Joe Raedle

Stanley Black & Decker (NYSE:SWK) is a leading maker of tools, outdoor, and industrial equipment. It is known for brands such as Stanley, Black & Decker, Dewalt, and Craftsman.

The firm is most known for its power tools, with those making up approximately 40% of revenues. Its hand tools and outdoor power equipment are also popular with consumers and contractors. The firm isn’t just a consumer-facing business, however. Stanley Black & Decker earns about 20% of its revenues from industrial B2B sales for products such as engineered fastening.

A Stay-At-Home Winner That Has Fizzled

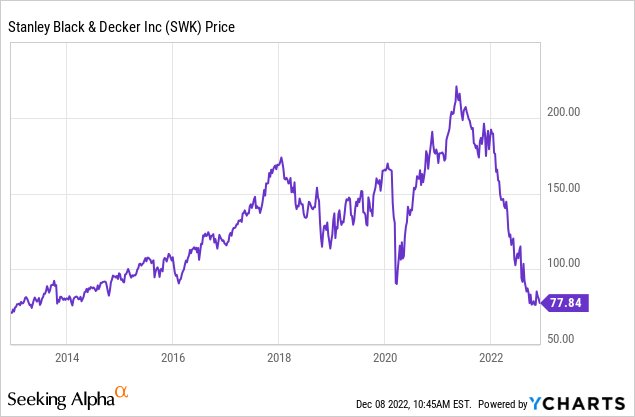

Stanley Black & Decker has ended up being a perfect microcosm of the economic disruption associated with the pandemic. The company initially enjoyed an earnings boom, and traders got carried away, lifting SWK stock to an unjustifiable valuation. Since then, the pendulum has swung too far the other way, pushing shares down to near 10-year lows:

What explains the rise of over $200/share last year and now the decline back to 2013 levels?

Earnings.

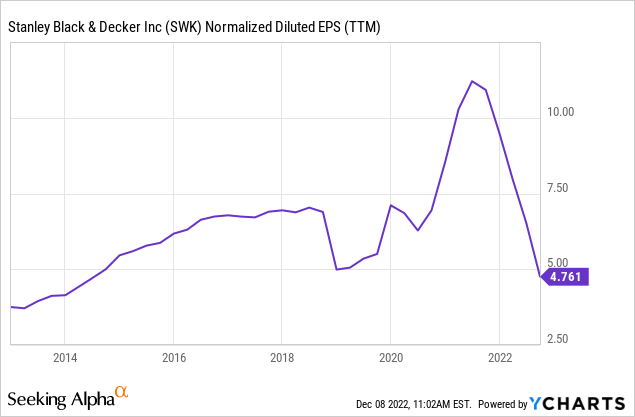

Specifically, Stanley Black & Decker saw earnings rise far above trend in 2020 and 2021 as people, stuck at home, decided to spend record amounts of money on home improvement and outdoor projects. Then that spending dried up, leading to an abrupt reversal in the company’s fortunes. Here’s a 10-year history of the company’s earnings per share:

As you can see, through the 2010s, the company’s earnings tended to rise at a steady pace, aside from a brief drop in 2019. Prior to the pandemic, Stanley Black & Decker was earning around $7/share per year.

As SWK stock was around $140 on average in the late 2010s, this worked out to a roughly 20x P/E ratio for the company’s normal baseline earnings.

In 2020 and 2021, everything changed. The company’s earnings hit $11/share at one point. And investors, seemingly not realizing how temporary those earnings would be, continued to pay the same 20x P/E ratio for the unusually strong results. This pushed SWK stock up to $225 at the peak.

Now, though, earnings have plunged to less than $5/share, which is far below where they were prior to 2020.

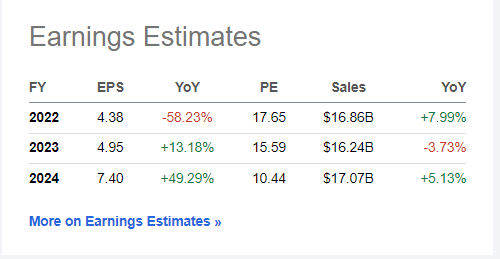

The interesting thing is that the P/E ratio has also come down:

SWK earnings estimates (Seeking Alpha)

We’re now trading at less than 18x this year’s estimated earnings. Moving out to 2023 and 2024, shares go for 16x and 10x estimated earnings, respectively.

In theory, investors are supposed to assign a lower P/E ratio to a cyclical company at peak earnings, and pay a higher P/E ratio when its earnings are near a trough. But, instead, we’re seeing a situation where Stanley Black & Decker’s valuation has come in at the same time it has dropped from peak to trough earnings.

Now, merely getting back to pre-2020 levels of operations – which management has laid out a clear pathway to achieving – puts the stock at less than 11x 2024 earnings. Given the company’s impeccable long-term track record of value creation and consistent dividend growth, this looks like a great opportunity for investors that are willing to wait for a few quarters while the current economic disruption finishes playing itself out.

Stanley Black & Decker Should Turn The Corner In 2023

SWK stock remains near its 52-week lows, even as the market as a whole has rallied sharply over the past two months. What explains the divergence? The company’s most recent quarterly earnings report was disappointing, and there was little to indicate an immediate improvement coming from the firm’s guidance, either.

Given how short-term Wall Street tends to be in nature, this made it an easy call. Avoid Stanley Black & Decker given the bad earnings and poor near-term outlook.

That said, for folks that listened to the conference call, we got the clue that things are going to turn within the next few quarters. Here’s CEO Don Allan talking about this quarter’s results:

“In addition, we made significant progress reducing debt, utilizing $3.3 billion in proceeds from our strategic divestitures. All key priorities we set out heading into the third quarter. All of this is not yet apparent in the financials, but we are encouraged by a few items.

One, our headcount reductions are largely complete. Two, inventory is coming down. Three, cash generation was positive in September, and we believe this can continue in the fourth quarter and next year. And four, gross margin will be the last to turn as we face the high cost of destocking, but we expect to be through that and pivot to better performance by the middle of next year.”

The company’s comeback plan is clearly laid out right there. Improve balance sheet flexibility, cut costs, get inventory back to where it should be, and return gross margins to normal levels. This stuff isn’t an overnight process, it takes many months for these changes to filter out through the whole operation. As Allan said, the right moves have been made, but they aren’t apparent in the financial results yet. Now it’s a waiting game until mid-2023 when these improvements really kick in.

SWK Stock Verdict

On the most recent conference call, Allan said that, “We’re not going to give a ton of color on 2023.” Rather, management is concentrating on showing investors the longer-term path back to earning normal levels of gross margins, which will, in turn, allow the firm to return to its baseline earnings level.

There’s still a ton of noise and short-term volatility to come for the company. We have currencies, supply chain issues, labor inflation, and the threat of recession among other potential concerns that could ding results over the next few quarters. For traders, it’s probably not time to buy SWK stock yet.

For longer-term dividend investors, however, the time is ripe. This is a company that has paid dividends for 146 years in a row. Yes, that dates back to 1876. And Stanley Black & Decker has increased its dividend for the past 55 consecutive years.

I see little evidence that anything going on today will be enough to disrupt the company’s longer-term trajectory. Power tools are an essential good for construction and building repair. The firm has excellent brands. And management has proven adept at leading the company through countless economic shocks before.

Dating back to the 1980s, SWK stock has only yielded 4% or more on two occasions; a brief period at the stock market bottom in 2003, and during the 2008 financial crisis. Both of those ended up being great times to buy companies tied to American industry and the housing market. I’d guess that this moment of 2022 will prove similar with the benefit of hindsight.

Be the first to comment