Scott Olson

Time to share a story. I had the good fortune of meeting Warren Buffett in person as a young MBA student. During my MBA days, I took a “Value Investing” class taught by Professor Eric Kirzner, and every year, the whole class would fly down to Omaha to meet Mr. Buffett during Berkshire Hathaway’s (BRK.A, BRK.B) annual meeting. To young investment nerds, this was the equivalent of meeting Michael Jordan or Babe Ruth. The one-on-one picture I took with Mr. Buffett at Piccolo Pete’s is still one my most treasured memories.

The reason my story is relevant is because the fund I am reviewing in this article, the SRH Total Return Fund Inc. (NYSE:STEW), is also intimately tied to Mr. Buffett. The fund counts Berkshire Hathaway, Inc. as its largest holding, and the founder of the fund, Stewart Horejsi, built his fortune by opportunistically buying Berkshire shares in the 1980s.

While I like the STEW’s “value investing” approach and the 4% distribution yield, I am concerned about its long-term underperformance relative to the market and high fees. I think the fund may be replicable by buying and holding the core (top 10) positions.

Fund Overview

The SRH Total Return Fund, Inc. is a closed-end fund (“CEF”) focused on total returns. The fund utilizes a “value investing” approach to identify attractive companies. The fund was formerly called the Boulder Growth & Income Fund (“BIF”), but changed its name to the SRH Total Return Fund (“STEW”) in April of 2022. Along with the name change, Mr. Stewart Horejsi retired from his role as the primary portfolio manager of the fund.

How To Become A Billionaire, The Value Investing Way

Mr. Horejsi’s story is a great example of what we all aspire to be as investors. As legend has it, Mr. Horejsi began buying shares of Berkshire Hathaway Inc. for as little as $265 per share in 1980 after reading John Train’s book, “The Money Masters.” As he expanded his family’s welding business, he kept investing the company’s profits into more Berkshire stock. Eventually, he became one of the largest individual shareholders of Berkshire Hathaway and was able to amass a 9-figure fortune through his Berkshire investments and shares in the STEW fund (Note, Mr. Horejsi consolidated three predecessor funds into BIF/STEW in 2002). As of May 31, 2022, trusts and other entities affiliated with Mr. Horejsi owned 45.4 million shares of the fund, representing 46.6% of the common stock outstanding.

Today, although Mr. Horejsi has retired as the portfolio manager of the fund, the fundamental value-investing philosophy he practiced is still in use by Rocky Mountain Advisers, LLC (“RMA”) to pick stocks for the SRH Total Return Fund.

Value Investing In Practice

As we briefly mentioned, the STEW fund adheres to classic “value investing” principles. The fund focuses on businesses that are defensible with solid financial positions and strong operating track records. Investments are made at a discount to intrinsic value, to increase the “margin of safety.” The fund typically invests in companies for the long term and will look through the day-to-day fluctuations in the markets. Divestments are only made if the underlying investment thesis has changed, or if the valuation reaches unjustifiable levels.

Portfolio Holdings

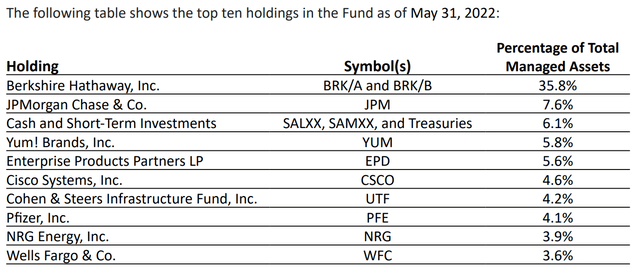

Figure 1 shows the fund’s top 10 holdings, which account for over 80% of the fund’s holdings.

Figure 1 – STEW Top 10 holdings (STEW May 2022 Semi-Annual Report)

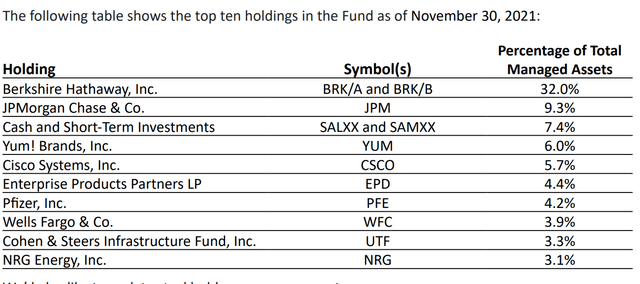

The fund has an extremely low turnover rate of 3% in the 6 months to May 31, 2022. In fact, Figure 2 shows the fund’s holdings as of November 30, 2021. The top 10 holdings are practically unchanged, with the only difference being slight changes in position weightings.

