Natalija Grigel/iStock via Getty Images

Investors in Stitch Fix (NASDAQ:SFIX) have faced a nightmare scenario over the last year where the company has hit tough online retail comps and the struggle of a new CEO to launch a promising new product. The online personalized shopping company slightly missed FQ4’22 targets, but the company lowered the boom on FY23 guidance. My investment thesis remains ultra-Bullish as Stitch Fix throwing in the kitchen sink with guidance setting up an easy hurdle for a business that should return to growth this year.

Tough Environment

No doubt, Stitch Fix faces a tough macro environment as consumers return to shopping in stores and focus on experiences. Some of the elevated sales from FY21 were naturally not sustainable in the short term and the apparel market has gotten far tougher than expected.

For FQ4’22, the online retailer reported revenues of $481.9 million. Stitch Fix missed consensus estimates by $6.9 million in a continuation of slight misses and guide downs from prior quarters.

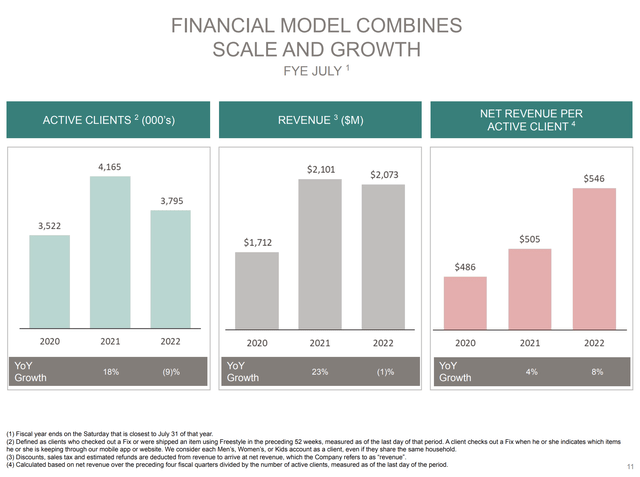

The company definitely saw a more mixed view on customer behavior. Stitch saw another dip in active clients to 3.8 million, though the number is still up from the 3.5 million reported back in FY20.

Source: Stitch Fix FQ4’22 presentation

On the flip side, the active clients are actually spending far more on Stitch Fix due to the combination of the Freestyle product and the traditional Fix. For FY22, the net revenue per active client was up a strong 8% to $546, though the ARPAC did dip from the $553 reported in the prior quarter.

If one took out the COVID boosted FY21 numbers, Stitch Fix would be reporting revenues up 21% to $2.07 billion. The business is up over the 2-year period due to a 273K increase in active clients spending on average $60 more each.

Depending on how one views the data, Stitch Fix has solid growth from the FY20 numbers or weak numbers from the FY21 numbers. The huge disappointment is that investors expected the company to hold onto far more of the COVID boosts hoping the Freestyle product was actually driving sales growth.

The kitchen sink quarter comes with the guidance for FY23 starting with the current quarter. The forecasts for revenues to decline up to 15% for the year seems incredibly dire considering the Fed should be close to ending rate hikes this month and apparel sales should bottom out here soon.

Stitch Fix guided to FY23 revenues of $1.76 to $1.86 billion. The numbers are a large dip from the $2.07 billion reported in the just ended year. The company starts with guidance for FQ1 sales to dip by up to 22% while analysts were forecasting a sequential sales rebound to $524.5 million.

The tough part with Stitch Fix is not knowing the macro impact compared to the product issues impacting the personalized online shopping service all year. As the world normalizes this year, Stitch Fix should start showing some benefits from the higher total addressee market and broadened ecosystem from the Freestyle product.

On the FQ4’22 earnings call, CEO Elizabeth Spaulding appeared clear weak guidance was based on consumers focusing on lower priced points items and signaling an intent to spend less, not further product problems:

I will say that consumers are telling us they are feeling more cash constrained. We have different experiences within Freestyle where we highlight items under $50. And in general, we have seen our price points that are at more affordable average unit retails outperforming, which is a strong signal that consumers are looking for value right now.

And then we do ask our clients about sort of their anticipated spending going forward. And we have heard clients both in serving consumers in the U.K. and the U.S. that they may be buying fewer items per fixed in the future. And so we’re just really preparing to have the right product at the right time.

