ChrisHepburn/iStock via Getty Images

“Train hard, fight easy.” – John Steele

The rapid rise in interest rates is starting to have increasingly negative impacts on the housing market. The average 30-year mortgage rate recently breach the six percent mark from just over three percent just over one year ago. Combined with the price increase of the average home since lock downs ended, this is pricing more and more prospective home buyers out of the market. Refinancing activity has slowed to a trickle.

This is also having its effect on home builder sentiment which just hit its lowest levels since June of 2020. That said, a lot of bad news seems more than priced into many home builder stocks. This sector of the market typically has a valuation of 40% to 60% of the overall P/E of the market outside of significant economic downturns. This discount is justified as this industry is historically cyclical. With the beatdown the home builders have taken over the past few quarters in the market, many good names are trading at 20% to 30% of overall P/E of the market.

There are some decent bargains here. This is not the same situation as the Housing Bust fifteen years ago. The country had seen years of overbuilding before that event occurred. Housing starts have run below long-term historical trends since then and housing inventory remains anemic.

Today, we look at one of largest and well-known home building names.

Company Overview:

Toll Brothers, Inc. (NYSE:TOL) is a Fort Washington, Pennsylvania headquartered homebuilder, known primarily for its luxury residential single-family detached home communities, although it also builds attached home, master-planned resort-style golf, and urban planned developments. The company boasts 455 operating communities, of which 340 are offering ~32,500 homes for sale in 24 states and the District of Columbia as of October 31, 2021. Toll Brothers was founded in 1967 and went public in 1986, raising proceeds of nearly $40 million at $1 a share, after giving effect to three 2-for-1 and one 3-for-2 stock splits. Shares of TOL trade around $41.50 a share currently, translating to a market cap of $4.8 billion.

The homebuilder operates on a fiscal year (FY) ending October 31st.

Operating Model:

Toll Brothers typically purchases large land parcels in affluent suburban geographies positioned near major transit hubs and highways and develops them into master-planned communities, employing its own architectural, engineering, mortgage, title, land development, insurance, smart home technology, and landscaping subsidiaries to accomplish this end. Additionally, the company develops and operates urban and suburban apartment communities, primarily through joint ventures under the brand names Toll Brothers Apartment Living and Toll Brothers Campus Living. Owing to the high-end nature of its offerings, Toll Brothers was the number four U.S. homebuilder in terms of FY21 gross home sale revenue ($8.43 billion) despite ranking 11th in total closings (9,986).

More specifically, 77% of the homes the company sold in FY21 had a base sales price between $500,000 and $2 million (19% <$500,000; 4% >$2 million), with an average selling price of $844,400. Approximately 18% of homebuyers paid for their Toll Brothers homes in cash with the remaining home buyers (on average) putting 31% down and financing the balance.

In addition to its 455 operating communities, the homebuilder owns or controls through options or purchase agreements land parcels for an additional 540 communities encompassing 48,386 home sites as of October 31, 2021. Of this total, 59 land parcels were earmarked for rental apartments comprising 19,500 planned units.

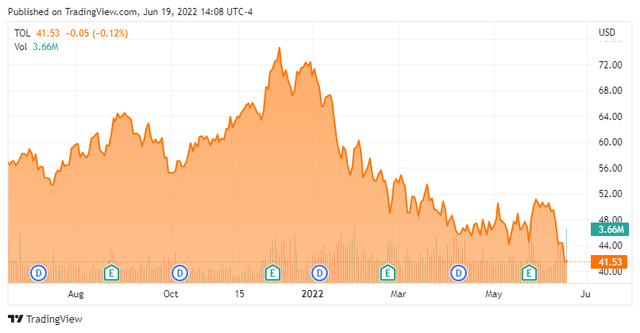

Recent Share Price Performance in a Significantly Altered Rate Environment

Propelled by nearly a decade of historically low interest rates that were pushed lower by the pandemic, Toll Brothers’ top line grew at a CAGR of 13.6% since FY15 to $8.8 billion in FY21 while its per share GAAP earnings grew at a CAGR of 22.4% over the same period to $6.63. The market rewarded this performance, bidding shares of TOL up 129% calendar YE15 through YE21 to $71.90. The biggest issue for homebuilders in 2021 was supply chain disruptions pushing out completion dates and driving significantly higher costs for lumber, steel, copper, and aluminum, all of which surged at least 40% versus 2020. However, the raw material costs were being passed on to home buyers and the supply chain bottlenecks only served to drive up backlogs. Illustrating these undercurrents, Toll Brothers unit backlog rose 32% to 10,302 units (October 31, 2021 vs October 31, 2020) while its backlog value surged 49% to $9.5 billion.

