NicoElNino

In my most recent Seeking Alpha article, I was pessimistic about the medium-term outlook, clustering to deteriorating macro and EPS. My view remains unchanged despite the likely continuation of the inflation decline. It appears like everyone is discussing about the recession. If this were to occur, it would be the first recession that everyone is discussing. Excluding the market, which does not price in such scenario. In the next chapters, I will attempt to show why the market does not perceive higher chances of recession as do several analysts, as well as how to play the market. It doesn’t matter if I’m accurate about the recession scenario, since a soft landing is still possible (though I doubt it, as many leading indications are deteriorating). What matters is how to play it to avoid losing money. The strategy allocation is disclosed at the conclusion of the research and might provide profits if the recession scenario plays out, but also if a soft landing occurs.

The market does not even think about recession

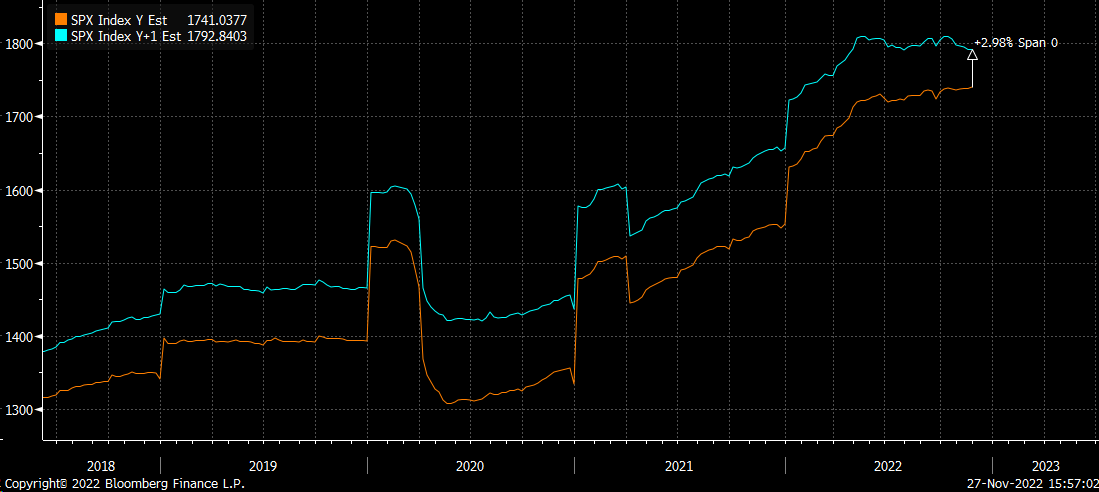

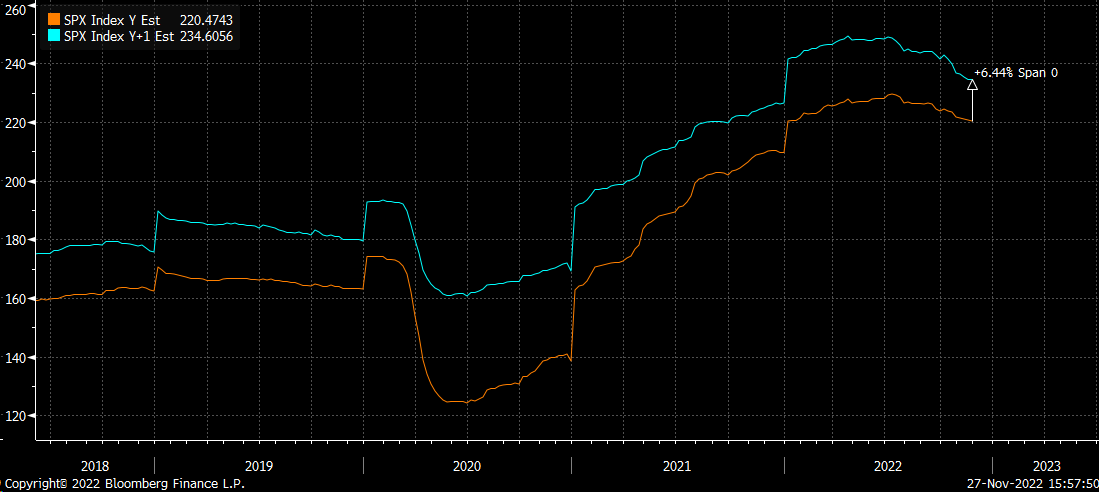

One could wonder how the hell I arrived at such a decision. I will present more justifications, but the first is the consensus expectations for forward-looking EPS for fiscal year 2023. According to these projections, sales should increase by 2.9%, while earnings per share should increase by 6.4% compared to 2022 values. Even when considering a “soft landing” scenario rather than a probable contraction, I find this to be unreasonable.

