DNY59

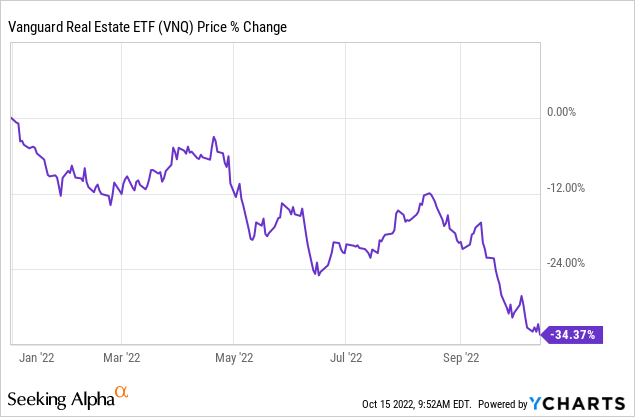

REITs are down 34% year-to-date:

If that’s the average of the REIT market (VNQ), you can expect the REITs with higher leverage and poor market sentiment to be down closer to 50%.

That’s not just a dip, that’s a crash.

REITs are down so heavily because the market fears that the recent surge in interest rates is going to cause them to suffer severe pain.

But as we have explained in previous articles, we believe that the market is overreacting since:

- Most REITs use relatively little debt these days.

- Their maturities are long.

- Most of the debt is fixed rate.

- Rents and replacement costs are rising rapidly as a result of inflation.

- REITs are already valued at huge discounts to NAV, providing margin of safety.

We have previously used the example of Vonovia (VNA / OTCPK:VONOY) because it is one of the best case studies in today’s market. Vonovia is the biggest landlord in Germany and it is currently priced at just around ~40% of its net asset value due to fears of rising rates and a likely near-term recession. This valuation leads you to think that something dramatic is about to happen in the short run, but in reality, its rents are growing the fastest in years (thanks to inflation), it has a strong investment grade rated balance sheet, and enough liquidity to address maturities with retained cash flow, asset sales, and JVs.

Could property values drop a bit from here? Sure. But how much can they really drop with so much inflation and rapidly rising rents? Its properties are already valued at a discount to replacement cost and we need more, not less housing in Germany. Even if property values dropped a bit, VNA would still be deeply discounted because it offers such a huge margin of safety and you earn an 8% dividend yield while you wait for an eventual recovery.

Vonovia

Is the market seeing something that we aren’t?

Or did the market simply overreact, like it always does during times of crisis?

We think that it is the latter and this is why we are so happy to buy the dip.

Uncertainty is high right now and this is why valuations are so low, but eventually, things will work themselves out and valuations will recover.

We have gone through world wars, pandemics, periods of high inflation, and many more crises, and the market always recovers. This time won’t be different.

Therefore, whenever you get the chance to buy good real estate at a steep discount to fair value, you should jump on the opportunity, especially when inflation is so high.

Here are three REITs that we are currently accumulating and/or have on our watchlist:

Global Medical REIT (GMRE): The small-cap REIT is down 60% this year. As a result, it is now priced at just 7.5x FFO and it trades at an 11.4% dividend yield. That’s the valuation of a REIT that’s going through some severe difficulties and is expected to soon cut its dividend. But this isn’t the case. GMRE owns mainly medical office buildings that enjoy relatively long leases at 7 years, high rent coverage at 5x, steady 2% annual rent escalations, and positive releasing spreads as leases expire. It’s business and tenants are recession-proof and there is nothing particularly serious to worry about. Sure, its growth will likely slow down in the near term due to rising interest rates, but a temporary slowdown is nothing that would justify such a drastic repricing of the shares. Interestingly, GMRE is down about as much as Medical Properties Trust (MPW), which is another healthcare REIT that’s down heavily in 2022.

Global Medical REIT

Douglas Emmett (DEI): Generally speaking, we continue to stay away from office REITs. They are all cheap, but there is still significant uncertainty affecting the future of the sector, and since other property sectors are discounted as well, we don’t see the need to invest in office REITs. DEI could be an exception that we are currently researching. It is the largest office landlord in two markets that enjoy particularly high barriers to entry: Honolulu and Los Angeles. Besides, about 20% of the company’s NOI comes from apartment communities that enjoy rapid growth, which should make up for some of the weaknesses of its office holdings. The company has an excellent track record and insiders are currently buying shares “hand over fist”. A director recently bought $6 million worth of shares. The CEO also bought $1 million worth of shares. It is currently priced at an estimated 40% discount to NAV, 8x FFO, and offers a 6.5% dividend yield, which is a 10-year high for the company. We are waiting to hear the 3rd quarter conference call before making an investment decision on this one.

Douglas Emmett

Segro PLC (SGRO / OTCPK:SEGXF): Industrial REITs like Prologis (PLD) are down particularly heavily in 2022. This is true in the US and it is also true in Europe. Segro is one of the leading industrial REITs in the UK and central Europe. It is down 47% year-to-date and it now trades at a historically large 40% discount to net asset value. Is the company facing significant headwinds? No, it isn’t. Its occupancy recently reached a new 10-year high as not enough new facilities have been built to meet the rapidly growing demand. Rents are also growing rapidly. So far this year, its rents on new leases are up 24%, which is far more than usual for the company. Its FFO per share is up 22.5% year-over-year, which recently allowed the company to hike its dividend by nearly 10%. The company has little debt with a 20% LTV and its maturities are long at 9 years with no major maturities until 2026. The company has a fantastic track record and it builds most of its own properties to earn yields of around 6%. As such, it is creating significant value for shareholders instead of simply buying the market at low cap rates. Segro mainly owns urban facilities that enjoy significant barriers to entry, and we think that its rents are deeply below market, which provides a predictable path to growth, and also margin of safety if we face a severe recession. So in short, Segro has a strong balance sheet, a great track record, and rapidly growing cash flow, and it is priced at an extreme discount.

Segro PLC

These are of course just 3 examples. In today’s market, there are plenty of opportunities for us to consider and all 23 REITs in our Core Portfolio are heavily discounted.

Be the first to comment