Marcus Millo/iStock via Getty Images

This article was originally published on Saturday, March 19 for members of Reading The Markets, an SA Marketplace Service

The week ending March 18 was unforgiving, especially for those like myself expecting a decline following the Fed. But most of the evidence I have found supports the idea that this week’s rally was about Options expiration than a less hawkish Fed.

While I know many would be quick to jump at the idea that calling for the markets to decline is wrong, and it may very well be, the mixture of the quadruple witching and index rebalancing makes it way too early for that assessment. While very sharp, the rally was nearly the same distance traveled at the end of January; the only difference was there was no weekend to break it up.

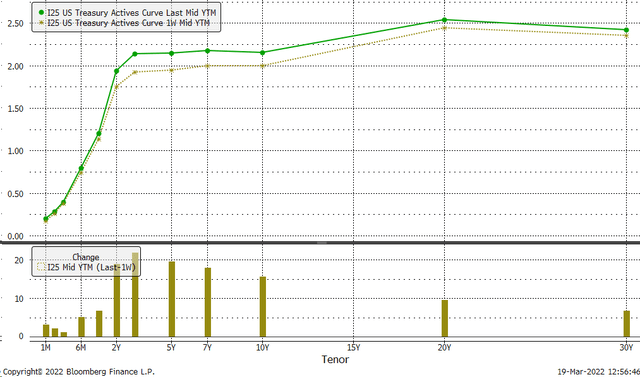

The bond market responded to the Fed exactly how we expected it to respond, which is a much better indicator at this point over the stock market. The yield curve steepened this week with the biggest gains at the two and three-year rates, rising by around 18 and 21 bps, respectively.

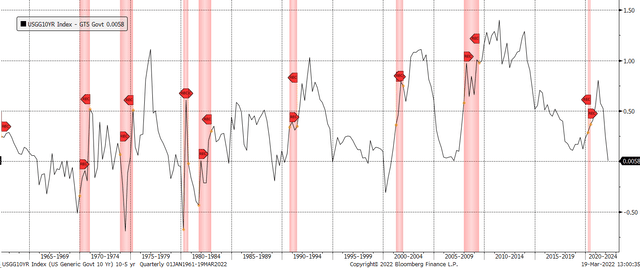

Meanwhile, the 10-year minus the 5-yr is now at 0% and predicts a US recession.

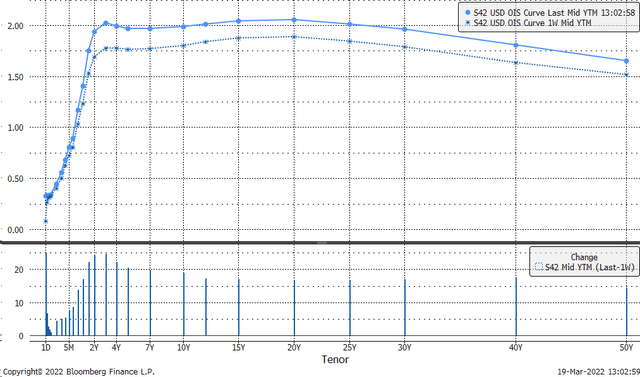

The Overnight Index Swap curve also saw a giant jump in rates and is now inverted from the 3-year rate all the way out to 15 years.

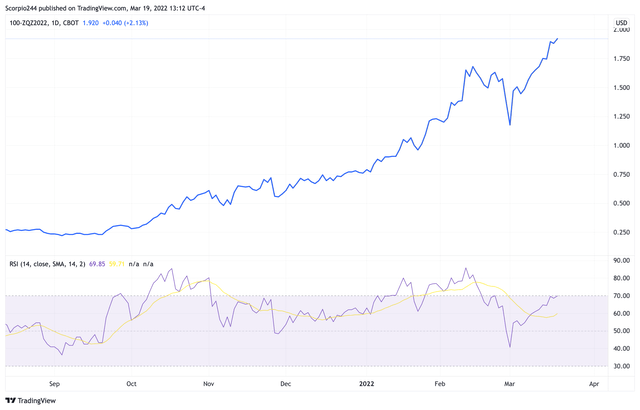

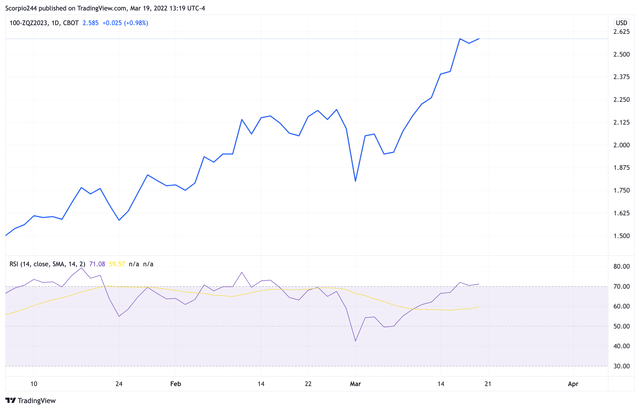

There was also a significant increase in the December 2022 Fed Futures, which are now pricing in rates at around 1.92%.

