elena_larina/iStock Editorial via Getty Images

Star Bulk Carriers Corp. (NASDAQ:SBLK) seems way too cheap to me at around $25.58 per share, with its ex-dividend date coming up at the end of August. I’m mentioning the upcoming dividend because it’s going to be another $1.65 per share. Further dividends are dependent on how much money the company makes and how much it decides to spend on investment. In terms of rates, it still looks like a great market for bulkers. In addition, there is limited supply growth. The order book for dry bulk shipping stands at 7.1% of the fleet, which is relatively low. Management commented on the reasons behind limited fleet growth on the recent earnings call as follows:

Uncertainty on future propulsion, along with surging shipbuilding costs has helped keeping new orders under control, while shipyards continue to fill 2025 capacity with more profitable to the shipyards vessels.

It is hard for orderbooks to go up as shipyard capacity has decreased in recent years. Inflation and supply chain issues are likely weighing on shipbuilding costs, making it tough to swallow new-build costs to management teams. I’ve been quite keen on the shipping trade for the last few years (betting on the longer term) because of the uncertainty around emission regulations. Management teams at all kinds of shipping companies are wrestling with the question of whether to order ships or not. If they want to order ships, the question becomes what kind of ships. The risk is in ordering a type of vessel that gets rendered obsolete or becomes a suboptimal investment due to new regulations. For now, this stalemate is unlikely to be broken completely as analysts expect shipping companies will deal with 2023 regulations by slowing down vessels (this still decreases practical supply because at the same GDP the world would still require increased tonnage on the water):

From next year, the International Maritime Organization (IMO) requires all ships to calculate their annual carbon intensity based on a vessel’s emissions for the cargo it carries – and show that it is progressively coming down.

While older ships can be retrofitted with devices to lower emissions, analysts say the quickest fix is just to go slower, with a 10% drop in cruising speeds slashing fuel usage by almost 30%, according to marine sector lender Danish Ship Finance.

“They’re basically being told to either improve the ship or slow down,” said Jan Dieleman, president of Cargill Ocean Transportation, the freight division of commodities trading house Cargill, which leases more than 600 vessels to ferry mainly food and energy products around the world.

I’m not sure how it’s all going to play out over the next decade. It just seems like a very attractive backdrop to buy into cyclical companies that are doing quite well under current conditions.

Usually, you expect cyclical companies to get destroyed because of supply growth driven by competitive forces. In this industry, this cycle may not play out exactly that way.

True, with shipping companies, it is possible to lose a lot of money if you’re caught in a downtrend. Often the sell-off happens quickly. The real killer is when you’re holding a company that ultimately gets bankrupted, and you never see the other end of the cycle again. Star Bulk’s balance sheet has improved quite a bit because its earnings have been so strong. The company has no debt maturities until 2024. In 2024 there’s a bit of a balloon payment required but of only 1.5x times the size of 2023-2027 and none seems unmanageable. I’m an interest rate bull (i.e., I think they are going up more than the market is pricing in) therefore, I’m cautious around companies with a lot of floating rate debt. Star Bulk definitely has quite a bit of floating rate paper, although it has been converting to fixed (per the 6-K):

as of June 30, 2022, a total of $796.1 million of its debt from floating to an average fixed rate of 45 bps. The weighted average interest rate (including the margin) related to the Company’s existing bank loans and lease financings for the six-month periods ended June 30, 2021 and 2022 was 3.06% and 2.82%, respectively.

The dominant market narrative (at least prior to the latest jobs report) seemed to be we’re headed for an imminent recession. I’m not so sure about that. I agree with the premise that the Fed is going to keep its foot on the brake, which ultimately means a slowdown or recession will materialize. If you look at some cyclical companies (like shipping companies Navios Maritime Partners (NMM) (see here) and commodity companies like Peabody Energy (BTU) (see here) and Vale (VALE) (see here), you’d think we’re already in a recession.

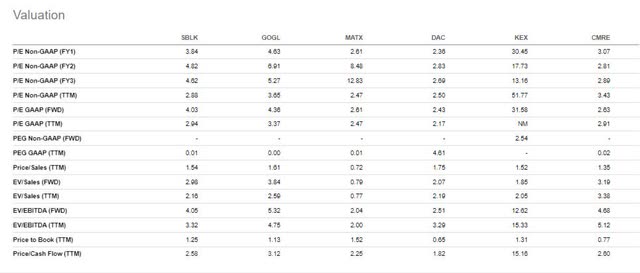

If, instead, we still have a few good quarters ahead of us and then hit a mild recession, these are looking very attractive. I pulled valuations for a set of bulk shipping companies off Seeking Alpha. These are all attractively priced in the grand scheme of things (indicating the market believes they are massively over earning):

valuations bulk shipping (Seekingalpha.com)

