koto_feja/iStock via Getty Images

Introduction

I went long Stanley Black & Decker (NYSE:SWK) back in July with the early indications of the inventory issues having become visible to the investors. At the time, the stock traded at $97.2 per share with a forward P/E multiple of 11.2. I thought I was entering the stock at the right time, but as we know today, I was early, as management had to slash the FY2022 guidance during the following period. Today, I reaffirm my bullish stance, as I believe close to maximum negativity is reflected in the stock price.

Forward P/E today, stands at 18.8 and forward P/E 1Y stands at 16.5 due to the forward EPS expectations having been hammered hard. One of my anchor points is, that SWK’s earnings won’t stay depressed forever, and that this company is in possession of established global brands, that resonates with the consumers, which end of day will continue to purchase SWK products. For now, however, the stock can continue to stay depressed and more likely than not (I believe we haven’t seen the stock market bottom yet), the stock will revisit its 52-week low of $70.2 per share, or perhaps even go lower. That’s also why I’m personally deploying my capital with a dollar cost average focus. Already now, I’ve bought the stock in four trances at $97.2, $86.8, $79.5 and $74.4 per share. In total, I’ve accumulated what equals half of a full-sized position according to my own portfolio. This means, that the stock is still on my watch list should it show renewed weakness.

Stanley Black & Decker Finds Itself In A Mess

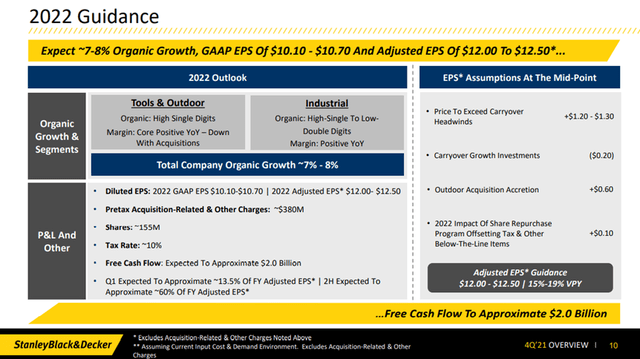

Let’s rewind the clock for just a minute and go back to February 1st of 2022. On this day, management released the Q4-2021 performance for SWK, including forward guidance for fiscal year 2022. The company exited its fiscal year of 2021 with high expectations for 2022. The company expected organic growth of 7-8%, GAAP EPS between $10.10-$10.70 corresponding to an adjusted EPS of $12.00-$12.50 with a free cash flow of roughly $2.0 billion. For FY2021 the company achieved an adjusted EPS of $10.48, so expectations were set for substantial growth in EPS, well exceeding the expected revenue growth. On that day, the stock changed hands for $176 á piece, which is roughly 52% higher than the stock price today.

Q4-2021 FY2022 Guidance (Stanley Black & Decker IR)

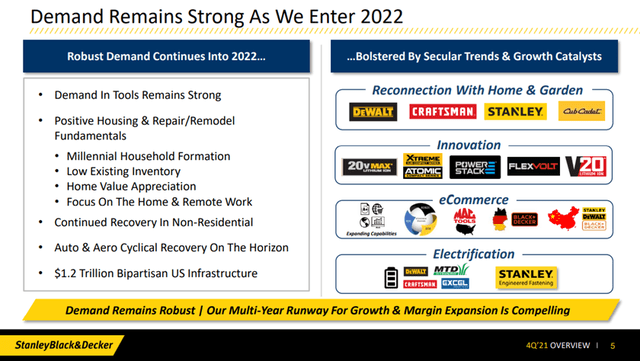

At the time, management was of the opinion that demand remained strong, which also translated into the very positive expectations for FY2022. Nothing out of the ordinary as such, since the company had delivered a set of very strong financial performances during FY2020 and FY2021 where it elevated its income substantially from the previous plateau of roughly $1.4-$1.6 billion to $2.0 billion during FY2021. All was good, Wall Street had a consensus buy rating for SWK and Seeking Alpha contributors also had a consensus buy rating for the stock.

Q4-2021 Management Expectations (Stanley Black & Decker IR)

Those expectations didn’t stand the test of time as we well know today, with the stock hovering around $80 per share, well off the heydays of February this year. Sure, the market in general has gone down significantly since then, but poor timing also struck hard at SWK with hindsight showcasing how a few unfavourable decisions can accumulate.

