marchmeena29

Inflationary pressures and an increasingly hawkish central bank point to higher interest rates, which, in the worst-case scenario, could send the economy into a prolonged slump.

Starwood Property Trust Inc. (NYSE:STWD) is well prepared to deal with higher inflation and interest rates, but it also has the financial foundation to deliver long-term growth during the next recession. In 2Q-22, the trust covered its dividend with distributable earnings, making it a true dividend titan.

A Disciplined Real Estate Investor With An Opportunistic Bent

Starwood Property is the largest commercial mortgage real estate investment trust in the United States, having funded billions of dollars in new loans for real estate projects nationwide. Starwood Property was founded in 2009, at the height of the real estate crash, and has since earned a reputation as a savvy and opportunistic real estate investor.

Beginning in the difficult market of 2009, the trust has developed expertise in commercial real estate markets and invested more than $25 billion of investor capital in the trust’s core strategies, which include Commercial and Residential Lending, Infrastructure Lending, Investing & Servicing, and Property. Starwood Property essentially invests in everything real estate. It originates commercial first mortgages and invests in commercial mortgage-backed securities as well as non-performing loans.

While the trust initially focused solely on the United States, it has since expanded and increased its diversification by originating loans for properties in the United Kingdom, Ireland, Australia, and even the Bahamas. However, the trust’s primary focus remains in the United States, which accounts for 72% of commercial lending values.

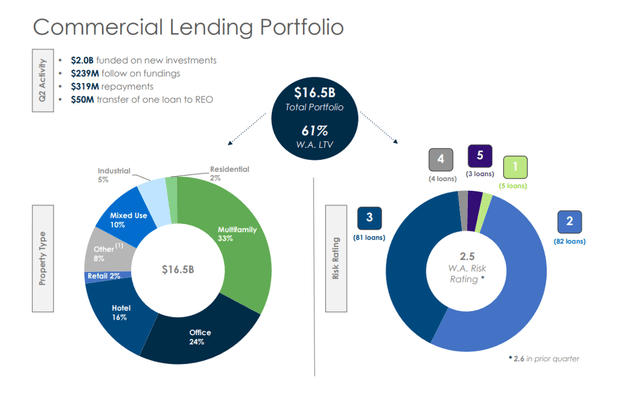

The commercial lending portfolio, which has grown to a $16.5 billion loan juggernaut, is the foundation of Starwood Property. The trust’s lending portfolio value increased by $1.7 billion in 1Q-22 due to new loan originations.

Commercial Lending Portfolio (Starwood Property Trust)

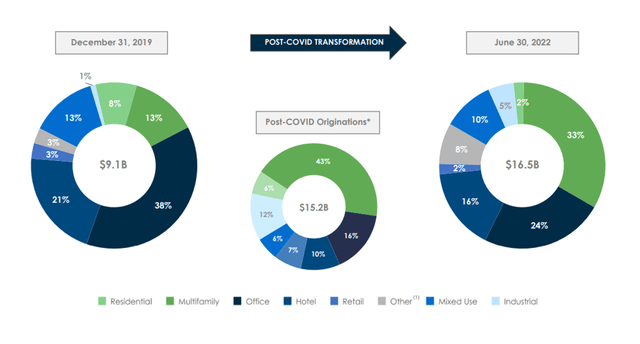

During Covid-19, the trust’s collateral composition changed, causing Starwood Property’s investment strategy to be reset. Starwood Property focused heavily on offices prior to the pandemic, but the trust has since reduced its exposure to the volatile office market, where vacancies can rise quickly and unpredictably during recessions.

On the other hand, Starwood Property increased its exposure to the multi-family market, which also accounted for the majority (43%) of the trust’s new loan originations.

