MarsBars

It’s safe to assume that most investors of REITs are there for the income. This asset class excels at that, as it’s incentivized to pay out 90% of its taxable earnings to avoid being taxed at the corporate level. This enables more shareholder returns and it’s no surprise that REITs have a higher average yield than that of the broader market.

No two REITs are alike, however, as some have higher dividend growth track records than others. One of the common complaints of STAG Industrial (NYSE:STAG) that I see in comment streams is its lack of meaningful dividend growth. Perhaps that contributes to why STAG hasn’t gotten the premium valuation that some of its peers have received. This article highlights why this label may change and why the recent share price weakness presents an excellent buying opportunity.

Why STAG?

STAG Industrial is an industrial REIT with a national presence, with 559 properties covering 111 million square feet across 40 states. Its strategy is to acquire and lease out properties in secondary markets, where it’s able to obtain more favorable deal pricing due to less competition from bigger players such as Prologis (PLD) and Rexford Industrial (REXR), which are focused on the more competitive Tier 1 markets.

What differentiates STAG is its focus on single tenant industrial properties, where there is price dislocation between private market sellers and net consolidators like STAG. That’s because a single tenant property is far riskier for a private owner of a few properties than it is for STAG, which is able to diversify its risk across 559 buildings in 40 states across the U.S. This is what management refers to as “shades of gray” than simple “black and white”.

STAG has emerged as a far more safe and durable enterprise than it was when it first went public back in 2011. Since then, it’s grown from just 93 properties to 559 at present, while reducing its flex office / industrial footprint from 21% of annual base rent to just 0.1%.

Meanwhile, STAG enjoys strong demand for its properties with a 90% tenant retention rate in its latest reported quarter and a very strong 98% occupancy rate, resembling that of many top-tier net lease REITs. Moreover, it saw an impressive 14% lease spread on new and renewal leases (22% on a GAAP straight-line basis)

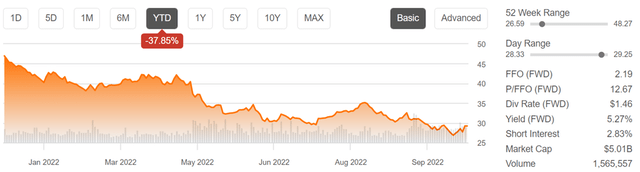

STAG’s share price has materially fallen since the start of the year. As shown below, the share price is down by nearly 38% since the beginning of January, pushing the dividend yield up to 5%.

STAG Stock (Seeking Alpha)

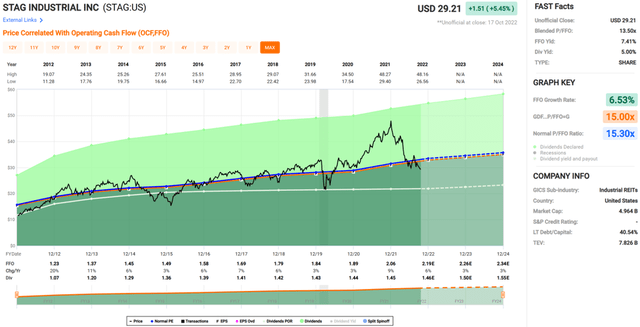

At the current price of $29.21, STAG carries a forward P/FFO of 13.3, sitting well below its normal P/FFO of 15.3 since inception.

STAG Valuation (FAST Graphs)

While this is great for income investors seeking to add more at value prices, having a lower share price raises the cost of equity for the company, thereby making acquisitions more expensive. However, it shouldn’t be ignored that there are two pieces to the capital raising pie, one being equity and the other being debt. This is where STAG shines, as it carries a low net debt to EBITDA ratio of just 5.1x. This puts STAG at an advantage when it comes to raising capital and bidding on properties against more leveraged and thereby weaker positioned private market buyers.

STAG’s dividend also carries a low 65% payout ratio (based on Q2 Core FFO per share of $0.56). This means that STAG is currently retaining plenty of capital to raise its dividend or to make acquisitions. Management has long targeted a 70% payout ratio, and I believe they will take a balanced approach between giving more meaningful dividend raises and using the funds for property acquisitions.

Given the relative undervaluation and potential for more dividend growth, I believe STAG is currently fundamentally undervalued. Wall Street analysts who follow the company have a consensus Buy rating, and S&P Capital IQ has an average price target of $38.41, translating to potentially very strong double-digit annual returns.

Investor Takeaway

The downturn in STAG Industrial’s stock price presents an excellent opportunity for long-term income investors. The company is well-positioned to continue its growth trajectory, with a strong focus on single tenant industrial properties in secondary markets. This strategy has allowed STAG to obtain more favorable deal pricing and to grow its portfolio. Lastly, solid portfolio fundamentals combined with a low dividend payout ratio sets up the stock for growing the dividend and potentially strong total returns.

Be the first to comment