Young777/E+ via Getty Images

Introduction

Steel Dynamics, Inc. (NASDAQ:STLD) is one of my favorite steel stocks for a number of reasons. The company has efficient operations and steel that goes high up the value chain thanks to its characteristics. STLD has a fantastic balance sheet and high free cash flow, and it’s one of the few steel producers that has delivered reliable long-term dividends and capital gains.

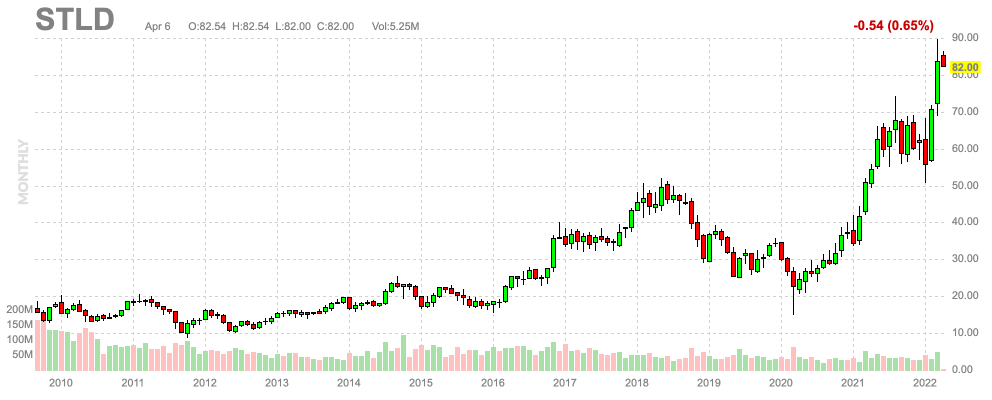

In this case, we’re dealing with a very unusual scenario. Global energy prices have exploded, suppressing steel production overseas. This is benefiting US-based producers in a trend that is further being accelerated by the war in Ukraine. Steel Dynamics has risen more than 30% year-to-date and more than 60% over the past 12 months.

FINVIZ

In this article, I want to share my thoughts on Steel Dynamics based on current developments and the company’s own characteristics. So, bear with me!

Steel Is Red Hot

Let’s start this article with a quote from a German Handelsblatt article I just read. The article highlights significant issues that come with sanctions on Russian exports (including steel). The translated quote can be seen below:

Because their nail suppliers are no longer getting steel from Russia, German pallet manufacturers are threatened with running out of material. Already in a few weeks, the first companies could be forced to shut down their production, the German Association of Wood Packaging, Pallets and Export Packaging (“HPE”) announced in Bad Honnef on Wednesday.

90 per cent of the so-called wire steel, from which the nails used for pallets are made, comes from Russia. However, steel deliveries are prohibited because of the Russian sanctions. According to the association, there are no short-term alternatives because special nails are needed.

In this case, it’s just one of many examples facing the steel industry. In general, it’s fair to say that the European steel industry is both suffering and benefiting from the war in Ukraine. Below is a translated quote from a different Handelsblatt article that explains why Salzgitter (a German steel giant) is doing well on the stock market despite demand issues:

For the steel industry, the Ukraine war is a double burden. On the one hand, the distortions on the raw materials markets are causing material and energy costs to rise. On the other hand, customers are more reluctant to place orders. This has to do with the fact that production at many car manufacturers, for example, is currently significantly slowed down because the war has made various primary products such as semiconductors or nickel even scarcer.

The problem is that Russia is the world’s 5th largest steel producer. Ukraine is number 13.

It also does not help that soaring energy prices are hurting steel production. As my friend Tracy Shuchart discussed in her recent article on steel:

Producers of the metal from Spain to Germany are beginning to slow down or entirely stop their output as the higher costs make production unsustainable, even with steel trading near record levels. Russia’s invasion of Ukraine has exacerbated already eye-watering power prices, affecting companies including Acerinox SA, Salzgitter AG and Liberty Steel.

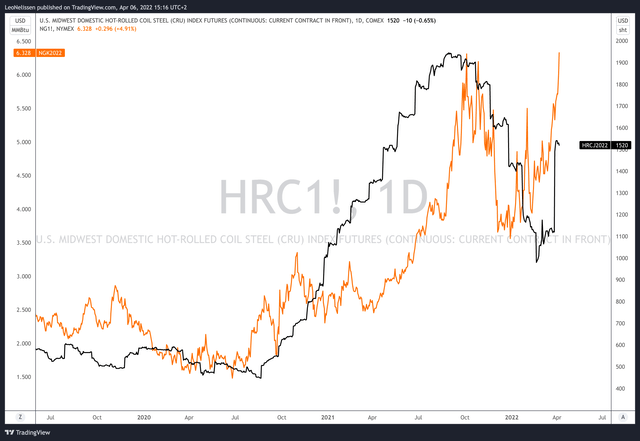

The graph below shows the price of US Midwest Hot-Rolled Coil Steel (black line) and the price of natural gas in the US (Henry Hub). Steel prices soared in 2020 due to empty inventories, rebounding demand, and higher exports. Now prices are benefiting from high demand from Europe and overseas as well as lower steel imports. One of the biggest issues facing the US steel industry was high foreign production. That issue is now fading as both Asia and Europe are facing headwinds due to rising energy price differentials.

