Prykhodov

Adobe Inc. (NASDAQ:ADBE) has been an outstanding story of success during the past decade. As such, its share price reflected not only the strong business model and management’s vision for the future, but also a decade-long monetary experiment that brought high duration equities to unsustainably high levels.

This put an anchoring bias for many investors, who now see their beloved names trading at significantly lower levels and thinking that the price they are paying is somehow a bargain.

Although this could be the case for some names, I do think Adobe is one of them, for the reasons that I will lay out below.

What a difference six months make

About six months ago, I warned that Adobe’s share price is likely facing stale returns ahead, even as the business continues to perform well.

At the time, the sentiment around Adobe was still close to ecstatic and it was indeed hard to envision a negative scenario for the share price going forward.

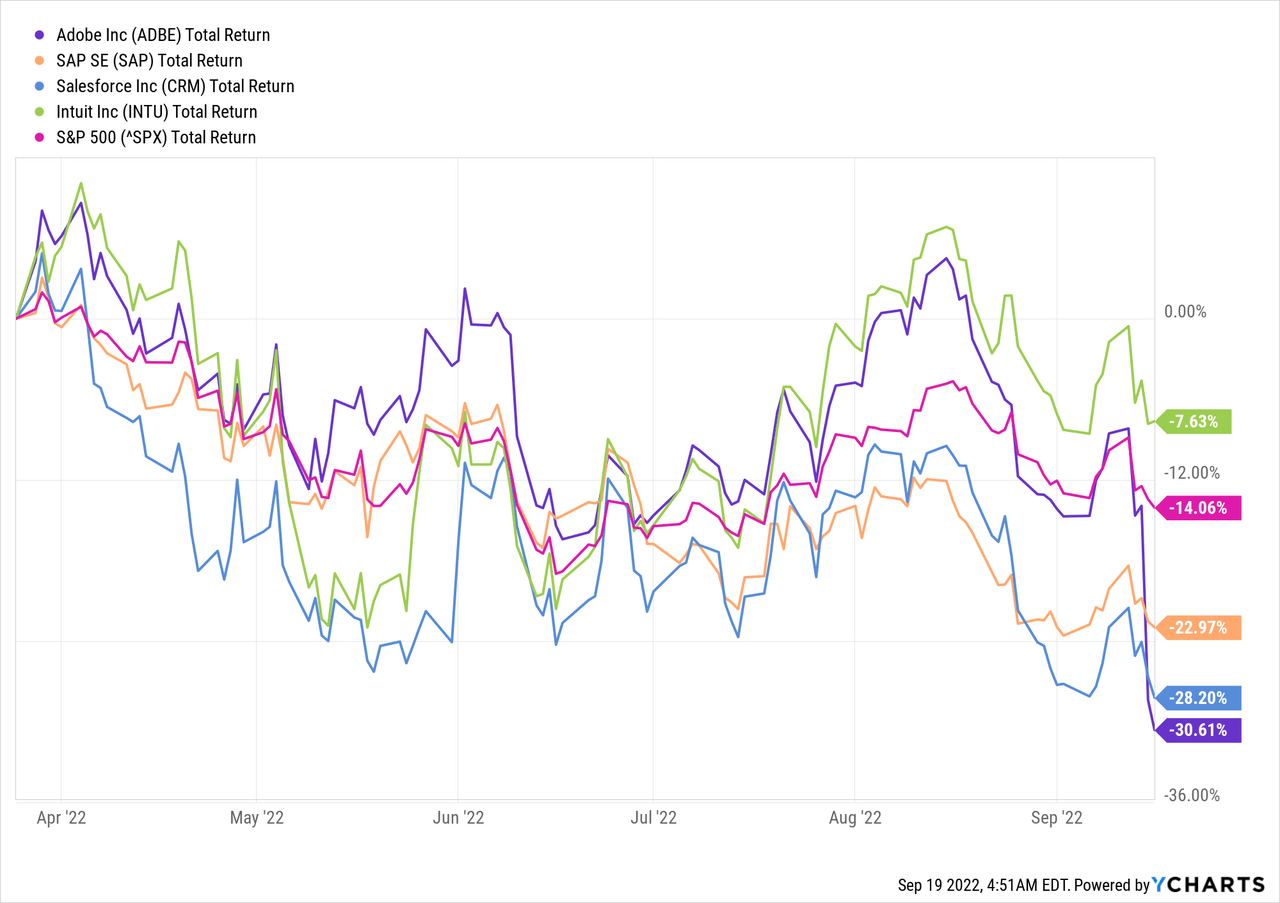

Fast-forward only six months, however, and the share price is now down more than 30% at a time when the market fell by only a shy of 8% and other high duration names in the sector still fared better than Adobe.