Looking under the hood, and it’s the classic supply-demand with a spice of inventory imbalance that has impacted SWK during 2022. In essence, it can be summarised as follows.

- SWK, as many others, feared potential supply chain bottlenecks as we’ve seen plenty of in the past 12-24 months in connection to unstable harbour operations as well as manufacturing capacity shortages. SWK, similarly to many other corporations scrambled to fill their inventories to avoid not ending up in a situation with no goods to sell. This was a natural consequence of SWK utilising a large and established manufacturing footprint in China, followed by importing the goods back to other regions for sales purposes. Looking back, and it’s now clear the company overordered to avoid stock-outs, while the demand eventually withered between their hands as the economy started shaking as a consequence of a dramatic inflation surge, a set of corresponding interest hikes and general drop in consumer sentiment in the wake of the economic instability. What was first considered a sure thing, turned out to become overordering resulting in booming warehouses and a lack of demand for those goods.

We’ve seen a similar situation for both Target (TGT) and Nike (NKE) earlier this year, and there is only one response once your working capital and cash conversion cycle (the time it takes a company to convert its inventory to cash) starts moving in the wrong direction at high speed. You have to offload inventory to the greatest extent possible, more often than not, via putting goods on sale. This causes a drastic reduction in margins while management strives to improve the working capital, that acts like an anchor on the balance sheet and liquidity. This is the very reason why we’ve seen the stock price take the express elevator to the bottom floor.

At the Q1-2022 earnings call, Jim Loree, then CEO, since replaced by Don Allan, stated the company found itself in one of the most challenging environments it’s been in for a long time. At that point in time, management also decided to postpone some of its share buyback program to 2023, in order to maintain ample liquidity and flexibility – a smart and necessary move as far as I’m concerned.

Back To Present Day

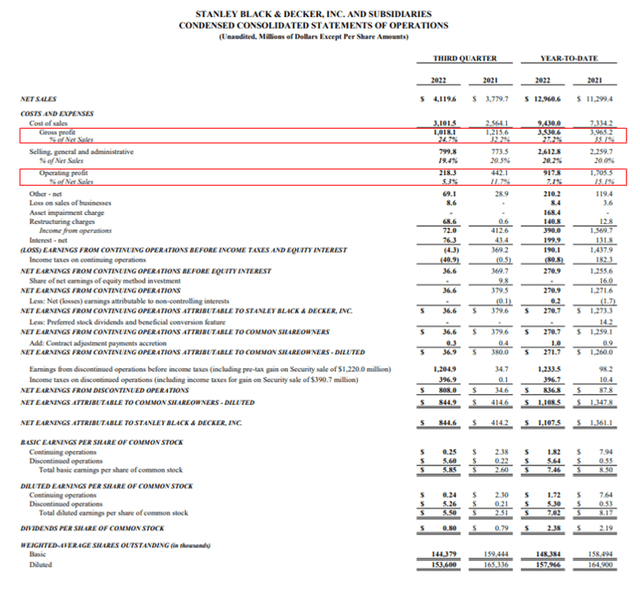

On October 27th 2022, management published the Q3-2022 financial performance, and here we can see exactly how hard the margins have been pummelled.

Q3-2022 Summary Financials (Stanley Black & Decker IR)

Year to date, the gross profit margin has dropped 7.9 percentage points – not percentage, but percentage points. Similarly, we can see the operating margin has dropped exactly 8.0 percentage points. While not indicatory in itself, but both gross profit- and operating margins are lower in Q3-2022 than YTD, showing a downwards moving trend, but also to be expected given the impact having struck harder in Q2 and also Q3 than Q1. However, it shows the cascading effects down throughout the financial statement as a consequence of the inventory and working capital issues.

