whitemay/E+ via Getty Images

The Dollar is at an unsustainable level. If Powell cares anything for his legacy, the last thing he would want to be blamed for is an international financial accident. Let’s think back to other times when Jay Powell pushed the envelope too far. I remember that the first time he started raising rates, in 2017, he will just continue to rise one after another. That is until the markets crashed, and he started cutting lickety-split.

From 1998 to 2008 the 2-Y was 4% that was CPI was in the 2% range Now it’s about 6%. That means rates will be raised and that is why the market is crashing and may even break the June low. What if at this point the falling value of housing and gasoline begins to seep back into the economy lowering inflation numbers? If Powell keeps raising into a recession and then starts to lower interest rates, he could reignite inflation expectations. Instead, he should lower the rises to 25% and then stop raising to wait for all the previous raises to catch up. In fact, holding at 4% to 4.5%, and NOT lowering it for ten years makes a lot more sense. This is not at all like what Arthur Burns did. He in fact would raise then lower. Truly going for rate raises of .75% as far as the eye can see will plainly destroy the economy and still may leave inflationary expectations smoldering with an interest rate reduction. I think the Fed will start stressing data dependency, and hint that the next raise may be .50% and not 75%. The notion that the Fed wants to smash down inflation to 2% immediately is ludicrous. No one can believe that is really possible without creating a lot more problems than what we are currently dealing with. Before this whole thing started the Fed was trying to get inflation up to 2%. We were trying to prevent deflation from happening, Japan has had decades of deflation, this stunted growth, and the dynamism of their economy. We don’t want that, certainly, Jay Powell doesn’t want to do that.

We want to get back to the time when the 2-Y stayed in the 4% range for 10 years again. It stays there because inflation is finally arrested, that is price stability. Let me just tie this off by reminding you all that probably 80% of the past rate raises have NOT had their effect on the economy as yet. On top of that this quantitative tightening of $95B is happening every month at the same time. Just as a reminder, the Fed was buying all kinds of treasuries as well as Mortgage Backed Securities. By buying in that market it was pushing down mortgage rates, essentially pushing up home values to encourage spending through mortgage refinancing. Now they are stopping this activity and letting the current mortgages they own run off as they expire doing the opposite of easing the mortgage rates. This September was the first month of QT at the $95B rate. The Fed could point to that as a reason for the lowering of the rate rise this month. Most economists believe that this QT program is the equivalent of .25% per month.

I gather that the Fed wants to maintain this hawkish stance for as long as possible keeping a floor under the 10-Y and not letting it retreat under 3% which it would have done if the dot plots indicated any relenting of this tightening regime. They have banished the skepticism of a Fed that cares not for the economy, no mention of a soft landing or even a softish landing. Now, Jay Powell, has everyone believing they are going to fiddle while “Rome Burns”, for what? To prove a point that he’s a tough guy? The 2-Y I am told holds the key to where the market believes the terminal rate is going, and after moving up steadily all week soared on Friday from 7.11 to 4.27 before settling to 4.21. The 10-Year actually fell from the day before. I think the 2-Y at 4.11% to 4.2% is where they are likely shooting at, but I think they should get there early in Q1. My main point that I make is this, and it bears repeating; Throwing the economy into a severe recession is not going to quell inflation expectations if they have to turn around and lower rates again. Instead, lower the size of rate rises. Then as inflation lowers, keep the rate where it is, instead of slamming the economy with repeated draconian rises and having to lower rates all over again.

If the market sees that the Fed is being reasonable the market will respond. That doesn’t mean that Zombie companies are going to get a lifeline. Already High Revenue growers are cutting costs and shooting for profitability, Twilio (TWLO) is a good example of getting the religion of showing profits. They announced layoffs and pledged to reach profitability.

52 Week Low 3,636.87 Friday’s Low 3,647.47 June’s Low held. Perhaps that level is broken this week.

I would expect that on Monday the market will make another run at breaking that 3636 level. I am hoping that it gets close to that level and closes above 3693 Friday’s close.