Figure 2 – STEW Top 10 Holdings (STEW November 2021 Annual Report)

Returns

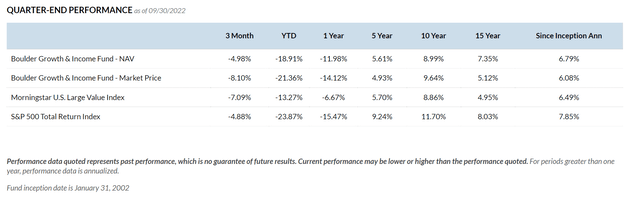

The STEW fund has delivered solid returns with 5/10/15 Yr average annual returns of 5.6%/9.0%/7.4%, respectively, to September 30, 2022. However, it lags the S&P 500 Index, which has returned 9.2%/11.7%/8.0% over the same time frames (Figure 3).

Figure 3 – STEW Fund Historical Returns (srhtotalreturnfund.com)

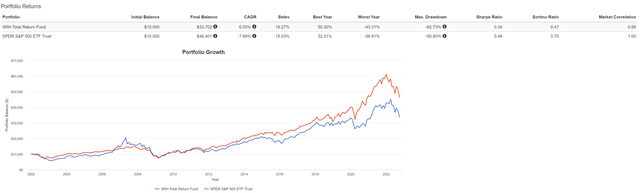

Furthermore, if we analyze the STEW fund relative to the SPDR S&P 500 ETF Trust (SPY) using Portfolio Visualizer, we can see that not only does the STEW fund have a lower CAGR return of 6.0% vs. 7.7% (January 2002 to September 2022), it also has a higher volatility of 19.3% vs. SPY at 15.0%, and a larger max drawdown of 43.3% vs. 36.8% for the SPY exchange-traded fund (“ETF”).

Figure 4 – STEW vs. SPY (Author created with Portfolio Visualizer)

Distribution & Yield

To STEW’s credit, it pays an above market distribution of $0.48 per year, which equates to 4.1% distribution rate on market price or 3.4% of NAV.

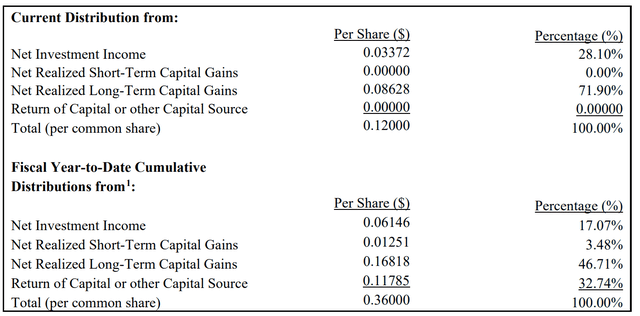

However, digging into the details, we can see that the distribution is majority funded through capital gains and return of capital, as the fund has only earned 17% of the distribution in investment income YTD (Figure 5).

Figure 5 – STEW Fund Distribution Allocation (STEW Fund July 2022 19a Report)

Unlike some CEFs that pay double digit distribution yields while only earning single-digit total returns (in effect, paying investors back their own capital), I think the 3.4% of NAV distribution rate for STEW is prudent and sustainable, as the fund has earned 6.8% in average annual total returns since inception in 2002.

Fees

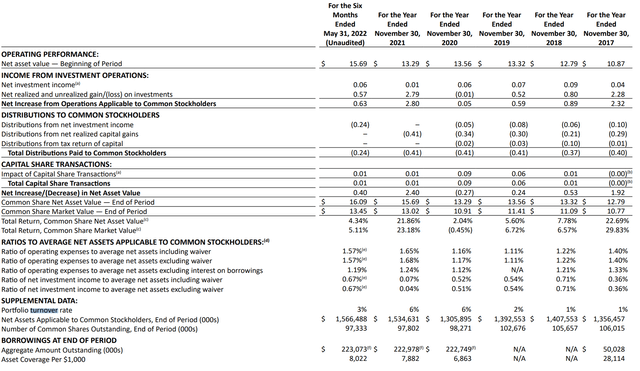

The STEW fund charges a 0.9% management fee, and operating expenses were 1.57% of average net assets in the most recent 6 months. Note, the fund began using leverage in 2020, which has added to operating expenses (Figure 6).

