luxiangjian4711/iStock via Getty Images

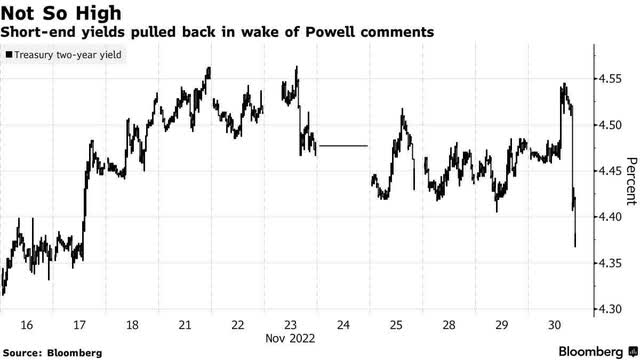

It was music to my ears to hear Chairman Powell state yesterday that “we have a risk management balance to strike,” which was an indirect way of saying that he does not want to tighten monetary policy to the extent that it causes a recession next year. He confirmed this by also saying that he thought a soft landing was “very plausible.” He hinted that December would likely be the time to moderate the pace of rate increases, which the market interpreted to mean 50 basis points. Bond yields plunged with the two-year Treasury falling 14 basis points to 4.34%, which is within the range of where I have forecasted short-term rates to peak for this cycle at 4.25-4.5%.

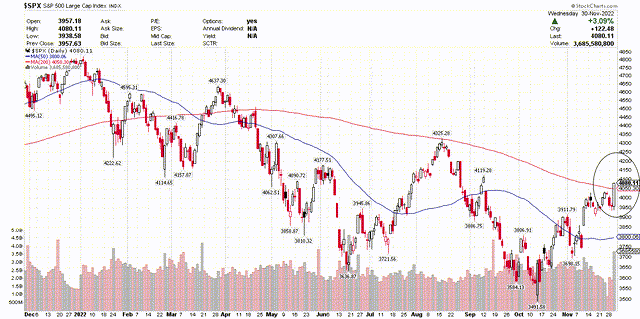

The major market averages ripped higher after Powell’s speech with the Dow Jones Industrials rising more than 700 points to a 20% gain from its September low, which gives birth to a new bull market for the index. More importantly, the S&P 500 cleared its 200-day moving average for the first time since March, which the bears assumed to be an insurmountable feat for the index at this juncture. I had my reservations as well, given the short-term overbought condition of the market, but I didn’t expect Powell to let the doves fly during his post-speech interview. The bears were quick to pounce on the rally with assertions that it was premature, because investors are second-guessing the Fed, while the Fed is focusing on the data.

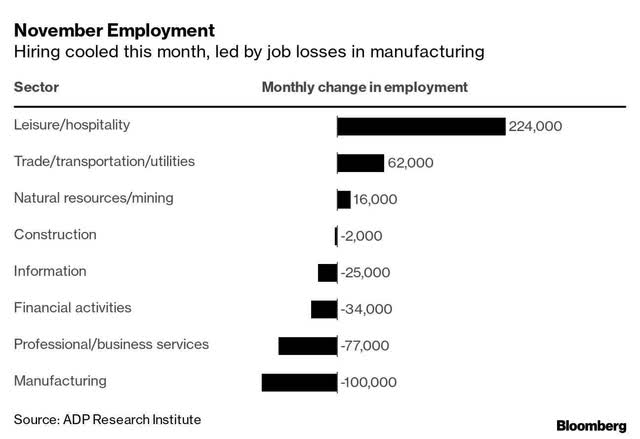

I have been arguing the opposite. The Fed may be focusing on the data, but its rhetoric has been ignoring it to manage inflation expectations. The market is reacting to the data, which has been telling investors that the Fed will not have to raise rates as high or for as long as Chairman Powell and other Fed officials have claimed. Again, focus on what the Fed does and not on what Fed officials say they may do. This is the mistake the bears have been making since this fourth-quarter rally began. The labor market continues to soften, which is exactly what we and the Fed want to see. We learned from payroll processing firm ADP that payrolls at private companies rose by just 127,000 in November, which was well short of estimates. The only strength was seen in the leisure and hospitality sector, which is characterized by much lower wage jobs.

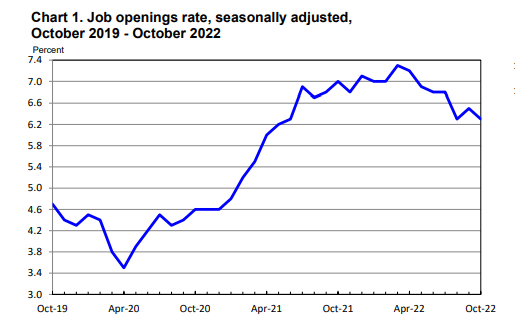

Additionally, the number of job openings declined by 353,000 to 10.3 million during October, as reported in the latest Job Openings and Labor Turnover Survey, which is also what we and the Fed want to see, as it should alleviate the upward pressure on wages. Markets focus on rates of change and not absolute numbers. On that front, nearly every data point is moving in the right direction to see the rate of inflation decelerate more rapidly in the months ahead and fall to the Fed’s target of 2%. That is why the market is telling the Fed it should be done in December. Investors should be listening to the stock and bond markets and not Fed officials.

BLS

The Technical Picture

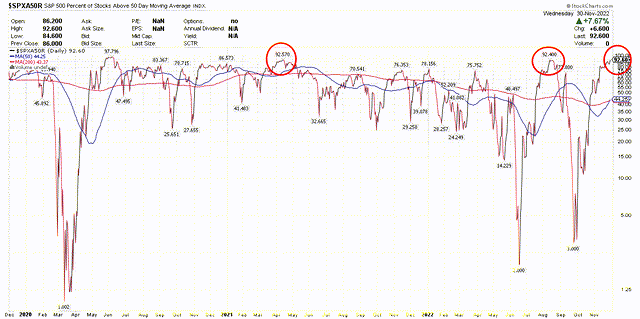

The S&P 500 finally broke above its long-term moving average, setting the stage for a year-end rally.

My only concern is that the percentage of stocks above their 50-day moving average is over 92%.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment