metamorworks

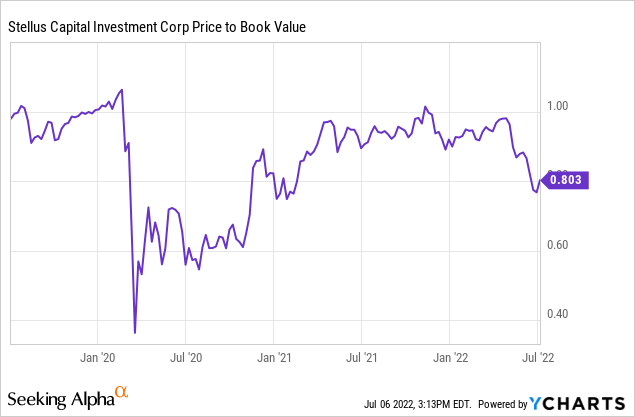

Stellus Capital Investment Corporation (NYSE:SCM) receives a high rating from me due to the BDC’s well-performing credit portfolio, unreasonably high discount to net asset value, and portfolio income potential.

Given current portfolio performance, the business development company trades at an implied net asset value discount that is too large, and Stellus Capital Investment is currently paying special dividends that help the effective dividend yield.

A BDC With Exceptional Portfolio Growth

Stellus Capital Investment is a business development firm that seeks to invest in private companies with annual EBITDA between $5 million and $50 million.

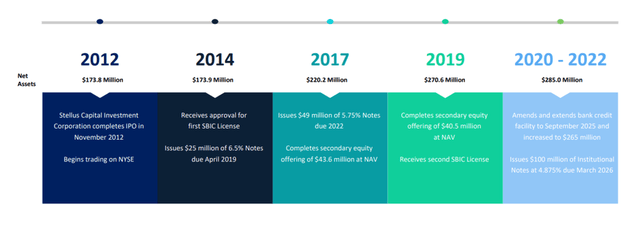

The business development company went public a decade ago, in 2012, with $173.8 million in net assets at the time. Stellus Capital Investment has produced consistent net asset growth over the last decade, primarily through secondary equity offerings. As of March 31, 2022, the BDC’s net assets had increased to $285.0 million.

Portfolio Growth (Stellus Capital Investment Corp)

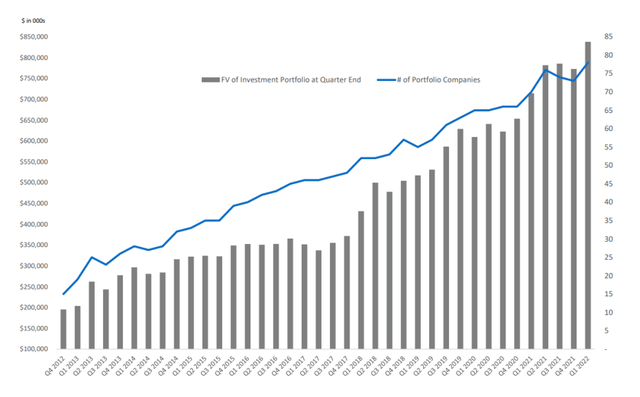

Stellus Capital Investment’s portfolio value has consistently increased over the last decade, as has the number of portfolio companies in which the BDC has invested. The long-term growth trend is very positive, especially considering Stellus Capital Investment’s portfolio continued to grow throughout the COVID-19 pandemic.

The number of portfolio investments reached an all-time high of 78 in 1Q-22, while the total portfolio value of the BDC has never been higher at $838 million as of March 31, 2022.

Number Of Portfolio Investments (Stellus Capital Investment Corp)