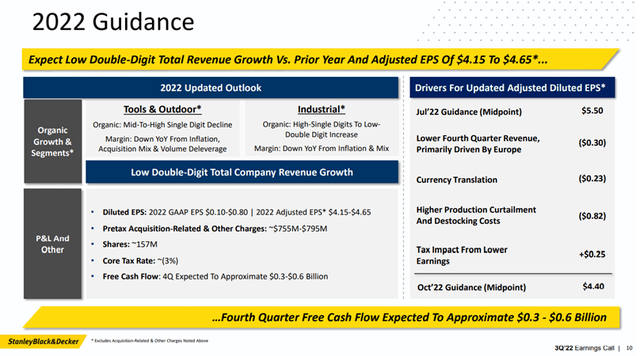

Q3-2022 FY2022 Guidance (Stanley Black & Decker IR)

If we jump to the updated FY2022 guidance released in connection to the Q3-2022 quarterly performance, we also observe the significant difference compared to the initial expectations released in February of this year.

The result? Adjusted EPS expectations have been cut down by two thirds for FY2022 – ouch.

All of this means, that SWK trades with a market cap of $11.8 billion compared to its expected FY2022 sales of $16.8 billion. A couple of months ago, Moody’s reaffirmed their BAA1 credit rating while Fitch has maintained their A- rating throughout. In plain language, they consider the company investment grade and find the company able to meet its financial obligations. With the company expecting positive cash flows going forward, there shouldn’t be an immediate need to strap on more debt, but if it was needed, the company could handle it.

SWK yields a forward 3.9% at today’s valuation and belongs to the club of dividend kings who’ve been able to hike their dividend for at least 50 consecutive years. In other words, this company has weathered lots and lots of recessions, but consistently managed to reward its shareholders and grow the business. Management provided a paltry hike this year, when it back in July was announced the dividend would grow 1.3% for this year, but that’s to be expected given the economic fallout that management is currently dealing with and the 5Y growth rate comes in at a much more acceptable 6%.

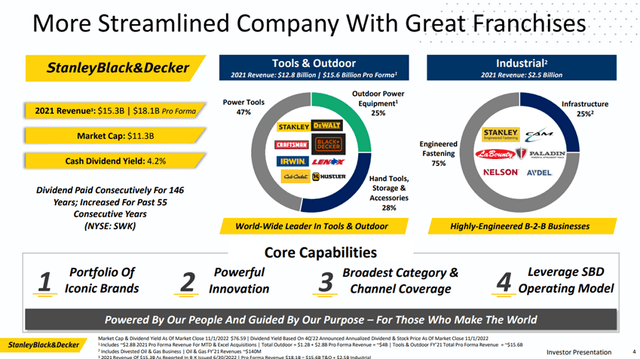

Investor Presentation Company Overview (Stanley Black & Decker IR)

The company has a global footprint revenue wise with 60% of revenue in the US, 17% in EU, 14% in emerging markets and the remaining 9% classified as rest of world. Consumers will recognise its many established global brands within its tools & outdoor division, also making up the vast majority of its revenue.

As I pointed out in my recent article, the company is currently streamlining its portfolio and divesting non-core units while having conducted acquisitions in the outdoor space primarily. All in an effort to consolidate and drive growth in the right areas of focus, creating a more synergetic plate of offerings.

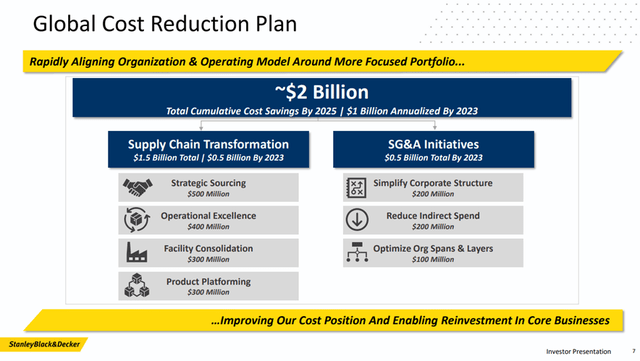

High Level Global Cost Reduction Plan (Stanley Black & Decker IR)

As a result of both the streamlining, but also the disappointing economic performance, it has become necessary to launch a clean-up operation. Management is striving to shave off $2 billion in total cumulative cost savings by 2025. That’s of course very appealing, but also somewhat disappointing. Especially the supply chain transformation part of the equation leaves me with the impression that the machine wasn’t fine-tuned to begin with. The targets for strategic sourcing and operational excellence suggests to me, that there was a certain layer of fat that was allowed to build during the good times, and that a regular crisis was needed for management to focus on these areas.