Of course, by far the largest driver of these abysmal returns has been the policy shift at the Federal Reserve which punished the high-growth and momentum stocks disproportionally.

Even though for some investors this policy shift might seem like a fluke, caused by recent geopolitical events or the current recession, the reality is that this change was plain to see. Back in November of last year, I spent a lot of time talking about these risks:

What we notice is that INTU, CRM, ADBE and WDAY are at the greatest risk of momentum trade reversal. The large ecosystem players – AMZN, MSFT and GOOG are much less exposed due to their larger size and more diversified operations, however, as I noted earlier the political risk here is much higher.

Source: Seeking Alpha

Looking ahead, we should acknowledge these risks and decouple from the anchor of exceptionally high valuations during the peak of excess liquidity of the past few years. In other words, just because many businesses are now trading at significantly lower levels, it does not necessarily mean that they are bargains opportunities.

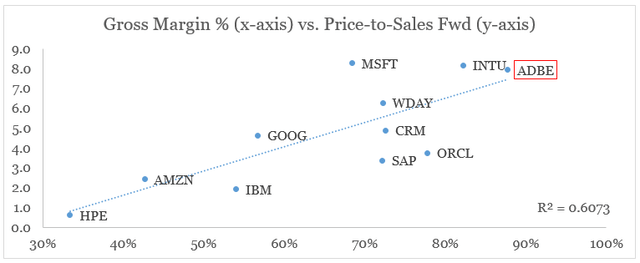

Trading near fair value

If we compare gross margins to forward price-to-sales multiples within the large cap cloud and software-as-a-service players, we see that there is now a relatively strong relationship (see the graph below).

prepared by the author, using data from Seeking Alpha

In that regard, Adobe lies just on the above trend line with its industry leading gross profitability of 88%.

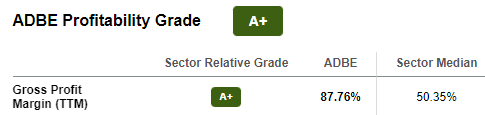

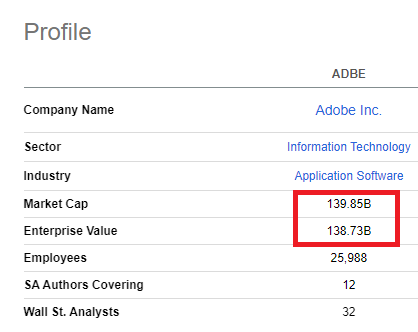

Seeking Alpha

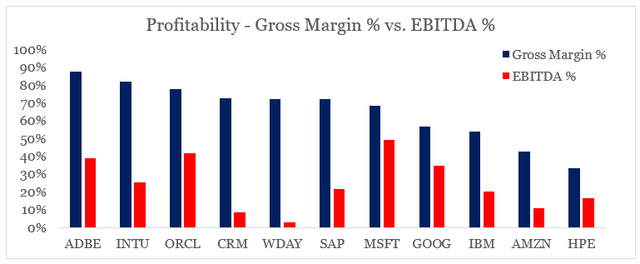

High gross margin players in the space usually have both the pricing power and the scale necessary to support that. This, however, is not always the case as certain business models require increasing level of fixed expenses, in order to support their larger size. Inefficiencies and inorganic growth could also be attributed to players such as Salesforce, Workday (WDAY) and SAP (SAP) as they deliver far lower EBITDA margins to what their gross profitability would suggest.

prepared by the author, using data from Seeking Alpha

While WDAY is still notably smaller, this dynamic helps to explain why CRM and SAP might appear undervalued based on their P/S multiples we saw above.

In that regard, Adobe’s business model is doing fairly well in translating gross profitability to EBITDA margins as we move down the income statement, although not as good as companies like Microsoft (MSFT) and Oracle (ORCL).

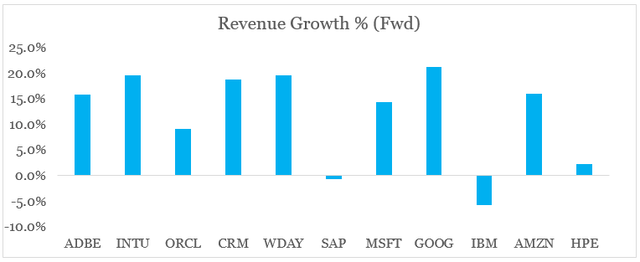

In terms of future expected growth, Adobe is roughly in line with its peer average (see below). However, its expected revenue growth of almost 16% is still behind other high-growth names in the peer group below.

