NgKhanhVuKhoa/iStock via Getty Images

Stem (NYSE:STEM) has quickly become one of the largest positions in my climate economy portfolio, a bullish positioning that reflects what is set to be significant growth of renewables and short-duration energy storage systems over the next decade. Indeed, the International Energy Agency just published a report that highlights just how positive the momentum of Stem’s total addressable market will be, with global renewable power capacity set to grow by 2,400 GW over the next five years. This figure was revised 30% higher than IEA forecasts from a year ago. By 2027, renewables will account for over 90% of global electricity capacity expansion and will overtake coal by early 2025.

High growth supported by a large TAM and boosted by strong fundamental tailwinds from the IRA to the energy crisis form the theoretical base for the long-term investment proposition of Stem. The scarcity premium will also come into play in the years ahead to boost the underlying value of the company’s commons. This describes the idea that investors are willing to pay more for companies that are perceived to be in high demand and short supply. Stem was the first pureplay smart energy storage company to go public, and there still remains a small number of truly pureplay utility-scale energy storage companies. The broader energy storage ecosystem includes proprietary energy storage companies like ESS Tech (GWH), Eos Energy (EOSE), and Energy Vault (NRGV).

Stem Is Executing Well, But Headwinds Remain

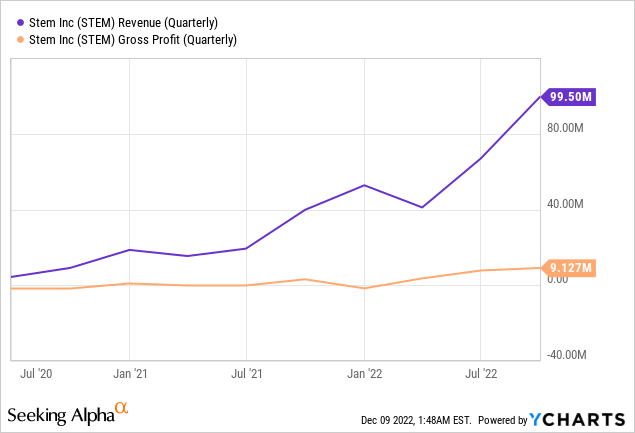

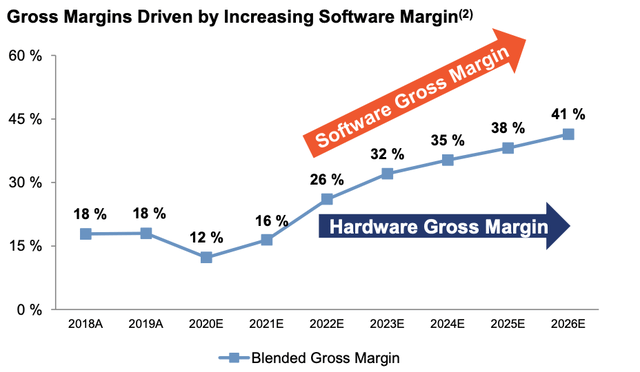

The company’s gross profit margin for its last reported fiscal 2022 third quarter came in at 9.5%, the fifth consecutive quarter of positive gross margin and in line with the year-ago figure. But bears would be right to flag that gross margins are so far tracking below Stem’s initial guidance provided when it announced it would go public.

Stem

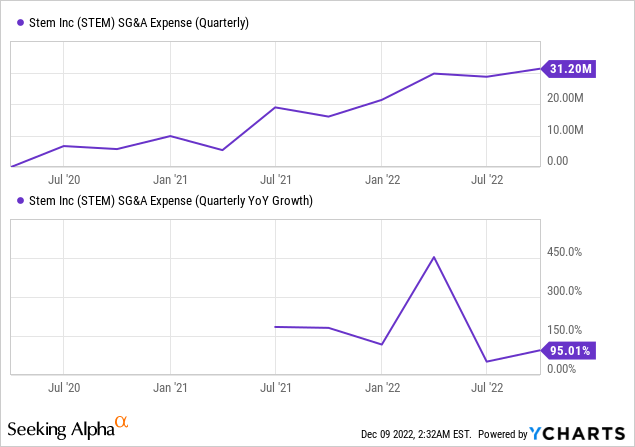

This would have seen a blended gross margin of 26% for this year, rising to just under a third in 2023 and then 41% in 2026. Stem bears would also be right to flag rising operating expenses as a barrier to near-to-medium-term cash flow breakeven.

