Pixelci/iStock via Getty Images

Citron Research almost a year into the pandemic released a bullish research note on Stem (NYSE:STEM). Led by Andrew Left, the infamous short-selling outfit had made a name for itself a few years prior with a report that catalyzed the collapse of Bill Ackman-backed Valeant Pharmaceuticals, now called Bausch Health (BHC). It was a rare bullish research note for a firm that had spent most of its history calling out numerous stock tickers loved by retail investors. Citron’s Stem note ascribed a $100 price target and called the company an 800-pound gorilla in a global energy storage market set to be a $1.2 trillion opportunity. The under-the-radar report empathetically described Stem as a disruptive market leader and an expected holding for ESG-dominated funds. Since this note came out, Stem has pulled back from what was then a $3 billion market cap to $1.85 billion.

This has happened as the broader renewables market is set to be accelerated by the Inflation Reduction Act beyond even the most widely optimistic bullish estimates. The IRA represents a step change for the industry, with initial cost of $370 billion being allocated towards net zero over the next decade, likely materially understating what I think will come to be the single most defining legislation for the climate economy.

The Inflation Reduction Act Is Truly Material

The IRA at its core intends to induce a long-term collapse of fossil fuels by bringing forward the timeline for the adoption of low emissions technology. Most of Stem’s shareholders might be aware of the $370 billion figure initially provided as the fiscal cost over the next decade, but this figure is somewhat misleading.

Credit Suisse analysts published a research note on the IRA in late October that highlights just how staggering its fiscal and financial impact will be. The IRA might spend twice as much as the currently earmarked $370 billion figure because many of its important provisions including subsidies for solar, wind, and utility-scale battery storage systems are uncapped tax credits. The US government has essentially written a blank check to the low-emissions industries.

The government will award credits as long as a project meets the terms. There is no upper ceiling, no budget, and no restrictions. The IRA’s total spending is likely to be more than $800 billion, 2x more than the frequently cited figure. Further, when you adjust for the crowding-in effects of private capital layering on top of government subsidies, the total allocated capital investments into technologies that constitute Stem’s total addressable market could top $1.7 trillion over the next decade until 2032 in my opinion.

The IRA now forms the thickest base of Stem’s short, medium and long-term bull case. It’s large in its scope and scale and represents one of the most pertinent efforts by any government on the planet and against any time in contemporary American history to heavily influence the winds of change for its entire energy system. Put simply, it could become the development that sees transitioning to a lower carbon economy no longer remaining in the realm of fiction.

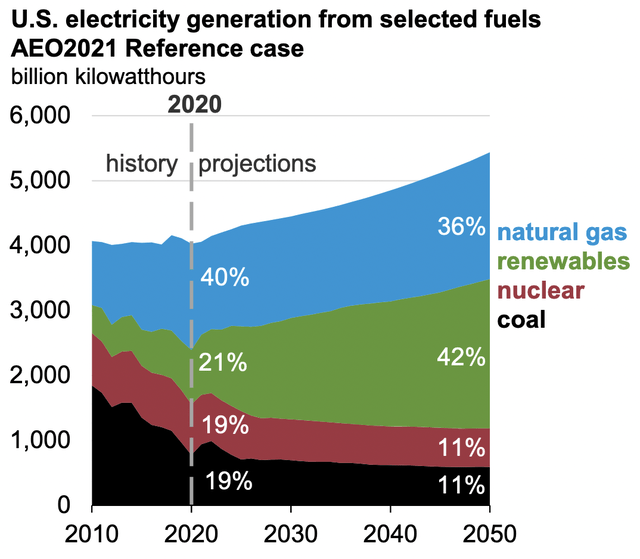

Energy Information Association

The Boston Consulting Group has estimated that the incentives included in the IRA could increase the deployment of zero-carbon energy to up to 80% of electricity production as soon as 2030 with US solar and wind potentially set to be the cheapest in the world at less than $5 per MWh by 2029. Utility-scale solar deployments alone are set to increase by 40%, around 62 GW, over pre-IRA projections through 2027.

The Growth Of Athena Is Stem’s Stalking Horse

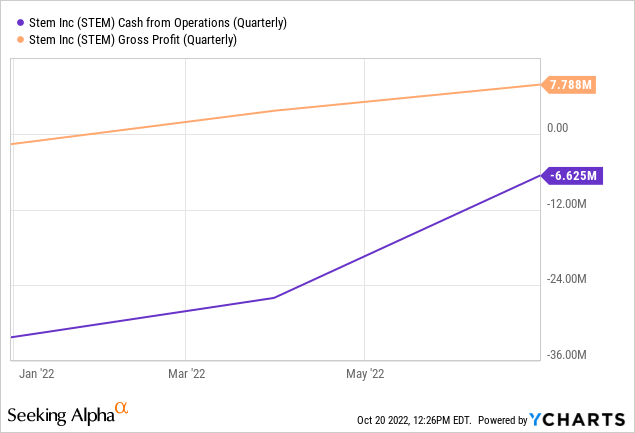

Stem is currently a low-margin and loss-making energy storage company.

The company’s gross margins have consistently been positive since the third quarter of its fiscal 2021, the most basic milestone for investability. The growth of Athena continues to be the main story when compared to its lower-margin hardware sales growth. Indeed, the growing visibility of Athena helped lead a 1,300 basis point improvement in GAAP gross margin for the company’s last reported earnings quarter. Sequential annual recurring revenue growth for Athena was 12% to $58 million.

Stem’s pipeline of software-only deals also realized a 10x year-over-year growth. The AI-driven battery optimization software platform is now operating or contracted across over 950 projects and has 2 GWh in storage assets under management. Hence, Stem is somewhat of an under-the-radar software company whose profitability in its future earnings quarters will be materially driven by the marriage of the IRA and the growth and stickiness of Athena.

Whilst Citron’s $100 price target should indeed seem outlandish against the current common share price, the market loves software stocks and the company will likely be re-rated higher once Athena constitutes an even larger share of revenue than it currently does. This places the company on a path towards growth with its total addressable market now fast expanding beyond pre-IRA estimates for growth.

Be the first to comment