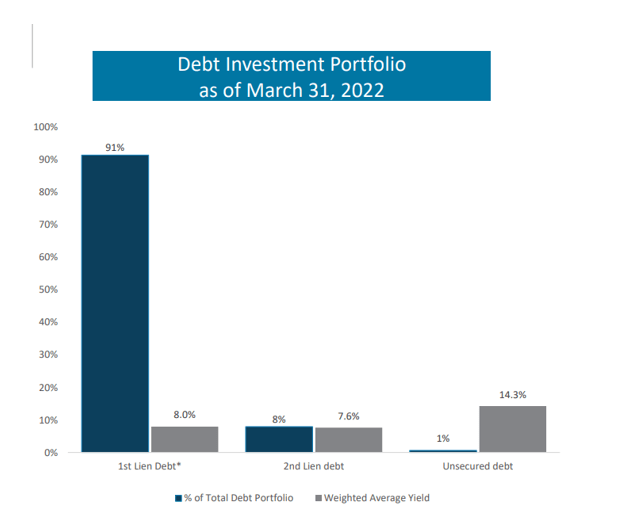

Stellus Capital Investment is focusing solely on first liens, the most secure debt investments a BDC can make. Approximately 91% of SCM’s portfolio was invested in various first lien investments, with the remaining 8% in second lien secured debt and only 1% in unsecured debt. 97% of those debt investments were in floating rate interest-bearing assets.

Debt Investment Portfolio (Stellus Capital Investment Corp)

Covered Dividend Pay-Out

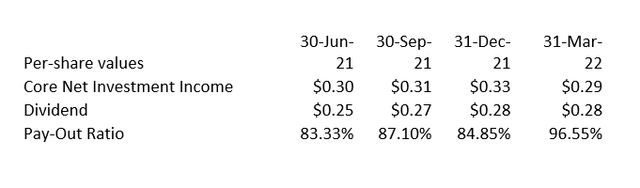

Stellus Capital Investment has covered its dividend with core net investment income for the entire fiscal year. SCM had an 88% pay-out ratio (based on regular dividend payouts), with excess earnings distributed as special dividends. If the BDC maintains its current payout ratio, SCM will most likely continue to pay the $0.02 per share monthly dividend.

Dividend And Pay-Out Ratio (Author Created Table Using BDC Information)

A 10% Yield Selling At A 20% Discount To Net Asset Value

Stellus Capital Investment stock has a dividend yield of 9.8% based on a monthly dividend payment of $0.093 per share. Having said that, the effective dividend yield could be as high as 11.9% if the BDC continues to pay a special monthly supplement dividend of $0.02 per share, as Stellus Capital Investment is currently doing.

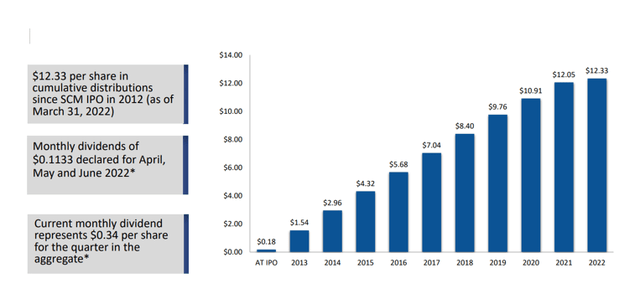

An investment in SCM at the time of its IPO a decade ago would have resulted in total distributions of $12.33 per share, representing 85% of Stellus Capital Investment’s net asset value as of March 31, 2022.

The BDC began with $0.18 per share in distributions in 2012 and could pay up to $1.36 per share in 2022 if management decides to maintain its special $0.02 per share monthly dividend.

Distribution Share Since IPO (Stellus Capital Investment Corp)

Aside from a strong impression in terms of net asset growth, Stellus Capital Investment is a BDC that I do not believe should trade at a discount to net asset value, especially not a 20% discount.

Stellus Capital Investment’s portfolio is diverse, and the BDC’s low pay-out ratio suggests that SCM may trade at a premium to net asset value.

Why Stellus Capital Investment Could See A Lower Stock Price

Stellus Capital Investment currently possesses many of the characteristics I look for in a high-quality BDC: Net asset growth that is robust and consistent, a dividend that is covered by net investment income, and floating rate exposure that positions the BDC for portfolio income growth if interest rates rise.

However, there are risks, which appear to stem primarily from the general state of the economy. Stellus Capital Investment’s ability to find new, profitable investments may be limited during a recession, and the BDC’s portfolio may deteriorate, potentially resulting in investment losses for Stellus Capital Investment and its shareholders.

My Conclusion

Stellus Capital Investment has produced consistent net asset growth over the course of a decade which not only attests to the BDC’s ability to attract capital, but also to its skill in finding attractive investment opportunities in different markets.

The business development company distributed approximately 88% of its LTM NII, and the special dividends, which are currently paid at $0.02 per share monthly, could raise SCM’s effective stock yield to 11.9%.

Be the first to comment