olm26250

My previous article on Seagen (NASDAQ:SGEN) focused on the potential acquisition of the company by Merck (MRK). At the time, there appeared to be limited upside even if Seagen was to be acquired and my take was neutral, but I did try to explain why the company would be a great fit for Merck. Fast-forward a couple of months, and there is no deal, and shares are down 23% since the article was written and Seagen is starting to look attractive as a standalone company, and it might not need to be acquired to deliver shareholder value from current levels.

Expectations reset after a change in the competitive landscape

Prior to all the Merck-related drama, Seagen’s share price declined due to the loss of its CEO after a domestic violence incident, and the expectations reset the company made when it issued the 2022 guidance. The full-year revenue guidance excluding Tivdak was $1.665 billion to $1.745 billion versus a $2.2 billion consensus at the time.

This was an effective reset of investor expectations and reflected a change in the competitive landscape around Tukysa and set the tone for the rest of the year with the potential for the company to beat its guidance and raise it. And that happened when the company reported second quarter results as it increased the full-year revenue guidance to a range of $1.71 billion to $1.795 billion.

Adcetris is now a mature brand, but it is still growing nicely – net sales grew 11% Y/Y in the second quarter. And there are additional shots on goal for Adcetris, and it could have additional label-expansion opportunities in CD-30-expressing lymphomas.

Padcev is the key growth driver in the near term with sales growing 50% Y/Y in the second quarter, although it had a $19 million benefit in the quarter due to clinical supply orders. Excluding this one-time benefit, sales grew 27% Y/Y.

Tivdak is off to a solid start, with net sales growing from $11 million in the first quarter to $17 million in the second quarter, but in its current indication, it will not become a meaningful product for Seagen.

Sales of Tukysa grew only 7% Y/Y to $89 million and the company expects additional challenges in the second half of the year and in 2023 due to the recent approval and launch of Enhertu. It will be tough to compete against Enhertu because it is generated remarkable data in the phase 3 trial in patients with HER2-positive unresectable and/or metastatic breast cancer previously treated with trastuzumab and a taxane – it reduced the risk of disease progression or death by 72% versus trastuzumab emtansine with very high overall response rates. This is a dataset Tukysa cannot compete with.

We should probably expect Tukysa to be used in later lines, in patients who have progressed on Enhertu.

So, in the next few quarters, Padcev and Tivdak will be the two key growth drivers along with continued decent contribution from Adcetris and with challenges ahead for Tukysa.

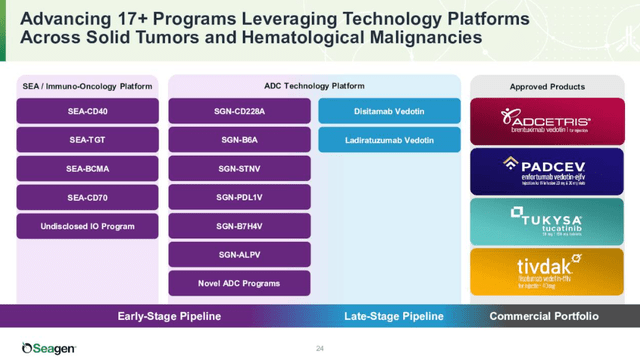

Seagen has a healthy pipeline with multiple shots on goal with existing and new assets. In addition to revenue growth in existing indications, label expansion should play a key role in the medium term, and longer term, the company’s expanding pipeline should start to contribute in a more meaningful way.

The use of Padcev should expand to frontline cisplatin-ineligible patients with unresectable, locally advanced urothelial cancer. It is currently used as second-line therapy. The company recently shared positive topline data from the Cohort K of the EV-103 trial, where Padcev was evaluated in combination with Merck’s Keytruda in frontline patients. The overall response rate was 64.5% and the median duration of response was not reached. The company plans to discuss the results with regulators with the intention of submitting a supplemental biologics license application (‘sBLA’) to the FDA later this year to support a potential accelerated approval.

Tukysa may start to recover if it receives accelerated approval in combination with trastuzumab in patients with previously treated HER2-positive metastatic colorectal cancer – the sNDA was submitted this year, and it could reach the market next year.