Indeed, SG&A expenses for the third quarter grew by 95% over the year-ago period to reach $31.2 million. However, this was 31.36% of revenue, down sequentially from 42.7%. Bears have called out full-year revenue guidance of between $350 million to $425 million as being too ambitious and highly unlikely at the top end. With Stem’s year-to-date revenue at $207.5 million, the company is expecting a remarkable $142.5 million to $217 million in revenue for its final fourth quarter.

Achieving the top end of this range would mean more revenue than its first three quarters combined. Of course, the company has visibility into the timing of its bookings so I have very little doubt that Stem will be unable to achieve at least the lower end of its revenue guidance. It would be odd for management to reaffirm full-year guidance in November, a third way through its fourth quarter, and then underperform it.

The dramatic growth reflects the positive dynamics of short-duration energy storage demand. To be clear here, and in my opinion, this is likely one of the most dramatic secular growth industries. The perfect marriage of growing storage commercial viability and positive growth-orientated government policy will see this TAM rise every year for the next decade. Decarbonization is here and it’s ramping.

Battery Storage LCOE Reverses Progress As Solar Ramps

Solar energy for example is at the cusp of a golden decade with expectations that US solar deployment will increase to form 10% of US electricity generation from all sources by 2030, up from 3% in 2020.

U.S. Energy Information Administration

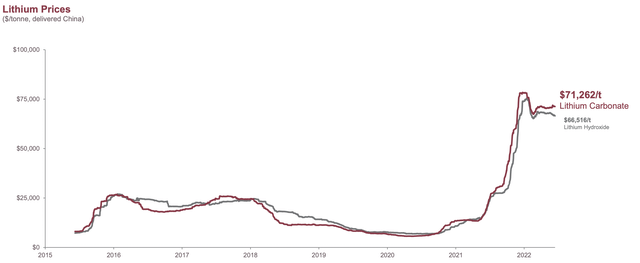

The long-term bullish argument is that the rising golden line will form the foundation for structural demand for energy storage. However, some have stated that whilst there will be strong growth, profitability stands to remain weak. The development of lithium mines for new supply faces significant bottlenecks. Only one lithium mine currently operates in the USA, with efforts to open more repeatedly blocked. For example, the Thacker Pass lithium mine being proposed by Lithium Americas Corp. (LAC) is currently in a legal battle for survival after multiple suits by environmentalists. This region forms one of the largest lithium deposits in North America. The impact of the mismatch between demand and supply has been for lithium prices to spike to record highs this year.

Lithium Americas

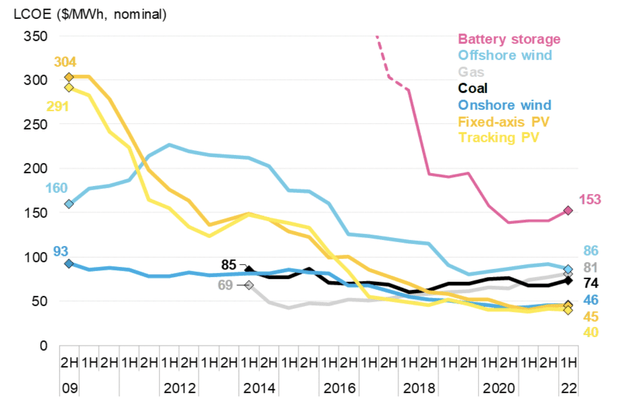

This has reversed the marked decline in the levelized cost of energy battery storage experienced since 2017. Battery storage LCOE at $153 MWh in the first half of this year rose from the second half of 2020.

BloombergNEF

These supply constraints are likely to be permanent, with relevant environmentalist groups seemingly unaware that demands for decarbonization will require a dramatic expansion of lithium mines. Whilst the IRA will help bring this LCOE down, other non-IRA countries could see some slowdown in momentum. Whilst this isn’t inherently an issue with just $1.7 million of revenue from Stem’s last quarter being from outside the US, it could taper some momentum from the company’s growth ramp.

My 2027 bull case reflects Stem’s 2020 gross margin guidance of around 42% in the year, roughly in line with Enphase’s (ENPH) last reported gross margins. This would be against annual revenue for Stem of around $1.2 billion. Hence, assuming a blunt like-for-like valuation based on this, the company’s market cap could rise substantially higher than it currently is. I will continue to add to my position on current Fed-induced weakness.

Be the first to comment