Liudmila Chernetska

CVR Partners (NYSE:UAN) stock price increased by about 20% in the last few weeks. The company reported strong financial results for the second quarter of 2022 and announced a cash distribution of $10.05 per common unit for the quarter. The main driver for the company’s profitability in 2022 has been the high prices of fertilizers, driven by the geopolitical tensions in Europe. I expect fertilizer prices to remain high as the war in Ukraine continues. The stock is worth $157. UAN is a buy.

Q2 2022 Highlights

In its Q2 2022 financial result, UAN reported net sales of $244 million, compared with Q2 2021 net sales of $138 million, up 77%. The company’s fertilizer sales increased by 82% to $231 million in the second quarter of 2022. CVR Partners reported a Q2 2022 cost of sales of $111 million, up 9% from its Q2 2021 cost of sales of $101 million. UAN’s net income increased from $7 million, or 66 cents per common unit in Q2 2021, to $118 million, or $11.12 per common unit. In the second quarter of 2022, the company’s EBITDA increased by 88% to $147 million. Moreover, its available cash for distribution increased from $18 million in Q2 2021 to $106 million in Q2 2022, up 489%. In the second quarter of 2021, the company produced 217 and 334 thousand tons of ammonia (gross produced) and urea ammonium nitrate (UAN), respectively. In the second quarter of 2022, these numbers decreased to 193 and 331 thousand tons, respectively. Furthermore, in Q2 2022, CVR Partners sold 52 thousand tons of ammonia (down 35% YoY) and 287 thousand tons of UAN (down 22% YoY). The company’s ammonia price per ton increased from $403 in Q2 2021 to $1182 in Q2 2022, up 193%. Also, its UAN price per ton increased from $237 in Q2 2021 to $555 in Q2 2022, up 134%. UAN announced a cash distribution of $10.05 per common unit for the second quarter of 2022. “CVR Partners achieved solid operating results for the second quarter of 2022, driven by strong global fertilizer industry conditions,” the CEO commented.

The Market Outlook

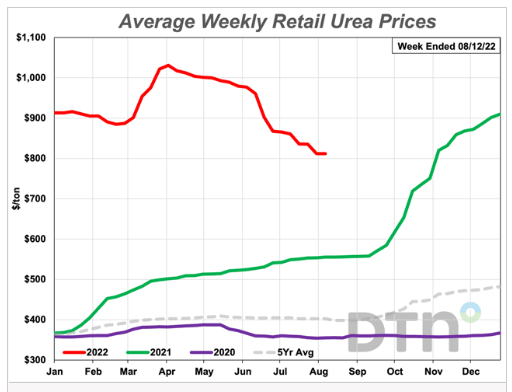

Fertilizers Price Index increased from 70 on 31 July 2020 to $127 on 31 July 2021 and to 213 on 31 July 2022. However, it is worth noting that on 30 April 2020, the Fertilizer Price Index was 255. It means that despite fertilizers prices soaring in the last two years, the prices retreated from their record highs. According to Figure 1, the average weekly retail price of urea dropped from $1012 per ton on 18 August 2022 to $812 per ton on 5 April 2022. However, the average weekly retail price of urea is up 46% YoY. In a word, despite lower fertilizer prices in recent months, the prices are significantly higher than a year ago.

