yangphoto/E+ via Getty Images

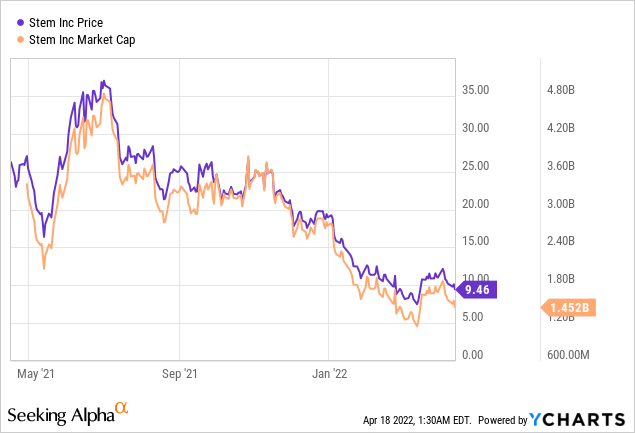

The market reacted with awe and euphoria when Stem (NYSE:STEM) went public and became the first pure-play smart energy storage company to become investable. Stem, a market leader in AI-driven clean energy storage systems, would soon see its stock price ascend rapidly to reach just under $38 for a market capitalization of $5 billion. This has now dropped by just over 70% to $1.45 billion.

In retrospect the bullish rationale then was clear; the continued uptake of renewable energy as the core driver for decarbonisation efforts would see continued state and national support for new clean energy projects. Stem directly compliments this shift as its utility-scale battery storage solutions address the intermittent nature of energy supply from both solar and wind energy developments.

To highlight just how strong the hype was then, infamous short selling outfit Citron Research called the stock the “most compelling market ESG story” and attached a $100 price target. A price now that would imply an almost 1000% increase from the current stock price. Against an immensely bullish backdrop, the current price seems tragic, perhaps an underappreciation of a company critical to the decarbonization efforts of the USA. Indeed, climate change has seemingly taken a back seat to the current energy crisis, the war in Europe, and multi-decade inflation highs. Hence, what does the future hold?

A tough question as investor sentiment sometimes ebbs and flows like feathers in the wind. Right now that wind is blowing the feathers against the ground as the broader macro backdrop, characterised by fear, is likely to persist for much of this year and into 2023.

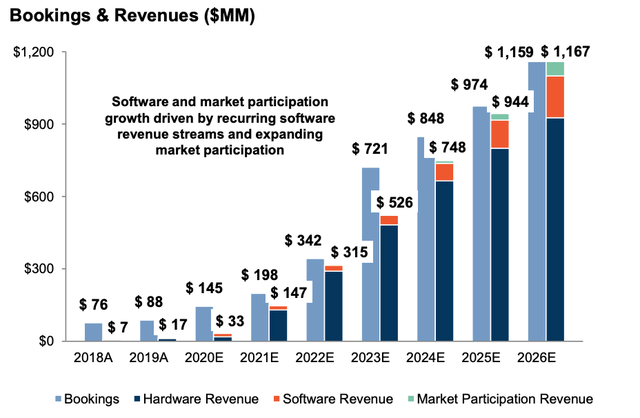

Another small issue arises when looking at the initial revenue guidance Stem provided last year as it announced it was going public.

Stem

With revenue forecasted to be $147 million for its fiscal 2021, Stem’s actual revenue of $127 million is $20 million short of guidance. So Stem is growing quickly, but missed its own guidance and saw the pullback on its common shares intensify as a result of this.

Hyper Revenue Growth Placed Within Higher Losses

Stem continues to grow rapidly. The company saw revenue for its fiscal 2021 grow by 251% to reach $127 million as the continued growth of large scale renewable generation projects with storage drove bookings and subsequent revenue generation. Gross margins also grew to reach 11% versus 10% in fiscal 2020. The company’s contracted backlog grew by 144% year-over-year to reach $449 million whilst its 12-month pipeline grew by 150% to reach $4 billion.

The company’s long term software revenue represents approximately 40% of total bookings and forms the foundation for predictable high-margin service revenue. This is being built with a 60-40 hardware-software split. Contracted AUM grew 60% from 1 gigawatt at the end of 2020 to 1.6 gigawatt at the end of 2021, this was also a 14% growth sequentially as booking momentum picked up. Stem was able to score a material win with the exclusive rights to provide storage hardware and software in Texas to a renewable developer Available Power. This will be to a portfolio of up to 100 sites and could become a 1 gigawatt to 2-gigawatt hour portfolio, more than doubling their AUM from current levels.

Further, the company ended the year with $921 million in cash on the balance sheet on the back of its yet to close $695 million acquisition of solar asset management software company AlsoEnergy and its $460 million green convertible bond raise last November. As this was 3 times oversubscribed at a coupon of 50 basis points, there is likely still appetite from the debt capital markets to finance future operations at relatively cheap rates.

Stem expects to realize revenue of $350 million to $425 million for fiscal 2022. This would place its current price to sales multiple at 3.75 using the midpoint of this revenue range.

Clean Energy Storage Set To Facilitate Stronger Adoption Of Solar And Wind Power

The growth of US renewable energy production over the last decade has been dramatic. The importance of this in the fight against climate change cannot be understated.

EIA

Energy storage is a critical facilitator of the global transition to renewables. This means Stem is chasing an extremely large TAM and the continued rollout of new solar and wind energy projects across the United States provides a long-term ramp for revenue growth.

The future is bright but the current investment environment has not been kind to early stage companies still in the cash burn phase of their growth. But this would be myopic as Stem’s core profitability is set to move up as the company starts to realize backloaded higher-margin software revenue. This is currently muted but is set to push higher in the years ahead. Stem’s common shares could experience more weakness if sentiment melts further from here, but I would rate the company as a buy on the back of this.

Be the first to comment