Post Covid Transformation (Starwood Property Trust)

Strong Liquidity Access Supports Growth And Opportunistic Investments During A Recession

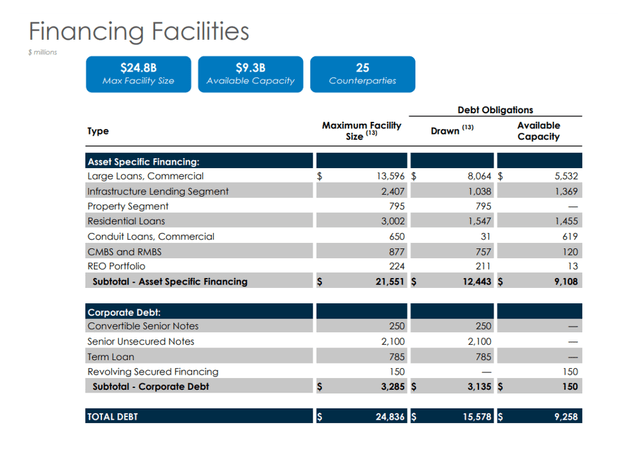

The ability to seize once-in-a-decade investment opportunities as they arise in the market is primarily dependent on easy access to capital. And this is where Starwood Capital’s extensive relationship network, long track record of commercial real estate investment, and large available financing facilities come into play.

Looking back on a decade of successful investments in U.S. real estate assets, the company has not only aggressively grown its loan portfolio, but also improved its access to capital.

Starwood Property has access to $9.3 billion in investment capital, which represents 57% of the trust’s total commercial lending portfolio, which was valued at $16.4 billion as of June 30, 2022.

When market conditions make it difficult to obtain cash, having access to large financing facilities creates a significant competitive advantage over other companies with more limited capital resources at their disposal.

Financing Facilities (Starwood Property Trust)

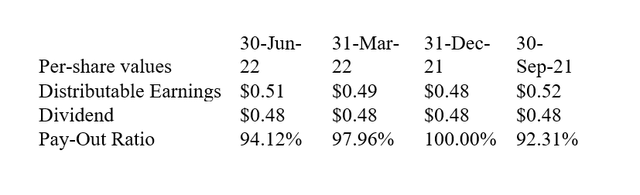

Distributable Earnings Outmatch Dividend

The dividend paid by Starwood Property is secure and covered by distributable earnings. This has been the case for some time, and the second quarter did not change that. Starwood Property earned $0.51 per share in distributable earnings while paying out $0.48 per share, resulting in a 94% pay-out ratio. The trust has a slightly higher 12-month pay-out ratio of 96%.

Distributable Earnings (Author Created Table Using Trust Information)

Starwood Property Vs. Top Peer: Comparable Valuation

Mortgage REITs have historically been valued using either a book value multiple or a multiple applied to the company’s distributable earnings. Companies like Starwood Property and Blackstone Mortgage Trust Inc. (BXMT) can be compared based on dividend yields because they are structured as trusts and must pay out the majority of their earnings.

Starwood Property has a dividend yield of 8.2% and a distributable earnings multiple of 11.5x based on a stock price of $23.50. Blackstone Mortgage Trust, on the other hand, trades at an 11.3x distributable earnings multiple and pays an 8.2% yield. I used the trusts’ last quarter distributable earnings on an annualized basis to calculate the distributable earnings.

Why Starwood Property Trust’s Stock Could Decrease In Value

Starwood Property’s risks haven’t changed much either, but they have since three years ago. Starwood Property has outsized exposure to the multi-family sector of the U.S. housing market because the trust is now a much larger player in the commercial lending market and has diversified away from office properties and into multi-family investments. A correction here would have an impact on Starwood Property’s origination business and would most likely result in lower distributable earnings.

My Conclusion

Starwood Property was at the height of the previous real estate crisis, and the trust has performed well since then. The trust has strong liquidity access, which allows for opportunistic capital deployment during the next recession.

Starwood Property Trust has also paid a very predictable quarterly dividend ($0.48 per share) over the last decade and has a pay-out ratio of less than 100%.

Management has demonstrated a thorough understanding of real estate market dynamics, resulting in a significant increase in the commercial loan portfolio. The dividend from Starwood Property is of high quality and should last through the next recession.

Be the first to comment