Sashkinw/iStock via Getty Images

Thesis

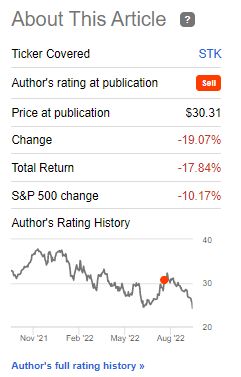

During the height of the summer bear market rally we wrote an article where we detailed why we were assigning a Sell rating to a historically robust buy-write CEF that has produced astounding positive total returns in the past decade. Nothing escapes the gravity of a bear market, even well-built vehicles like STK. Since our article, the fund is down -19% on a price basis and -17.8% on a total return basis, meeting our Sell target:

Original Rating (Seeking Alpha)

We are of the strong opinion that even robust buy-and hold CEFs need position adjusting and trimming based on market macro factors. It is very straight forward – in a bear market trim or liquidate positions if you expect the vehicle’s risk factor to decrease during the fiscal year. We are currently in a bear market driven by the vertical move up in rates by the Fed and their relentless drive to “keep at it“. Technology is taking it on the chin and will be the most affected asset class after its excesses of the past.

Columbia Seligman Premium Technology Growth Fund (NYSE:STK) is an equity “buy-write” closed-end fund focused on technology stocks:

Under normal market conditions, the fund’s investment program will consist primarily of investing in a portfolio of equity securities of technology and technology-related companies as well as writing call options on the NASDAQ 100 Index or its exchange-traded (ETF) fund equivalent on a month-to-month basis. The aggregate notional amount of the call options will typically range from 25% to 90% of the underlying value of the fund’s holdings of common stock. The fund expects to generate current income from premiums received from writing call options on the NASDAQ 100 or its ETF equivalent.

Currently around 89% of the fund is overwritten with call options but this source of premium is unable to cover the losses experienced in the underlying assets. Our call to sell would have saved an investor almost 3 years’ worth of dividends based on the fund’s current yield which is approximately 7.5%.

In our article, we wrote:

We believe we are currently in the midst of a bear market rally, triggered by significantly oversold conditions and earnings which came in better than expected from a low threshold to begin with. Inflation is not yet coming down, it is actually surprising to the upside. The Fed is not done hiking and rates will stay higher for longer. This is a relief rally which will turn as market participants realize a Fed dovish shift is much farther away than expected and that the discount rate to be used for Tech stocks will be higher. We expect another leg down in this market which will result not only in a NAV move lower for STK but also a compression of the premium to par values, as we dully saw in June. We are targeting a -10% to -15% move in STK in the next months. Let us not mince our words – STK is a premier technology CEF and a golden standard in the space via its performance, but it is currently very overpriced via its premium and it will not be able to escape the gravity of the next leg down in this bear market.

Our target having been met we are moving to Hold on the name. We believe the current re-visiting of the June lows have overextended the markets on the downside and we are due for a brief rally.

Performance

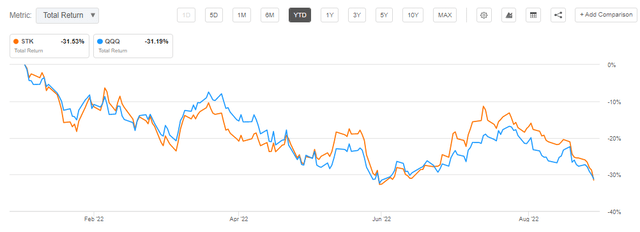

The fund is down -31% year to date, in line with the Nasdaq:

YTD Total Return (Seeking Alpha)

Tech has been the worst performer on the back of higher rates in 2022. On a five-year basis, the fund is still up a hefty 80% plus:

5-Year Total Return (Seeking Alpha)

We can see from the above chart that although being up, STK does not manage to outperform QQQ during the respective time period.

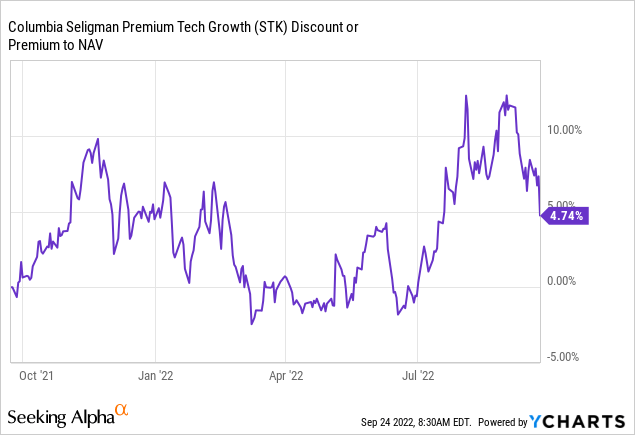

Premium / Discount to NAV

The fund is currently still trading at a slight premium to NAV:

As anticipated in our prior article the fund’s premium has moved towards flat to NAV from a very high level. We see this type of behavior during risk-off environments when investors start discounting the value provided the by the written calls premiums.

Conclusion

During the height of the summer bear market rally we wrote an article on STK where we assigned it a Sell rating. We were targeting a -15% total return in the next months. Having hit a -17.8% total return since our article and having witnessed a temporary bottom during Friday’s washout price action we are now moving from Sell to Hold on this name. The easy short selling money has been made on this CEF. An investor who would have heeded our advice would have saved three years’ worth of dividends by trimming their position in the name.

Be the first to comment