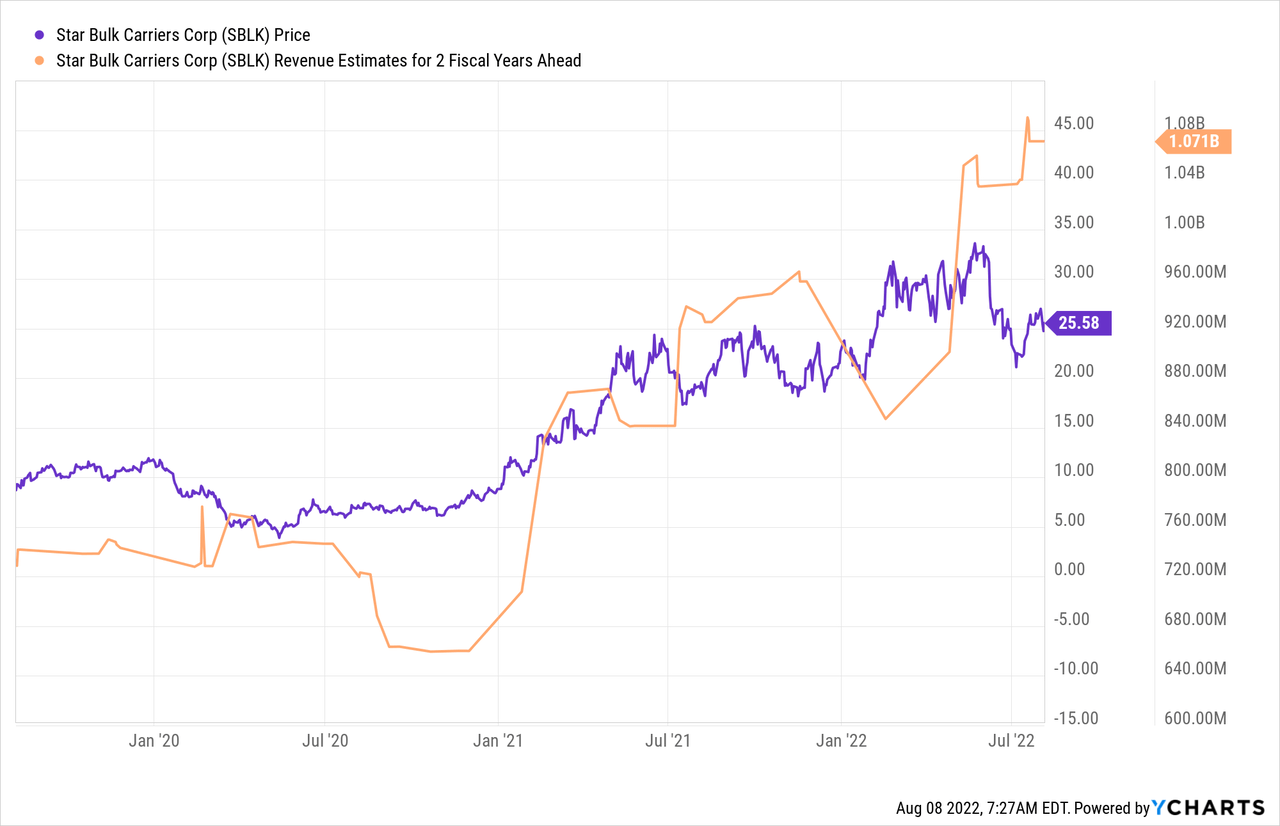

Granted, earnings are likely to decrease at some point. Analysts pencil in a billion in annual revenue for 2024. That’s a significant fall from the current TTM $1.7 billion.

SBLK price and revenue estimates (Ycharts.com)

The shares are currently at $25.58 and through the end of August $1.65 is coming my way. That will take down my effective investment per share to ~$23.93. Rates are currently still holding up, and we’re already halfway through the quarter. I don’t think it’s crazy to expect another $1.50 soon after. By that time, my effective investment is down to $22.43. Analysts are estimating $5.54 in EPS for the year after. That would be only a slight step down. This doesn’t surprise me, given the tonnage supply backdrop and the fairly strong global demand. There’s certainly downside risk here, but the upside risks seem present as well. Chaos tends to derail supply chains and efficient trade. Efficient trade means the fewest tonnage miles required. But there’s plenty real opportunity for global chaos. Russia’s invasion of Ukraine is still factoring in there. China has only recently started stimulating its economy a bit. Usually, when it stimulates for real, this results in commodity (i.e., bulk) demand. Bulker fuel prices could increase sharply (due to Russia/Ukraine or emissions regulation), which tends to result in slower steaming ergo lower bulk capacity on the water.

I see a lot of ways to earn a good return with the stock at an effective 4x forward P/E ratio or an EV/EBITDA of 4.05 or a book value of 1.25x. There are scenarios where this investment turns sour but these seem somewhat unlikely to me. Blue sky scenarios (usually involving more global chaos) also seem unlikely, perhaps even more unlikely. However, I don’t need any blue sky scenario to come out well here. A moderate decline in earnings over the next few years and prospects penciling out similarly, and SBLK investors should be in great shape.

Be the first to comment