has A Buyout Deal – Now What?

For those unfamiliar with the company, STORE Capital is a company founded by former CEO Christopher Volk. It’s the third REIT that he helped to guide to an IPO (two of which he co-founded). Its focus is to own single-tenant operational real estate which are profit centers, making them more valuable in the eyes of their tenants.

At present, it owns a diversified portfolio of 3,000 properties across 49 U.S. states, most of which are related to the service sector (think e-commerce resistant). In addition, STOR gets unit-level financial reporting from the vast majority of its properties, giving it line of sight and the ability to address tenant issues before they become problems.

Net lease REITs have seen material weakness in their share prices over the past month. For example, Realty Income (O) now trades at $64.33 with a forward P/FFO of 16.0, sitting well below its near-term high of $75 from as recently as August, equating to a forward P/FFO of 18.7. This falling out of market favor is likely due to investor worries over stubbornly high inflation as it relates to perceived slower-growing net lease REITs.

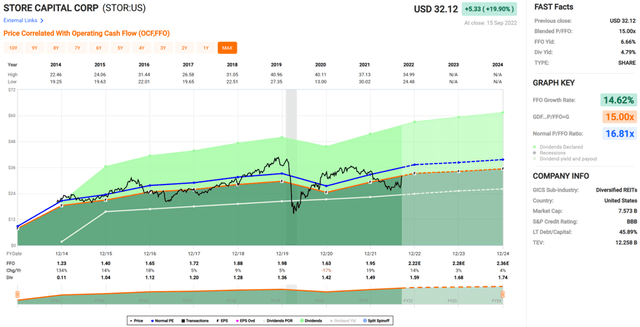

The fact of the matter, however, is that STOR has been one of the fastest growing net lease REITs, generating 5.9% AFFO/share CAGR since its IPO 8 years ago. Furthermore, management has guided for an impressive 9.8% to 10.7% AFFO per share growth this year, outpacing the rate of inflation that the U.S. economy has seen so far this year.

A key reason for this impressive growth is a higher reliance on internal funding sources, as STOR has a dividend payout ratio of just 66% (based on Q2 AFFO per share of $0.58). As such, STOR doesn’t have to have a high share price in order to generate growth through share issuances, nor is it entirely at the mercy of debt markets when interest rates go up.

Of course, it would be nice to have a high share price and low cost of debt as funding sources for growth, but the point is that STOR can still grow without those characteristics. Moreover, reduced reliance on external funding sources makes STOR better positioned during down markets as it can outbid higher leveraged private equity players in the space with attractive cap rates.

Given these attributes, I believe the deal on the table for STOR at $32.25 with a forward P/FFO of 14.66 fundamentally undervalues the company. It appears that the market also thinks so, as the share price has been bid up to $31.95 (it was at $32.20 yesterday). This represents just a $0.30 share price appreciation plus a $0.385 dividend payment based on the current deal price.

As such, it appears that the market believes (but no guarantees of course) that there could be another bidder for STOR within the 30-day go shop period. I believe STOR is worth $38.50 per share in an all-cash buyout scenario. This represents a forward P/FFO of 17.5x, and would bring all shareholders who bought over the past 12 months above water.

Perhaps that’s wishful thinking and that may never happen, but I think that’s reasonable, considering that it represents a moderate premium over fair value, and would compensate for the capital gains taxes that investors have to pay in an all-cash deal. As shown below, STOR’s has traded at a normal P/FFO of 16.8 since inception.

So what’s an investor to do now? Those who believe that the overall market will remain weak over the next 30 days can do a wait and see approach, to see if a better deal comes through. Or, they can possibly wait out the full term of the deal, with the possibility of shareholders voting it down.

For those who have had enough and simply want to cash out now, I see Realty Income (O) and National Retail Properties (NNN) as being solid options. Realty Income comes with an A- rated balance sheet and a healthy and growing 4.6% yield, while NNN comes with a 5% yield with a BBB+ rated balance sheet. For those who have more risk appetite, Spirit Realty Capital (SRC) throws off a 6.3% dividend yield and trades at a P/FFO of just 11.5.

Investor Takeaway

The market pricing on STOR appears to indicate belief that a better deal may come along. Plus, the tax considerations of an all-cash transaction makes it unattractive, especially for retail investors. Those who believe that a better deal may come through may want to hang onto their shares. There is also a chance that shareholders don’t approve of the deal. For those who think the deal is fair, or simply want to cash out, and want to stick with the net lease space, O, NNN, and SRC present solid alternatives at their current prices.

Be the first to comment