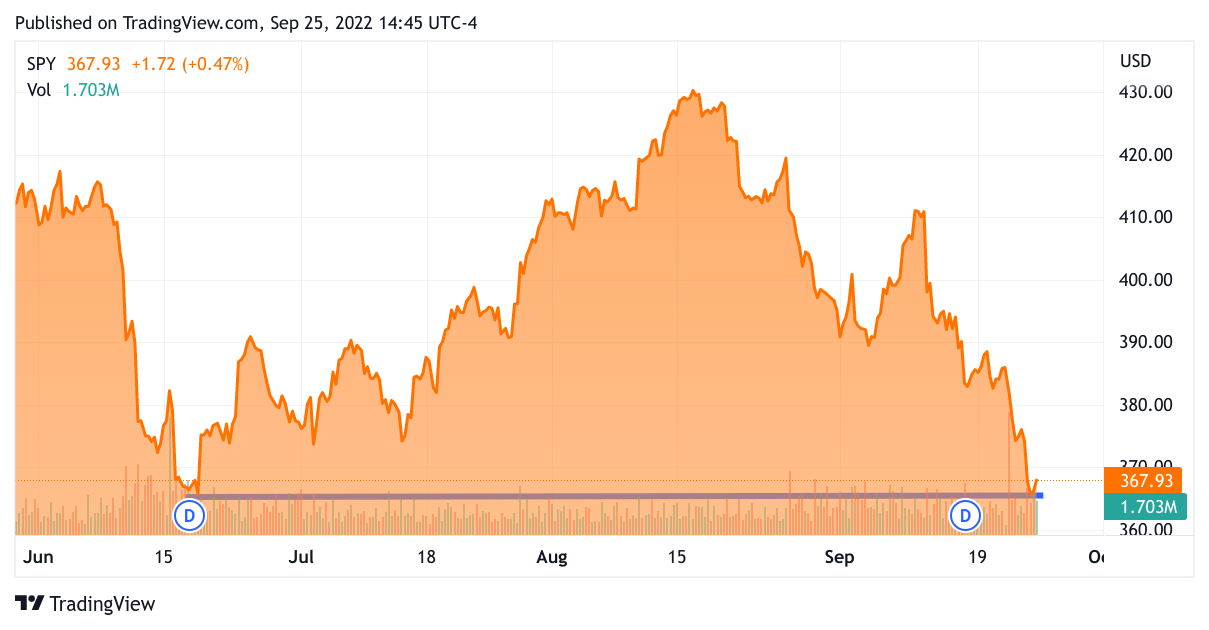

Below is a 4-month chart. I think the head-and-shoulders formation has run its course. Can the S&P 500 go lower? Sure, at some point it has to make a stand, it held up on Friday, whatever happens, I believe it will close higher. What I really want to show is the Dollar index.

TradingView

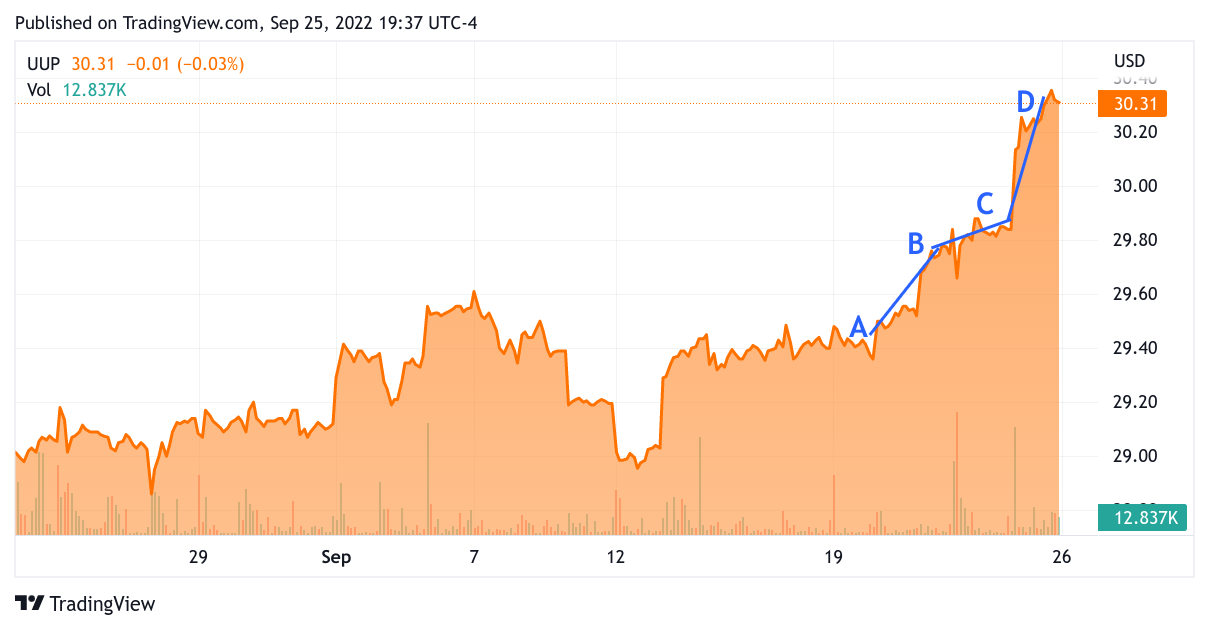

Here is a 1-Month Chart of the UUP which is the dollar ETF.

