Capital Square Partners trying to eat the little fish. maxsattana

An Update

Startek (NYSE:SRT) is a company that I wrote up in July as a catalyst driven idea with an outstanding take-private offer at $5.40 per share. A number of things have happened in the interim so I wanted to share some updated thoughts on the company.

The take private offer was made by Capital Square Partners (CSP) who own 56% of shares already. In my previous article I highlighted how current CEO Bharat Rao and former CEO Aparup Sengupta are both affiliated directly with CSP and that it was likely the offer was an opportunistic attempt to buy the company cheap. CSP revealed in June through a filing that they expected to get clarity on financing for this offer by August.

On August 9th, 2022 the company released an 8-K which highlighted:

Now CSP has informed the Special Committee that CSP was not able to arrange a debt and equity financing package on terms acceptable to CSP for its proposal, dated December 20, 2021, at $5.40 per share, that CSP has withdrawn its proposal, dated December 20, 2021, at $5.40 per share, and that CSP is replacing it with a new proposal, dated August 8, 2022, at $4.65 per share to be funded exclusively with equity financing.

It revealed an awkward interaction from my viewpoint. Essentially CSP lowered their offer to $4.65 per share because they couldn’t find financing. Why that makes Startek any less valuable is entirely unclear and again reflected what I believe was an opportunistic attempt to buy the company cheap. CSP was so confident in their ability to close this deal that they revealed that their lower price target had nothing to do with the fundamentals of the company.

The stock opened at $3.71 on August 9th so the updated offer at $4.65 still represented a 25% premium to current prices. Yet the price was still below the stock price of $3.94 back in December 2021 when they first made an offer. The stock traded above the $4.00 mark for a bit amidst a broader market rally and as the deal was being reviewed by the special committee. That is until September 9th rolled around.

The special committee took just one month to produce their decision: rejection of CSP’s offer. In the 8-K they filed on Sept. 9th announcing this they highlighted:

In July 2022, at the request of the Committee, management of the Company prepared an updated financial forecast (Forecast) for the 2022 calendar year and the four following calendar years 2023 to 2026. The Forecast projects annual revenue growth, beginning in calendar year 2023 and for the duration of the Forecast period, to exceed 5%. The Forecast projects that the margin for variable profit and for adjusted earnings before interest, taxes, depreciation and amortization, will steadily increase over the Forecast period, with the latter approaching 11% by calendar year 2026. The Forecast was reviewed by the full Board of Directors of the Company to ensure the Board’s comments were reflected. On August 1, the Company provided the Forecast to the Committee. The Committee and its financial and legal advisors separately engaged in several additional discussions with management of the Company to assist the Committee in determining whether to adopt the Forecast for purposes of evaluating the CSP proposal.

Based upon this work, the Committee determined that the Forecast represents a reasonable and achievable plan to return the Company to improved financial performance over the Forecast period. The Committee adopted the Forecast for purposes of evaluating the CSP proposal. The factors that the Committee has considered include the trading history of Startek stock, financial analyses of Startek using the Forecast, the macroeconomic environment, the Company’s limited float and liquidity, the ability to pay of a financial sponsor such as CSP, communications that the Committee has received from shareholders, and CSP’s statement that it is currently not a seller of its majority stake in the Company. The Committee has determined, at this time, that the proposal at $4.65 is inadequate and not in the best interests of the shareholders of Startek.

What’s amusing about this for me is that the special committee, which is independent of CSP’s interest, asked management to create a forecast of what they think the business will look like over the years leading up to 2026. Management led by Bharat Rao who is affiliated with CSP took the task seriously and created a model which showed revenue and profit growth in the coming years.

The special committee had the full company board review this which includes Aparup Sengupta and two additional CSP affiliated board members. So all four of these CSP related folks signed off on this forecast which then the special committee had financial and legal advisors work to agree that it was a good forecast. So they adopted it as part of their review of the $4.65 take-private offer and decided that an offer at a P/B of 0.98x wasn’t beneficial to Startek shareholders. And they let CSP know this on August 21st, a full three weeks before it was revealed in this filing:

Foros, the Committee’s financial advisor, notified CSP on August 21, 2022 that the Committee had determined that the proposed price of $4.65 was inadequate and explained the basis for this determination as described in the preceding paragraphs of this press release. Since that time, rather than submitting a revised proposal, CSP has repeatedly requested more “specific directional guidance on how [the Committee] is thinking about value and price.” The Committee considered this request by taking into account that CSP already possesses the full Forecast and has understood since August 21 that the Committee is using this Forecast for its financial analysis of proposals by CSP. After considering this factor, as well as the Committee’s objective of maximizing value for shareholders, the Committee determined and informed CSP that it would be inappropriate and redundant to provide additional directional guidance to CSP beyond the explanations already provided to CSP. The Committee has reiterated to CSP that the Committee remains available to evaluate and respond to a revised proposal by CSP.

