Bilanol

Stem (NYSE:STEM) has been reporting bumper numbers for a while now but its fiscal 2022 third quarter results were simply ridiculous with revenue growth that came in at 150% and was boosted by bookings that was up 115% year-over-year. The company is now clearly the world leader in the deployment of short-duration energy storage systems for the ongoing shift to renewable energy. This is set to be one of the most significant growth opportunities accessible to public market investors over the next decade and Stem is carving a material part of the fast-expanding TAM through its strong execution and software-based strategy with Athena and AlsoEnergy.

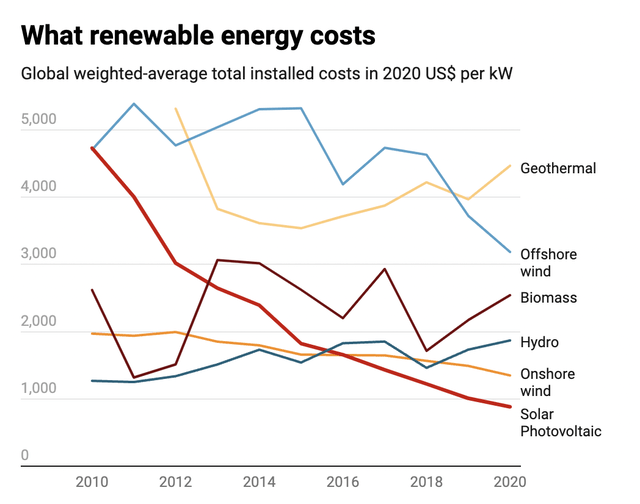

Whether or not the climate economy would reach a runaway phase of growth was always rightly questioned by bearish sentiment on the industry. The argument went that falling renewable energy costs would eventually stall to discombobulate the rollout of solar and wind power versus other alternative sources.

Spectator Data Tracker

But the energy crisis and the Inflation Reduction Act have both partnered to disrupt this thesis. Coal and natural gas have rallied to multi-decade highs on the back of Russia’s war in Europe with renewables plus energy storage maintaining their downward momentum. This has rendered them critical building blocks for economies around the world looking to embed cheaper zero-carbon energy into their electricity grids. Solar and onshore wind now form the cheapest sources of electricity and energy storage helps these systems better match the variability in energy demand realized throughout the day.

Athena and AlsoEnergy enable Stem’s customers to better forecast energy supply and demand while optimizing their batteries across energy arbitrage, wholesale market participation and backup power. Fundamentally, Stem’s energy storage solutions allay bearish concerns about the intermittency of renewables by allowing excess energy to be stored for later use to increase the viability of renewables to replace their alternatives.

Growth Like An Early Stage Startup

The company reported earnings for its fiscal 2022 third quarter after the market closed on Thursday. This saw revenue come in at $100 million, an increase of 150% from the year-ago quarter and a nearly 50% sequential growth from revenue of $67 million in the second quarter. The company sold more hardware in both the front-of-the-meter and behind-the-meter segments. AlsoEnergy, Stem’s solar PV monitoring and controls software subsidiary, contributed $17 million to this figure.

Year-to-date revenue now stands at $207.5 million, up from $127 million in the comparable year-ago period as assets under management during the quarter grew to reach 2.4 GWh from 1.4 GWh in the year-ago period. Contracted backlog also grew to reach a new record of $817.2 million, up sequentially by 11%. The company is now guided to exit 2022 with a nearly $1 billion dollar backlog as the Inflation Reduction Act catalyzes significant activity in its core TAM.

Further, Stem expects to be adjusted EBITDA positive by the second half of fiscal 2023 as growing hardware deployments with Athena attached feeds through to gross margins and underlying operational profitability. This is with an adjusted EBITDA loss for the third quarter at $13 million, a strong deterioration from a loss of $7 million in the year-ago period. The widened loss was due to higher personnel costs and investments the company made in growth initiatives. With cash and equivalents of $293 million as of the end of the quarter against cash burn from operations that came in at $36 million, the company remains in a good position to fund itself for the next few quarters until positive adjusted EBITDA is reached. Not leaning on the market for an equity sale in the interim would compound long-term value creation as the current price of Stem’s common shares is materially below its 52-week peak.

Climate Economy Takes Off

The immediate impact of the Inflation Reduction Act was to spark a rally of Stem’s shares to a 6-month high of over $17. This has since pulled back as the nearly structural market risk-off trade continues and will likely see shares get pulled down below $10 in the interim. The long-term secular growth market, one now fast accelerated by the IRA, looks underhyped against this down-trending price movement.

Bears would be right to point to Stem’s market cap of $1.8 billion as a reason for some pause as against full-year 2022 revenue set to come in at not more than $425 million. This would mean a 4.2x multiple and is significantly higher than the sector median. It builds in the more potential downside as it’s a risk in itself amidst a risk-off environment. However, the long-term bull case remains. Solar and wind are set for their most significant growth decade ever. This will be pivotal in the fight against anthropogenic climate change and will see intense wealth created for the companies that come to dominate the industry.

Be the first to comment