Giving Shares Away

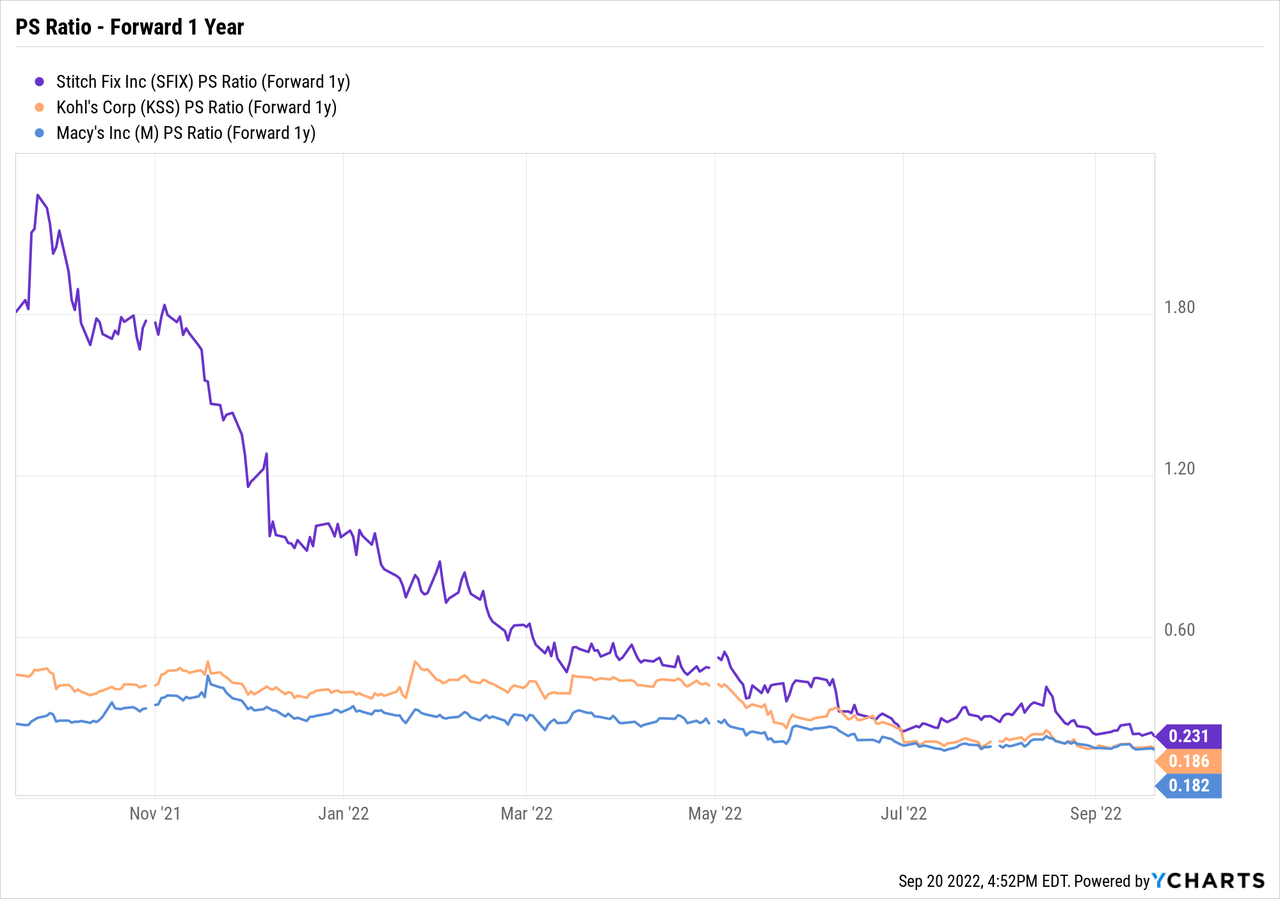

Stitch Fix has definitely struggled the last year. My expectations were for revenues to hold up far better, but the stock trading down to $4 is just absurd. The market is virtually giving away shares as people extrapolate far too much on the current weakness.

The company ended the quarter with a cash balance of $212 million. In addition, Stitch Fix has another $197 million in inventory for a stock with a market cap of just $500 million.

The stock is so cheap Stitch Fix trades at similar valuation to department stores now. Both Kohl’s (KSS) and Macy’s (M) trade in the 0.2x forward sales multiple range and in both cases those stocks are very beaten down.

If Stitch Fix figures out how to grow the active client base while still expanding the revenue per client, the stock is a home run here. A return to solid growth would easily value the stock back at 1x to 2x sales targets.

If Stitch Fix fails to ever reinvigorate growth, the stock could easily be sold for something around the current value. The company has valuable customer data and technology with a hoard of data scientists possibly more valuable in the hands of a better management team.

Takeaway

The key investor takeaway is that Stitch Fix is insanely cheap down here. The stock is valued as if the company is going out of business with the market extrapolating too much of the current weakness beyond macro issues.

The online personalized shopping experience has faced a nightmare scenario, but investors could eventually hit a home run with the stock trading at levels where Stitch Fix doesn’t belong.

Be the first to comment