So the idea that the market had already priced in the more hawkish Fed is not valid. You wouldn’t have seen rates on the short end of the curve rise by 20 bps. Additionally, Fed Fund Futures were not priced correctly either; they too were trading almost 20 bps lower. So the Fed seems to have been more hawkish by one rate hike in 2022.

Additionally, the Fed Fund futures for 2023 were trading around 2.4% before the Fed meeting and are now trading at 2.6% and are likely heading to around 2.8%, which was in the Fed’s projection, over the coming weeks.

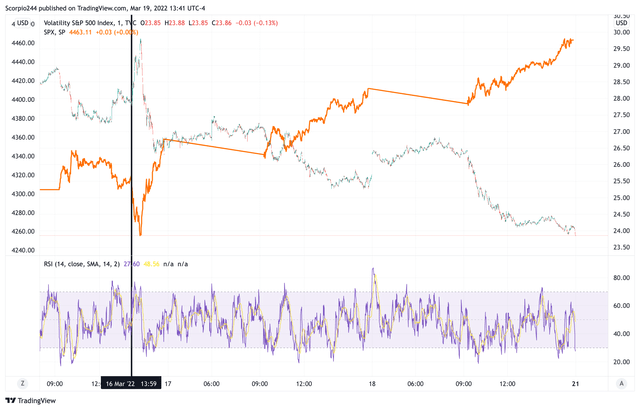

So why the rally in stocks? From the best I can tell, this was a counter-trend rally due to the unwind of volatility and options expiration. My mistake was underestimating the size of the potential unwind in volatility and the OPEX. I thought the more hawkish Fed would outweigh the options expiration, and it didn’t.

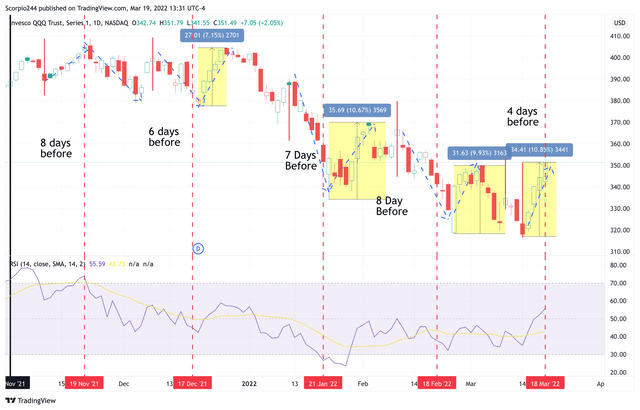

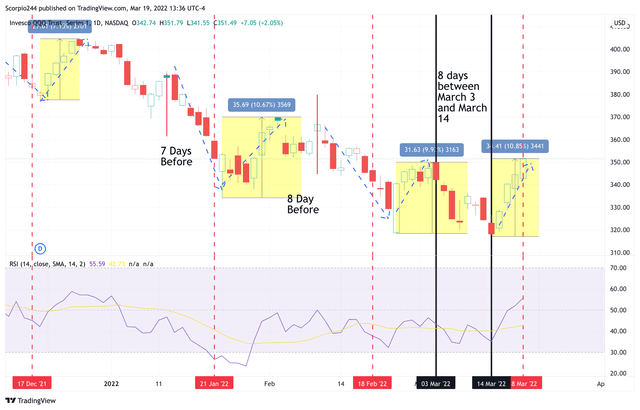

The cycle below, which I found this weekend, shows that 6 to 8 days prior to options expiration, there is a countertrend-rally that forms and continues into expiration, with a reversal of that trend in the days after expiration.

For example, stocks fell sharply from January 12 into options expiration, followed by a rally from the January 24 lows until February 2 of more than 10% in the NASDAQ QQQ ETF. The ETF then fell sharply again into options expiration and followed through for an additional two days, bottoming on February 24. That led to a rally of nearly 10% off the February 24 lows through March 3 highs. That is the rally that most closely mimics this one.

But for some reason, the cycle in March shifted and appeared to have been pulled forward with the QQQ peaking on March 3 as part of the Post OPEX counter-trend rally and then declining into March 14. This led to a very sharp 10% rally we would typically see after Opex.

The move further extended after the release of the Fed statement at 2 PM, which resulted in a VIX spike, and then at 2:30, when the press conference started, the VIX began to melt, which triggered a massive move to start as implied volatility levels began to drop, which results in puts losing value.