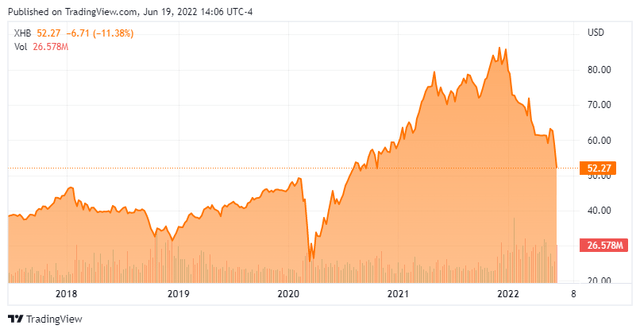

The company seemed poised for a solid FY22 with the average 30-year mortgage rate still below 3% as late as December 21, 2021. But with spiking energy prices courtesy of misguided fiscal policies laid bare by the conflict in Ukraine, inflation surged to 40-year highs, breaking an already weakened bond market’s back, causing 30-year mortgage rates to surge above 5% in three and a half short months. With housing affordability suddenly much more expensive for many, the market began to price in a decline in demand, wiping out all the 2021 gains in the SPDR Homebuilders ETF (XHB). Toll Brothers’ stock has not been spared, currently down 40% YTD.

In addition to a potential decline in demand, cost inflation has shown few signs of abating, stoking fears that margins could get squeezed. In FY21, Toll Brothers achieved solid 25.0% Adj. home sales gross margin against 23.5% in FY20, benefiting from 18% unit sales growth further leveraged by a 3% average selling price increase.

Recent Quarterly Earnings:

There weren’t many signs of weakness at Toll Brothers when it announced 1QFY22 earnings on February 22, 2022, when the average 30-year mortgage was at exactly 4.00%. The homebuilder reported net income of $1.24 per share on revenue of $1.79 billion versus $0.76 a share on revenue of $1.56 billion in 1QFY21, representing 63% and 15% increases, respectively. Adj. home sales gross margin remained strong at 25.6%, up 270 basis points over the prior year period. Toll Brothers signed 2,929 net contracts for $3.0 billion in the period, up 2% and 19% over a strong 1QFY21, which delivered up 59% and 68% over 1QFY20, respectively. Furthermore, backlog on January 31, 2022 stood at a record $10.8 billion and 11,302 homes as compared to $7.5 billion and 8,888 units one year prior.

In late May, the company reported second quarter results. The company delivered $1.85 a share of GAAP profits as revenues rose 14% to $2.2 billion. Both top and bottom line numbers easily exceeded expectations. The company also noted that its backlog value was $11.7 billion up 35% compared to FY 2021’s second quarter; homes in backlog were 11,768, up 16%. Gross margins improved to 24.1% from 21.9% a year ago.

It should be noted that net signed contract value was $3.1 billion, which was up just 1% from the same period a year ago. Contracted homes also fell 185 to 2,874, as higher interest rates take their toll.

For the full 2022 fiscal year, the company expects to deliver 11,000 to 11,500 homes at an average price of between $890,000 to $910,000.

Balance Sheet & Analyst Commentary:

Toll Brothers is in solid financial condition with cash and equivalents of $535 million at the end of the second quarter against nearly $3.2 billion in long term debt. The company also has additional liquidity of $1.8 billion on an untapped credit facility. The homebuilder ended the second quarter with a book value of $46.51 a share.

Toll Brothers returns capital to shareholder through both share buybacks and dividends. The company repurchased approximately 2.2 million shares at an average price of $48.30 per share for a total purchase price of approximately $106.5 million, leaving 7.35 million shares remaining on its authorization. This program was increased to 20 million shares in May. As a further sign of confidence in the homebuilder’s future, management raised its quarterly dividend 18% to $0.20 a share in the first quarter, for a current yield of 1.93%.

Insiders have neither bought or sold shares in 2022. There was a spate of insider selling late in 2021 when the stock was over $70.00 a share it should be noted.

Verdict:

The analyst consensus has this homebuilder generating earnings of $10.26 a share on revenue of nearly $10.2 billion in FY22, followed by $11.66 a share on revenue of $11.2 billion in FY23.

There are plenty of takes on homebuilders in general and one on Toll Brothers specifically. On the bullish side, there is significant backlog that should be secured by the fact that homebuyers do not want to lose their deposits while housing prices and rents continue to rise in an inventory-light market. Second, margins should remain solid as homebuilders are still selling homes on land that was acquired far below current market values. Lumber is down more than two thirds from its all-time highs late in 2021.

And even though affordability has taken a hit, from a historical perspective, 6% 30-year mortgages are not outrageous. Since Toll Brothers caters to the higher-income homebuyer, it can be argued that it will be less impacted by the higher rates as it has a higher percentage of cash buyers than its competition. Furthermore, it is trading at a forward PE of just over four, a price-to-book value of around .9 (versus an average of ~1.5 over the past decade), and a forward price-to-sales ratio of under .5.

With that said, from a historical perspective, homebuilders consistently underperform in periods of rising rates or Fed tightening periods. However, Toll Brothers stock is already down some 45% from its all-time high set six months ago, anticipating a major slowdown in the sector, yet the opposite is reflected in both Street analysts’ and the company’s FY22 outlook.

I expect earnings estimates to come down significantly as the country appears heading into a recession. However, even if FY2023’s profit projections get chopped by 30%, Toll Brothers should still print around eight bucks a share of profit next fiscal year. At current trading levels, the stock sells for just over five times that downwardly revised figure, meaning a lot of bad news is already price into the shares. Given this, I have started accumulating shares in TOL using covered call orders.

“Greatness comes not in possessing security, but in withstanding insecurity.” – Jeffrey Fry

Be the first to comment