It seems that the special committee threw CSP for a loop simply by using a forecast that they helped create showing that the company is likely to experience growing revenue and profits in the coming years. Not altogether bad news if someone is a long term holder and believes in the prospects of this company.

Yet for those playing the deal, the news capped a near year-long saga of will they or won’t they actually do it. It seems CSP was happy to move forward at the $4.65 price and the special committee determined that this actually undervalues the company. With no clear catalyst to drive the price over the near term though many bailed out of the stock. Add to this the market’s decided downturn in the past month and the price decline SRT makes some sense.

Where Does that Leave Things

Rejecting the CSP deal likely leaves only one option: operate the company. There are two reasons for this. The first is that CSP has previously stated they are not interested in selling their ownership stake. So a sale of the company beyond CSP is not likely unless they change their minds. The second piece driving this is that CSP clearly was unable to finance a deal above $4.65 in the first place. With even more uncertainty in the markets these days it’s unlikely they are now somehow able to find financing and increase their offer.

The question now is whether management can shift from the distraction of this process into operations mode. I have some concerns about management led by Bharat Rao given the debacle that this process has been and I’m not at all convinced that they are protecting shareholders’ interests overall.

The pattern I’ve seen again and again in this is CSP attempting to buy this company cheap from their fellow owners. It’s not a pattern of how we can grow value for all shareholders. This is a red flag to me and I think the company’s attempts at the end of this process to try and repeatedly get more information from the special committee shows that they still are looking for ways to buy this cheap if they can.

I’m not interested in being long-term co-owners with CSP as an entity at this juncture as it seems like their goal is to take advantage of minority shareholders in my opinion. That’s not a very good place to start even if there’s value in the company. With a CSP affiliated CEO and four CSP affiliated board members there are still levers that they can use to pressure minority shareholders rather than simply growing the business for all owners.

With that said if management starts to articulate a strategy moving forward to unlock value for all then perhaps that would be a moment to come back to this stock. But given the current context and with the deal falling through I personally think there are better opportunities out there.

An After Action Review

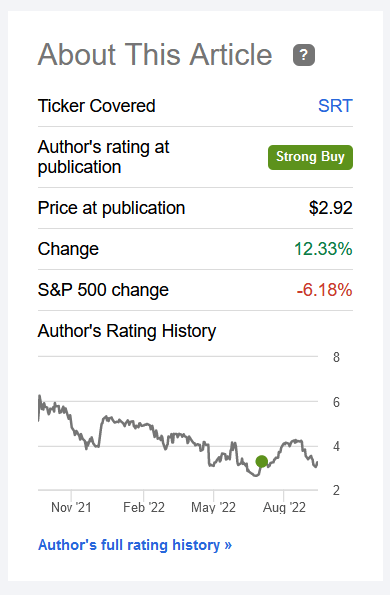

When I first published my thesis on SRT the stock price was at $2.92. It’s never been below this price since and for a while traded above $4.00.

Seeking Alpha

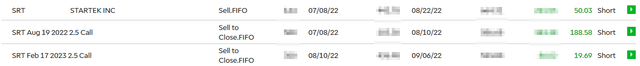

I closed out my initial investment after the $4.65 per share announcement. As the stock was trading above $4.00 I felt that the margin of safety offered in that last $0.65 wasn’t worth it. I closed out my initial stock and call option positions to capture some gains and opened a further out call option position which I closed days before the September 9th announcement. My initial stock and call option positions returned around 50% and 189% respectively. The second call option returned around 20%.

While the returns were positive in this case I think it’s still helpful to reflect on what worked, what didn’t, and what could be improved. Overall, my original thesis relied upon the $5.40 per share offer from CSP as a base case valuation and did so with the idea that CSP was attempting to buy the company cheap. When they came back around with the $4.65 per share offer for no reason other than their own financing ability my suspicions were confirmed.

This was a key moment. I ultimately decided that despite the stock likely being undervalued and the lowball offer, the stock wasn’t likely to trade above the $4.65 mark as long as this was in process. While it was still possible that the special committee would reject CSP’s proposal I figured that would cause prices to decline given there was no clear way to unlock value. Especially given CSP was unwilling to sell their stake.

And in hindsight it seems my trading choices were largely beneficial, if not simply lucky with the last call option. That trade could’ve quickly gone the other way had I maintained that position only a few more days so I would actually chalk this trade up overall as a lucky failure. I think I should’ve sold this position earlier given it was unlikely that a higher offer was going to come through. Call options are something that I’ve been investigating more recently as an investment tactic so I’ve benefited overall from this experience.

At current prices of $3.28 readers who joined in on the trade due to publication could still close for a profit here. As I’ve said, I’m not interested as a buyer at these levels though I think there is an argument that could be made for holding. Management’s expected forecast projects growth moving forward which if correct would help in re-rating the stock price upward in the future. If one held from here it would likely be a long-term approach and requires faith in management.

Be the first to comment