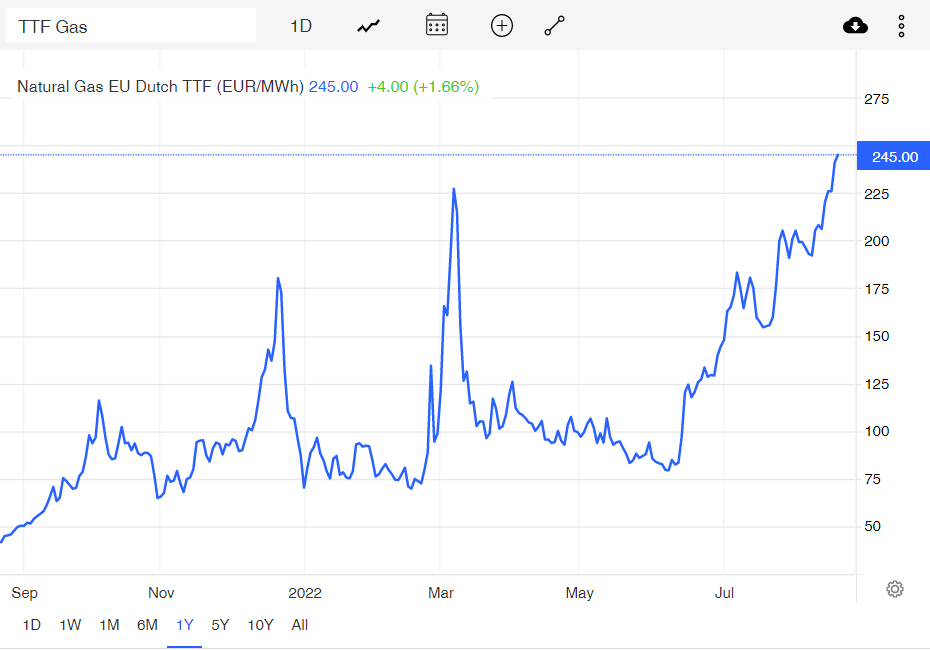

Due to the ongoing natural gas crisis in Europe, I expect the price of ammonia and urea to increase as the summer ends. Figure 2 shows that the natural gas price in Europe has soared again. Also, it is worth mentioning that the natural gas price in the United States increased from $5.39/MMBtu on 30 June 2022 to $9.04/MMBtu on 19 August 2022. Recently, Gazprom announced that due to sanctions on Moscow, delivery of a turbine needed to keep gas flowing to Europe via the Nord Stream 1 pipeline is impossible. The company has reduced flow through the Nord Stream pipeline to Euro to 20% of its capacity. Overall, because of geopolitical tensions in Europe, low domestic storage capacity in the region, declining European domestic production, global competition for LNG, and increasing European carbon pricing, I expect the natural gas price in Europe to remain high and even go further through the winter. All of these means that as the war in Ukraine continues, the market outlook for fertilizers is strong. Also, due to the Russian & Chinese fertilizer export ban, the demand for UAN’s products will be solid. I expect that in Q3 2022, the company’s UAN price to be $481 per ton. Also, I expect its ammonia price to be $1152 per ton.

