glegorly

SSE plc (OTCPK:SSEZY) recently posted a mixed trading update heading into its interim results later this year. On the one hand, renewable output came in well short of expectations. Yet, the balanced portfolio has shielded the FY23 EPS guidance from a downgrade (for now), as management reiterated the earnings outlook on strength across gas storage and flexible thermal generation.

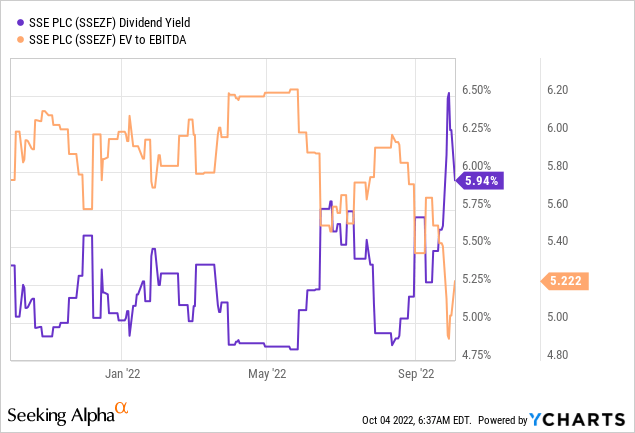

Challenging near-term environment aside, SSE, as a major integrated utility with scale, is well-positioned for long-term growth given its exposure to renewables. Recent policymaking in the UK and the EU support this view as well – both regions are increasingly turning to renewables as an affordable and sustainable solution to energy security amid the accelerating transition away from imported gas. While the fundamental outlook is attractive, there remains limited visibility into the extent of political intervention in the UK. The path of rate hikes in the coming months adds another element of uncertainty (higher rates make SSE stock less attractive as a bond proxy), keeping me cautious despite the current ~6% yield.

P&L Guidance Intact Following Latest Trading Update

SSE’s latest trading update heading into H1 2023 was largely status quo, with the company calling for at least 40p of adj EPS for the half-year and at least 120p for the full year. As this was in line with prior guidance, headline FY23 consensus estimates should remain broadly unchanged following the release. Despite the operating challenges, SSE underlined its value to the energy system with strong gas storage and flexible thermal performance to date.

Offsetting this strength was lower-than-expected renewable output for the year, as the adverse weather impact drove the result to ~13% below plan. While this likely entails near-term downward revisions for the renewables business, particularly at the operating profit level, the transitory weather headwinds should eventually fade and clear the path to a rebound over the long run. Elsewhere, there was no progress update on the electricity transmission disposal, which likely means any meaningful full-year updates will only happen post-winter.

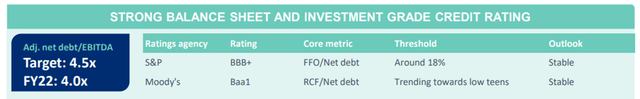

Manageable Debt Levels (For Now)

On a positive note, guidance for SSE’s adj net debt levels remains at ~GBP10bn for the half-year. Given most of the debt outstanding is at fixed rates as well, the impact of more interest rate hikes will likely be limited. In the meantime, the liquidity position looks good – collateral requirements are within existing facilities, while SSE’s ~GBP1.5bn of revolving credit remains undrawn.

The company has also been prudent on capex, opting to delay the completion of the Keadby 2 combined cycle gas turbine (CCGT) power plant commissioning to later this winter. While this will also weigh on the growth outlook, it significantly reduces the capex burden – as things stand, SSE is already on track to report a record capex run rate of >GBP2.5bn (including acquisitions). Assuming all goes as planned, leverage levels are guided to be lower than the 4.5x net debt to EBITDA target, which limits any funding/capital raise risk. That said, there isn’t much room for error and any unforeseen headwinds (macro or policy-related) could reignite balance sheet concerns.

Upcoming Policy Updates Could Catalyze Renewables-Led Upside

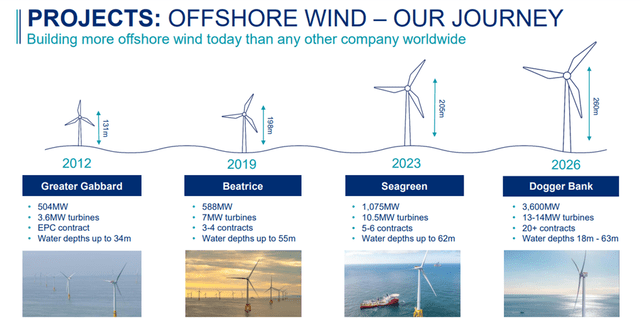

Going forward, the upcoming government policy decision with regard to long-term contracts for merchant renewables will be worth watching as a potential stock price catalyst. Recall that earlier this year, the government had published the ‘British Energy Security Strategy’ targeting an accelerated shift to renewable energy by 2030 (e.g., 50GW of offshore wind by 2030). This adds to the increasing discussions on structural reform across Europe as well – in May this year, the European Commission motioned for the optimization of electricity market design to accelerate its shift away from gas dependence. Given SSE’s leadership in offshore wind and progress on further building out its generation capabilities (e.g., the multi-phase construction of the 3.6GW Dogger Bank is currently underway, with the wind farm set to be fully commissioned by 2026), the company is positioned to benefit.

Over the near term, the UK government’s decision on a scheme allowing renewable generators to ensure long-term price stability by trading at the wholesale market (via contracts for difference) will be worth keeping an eye on as well. The scheme remains in the works at the Energy Supply Taskforce level and looks likely to gain approval given it not only ensures a fair price for generators but also reduces the related intervention costs. As a move to contracts for difference ensures long-term revenues and earnings visibility (vs volatile merchant revenues in the current regime), SSE’s trading multiple should benefit. That said, a positive outcome is far from certain (i.e., the level these CFDs will be set is unknown), so I would hold off on building a speculative position solely on this basis.

An Uneventful but Solid Trading Statement

SSE’s latest trading statement reiterated FY23 adjusted EPS of at least 120p/share (unchanged vs previous guidance) despite lower-than-expected output. While the operational statistics were relatively uneventful, the confirmation of its Electricity Transmission disposal launch is a step in the right direction and presents a nice catalyst into year-end. Coupled with the favorable policymaking in the UK/EU, SSE’s exposure to renewables leaves it well-equipped to capitalize on secular growth opportunities.

Still, it remains early days in the fiscal year and I wouldn’t expect firmer guidance numbers or visibility around its growth targets in renewables until its H1 2023 results in November. In the meantime, the extent of political intervention in the energy markets and the rising rate risk add elements of uncertainty, likely keeping a lid on the upside potential at these levels.

Be the first to comment