prepared by the author, using data from Seeking Alpha

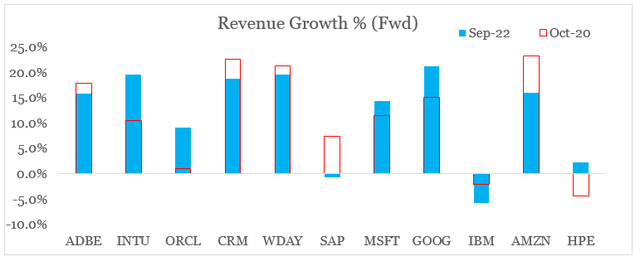

If we compare these numbers today to what they were two years ago, we will notice that in addition to the monetary conditions I mentioned above, there is a broader theme of growth slowdown. Only 4 out of the 11 companies reviewed below are now expected to have higher topline growth when compared to October of 2020.

prepared by the author, using data from Seeking Alpha

We should mention that Intuit (INTU) and Oracle have both engaged in large M&A deals within this timeframe which helps elevate their growth profile.

With all that in mind, Adobe appears to be trading near its fair value, if we assume that there won’t be yet another event of unlimited liquidity being provided by the monetary authorities.

Problems with capital allocation

While Adobe’s share price has been in the eye of the storm of the recent monetary policy normalization, issues regarding the company’s capital allocation also begin to surface.

The recently announced mega deal for Figma was a significant departure from Adobe’s recent strategy of smaller bolt-on acquisitions.

Seeking Alpha

The $20bn deal for Figma dwarfs even Adobe’s largest deal for Marketo back in 2018 when the company also acquire Magento.

On one hand, this reinvigorates fears that Adobe is likely facing slowdown in expected revenue growth and management is embarking on a frenzy of new deals, a strategy that is rarely successful in long-term value creation.

I raised the alarm earlier this year, but it seems that the deals for Workfront and Frame.io were just the beginning.

The slowing growth could also explain why Adobe suddenly engaged in two major acquisitions since November of 2020 – those of Workfront and Frame.io.

Source: Seeking Alpha

Although I was expecting a similar scenario, I wasn’t counting such a large deal so soon.

What usually follows is that a company in such situation embarks upon an aggressive M&A strategy in order to deliver on these optimistic growth projections. This has been the case of Salesforce and as of late appears to be the case for Intuit. Although this is not necessarily a bad thing, it brings in significant additional risk for shareholders of an already richly priced enterprise.

Source: Seeking Alpha

But large M&A deals are not always a bad omen, although investors should be on guard for management teams get too aggressive in their M&A strategies.

Figma, as all of the previously mentioned acquisitions, indeed sounds like a very good fit for Adobe’s business model.

