z1b

For investors who can hold a stake for a few years, SPDR Portfolio S&P 500 Growth ETF (NYSEARCA:SPYG) provides one of the best profit-making opportunities. This ETF offers an excellent entry point since the current bear market has bottomed out and there is a limited risk of extraordinary losses like those seen in 2022. Multiple factors that may contribute to the recovery phase in 2023 include declining inflation, the possibility of a soft landing, attractive valuations, and the likelihood of steady earnings growth. Low inflation and a reduction in interest rates will further amplify economic trends and earnings growth in 2024.

The Downside Risk is Limited

Stock market performance after inflation peak (Bloomberg)

One of the fastest interest rate hike sprees, the risk of a recession and high inflation has hit growth stocks harder in 2022. However, growth stocks and ETFs like SPDR Portfolio S&P 500 Growth ETF are expected to gain investor confidence in 2023 as key fundamental risks are likely to diminish. Over the past two months, inflation has declined at a faster rate due to tight monetary policy and demand destruction, with predictions suggesting inflation will drop to 3% by 2023. Generally, the demand for risky assets increases when inflation declines due to its association with interest rates and purchasing power. Historical data also vindicate this trend. With the exception of 2008, when markets experienced one of the worst financial collapses, the S&P 500 returned an average of 17% in the twelve months following inflation’s peak.

Fortunately, the Fed’s aggressive tightening stance has changed after a faster-than-expected drop in CPI for November. In the latest meeting, the Fed lowered its rate hike pace from 0.75 basis points to 0.50 basis points. Fed funds rates are currently hovering in the range of 4.25% to 4.50%, leaving less room for more significant rate hikes in 2023 given a terminal rate of around 5%. Additionally, the Fed is likely to begin lowering rates by the end of 2023 or early in 2024.

While some optimism has returned for risky assets, the market remains jittery and searching for direction due to concerns over the Fed’s hard landing, a phenomenon that slows business activity and plunges the economy into recession. So far, a strong labor market has protected the economy from a hard landing. Analysts are divided on whether the US economy will enter a recession in 2023, with some predicting a mild recession and others not see any risk of a hard landing. I believe the economy could slow down in 2023 due to high rates and slowing investments but the U.S. will probably see a soft landing next year as inflation has been fading at a healthy pace without creating a big dent in the employment rate and business activities. Goldman Sachs analysts also consider the economy is doing well and is nowhere near a recession.

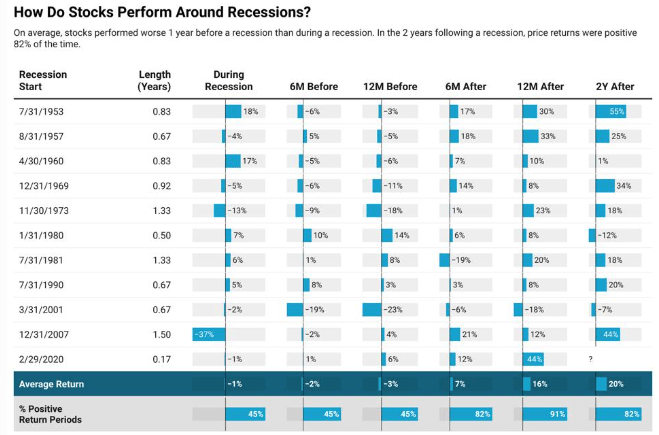

S&P 500’s performance before and after the recession (Forbes.com)

Interestingly, there is a limited risk of losses even if the US economy encounters a mild recession in the first half of 2023. The historical trend indicates that the market performs worse one year before the recession than it does during the recession. Moreover, stocks mostly rise after the recession. This phenomenon indicates that markets are more likely to respond to anticipations than actual events.

Earnings Quality is Strong Enough to Support Upside Momentum

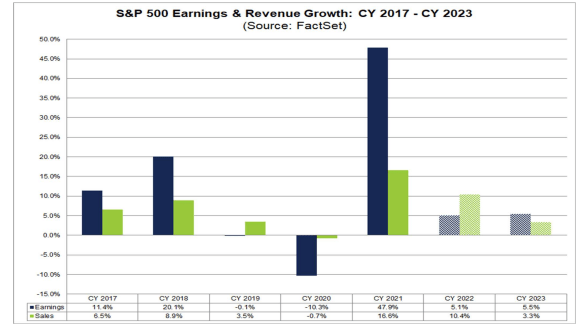

Earnings projection (FactSet.com)

Market conditions turned challenging in 2022 due to a shift in monetary and macroeconomic policies, resulting in lower year-over-year growth rates for the S&P 500 components. The extraordinary growth in 2021 also made comparisons difficult for companies. Yet, a scenario of steady year-over-year growth in a tough economic environment still offers much-needed support to growth stocks and ETFs in the following years. The FactSet data shows the index is likely to experience a mid-single digit revenue and earnings growth in 2023 while a rate cut and low inflation may boost growth trends in 2024.