Steel Dynamics benefits from all of this.

Steel Dynamics – Still Cheap

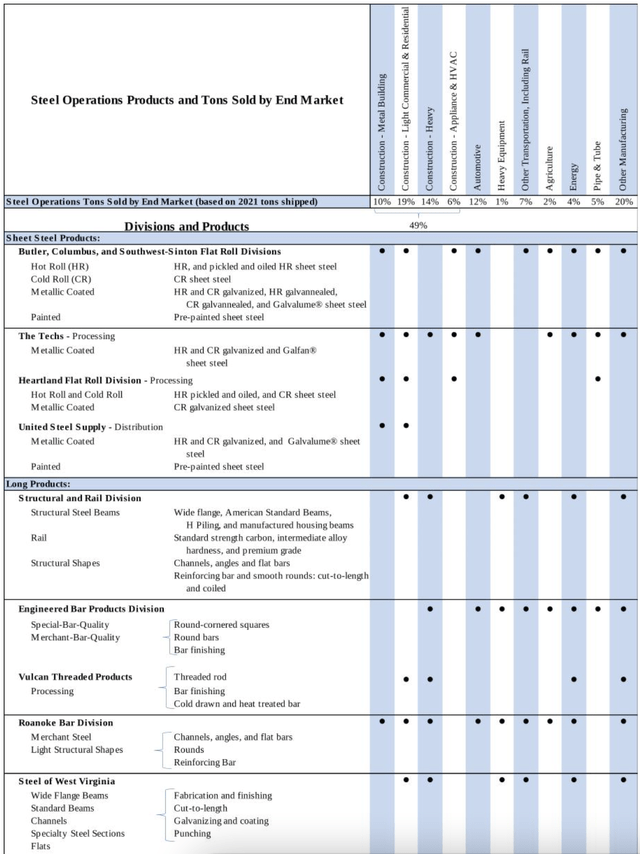

There are many steel types. The best steel products are “value-added” steel products. These steel products are used in engines, automotive production, shipbuilding, as well as defense projects.

70% of STLD’s steel is value-added. The table below shows the company’s many divisions, locations, as well as end-markets. The table also shows that roughly half of the total steel shipments in 2021 went toward construction customers.

Moreover, according to the company:

The principal customers for our structural steel products are steel service centers, steel fabricators and various manufacturers. Service centers provide key distribution channels for the mills and value-add services to the end-user. A growing number of fabricators and end-users request to source some of their steel products directly from the mill. The steel rail marketplace in the United States, Canada and Mexico is specialized and defined, with eight Class I railroads and a large distribution network.

As I discussed in my last STLD article, the company is big in recycling. In 2021, 11% of total sales came from recycling. That’s up from 9% in 2019.

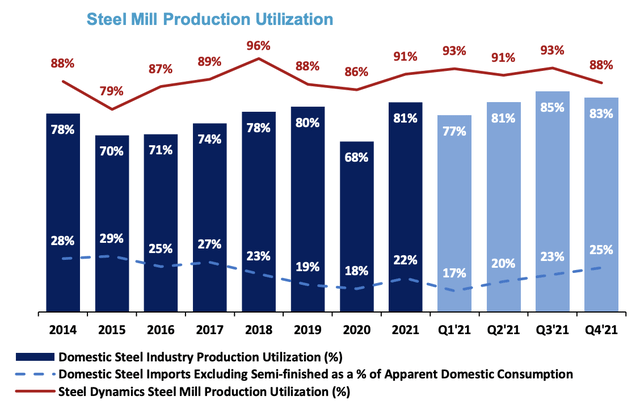

In this case, STLD is hitting it out of the park. The company shipped 11.2 million tons of steel in 2021 with an above-average utilization rate of 91%.

These shipments resulted in $18.4 billion in revenue (a record), $4.6 billion in adjusted EBITDA (a record), as well as $3.2 billion in net income. You guessed it, also a record.