Figure 6 – STEW Fund Financial Summary (STEW May 2022 Semi-Annual Report)

Risks

As mentioned above, the STEW fund is highly concentrated, with 80% of net assets invested in 10 securities, and approximately 1/3 of net assets invested in Berkshire Hathaway. High concentration exposes the investor to potential downsides from negative developments at any one company. For example, one of the fund’s main holdings is Wells Fargo & Company (WFC), a position the fund has held for a very long time. However, since 2016, when the Wells Fargo’s account scandal came to light, the performance of WFC has massively underperformed its banking peers, as measured by the SPDR S&P Bank ETF (KBE) (Figure 7).

Figure 7 – WFC vs. KBE (Seeking Alpha)

Another risk is that as Mr. Horejsi retired this past April 2022, the driving force behind the fund’s investment culture and performance may have left as well. Furthermore, Mr. Horejsi and entities associated with him collectively own 46.6% of the shares of the fund. For estate planning purposes, Mr. Horejsi may decide to liquidate part or all of their holdings of the fund, which could widen the fund’s discount to NAV. On the upside, this could also spur a re-rating of the Fund and close the NAV discount, if Mr. Horejsi decides to wind up the fund.

Fund Trades At A Persistent Discount

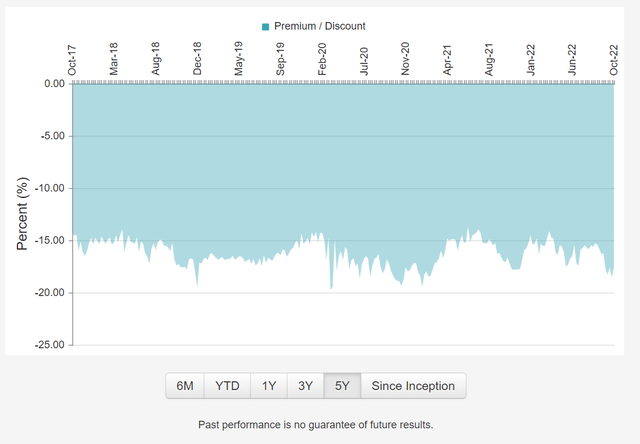

The STEW fund has consistently traded at a discount of 15-20% since 2008. I believe the discount is due to the control Mr. Horejsi has on the investments of the fund through his large holdings.

Figure 8 – STEW trades at persistent discount to NAV (cefconnect.com)

In fact, this discount had been a point of contention for many years, including some activist activity in the 2000s mentioned here and here. At this point, with the discount in place for the better part of 2 decades, it is hard to see a change unless Mr. Horejsi decides to wind up the funds and surface value.

Pros And Cons Of BIF/STEW

(Author’s note, is the wordplay in the fund tickers deliberate?)

The STEW fund has many positive attributes and qualities that may appeal to investors. First, it follows a proven “value investing” approach to selecting stocks (Mr. Horejsi’s personal wealth can attest to this). It gives investors exposure (1/3 of the fund) to Warren Buffet (through Berkshire Hathaway), one of the best capital allocators ever. It pays a healthy 4%+ distribution yield. STEW also trades at a significant discount to NAV (17% currently), with the NAV backstopped by Fortune 500 companies like Berkshire Hathaway and JPMorgan Chase & Co. (JPM). A potential catalyst to close this discount exists if Mr. Horejsi decides to wind up the fund and distribute assets to stockholders.

However, there are also negative attributes to the STEW fund. From figure 3, we can see that the fund has underperformed the market on a 5, 10, 15Yr timeframe. The underperformance can be mostly explained by the fund’s relatively high cost (1%+ operating expenses). The fund is heavily concentrated in a handful of securities and may be susceptible to negative shocks to any one company, like the WFC fiasco. The catalyst to close the discount to NAV is also outside the control of stockholders.

Conclusion

In summary, the SRH Total Return Fund has many positive qualities that may appeal to investors. It follows a “value investing” approach that has made its founder a billionaire. It pays a 4% distribution yield, and it trades at a discount to NAV. However, it has lagged the market over the long-run, with the main detractor being its high fees (1.65% operating expense in Fiscal 2021). The timing to close the NAV discount is also out of stockholders’ control. While I like the STEW’s “value investing” approach, I think it may be replicable by buying and holding the core (top 10) positions.

Be the first to comment