The late-stage pipeline also includes two candidates:

- Disitamab vedotin, a novel, high-affinity antibody with blockade of HER2 signaling and enhanced internalization compared to trastuzumab. This candidate leverages Seagen’s vedotin-based drug-linker technology, and data suggest vedotin-based ADCs combine well with checkpoint inhibitors. It has generated encouraging monotherapy data in HER2 low breast cancer, and Seagen is enrolling a phase 2 trial in second line+ metastatic urothelial cancer with the potential for accelerated approval. And there is a broad development program behind this indication – first-line metastatic urothelial cancer in combination with an anti-PD1 antibody, first-line HER2 low breast cancer, and potentially in gastric cancer and other solid tumors.

- Ladiratuzumab vedotin is an ADC targeting LIV-1 which is expressed in most metastatic breast cancers, and also melanoma, prostate, ovarian, uterine, and cervical cancers. It is currently being investigated in phase 2 trials in first-line metastatic triple-negative breast cancer in combination with pembrolizumab and as monotherapy in a phase 2 basket trial in relapsed/refractory solid tumors and a phase 1 trial in relapsed/refractory metastatic breast cancer.

And there is a broad early-stage pipeline behind these candidates, and Seagen has years of growth ahead.

And Seagen should continue to expand its pipeline through internal efforts and external collaborations. The most recent example is the collaboration with LAVA Therapeutics (LVTX) for a preclinical candidate LAVA-1223, which is designed to target epidermal growth factor receptor (‘EGFR’)-expressing solid tumors. The agreement also gives Seagen exclusive rights of negotiation to apply LAVA’s Gammabody platform on up to two additional tumor targets.

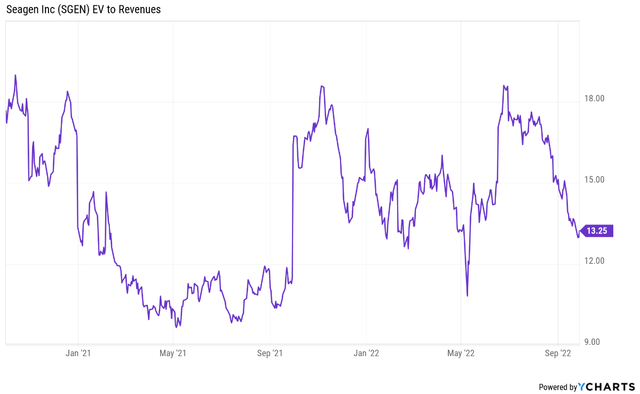

Standalone valuation looks more attractive now

Seagen’s enterprise value to revenue ratio has contracted in the last few months and is now just below the mid-point of the range it traded in over the last two years.

With the above-covered expectations reset and a strong long-term growth outlook, I think Seagen is in a good position to deliver shareholder value in the following years as a standalone company.

Acquisition by Merck is still possible

With the stock back to the levels it traded prior to the buyout rumors, the risk-reward has improved, although I believe the potential buyout is probably not completely eliminated from Seagen’s valuation. And while it appears the probability of a buyout has decreased substantially in the last few weeks, a buyout is still possible, although I think it could now come closer to the low end of the range I provided in my previous article – around $200 per share, primarily due to the recent arbitration loss to Daiichi Sankyo.

There is one potential negative catalyst in the near term that could additionally dampen buyout expectations – Seagen appointing a new CEO. This role is still being handled by the interim CEO – Roger Dansey, the company’s Chief Medical Officer, and the search for a new one is ongoing, although the company recently indicated it is in a good position and in no hurry to appoint a permanent CEO.

Conclusion

With the share price down to the level it traded prior to the Merck buyout rumors, Seagen is starting to look more attractive as a standalone entity. The company has years of strong growth ahead and while I do not believe a buyout by Merck (or any other big pharma company) is off the table, the associated buyout premium has nearly disappeared. The appointment of a new CEO may further dampen the buyout prospects, but that could also be the time the stock bottoms.

Be the first to comment