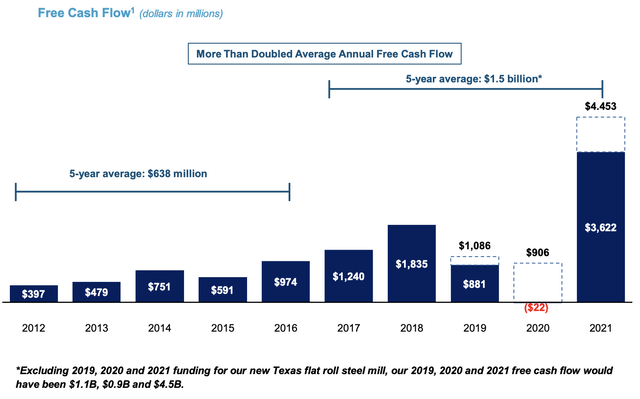

What this does to the company is it provides a wave of cash it can use for dividends, buybacks, its expansion in more environmentally friendly steel, and balance sheet debt reduction. Between 2012 and 2016, the years that saw a significant improvement in consumer spending and construction, the company averaged $640 million in annual free cash flow. Free cash flow is basically net income adjusted for non-cash operating items and capital expenditures. In the years from 2017 to 2021, free cash flow has averaged $1.5 billion per year. It’s obviously highly skewed due to 2021, but the improvement started in 2016.

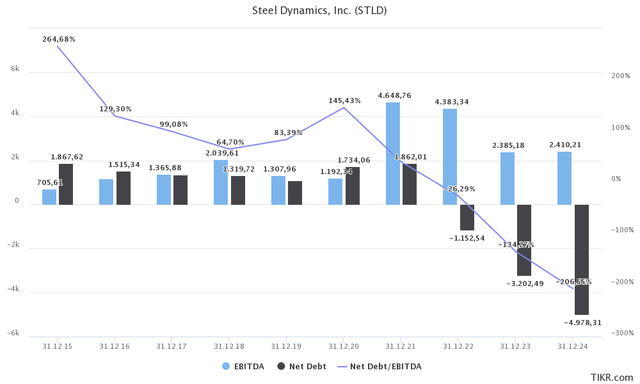

*If* the company were to continue generating $1.5 billion annual free cash flow, we would be dealing with a 9.5% free cash flow yield based on a $15.8 billion market cap. As the company’s dividend yield is only 1.6%, this leaves a lot of room for buybacks, debt reduction, and, of course, dividend hikes. Between 2017 and 2021, the company reduced shares outstanding by 3.1% per year. This sustained earnings per share growth and overall shareholder returns. The company can do this because it has always had a healthy balance sheet. Even prior to the pandemic, net debt was valued at close to 1x EBITDA. Now, net debt is turning into net cash as the company is generating a record amount of free cash flow.

So, what does this mean with regard to valuation?

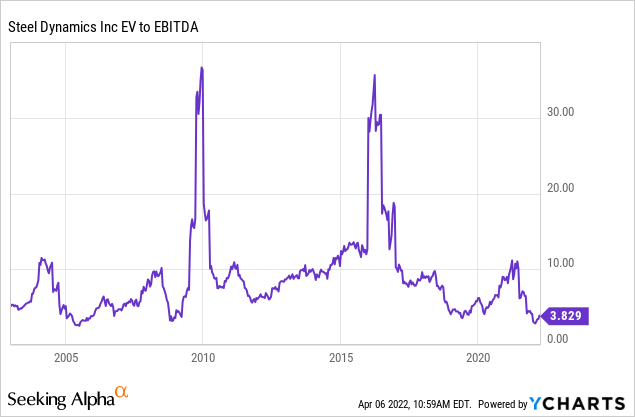

As aforementioned, STLD has a market cap of $15.8 billion. This year, the company is expected to lower net debt to -$1.2 billion (that would imply positive net cash). Using 2022 numbers, we are thus dealing with an enterprise value of $14.6 billion, which is 3.3x expected EBITDA of $4.4 billion.

Using 2023 numbers, we’re dealing with lower EBITDA as steel prices are expected to come down, but also much higher net cash. So, $15.8 billion minus $3.2 billion in expected net cash gives us an implied enterprise value of $12.6 billion. That’s 5.3x expected EBITDA.

What we are dealing with here is a fair valuation. The stock is not overvalued after its massive post-pandemic rally.

Here’s how I would deal with the situation.

Takeaway

Steel stocks are in a very interesting situation. Economic growth in the US and Europe is slowing. Yet, steel stocks remain close to their all-time highs as steel prices remain high. Especially US companies are in a good position as auto inventories are low and foreign producers are not able to boost their shipments to the US due to high production costs at home.

STLD has outperformed the market by a mile. It is in a terrific spot to generate high free cash flow used to maintain and grow its dividend, continue share buybacks, and reduce balance sheet debt.

The valuation is fair, and I believe that STLD has more upside. However, I’m going to remain neutral for the time being as I dislike the risk/reward at current levels. If investors want to buy, please wait for a 10-15% pullback first.

(Dis)agree? Let me know in the comments!

Be the first to comment