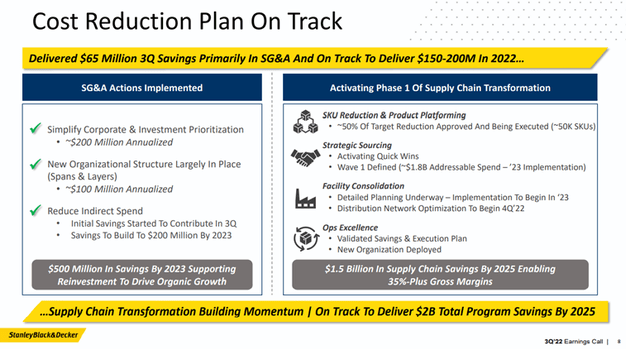

Q3-2022 Cost Reduction Plan Status (Stanley Black & Decker IR)

Time will tell if the organisation can deliver on these aggressive targets, but as a shareholder I naturally hope to see the company capable of churning out stronger margins, allowing for greater unit economics. It will be interesting to follow if they really are able to achieve gross margins of 35%+.

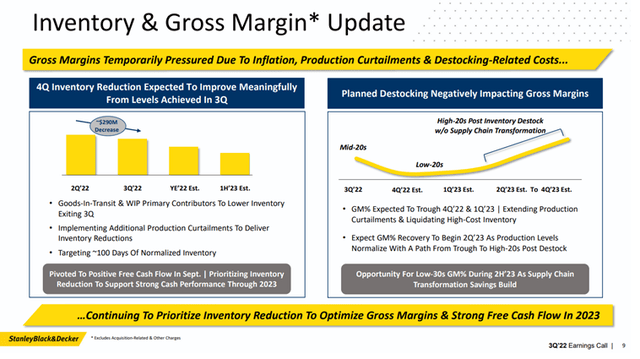

With so many headaches currently visible, it’s only natural to ask the question why this remains an interesting company. The answer, to me, lies in the fact the company is currently trading on the basis of low EPS expectations and a short-termed orientation concerning that situation. As indicated by management below, margins are deeply under pressure right now, but there also comes a time where the company moves past the current issues and at least somewhat back to where they used to be. This will not be tomorrow, but I’m also not investing with a focus on tomorrow.

Q3-2022 Inventory And Margin Update (Stanley Black & Decker IR)

SWK is an established company with well over a hundred years of operations. It’s powered by global brands and is considered a market leader within its primary focus of tools and outdoor.

Taking the helicopter perspective to highlights pros and cons, it could look like this:

Pros include:

- Company has remained in operation for well over a century

- Status of dividend king underlining stability throughout changing economic conditions

- Investment grade rating from rating agencies underline ability to assume more debt short-term if required to overcome the situation

- Postponed parts of current share buyback program to focus on immediate correction of financial situation

- Home to globally recognised brands in its portfolio that have stood the test of time and have appeal with consumers

Negatives include:

- Q4-2022 will be very interesting as we’ll know the continued impact of correcting the inventory situation, especially around the holiday season

- Ballooning inventory in excess of $6 billion on a $25.5 billion balance sheet

- Having taken on more debt with short-term debt up from $2.2 billion in January this year, currently at $2.5 billion and long-term debt up from $4.3 billion to $5.3 billion. Effectively stretching the balance sheet and leaving a lasting impact which management has to deal with for multiple years

- Very negative consumer sentiments may weigh heavy on the stock, pushing it down towards the previous 52-week low, or even further down.

The list of negatives is significant and shouldn’t be ignored, but that’s also exactly why the stock price is depressed. There is a certain risk associated with the company at this point in time, but I also believe this is an opportunity that can create market beating returns over the coming years. The upcoming Q4-2022 results will be very interesting as each quarter gives a clearer indication of how the company is faring, but it’s also the point in time where management will unveil the FY2023 expectations, which are currently quite low and should be expected to remain so.

With a long-term perspective on the investment case, I believe there is value to be found here and that we are discussing a broken stock and not a broken company.

Valuation & Concluding Remarks

Current analyst consensus estimates for EPS FY2023 currently stand at $4.96 and for FY2024 it’s $7.48. Estimates are always uncertain, and we won’t have managements’ expectations until we are in the middle of Q1-2023 calendar wise when they report the FY2022 results. With the current stock price in mind, that would result in forward price earnings of 16.5 and 10.9 respectively.