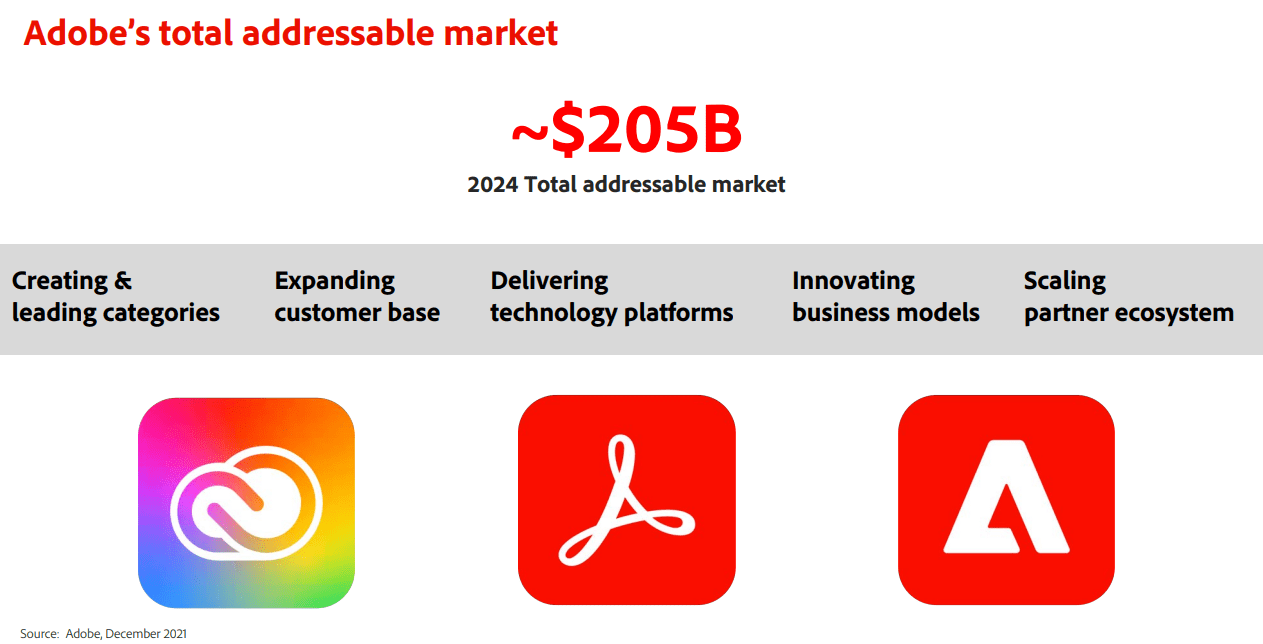

Apart from the hefty price, another problem from my point of view is the focus on total addressable market. An estimation that as we saw last time, is highly arbitrary and subject to sudden changes.

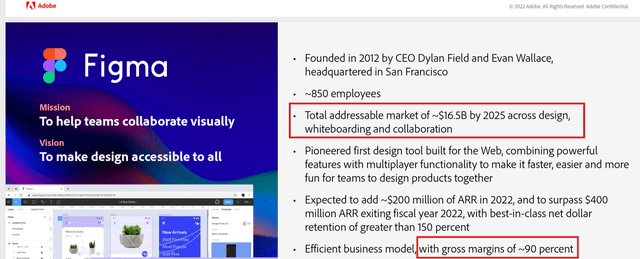

During the last conference call the CEO of Adobe mentioned that Figma has a total addressable market of around $16bn “as it exists today”.

So when we talk about the fact that Figma has a $16 billion TAM, that’s referring to the TAM as it exists today, in terms of what they are doing, both as it relates to product design, as well as that would relates to collaborative whiteboarding and ideation, which as you know, say, FigJam this incredible product that has, I believe, a much, much larger available addressable opportunity.

Shantanu Narayen – Chairman and CEO

Source: Seeking Alpha

But in the earnings deck we see that this is an estimation of TAM by 2025.

Although this might be a tiny detail, it clearly illustrates the amount of future expectations and beliefs that go into these numbers. This is yet another reason, in my view, why the market reacted so abruptly to the announcement.

Seeking Alpha

If we were to justify the amount to be spent on the deal, we must rely on many assumptions and forecasts that go beyond the short-term and get highly speculative.

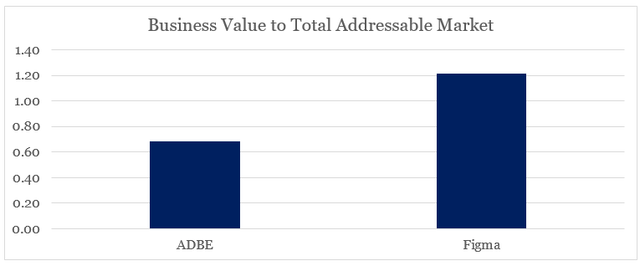

However, if we compare the two total addressable markets – those of Adobe prior to the deal and Figma – we will notice that the latter is only 8% of Adobe’s TAM.

Adobe Investor Presentation

At the same time, the Figma deal of $20bn is more than 14% of Adobe’s current enterprise value.

Seeking Alpha

This illustrates the exceptionally high premium that Adobe’s management is willing to pay for a dollar’s worth of TAM.

prepared by the author, using data from Seeking Alpha

Conclusion

Over the years Adobe has created a unique ecosystem of digital services used by freelancers, students, small businesses and large enterprises. Most of the offerings are also quite sticky and benefit massively from scale. Naturally, this made the company a notable success story of the past decade.

Nevertheless, it is not uncommon even for the most competent management teams to get carried away during market cycle peaks and tempted by the opportunity to acquire whatever they can get their hands on. This in my view, creates exceptionally high risks for shareholders and is often associated with shareholder value destruction.

Moreover, as I outlined last time, Adobe has been in the epicentre of the exuberant momentum trade of the past few years which was fed by the excessive liquidity in the markets. This has now caused ADBE to fall down back to earth and it has not necessarily created a bargain opportunity.

A note for roundabout investors

The analysis above follows my strategy of finding roundabout investments. These are reasonably priced, high quality companies with strong competitive advantages where the management is focused on managing the business with a solid long-term view.

In The Roundabout Investor service I will focus on my highest conviction ideas and will also present the readers to a concentrated all-equity portfolio and potential ideas to keep on their watchlists.

The service is scheduled to launch next Thursday, on the 22nd of September. I will also feature an early subscriber discount, so stay tuned.

Be the first to comment