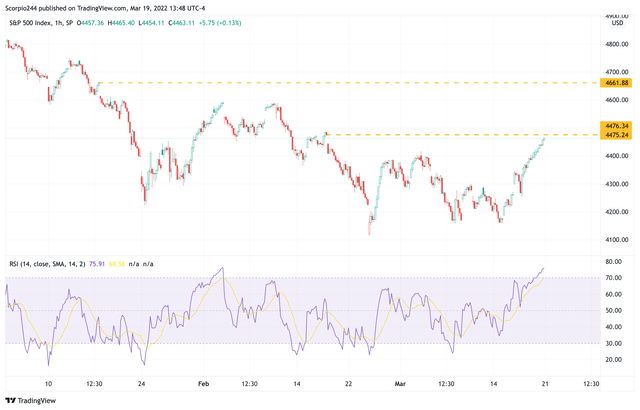

If the assessment is correct, we should see the index continue to move higher on Monday in an attempt to fill the gap at 4,475, that is, from February 16. If that gap gets filled and the index continues to push beyond the gap, then the next level for the index to climb to would be around 4,660. After that, there would be no gaps left.

However, I think it is more likely that once the gap is filled at 4,475, we see a retracement of this recent rally over the coming days as the OPEX moves to the side and the Fed’s effects in the bond market trickle over into equity prices. Additionally, investors will likely look to re-establish put positions, especially into the uncertainty of the Fed minutes, which is likely to have more details on the balance sheet run-off.

Additionally, liquidity in the market remains very thin, and spreads remain very wide. This is making the volatility in the market even more pronounced.

Moving Forward

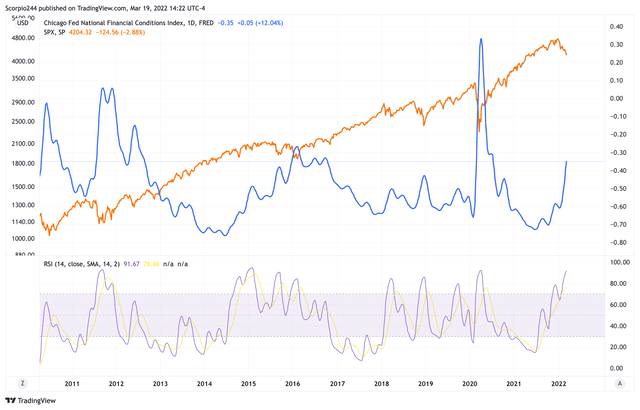

The Fed’s intention from listening to Powell indicates the Fed wants financial conditions to tighten further. Tighter financial conditions hurt stocks over time. This time is likely not to be any different. While it is impossible to call out when the markets will bottom, what seems clear is that in the coming weeks, as the more details of the Fed’s plan for the run-off of the balance sheet and rate hikes, the financial condition shall tighten further.

The period most similar today is during 2015 and 2016, when the Fed wanted to raise rates. The competition of QE led to a long period of tightening financial conditions, which led to a tremendous amount of equity market volatility.

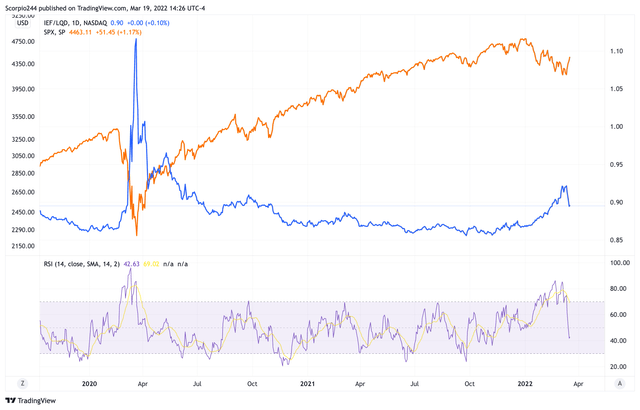

The early indications are that financial conditions this week eased some, at least based on the IEF/LQD ratio. If financial conditions continue to ease over the short-term, that could help further rally stock price. However, based on what Powell said at the press conference, it is unlikely that any easing will persist because the Fed wants tighter financial conditions in an attempt to slow the economy.

This will produce a lot of volatility in the market in the coming weeks and is likely to result in a lot of choppiness, as witnessed in 2015 and 2016. The only difference between now and 2015 and 2016 is that the balance sheet run-off is starting much sooner, which should also help tighten financial conditions.

The bottom line is that the short-term may have been influenced by options expiration, but the longer-term is going to be influenced by further tightening financial conditions. If that is the Fed’s intention, those conditions will get tighter.

– Mike

Be the first to comment