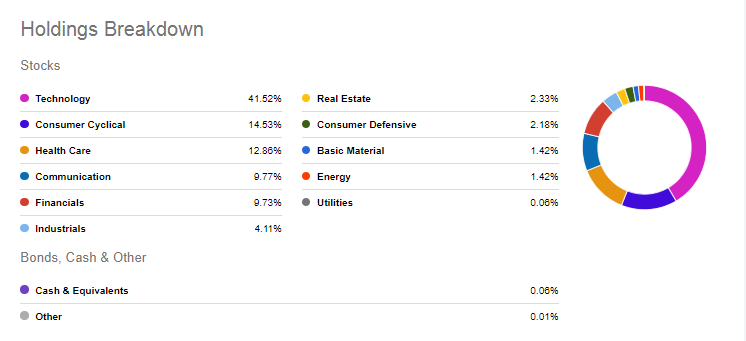

SPDR’s stock holdings (Seeking Alpha)

In the case of SPYG, the ETF is composed of 244 S&P 500 growth stocks, primarily in the technology, consumer cyclical, healthcare, communication, and financial sectors. The technology sector, which represents 41% of its overall holdings, plays a key role in SPYG’s performance. After an astounding 2021, the sector growth slowed in 2022 due to one of the worst market conditions in decades. Despite this, the entire sector remained resilient. FactSet’s third-quarter earnings data shows that the sector was the second-best performer in terms of earnings surprises. Seventy-nine percent of tech companies reported higher earnings than expected in the third quarter, while only 12% reported lower earnings. In 2023, estimates show that tech earnings could grow by a mid-single-digit percentage, followed by rapid growth in 2024. For example, Apple (AAPL), SPYG’s largest holding, posted record revenue and earnings in 2022, and Wall Street projects mid-single to high single-digit growth in revenue and earnings for the next two years. Furthermore, Wall Street expects Microsoft (MSFT), the second largest stock in SPYG’s portfolio, to grow its revenues from $198 billion in 2022 to $213 billion in 2023 and $242 billion in 2024, representing a year-over-year increase of 7% and 13.52% respectively.

In 2022, consumer cyclical stocks performed poorly, but this trend is likely to change in 2023, according to FactSet data. In 2023, internet and direct marketing retail companies are likely to see average revenue growth of 11%. The Wall Street analysts also predict Amazon’s (AMZN) revenue to grow at a double-digit percentage rate over the next five years, reflecting a strong outlook for consumer cyclical companies. It appears that key communication services corporations like Alphabet (GOOG) (GOOGL) could also experience steady double-digit growth in the future. Moreover, healthcare and financials have performed well in 2022, and the trend is expected to continue in the following years.

Valuations

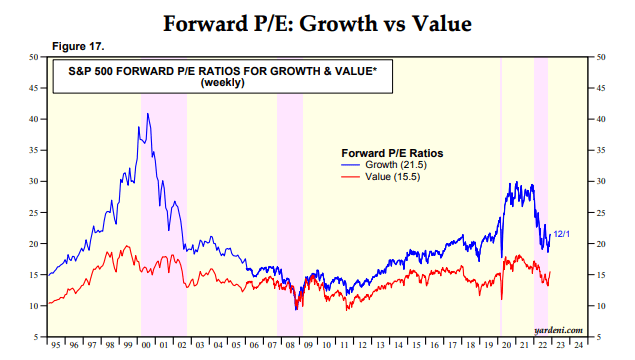

Growth stocks forward PE (Yardeni.com))

Stock valuations of large-cap growth companies, particularly in the technology, consumer cyclical, and communication sectors, soared sharply in the second half of 2020 and remained high in 2021. Due to a sharp decline in share prices, forward valuations such as price-to-earnings ratios of growth stocks have fallen sharply recently. Growth stocks are currently trading around 21 times forward earnings, which is in line with pre-covid levels. In addition to the drop in forward PE, growth stocks appear attractive due to expectations of mid-single-digit earnings growth in 2023 and double-digit growth the following year. This means that if the share price increases in the following years, the PE ratio would get support from a steady earnings growth trend and help it remain in line with the historical averages.

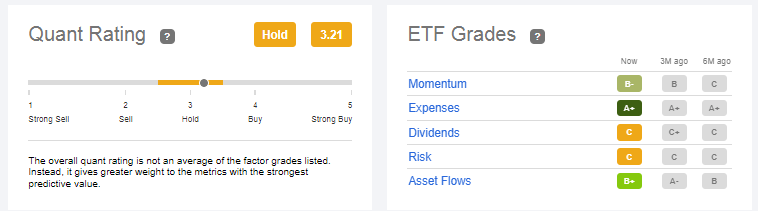

Quant Ratings

Quant Data (Seeking Alpha)

The SPYG ETF received a hold rating from the Seeking Alpha quant system due to low grades on dividends and risk, but momentum and asset flows make it attractive. With a negative B grade on momentum, the ETF has a high chance of creating an upside trend, while a positive B grade on asset flows suggests investors are buying the dip in anticipation of a future recovery. Moreover, the ETF earned an A-plus on its expense ratio, which can significantly contribute to long-term returns. Having a low expense ratio means that owning this ETF is less expensive than many of its competitors.

In Conclusion

As negative elements such as inflation and high rates have already been priced in, this is the ideal time for dip buyers to add growth ETFs like SPYG to their portfolios and hold them for a couple of years. Moreover, data such as slowing inflation and ease in Fed’s tightening policy would add to investor sentiment in 2023. The historical trend also favors dip buying after inflation peaks. Share prices could also be supported by steady earnings growth in 2023 and expectations for significant growth in the following year.

Be the first to comment