Hirkophoto/iStock via Getty Images

Thesis

Columbia Seligman Premium Technology Growth Fund (NYSE:STK) is an equity buy-write fund. Unlike some of its peers that apply a systematic methodology in terms of writing covered calls, STK has the flexibility to employ the option overlay at its discretion. As per its literature:

Under normal market conditions, the fund’s investment program will consist primarily of investing in a portfolio of equity securities of technology and technology-related companies as well as writing call options on the NASDAQ 100 Index or its exchange-traded (ETF) fund equivalent on a month-to-month basis. The aggregate notional amount of the call options will typically range from 25% to 90% of the underlying value of the fund’s holdings of common stock. The fund expects to generate current income from premiums received from writing call options on the NASDAQ 100 or its ETF equivalent.

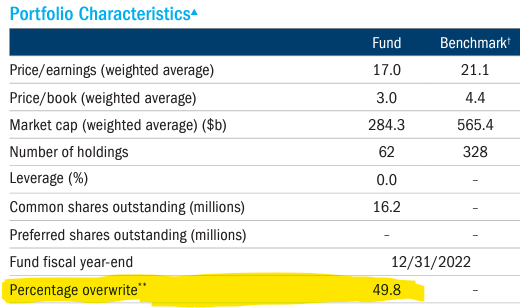

We can see that the CEF can have anywhere from 25% to 90% of the underlying holdings covered by call options. As of the latest Fact Sheet, dated September 2022, that percentage is 49.8%:

Portfolio Characteristics (Fact Sheet)

We can also observe that the fund has a fairly small amount of holdings that amount to only 62 names. The fund is technology oriented, and tries to outperform the market via its single name selection.

What is notable about STK is that its long term performance is nearly identical to that observed in the Nasdaq index, as posted by the Invesco QQQ Trust Series 1 (QQQ). On a 5-year basis both tickers have a total return close to 78%, with the outright fund (QQQ) outperforming during the 2020/2021 bull market. STK has not managed to dampen the downside in 2022 though, which is surprising. When accounting for its slight premium to NAV, the CEF exhibits virtually the same total return as QQQ. We can attribute this feature to two risk factors: 1) Build – the CEF’s portfolio represents a selection of the portfolio manager, 2) Non-linear bear market: the best bear market for STK is a slowly down-sloping one. Why? Because written call options can be monetized in a linear fashion. The 2022 bear market has been marked by furious rallies which have seen +17% and higher type of returns, meaning that the fund triggered written calls and had to re-purchase equities at much higher prices.

As financial writers it is beyond our ability to tell a portfolio manager how to write call options and what strategy to pursue, but we can observe the obtained results. In 2022 they are slightly disappointing. We would have expected a dampened result for STK when compared to QQQ (i.e. STK to post better annual total returns when compared to the index) but we do not see them. Volatility has been extremely high this year, and an active, agile management of the options book should have put STK at an advantage versus just investing in the index. It has not happened unfortunately. This set-up moves this CEF, in our minds, as a pure play on the index, or better said as utilizing the CEF structure to extract dividends from technology stocks.

Another buy-write in the space, an ETF, namely the Global X NASDAQ 100 Covered Call ETF (QYLD) has managed to be down only -19% this year, thus exhibiting that dampening effect expected for short vega structures. STK remains a good structure to extract quarterly dividends from technology equities but does not outperform as a buy-write fund in an extremely volatile 2022.

STK Performance

We can see that STK has not managed to dampen the QQQ downside experienced in 2022:

QQQ is down -32% year to date, while STK is down -28%. Given that the CEF is trading at a premium of 6%, when normalizing for NAV performance solely, we can see the fund is closely tracking the Nasdaq.

Longer term we see a similar trend:

On a 5-year time range the two instruments have performances which are virtually identical. While QQQ outperformed during the 2020/2021 bull market (as expected since STK writes options), STK has caught up performance wise since the end of 2021. An investor can think about STK as a method of utilizing the CEF wrapper and ancillary benefits (option writing ability of the structure) in order to extract dividends from the technology equity market.

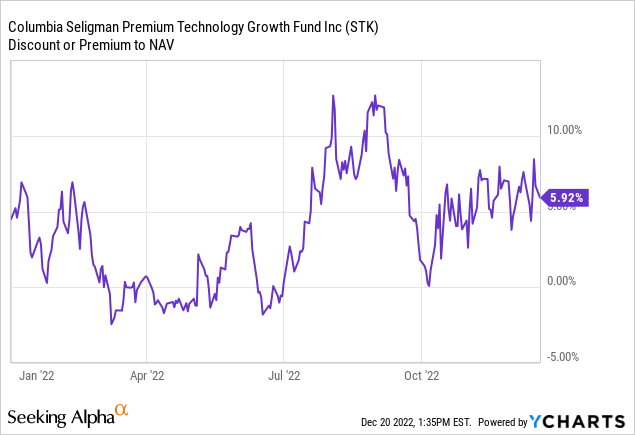

STK Premium / Discount to NAV

The fund has traded at large premiums to NAV this year:

We do not think this is justified. The fund has just tracked the index, not really monetizing the short call positions to a substantial advantage. It should not trade at a premium to NAV.

Conclusion

STK is an equity buy-write fund. The CEF focuses on technology stocks, with overweight positions in semiconductor and software equities. The fund only holds 62 names and currently writes calls on 49% of its portfolio. The vehicle has the flexibility to adjust the overwritten percentage to a range from 25% to 90% of the underlying value of the fund’s holdings of common stock. The fund has not exhibited the dampening effect we were expecting in 2022, posting a total return that matches the one exhibited by QQQ, when adjusting for the CEF’s premium to NAV. Long term, the two tickers exhibit a nearly identical performance. Ultimately, a retail investor should think about STK as taking a position in the Nasdaq, the only difference being quarterly dividend distributions equating the index’s long term performance. We expect more weakness ahead in the wider markets, but once the skies clear, a retail investor looking for dividend distributions from technology stocks should re-visit STK.

Be the first to comment