John Moore/Getty Images News

From the dusty and rocky landscape of the Atacama desert of Northern Chile, Santiago-based Sociedad Química y Minera de Chile (NYSE:NYSE:SQM) produces lithium carbonate from brine. The company is the largest public company in Chile, highlighting the importance of mining to the relatively prosperous Andean nation.

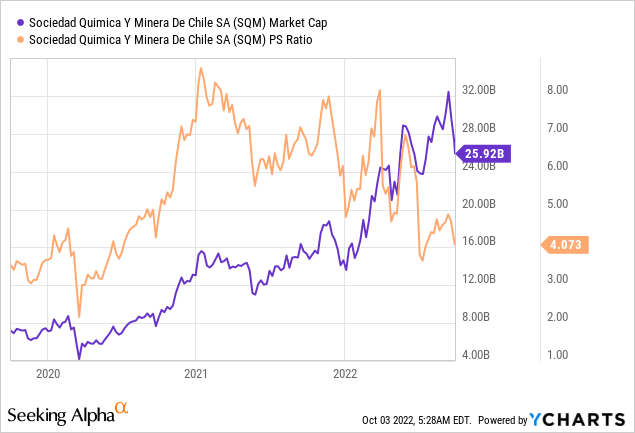

SQM is not a lithium pure play as it derives only about 67% of gross profits from the alkali metal with the rest coming from four other operational divisions including Industrial Chemicals and Potassium. The company has been riding high in recent months over a number of positive catalysts that promise to maintain the upward momentum that has drove SQM to a record market capitalization of just over $32 billion.

The first catalyst came from the signing of the mammoth Inflation Reduction Act into law. This will see an unprecedented level of fiscal spending by the US government on the zero-carbon industries. A not immaterial $370 billion has been earmarked to be invested over the next decade till 2032 in any such initiative that pulls the US closer to its carbon emission reduction targets. The scope of the Act encompasses SQM’s core demand drivers.

Firstly, it will extend a $7,500 tax credit on EVs and also aims to catalyze a more significant expansion of wind and solar power projects. This will see broader lithium demand from short-duration lithium-ion battery storage required to smooth out the intermittency of renewables. Further, as Chile has a free trade agreement with the United States, the country is set to become a major supplier for this enormous effort by the US to decarbonize.

Secondly, Chilean voters went to the polls to reject a proposed new constitution. The constitution if enacted would have more heavily emphasized strong environmental protections and other poorly defined measures for climate justice to radically reform the country’s mining sector. Hence, its defeat was seen as removing what could have fast become regulatory barriers to SQM’s operations in Chile.

SQM’s structural demand drivers are extremely strong. Decarbonization has become gospel for governments around the world who have now started to entrench the foundations for long-term decarbonization. The future is clear, the world is about to see demand for lithium rise to levels never before seen and SQM likely stands to ride this demand to new highs.

Lithium Prices Reach New Highs As A New Clean Energy Orthodoxy Is Built

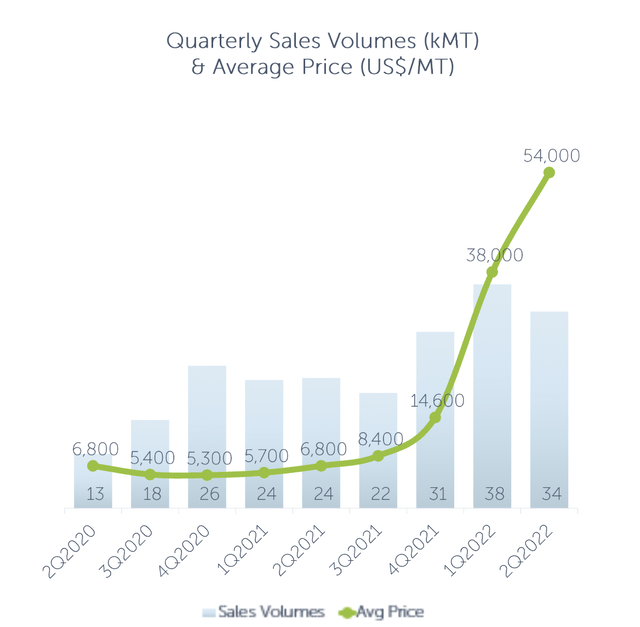

The company last reported earnings for its fiscal 2022 second quarter which saw revenue come in at $2.6 billion, a 342.2% increase from the year-ago quarter and a beat by $257 million on consensus estimates. This surge was driven by lithium prices during the quarter growing to reach $54,000 per MT from $38,000 per MT in the first quarter of 2022 and from $6,800 per MT in the year-ago quarter. There was also an increase in sales volume to 34,000 MT from 24,000 MT in the year-ago period, albeit a decline from 38,000 kMT in the previous quarter.

Net profit surged to an astounding $859.3 million, up 856% from $89.8 million in the year-ago quarter but slightly below consensus estimates of $876.4 million. This drove cash from operations to increase by 108% from its year-ago quarter to $412.6 million. A movement that helped support a quarterly dividend payout of $1.85 per share. As SQM has a variable dividend policy, these large payouts are set to continue as long as lithium prices remain elevated and the company is able to meet lithium production targets.

Indeed, the company revised upwards its lithium sales guidance to 145,000 MT from a previous forecast of 140,000 MT. This was to reflect rising demand from the automotive industries for lithium as the transition to EVs speeds up.

EVs Have Become Critical Post-Pandemic Economic Pillars

The list of states and countries on a planned phase-out of combustion engine vehicles continues to grow. Just recently, New York joined California in legislating to make all new vehicle sales zero emissions by 2035. This places two of America’s largest economies on the same footpath as the European Union, the United Kingdom, Japan, and South Korea. Fundamentally, such phase-outs send a signal to automakers to transition their production lineup ahead of time. This pulls forward SQM’s total addressable market.

The historic growth of EVs has been material. For example, just 120,000 EVs were sold globally in 2012. Last year saw that figure being sold in a week with 10% of cars sold in 2021 being electric, 4x the market share in 2019. More broadly, against strong sales momentum EVs are forecasted to grow to at least 26.8 million by 2030, up from 6.6 million in 2021.

Lithium demand is fast becoming exponential and all SQM has to do is sit tight and let it drive outsized profits in the years to come. The company faces a strong future with the proposed Chilean constitution in the rearview mirror and the Inflation Reduction Act set to kick in next year.

Be the first to comment