Figure 1 – Average weekly retail urea prices

www.dtnpf.com

Figure 2 – Natural gas price in Europe

tradingeconomics.com

Performance

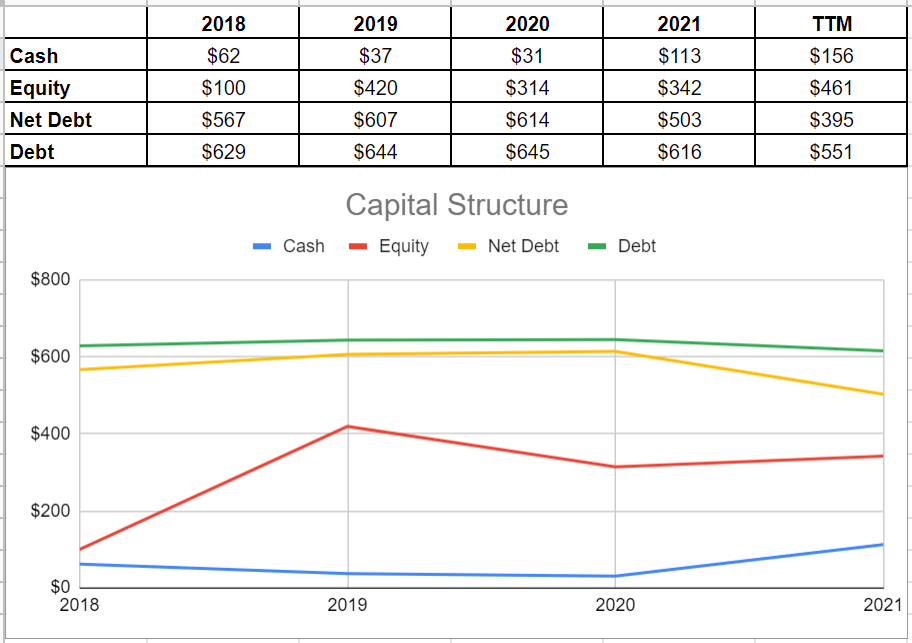

After a steady trend in total equity of $314 million and $342 million during 2020 and 2021, respectively, the company increased its total equity severely to $461 million in TTM, up 34%. Moreover, we observe that CVR Partners’ net debt has started shrinking since 2021. The company’s net debt decreased to $503 million in 2021 compared to its previous level of $614 million in 2020 and kept declining to $395 million in TTM. In the case of the company’s recovery after COVID-19, UAN’s net debt in 2021, which was before the embarking of the Ukraine war, was beneath its net debt of $607 million at the end of 2019. Furthermore, we see an impressive growth in the company’s cash balance to $113 million and $115 million in 2021 and TTM, respectively, compared to its previous level of only $31 million at the end of 2020. In brief, UAN’s capital structure shows a healthy cash and leverage position (see Figure 3).

Figure 3 – UAN capital structure (in millions)

Author (based on SA data)

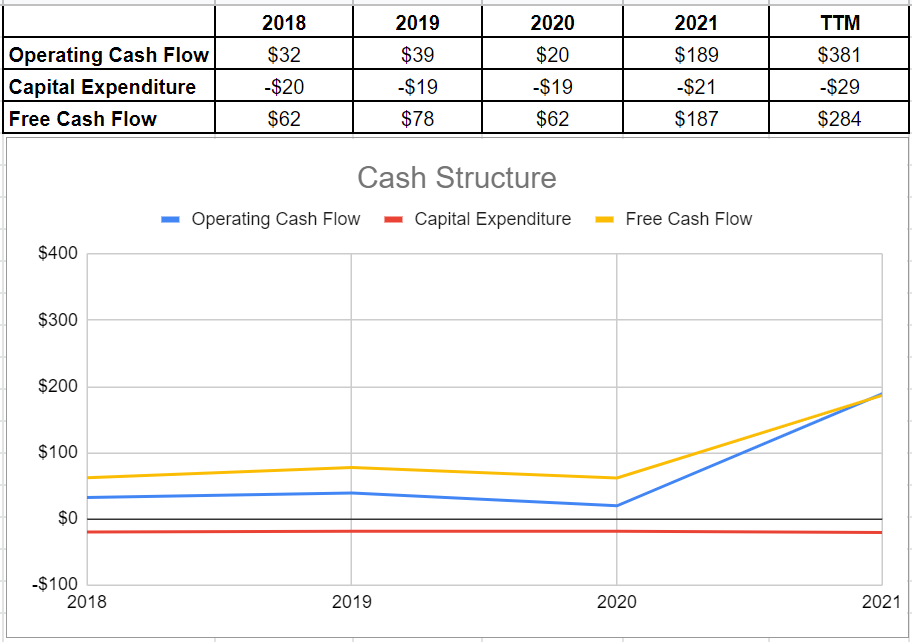

Analyzing the company’s operating conditions indicate that UAN’s operating cash flow has surged amazingly from $20 million at the end of 2020 to $189 million at the end of 2021 and $381 million in TTM. On the other hand, UAN’s capital expenditure saw a slight increase from $21 million in 2021 to $29 million in TTM. All was said and done, growth in cash balance has led to a good free cash flow generation. The company’s free cash flow boosted from $62 million in 2020 to $187 million and $284 million in 2021 and TTM, respectively. Thus, CVR Partners’ cash balance is healthy enough to bring more profit for shareholders in the future (see Figure 4).

Figure 4 – UAN cash structure (in millions)

Author (based on SA data)