TradingView

Even without the ABCD bearish formation, just look at the parabolic rise this week. You can’t maintain that level for long. Perhaps dollar investors decide to buy a strong dividend payer in the UK like Shell (SHEL) or a Euro-based stock Like TotalEnergies (TTE), or perhaps a pharma giant like Novartis or Roche. The notion is that the Dollar has gone too far, so the Swiss Franc will rise and the dividends from Novartis (NVS) or Roche (OTCQX:RHHBY) will rise faster, along with profits. At some point, the reward will outweigh the risk of betting against the dollar. The same is happening with interest rates, though right now the 10-Year is being bought keeping it a bit lower interest rate.

So am I being “reckless” again?

Ok, so when I say now is the time to buy, what do I mean by such an outrageous suggestion? My trolls will certainly say that I am being reckless once again. I and the DMR Community have been using the Cash Management Discipline. One of the rules is to buy in very small increments, with some purchases of high-priced stocks at one share at a time. I keep my purchases no higher than $1,000 at a time with most at about half that level. When the market is dropping by 1% increments, I might keep it to $200 at a time. This way I mitigate my risk in these crazily volatile times we edge into a position and be able to sleep at night. Also, I have been calling for investing/trading in the highest quality growth names, and that is where I am concentrating most of my funds. I also believe that last week’s drop in oil stocks is a great opportunity to reload my trades once again. So if you have the self-control of keeping your buys small you can ease into fantastic names. Also, the judicious use of hedging can help smooth the bumpy ride we are having. You have to buy when everyone is freaking out, not when everyone is bidding up prices. The idea is to buy when everyone is selling and sell when everyone wants to buy.

My Trades

The newest name on the high-quality list for me is Eli Lilly (LLY), the news here isn’t terribly new but the downward pressure on all stocks I believe is holding down its valuation. They have a diabetes drug that has been shown to be able to reduce body weight by +21%, with little side-effects. As I understand it, the drug hasn’t yet been approved for weight-loss as yet in a 72-week trial with data showed Tirzepatide patients lost between an average of 35 and 52 pounds throughout the trial. Beyond its apparent weight loss perks, Tirzepatide significantly reduced blood pressure. LLY is not only about diabetes and weight loss they are also developing a drug for Alzheimer’s. I don’t believe Alzheimer’s drug development is priced into the stock. My main point is, the stock would be way higher under normal circumstances. The high is 335, so it is 25 points below its 52-week high. LLY is a very well-run company. For me this is not only a slow-money trade, I also acquired it for my long-term investment account. This portfolio is heavily weighted to a variety of health-related, and high dividend stocks and ETFs. Can Tirzepatide is not yet approved for weight loss, but doctors can prescribe it. How much value could this drug add? There is talk that if you combine these two chronic illnesses it could reach $25B. Even if it cost $15B to develop, the stock trades at 50 times earnings that would be $500B in market cap. Some could say that a lot of the value is already in the stock, so let’s say it translates into $250B. The current market cap is $295B. Whatever value is already in the stock is likely the contribution of Diabetes since that has approval already. However you slice it, 310 per share is a bargain.

For the oils I added back Apache (APA), Exxon Mobil (XOM), added to Coterra (CTRA), Devon Energy (DVN), Equinor (EQNR), EQT (EQT), Ovintiv (OVV).

I added to my high-quality names Amazon (AMZN) at $113.73, Alphabet (GOOGL) a few shares from $100 to $99.40, Microsoft (MSFT) from $241 to $238.76, NIKE (NKE) at $98.87; NKE is reporting this week so I added 1 share, and if NKE gets to $92ish I will buy a bit more.

At the Mid-quality level is MongoDB (MDB). I took 3 shares at $216, $215, and then $206. After that, it plummeted on Thursday and Friday down to $194ish. I am going to buy another few shares as it falls further. I also added to ADBE at $294.56, it kept falling and finished at $284. I suspect that tomorrow morning it should fall a bit lower and I will add a few shares there as well.

I was more aggressive on the oil side in adding shares and I have my eye out for a name like EOG Resources (EOG) or Diamondback (FANG) – if they fall really hard I will start on them too. I will also add to XOM. I just think that these names will buy back shares and have great dividends. These are the classic type stocks that this kind of market should love. Even at WTI at these levels dividends are safe and they are free to buy plenty of shares.

What I am advocating is not at all reckless, it actually is the best way to operate in this kind of market. If you believe that Powell wants to destroy our economy in order to save it, yeah go ahead and stay on the sidelines. Just remember that these bear market rallies are here and gone in a week. I’d rather come in early than arrive late to the party and only see the leftovers. I am operating on the premise that Powell will change course ever so slightly, and bring the terminal rate back to a sustainable level, that in light of history 4.15% to 4.25% is perfectly fine.

Be the first to comment