Petmal

Here at the Lab, this year, we have already covered Stem, Inc. (NYSE:STEM) twice. In our initiation of coverage, we started with a comps analysis with an Italian peer, and then we reaffirmed our buy rating target with a publication called ‘All About The Long-Term Trends‘. In our last analysis, we provided a follow-up note starting from MACRO consideration up to a MICRO level:

We estimated a 35% CAGR in global electric storage demand to reach 75 GWh by 2026. The US market will drive the demand due to net-zero emission targets and federal investment tax credit. This is also supported by the Biden administration’s recent infrastructure bill. More importantly, Stem is leveraging its hardware sales over the short-term horizon, but the real opportunity is represented by the software as a service business. This is a less capital-intensive division and serves to optimize energy peak and battery performance. The software division revenues are long-term contracts (10/20 years duration) and will enhance the company’s future profitability.

With pleasure, we report that Stem is executing very well on its long-term promises. Since our latest analysis, the company reported its Q3 results and updated its investor community with a capital market day that fully supported our positive view. In detail, at Stem’s analyst day, the company’s top management spent a lot of time demonstrating the full capability of its Athena platform. Having unified the clean energy management, we should now record that Athena is helping solar, EV charging, and storage companies to be less costly and optimize their renewable assets with real-time status and automated monitoring at the operating level to enhance profitability.

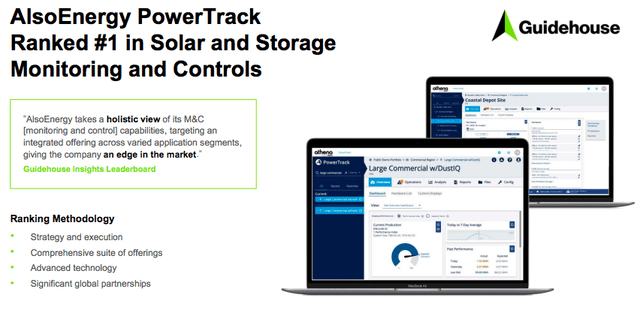

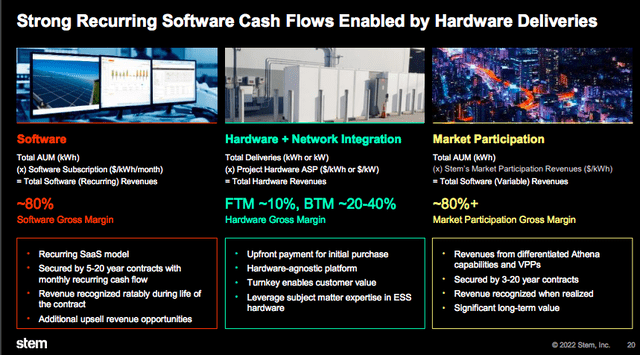

Over the medium-term horizon, the company aims to win market share thanks to four core pillars: 1) Technology Leadership, 2) Operational Excellence 3) Commercial Strategy and 4) Macro Tailwinds. In the 2022 first half, Stem invested more than $8 million in software development and was able to show how PowerTrack and Athena’s platforms are increasingly providing synergies. In detail, the company’s CEO would like to transform Stem into a SaaS company with Athena acting as a platform for different operators (Fig 1). Five external platforms are already integrated and seven are coming online soon. As a note, Stem’s software division has a target gross margin of approximately 80% (Fig 2). These numbers are already incorporated in our DCF analysis.

Athena and PowerTrack Power platforms

Fig. 1

Stem Software Gross Margin

Source: Stem Investor Day 2022 (Fig 2)

Looking at the numbers, it is important to emphasize that 2025 financial targets were confirmed. Stem management guided:

- Hardware turnover growth at 25/35% CARG until 2025;

- Service/software turnover growth at 65/85% CARG until 2025;

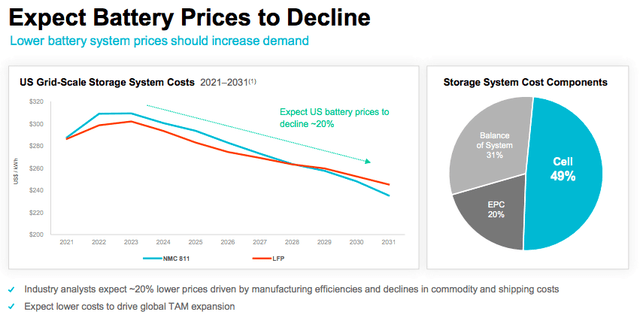

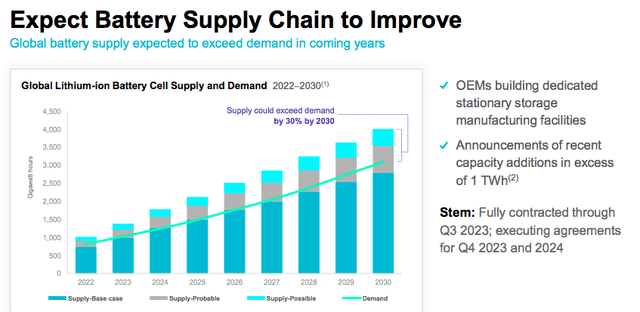

- With a gross margin of 25/30% and an adjusted EBITDA margin between 15% and 20%. This is supported by a decline in battery prices (Fig 3) as well as an imbalance between supply (less) and demand (more) in the global battery market (Fig 4). Aside from the solar panel demand, Stem also included a clear upside in the e-mobility market.

This goes well in line with our mid-point forecast that suggests a top-line of $1.2 billion with an EBITDA of $200 million in 2025. In the Q3 accounts, cross-checking Wall Street numbers, the company had a solid beat in the revenue line and was in line with the EBITDA margin. As already mentioned, the company confirmed the 2022 financial targets but we believe that Stem will exceed the forecast projection (having beat targets in the last three quarters). In Q3, Stem recorded $100 million in revenue and an EBITDA of minus $13 million, and more important to report was the higher order backlog and the fact that they raised the booking low-end by 10%. Talking about the backlog, the company now has $7.2 billion in orders with a 200% growth on a yearly basis and a strong acceleration quarter by quarter. Speaking of Q4, in our model, we estimate more than $200 million in revenue (at the high end of management guidance) and we still expect a positive EBITDA in the second part of 2023.

Battery cost evolution

Fig 3

Battery growth

Source: Stem Investor Day 2022 Fig 4

Conclusion and Valuation

Mare Evidence Lab’s DCF is unchanged and therefore we reiterate our target price of $22 per share. Stem’s top management is executing very well and there are many secular growth trends that fully support the company’s investment case. As already mentioned last time, there is also an additional upside from the Inflation Reduction Act. The IRA supports storage facilities with a tax credit (with a project cost reduction estimated between 30% and 50%). Other risks to our target price are higher competition, regulatory changes, and software delays.

Be the first to comment