Valuation

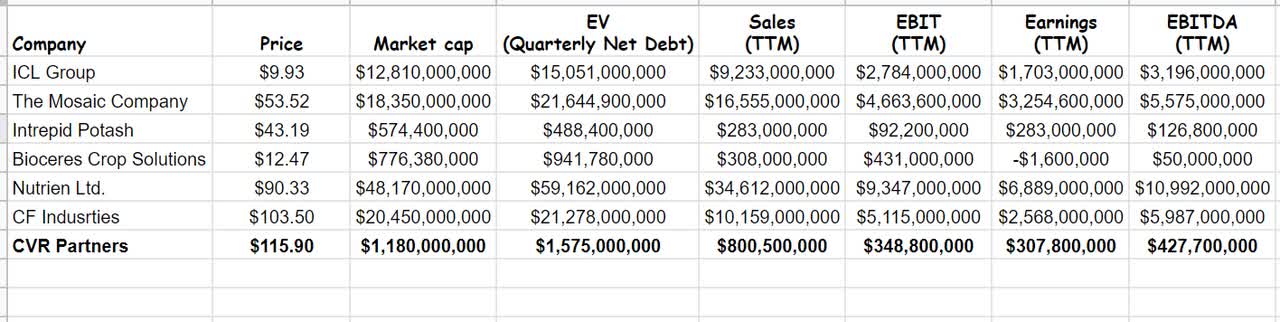

Using Comparable Company Analysis, I evaluated that the UAN stock is attractive and undervalued. Comparing CVR Partners with other peer competitors like CF Industries (CF), Nutrien (NTR), and ICL Group (ICL) and using the CCA method, I estimate that the stock’s fair value is about $157. This method reflects the real-market data and is an appropriate way of analyzing CVR Partners since the company is relatively stable. However, choosing a set of comparable companies is the first and most crucial step in the CCA method. In doing so, I chose competitors with relatively similar field of work and profit margins. Data was gathered from the most recent quarterly and TTM data (see Table 1).

Table 1 – UAN financial data vs. its peers

Author (based on SA data)

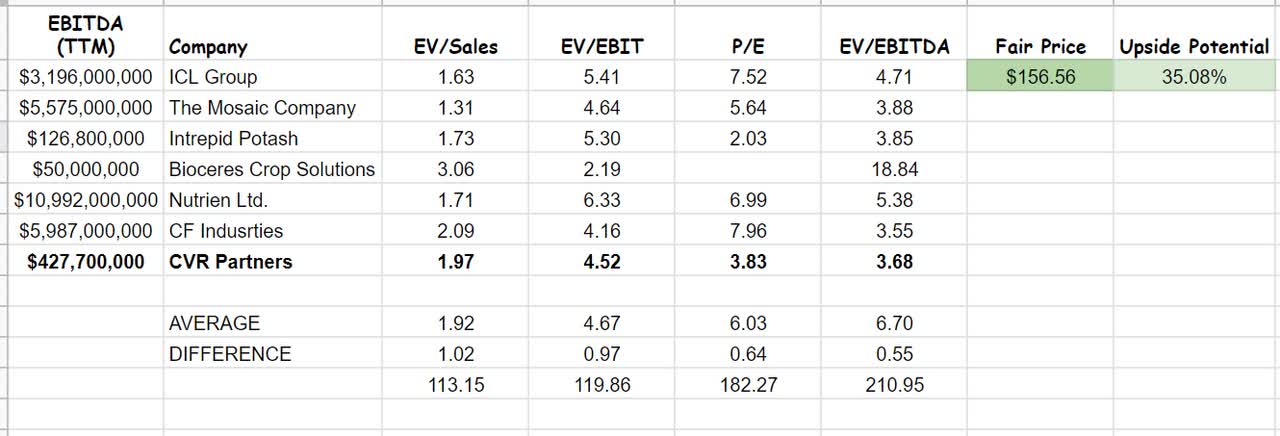

Analyzing other companies’ ratios and comparing them with UAN’s, we can figure out that CVR Partners looks relatively attractive and is undervalued. The company’s P/E ratio is 3.83x, which is 36% lower than the peer’s average. Also, its EV/EBITDA is 54% lower than the group’s average of 6.7x. Meanwhile, UAN’s EV/sales and EV/EBIT are 1.97x and 4.25x, respectively, which are in the same line with the peers’ averages. Ultimately, evaluating CVR Groups indicates that the stock is worth $157, a 37% upside potential. (see Table 2).

Table 2 – UAN stock valuation

Author

Summary

Natural gas price in the United States and Europe have soared again in the last few weeks. High natural gas prices caused by the war in Ukraine cause the price for UAN’s products to remain high. I expect that in Q3 2022, the company’s UAN price to be $481 per ton. Also, I expect its ammonia price to be $1152 per ton. UAN’s capital structure shows a healthy cash and leverage position. Moreover, CVR Partners’ cash balance is healthy enough to bring more profit for shareholders in the future. I estimate that the stock’s fair value is $157. The stock is a buy.

Be the first to comment