These levels pale in comparison to the previous forward EPS guidance of the company, but they were also outlined under different circumstances e.g., the home improvement surge in the wake of Covid-19 and bipartisan infrastructure bill.

The investing environment has changed. Interest rate levels have changed, inflation has increased, and quantitative easing has been put to rest – and most recently, consumer confidence has shown a negative development as a result. All of these parameters were favourable for a long time, allowing the stock to expand to $220 per share back in the summer of 2021. That should not be the targets for investors wanting to invest in SWK, in fact, the stock may yet have to find its bottom. This company is not a high growth company seen over an extended period, and as such, it doesn’t deserve price to earnings ratios in the 20’s. However, its quality and stability also shouldn’t lead to a depressed price to earnings in the single digits.

Right now, the EPS consensus estimates for FY2023 stand at $4.96 which is why the forward 1Y P/E comes in at 16.5. Let’s not forget the company was able to churn out much higher earnings only a while back, and while it will take some time, I expect the company is able to elevate its earnings to higher levels than the current estimates for FY2023, while perhaps not being able to fully retrace to the double-digit EPS levels in the short- to medium term. We will need to have a closer understanding of how FY2024 will come to look, to be able to dissect the future profitability levels of the company, as this is also tied to the current efficiency program launched by management.

We’ve reached a point, where many investors who were previously bullish, have begun to throw in the towel, and it’s in this particular situation I believe we should pay close attention. We must consider the reversal potential, because the current issues can’t be expected to persist.

Sentiment in the current market is negative, meaning there is little leniency for companies finding themselves in a weak spot, as is the case for SWK and while the stock price may stay depressed for 6-9 months, we simply don’t know, I expect the reversal to kick in sometime in 2023 once the uncertainty settles – and that is when investors want to be on board.

A conservative standpoint would consist of awaiting the actual confirmation, at which point the stock will most likely already trade higher as the market will have captured this turn around sooner, while a riskier approach would be to accumulate prior to the visibility of the turnaround based on the strong suits of the company, expecting management being able to rectify the situation.

We don’t have to assume a return to the previous peak valuations to find an attractive case for this company, as just applying a 14-16 P/E ratio on the basis for the FY2024 consensus of $7.48 would indicate a stock price between $104.7-$119.7 per share. This would suggest a very attractive upside between ~30%-45% from today’s price, and I do believe it’s within striking range. If management is able to fully deliver on the current efficiency program, I believe the upside could prove better looking at FY24-FY25.

Anyone can play around with these numbers, and it’s a very forgiving exercise, but taking the company specific pros into consideration in combination with where a stable dividend king should find itself, I don’t consider it an unfair expectation.

Going back a year, and multiple analysts had price targets well in excess of $200 per share and today the company find itself in the low $80’s for a share, so that shows the uncertainty tied to any such price target, but we can’t take away the fact that SWK is home to a set of strong brands and historically strong track record.

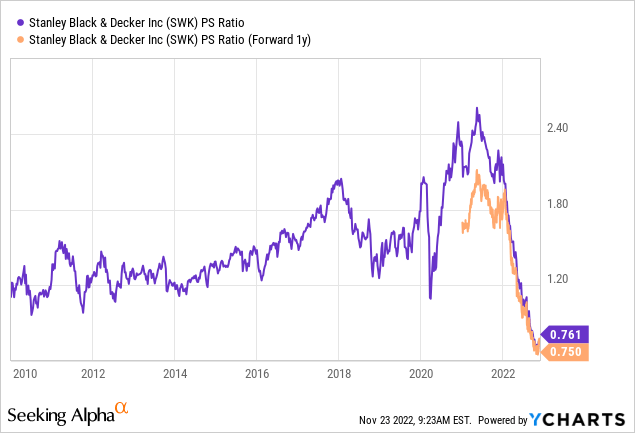

I’ll close with the illustration above, depicting the P/S ratio of SWK since 2010. The investment environment has been unique in the past decade with low interest rates and plenty of quantitative easing to fuel ever expanding asset prices, and while that most likely won’t be part of the future, I do wonder if a dividend king with such a track record should be at such depressed levels valuation wise over the long period. Once profitability is re-established, I don’t believe this is the valuation the market will assign SWK.

Be the first to comment