Kateryna Onyshchuk

Transcript

The U.S. market surged after a smaller-than-expected inflation print for the month of October. That in itself is good news, but one data print does not make a trend.

It does not change the overall big picture of production constraints, whereby we have labor shortages, leading to higher wage pressure, leading to higher services inflation.

1) Stocks not fully pricing Fed moves

Also importantly, it does not change the inflation fighting at all costs stance that the Fed has right now.

What it does tell me is that markets are primed to interpret a less-hawkish Fed whenever it can.

2) Markets disappointed by hawkish Fed

We have already seen this happening at multiple moments this year, whereby markets were hoping for a less-hawkish Fed only to be disappointed later when the Fed started talking tough again.

Here’s our market take

We believe that this time is no different. In fact, given the market bounce, we are even further away from markets pricing in the recession that we see coming next year.

__________

One economic release overshadowed the U.S. midterms for markets. Stocks surged last week after the October core CPI rose less than expected, stoking market hopes that a Federal Reserve pause on rate hikes is nearer. That’s optimistic, we think. Goods inflation is easing as it needed to, but the labor constraints driving wage growth and core inflation persist. So the Fed is still on a path to create a recession via policy overtightening. Stocks aren’t pricing that in, so we stay underweight.

Stocks and earnings expectations part ways

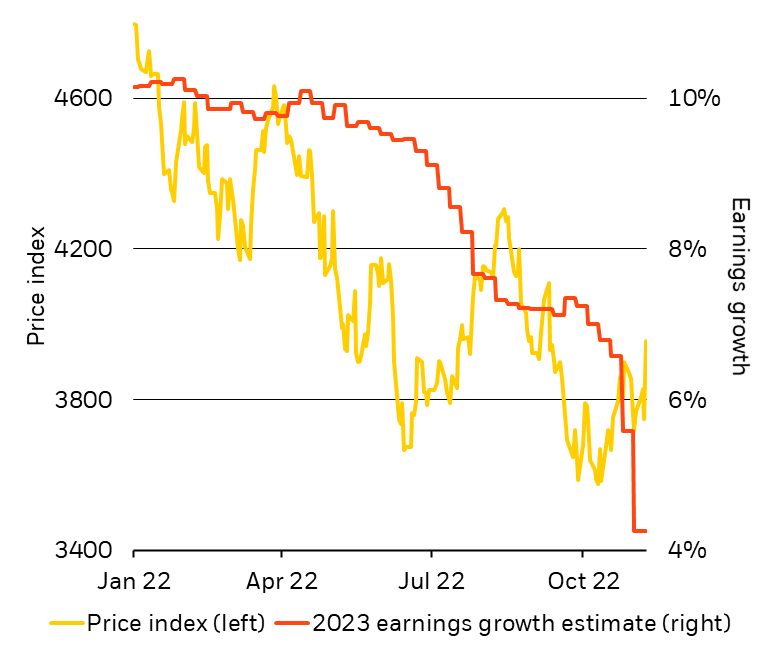

S&P 500 Price And 2023 Earnings Growth Estimates (BlackRock Investment Institute, with data from Refinitiv Datastream as of November 10, 2022)

Notes: The chart shows the S&P 500 price index (yellow line) versus analysts’ earnings growth estimates for 2023 (orange line) since the start of 2022.

Equities have repeatedly jumped this year on hopes the Fed may be getting closer to stopping the fastest hiking cycle since the 1980s, letting the economy enjoy a soft landing that avoids recession. We think those hopes will be dashed again as the Fed pushes ahead with policy overtightening. With the S&P 500 jumping 13% from its October low, stocks are even further from pricing in the recession – and earnings downgrades – we see ahead. (See the yellow line in the chart.) Earnings estimates are set to be downgraded further. The consensus expects earnings growth of just over 4% in 2023, down from about 10% at the start of 2022 (orange line). We expect zero growth. Third-quarter annual earnings growth would already be negative without the energy sector, Refinitiv data show. We need to see stocks fall more or more good news of easing inflation to turn positive on stocks.

Good news and bad news

The slower rise in core CPI inflation, which excludes volatile food and energy prices, due to falling core goods inflation is good news. We’d expected this to happen at some point as spending patterns normalize after the pandemic, when a sharp shift in consumer spending toward goods and away from services drove the initial spurt of goods inflation. Spending is starting to return to services, easing supply constraints on goods. We expect declining goods inflation to continue. But high core inflation also reflects constraints on labor supply that are driving up wages, seen in services inflation. We don’t expect this to improve much because many workers retired during the pandemic. We also see the U.S. labor pool shrinking as people over 65 account for a larger share of the population in coming decades.

The Fed can only try to push wage and overall core inflation quickly down to its 2% target by crushing demand with a deep recession, in our view. We expect the Fed to pause its sharp hikes only after having caused a recession and when confronted with the economic pain. We don’t think a soft landing is in the cards. Yet, it took just one downside surprise in CPI – one data release, not a trend – to revive hopes that the Fed would stop hiking soon and a soft landing could still be achieved. That helped to quickly wipe the U.S. midterm election – the original subject of this week’s commentary – from the market’s mind. This is a good reminder that in this new regime of higher macro and market volatility, we should not be surprised by surprising data. We think the Fed’s “whatever it takes” approach to bringing down inflation means that no single data release or catalyst is about to change the Fed’s path to overtighten policy.

Our bottom line

We’re tactically underweight DM stocks, including the U.S., because they’re even further away from pricing in recession after last week’s surge. But we think some sectors like energy, financials and healthcare allow us to take advantage of thematic, near-term and structural trends. Landmark U.S. legislation over the past year, like the Inflation Reduction Act, has brightened the outlook for renewable energy and the industrial sector. Earnings for traditional energy are still strong given ongoing supply shortages. Healthcare is a favorite of investors looking for shelter as recession looms given its stable cash flows in economic downturns and attractive valuations. The sector will also benefit as an aging world population ramps up medical spending. Lastly, deposit rates not rising as much as policy rates has boosted bank earnings, making their income from lending greater than the amount paid on deposits. We believe the new regime warrants a granular approach as themes like production constraints, dollar strength and geopolitical fragmentation are better implemented through sectors.

Market backdrop

U.S. stocks surged and Treasury yields fell sharply after the core October CPI rose a lower-than-expected 0.3%. We think this is finally an encouraging development on inflation but doesn’t yet change the overall picture. Core goods prices declined. But core services inflation remains sticky. We don’t think one data release will change the Federal Reserve’s path to overtightening policy – and think it would need to see more sustained signs of core inflation slowing.

The UK takes center stage this week with unemployment and CPI inflation data, as well as the announcement of the much-anticipated fiscal statement from the new government. The UK fiscal update will factor into the Bank of England policy tightening plans depending on the size and timing of any austerity unveiled as the UK heads for a deep recession.

Be the first to comment