Dzmitry Dzemidovich

STAG Industrial Inc. (NYSE:STAG) remains a high-quality REIT investment for investors who value capital safety as well as a consistent stream of dividend income from one of the sector’s best-managed real estate investment trusts.

The trust’s low payout ratio based on funds from operations and aggressive acquisitions are positioning it for long-term FFO and dividend growth.

Since the payout ratio fell to 65% in 2Q-22, the dividend will most likely be maintained even during the next recession.

Transformative Business Development

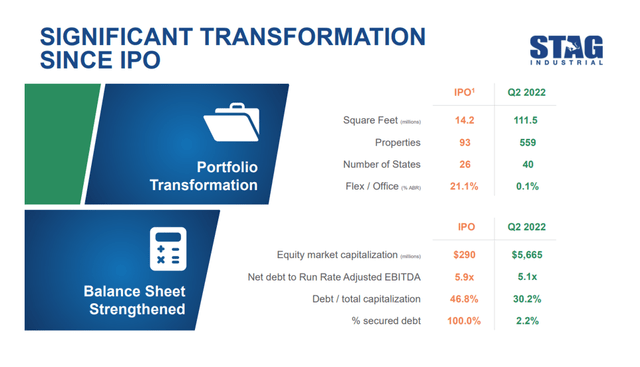

STAG Industrial’s business development has been truly transformative, with acquisitions playing a significant role. STAG Industrial had only 93 properties in 26 states when it went public in 2011, but it has since grown to a portfolio of 559 properties and representation in 40 states. STAG Industrial is about eight times larger today than it was a little more than a decade ago, with a portfolio of 111.5 million square feet.

Transformation Since IPO (STAG Industrial)

Acquisitions have been critical to STAG Industrial’s rapid growth. The trust rapidly acquires industrial properties, resulting in slow but steady portfolio growth over the last decade.

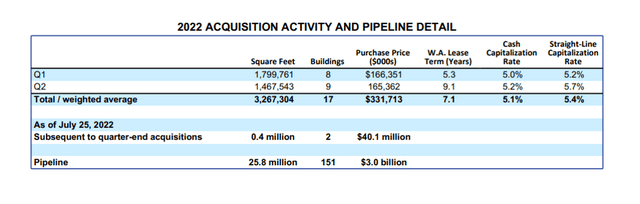

STAG Industrial’s acquisition department approved 17 properties totaling 3.3 million square feet in 2022. STAG Industrial acquired 15 buildings totaling 2.9 million square feet on a net basis, which includes the disposition of undesirable or non-performing properties.

Acquisitions were made in 2022 at an appealing weighted average capitalization rate of 5.4%, and the trust’s acquisition pipeline is full of potential deals worth $3.0 billion.

2022 Acquisition Activity (STAG Industrial)

STAG Industrial’s Dividend Will Likely Last Through A Recession

This isn’t as dramatic as it sounds. The industrial trust easily covers its dividend payout with funds from operations, and the payout ratio is so low that even a significant increase in vacancies during a recession would most likely have little impact on STAG Industrial’s dividend coverage.

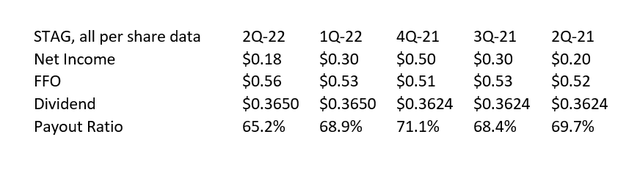

STAG Industrial benefited from strong funds from operations growth in 2022, as demand for industrial properties recovered and rents rose. The trust earned $0.56 per share in funds from operations, representing 8% YoY growth, while STAG Industrial only paid out 65.2%, or $0.3650 per share. The payout ratio improved 3.7 percentage points QoQ due to STAG Industrial’s strong FFO growth in the second quarter, implying that the margin of safety increased in 2Q-22.

STAG Industrial pays a monthly dividend of $0.1217 per share, and given its low payout ratio, the trust could probably even afford to raise its dividend by a moderate percentage during a recession.

Dividend And Pay-Out Ratio (Author Created Table Based on Trust Information)

Guidance And Valuation

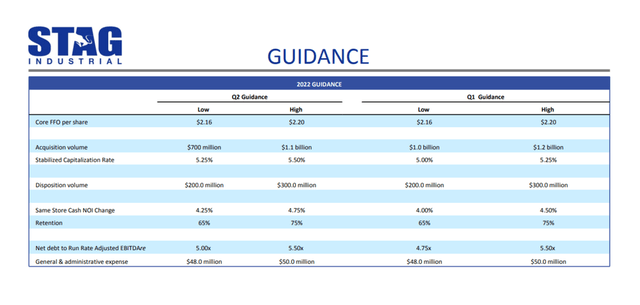

STAG Industrial did not increase its funds from operations guidance in 2Q-22, but it did not need to in order to demonstrate that the REIT is reasonably valued. The trust’s funds from operations are expected to be $2.16-2.20 per share in 2022, but STAG Industrial has reduced its acquisition volume forecast from $1.0-1.2 billion to $700 million to $1.1 billion.

STAG Industrial’s FFO guidance translates to a funds from operations multiple of 16.1x using a stock price of $35.14 as a reference.

STAG Industrial’s competitor in the industrial real estate market, Prologis (PLD), raised its FFO guidance from $5.10-5.16 per share to $5.14-5.18 per share. This guidance translates into a 26.4x multiple of funds from operations.

Why STAG Industrial Could See A Lower Valuation

A rise in vacancies and a slower acquisition pace may be a drag on STAG Industrial’s funds from operations growth, but given how easily the trust covers its dividend with funds from operations, I don’t see this as a major issue for the company.

A significant increase in vacancies or an increase in lease terminations could pose a problem for STAG Industrial, but given the 65% payout ratio, investors shouldn’t be concerned about the dividend.

My Conclusion

STAG Industrial’s 2Q-22 earnings have once again demonstrated that the dividend has a very high margin of safety and that the trust should have little difficulty paying its dividend during a recession.

The trust remained aggressive in terms of acquiring new square feet in 2022, and despite lower acquisition guidance, the company expects to acquire a significant number of new properties this year.

The valuation is appealing in comparison to Prologis, and I believe STAG Industrial is close to a recession-proof investment for income investors.

Be the first to comment