xavierarnau

Starwood Property Trust Inc. (NYSE:STWD) is currently trading at a 9% dividend yield, and I believe the stock is still appealing to passive income investors.

In the third quarter, the commercial real estate trust covered its dividend with distributable earnings and benefited from strong demand for new loan originations.

Starwood Property’s senior loan portfolio is very well managed, and the trust’s stock is currently trading at around book value, which is more than a fair valuation for a high-quality REIT like STWD.

Strong Originations In Q3’22

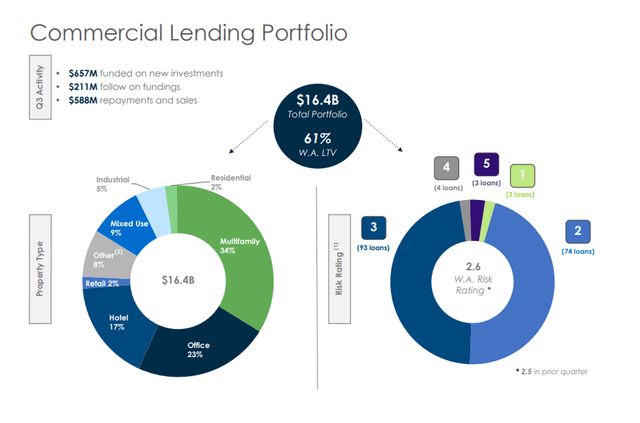

In Q3’22, Starwood Property’s commercial lending portfolio was valued at $16.4 billion, and the trust funded $657 million in new investments. In total, the commercial real estate trust invested $1.3 billion in new commercial lending as well as other trust businesses.

Starwood Property Trust maintained a high capital allocation to the multifamily and office markets, with the latter being more cyclically exposed to changes in the U.S. economy than any other market.

Commercial Lending Portfolio (Starwood Property Trust Inc)

Dividend Is Well-Covered

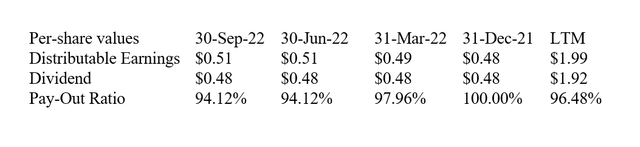

Starwood Property earned $0.51 per share in distributable earnings in the third quarter, the majority of which came from the trust’s commercial and residential lending segment, which contributed a total of $0.48 per share in distributable earnings, or 68% of distributable earnings before corporate expenses.

Starwood Property’s pay-out ratio was 94% in the third quarter, compared to 96% in the previous year. Starwood Property continues to pay a quarterly dividend of $0.48 per share, which will most likely be maintained.

Dividend (Author Created Table Using Trust Information)

Starwood Property Trust’s Biggest Ally: The Central Bank

This year, the central bank has begun an aggressive rate hike cycle in order to contain 40-year high inflation rates. So far, the central bank has decided to raise rates in 75-basis-point increments.

The central bank raised its key interest rate four times this year, which is significant for Starwood Property because the real estate investment trust invested its loan portfolio in a way that allows it to profit from it.

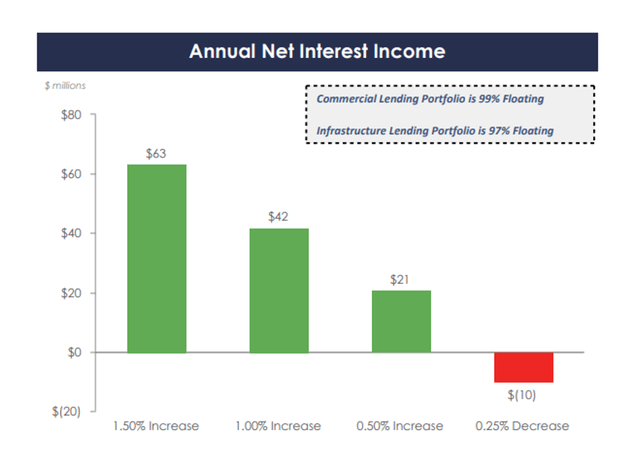

The trust’s commercial and infrastructure lending portfolios are invested in high quality floating rate loans, the sensitivity of which is shown in the chart below. A 100-basis-point increase is expected to boost net interest income by $42 million.

Annual Net Interest Income (Starwood Property Trust Inc)

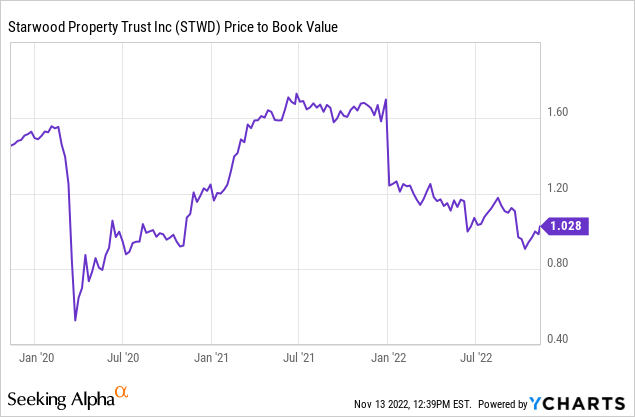

Trading At Book Value

Starwood Property’s stock is currently trading at a slight premium to book value, which makes the stock appealing to passive income investors in my opinion.

The stock was a steal a few weeks ago, when I aggressively recommended the trust, but I still think the pricing of the trust’s book value is quite appealing here.

Why STWD Could See A Lower/Higher Valuation

Because the trust’s portfolio is geared toward floating-rate loans, Starwood Property benefits from higher interest rates, which are largely determined by the trajectory of the inflation rate. For the time being, inflation rates remain significantly higher than the long-term average.

The consumer price index increased 7.7% year on year in October, implying that the central bank will continue to raise rates, resulting in higher portfolio income for Starwood Property.

A U.S. recession is also becoming more likely in 2023, so the trust’s exposure to the cyclical office real estate market could be a drag on the trust’s distributable earnings and origination growth.

However, because the trust has long covered its dividend with distributable earnings and originations have been strong, I don’t believe Starwood Property will have to reduce its dividend.

My Conclusion

Starwood Property is a high-quality, well-managed, and diverse commercial real estate trust that covered its dividend with distributable earnings in the third quarter for the third time in a row.

Originations continued to rise, indicating strong demand from commercial real estate investors.

Given that the trust’s stock is trading near its book value and the dividend is quite safe, I believe Starwood Property should be in the portfolio of every passive income investor.

Be the first to comment