S&P 500 Sales estimates (M. Kramer via Bloomberg)

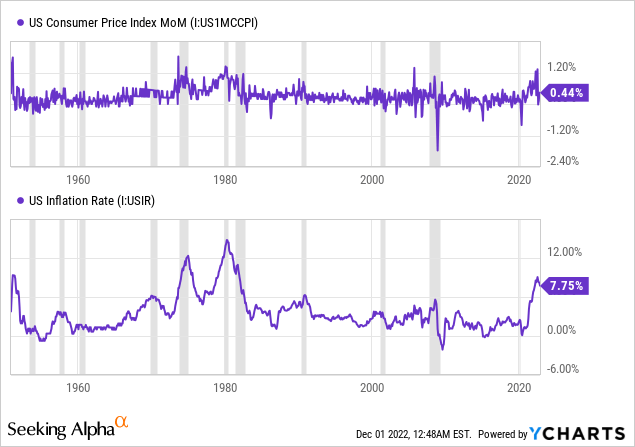

These charts were released by M. Kramer through Bloomberg. A little more logic might be added to the sales consensus. The rise in CPI for 2021, 2022, and 2023 (expectations) might result in a boost in sales that is solely attributable to nominal price increases. In this scenario, total volumes should decline while real sales (adjusted for inflation) fall. And if the sales increase is only attributable to higher nominal pricing (as a result of inflation), it makes no sense to anticipate an increase in earnings per share of 6.4% because total product volumes would decline. While the consensus predicts that sales would increase just moderately, they anticipate that EPS will be significantly higher, indicating considerable gains in margins.

S&P 500 Earnings estimates (M. Kramer via Bloomberg)

Where could the margin expansion be hidden?

Even if a soft landing occurs, I am doubtful of EPS growth. The current EPS forecast includes highly successful cost-cutting measures. Possible if there are some layoffs or if there are no wage rises, which everyone will demand due to the large decline in real income. Therefore, labor cost reductions are achievable if there are significant layoffs and no salary rise in order to expand operational margins. On the other hand, if this scenario plays out, higher unemployment rate would lead to lower demand (and lower sales).

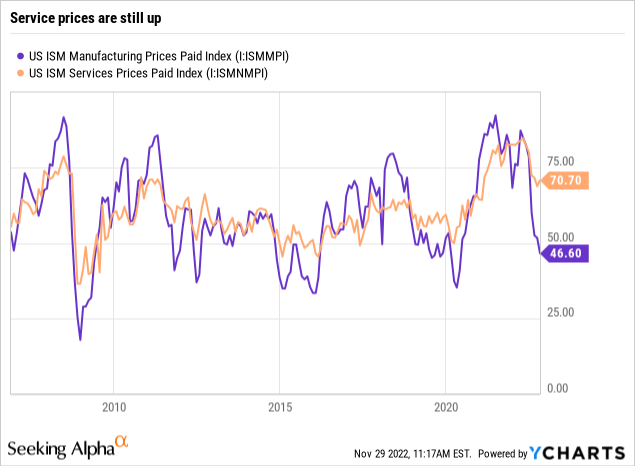

If producer prices or input costs decline considerably, the next potential margin expansion might occur. There may be viable and reasonable cost-cutting alternatives. In this area, it is plausible. Now let’s examine the input pricing. Despite the fact that the ISM Manufacturing Prices Paid Index is significantly lower and might offer some leeway for cost-cutting measures, the ISM Services Prices Paid Index is still quite high, so it would be problematic if we did not observe a substantial decline in this sector. And despite the fact that “services” nearly dominate the S&P 500 basket, we must observe a substantial drop in service pricing before we can expect margin increases. Alternatively, the drop in oil prices might encourage the increase of margins.

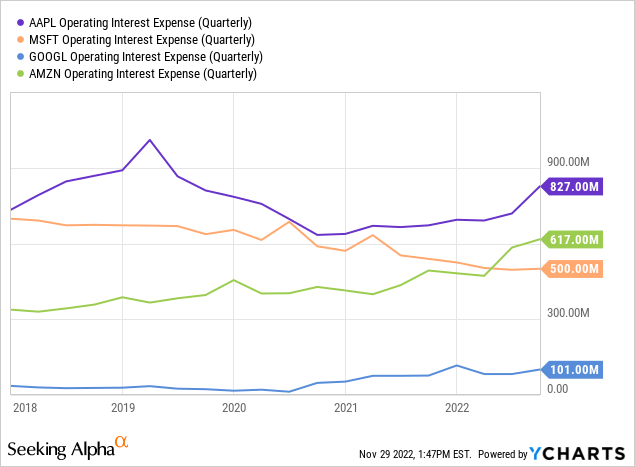

The final and most significant reason why I do not anticipate such a margin growth will materialize is debt service expenses. If this item does not decrease much, as it seems today, it will not. Nonetheless, a turning point in Fed policy may occur in 2023, and if so, unemployment and economic forecasts will be the determining factors. Debt service costs are a significant concern, particularly for enterprises with weak balance sheets that cannot refinance under favorable terms. And under present conditions (the tightening cycle), it is rather difficult for them to acquire additional loans. With this level of economic leverage, debt payment expenses are extremely hazardous, consume a substantial amount of income, and eliminate any residual profit. Because financing via the bond market or bank funds will be more difficult, excessive debt service expenses will inevitably put pressure on the remaining margin. As a result, it will be retracted.

On the chart above, there is a clear upward trend in the quarterly operational interest expenditure of the top S&P 500 companies. This can be affected by a rise in interest due to a rise in yields or extra funding, which results in higher interest costs. Or combined. Among the top SPDR S&P 500 Trust ETF (NYSEARCA:SPY) holdings, however, there are fantastic firms with very sound balance sheets. And with the exception of Microsoft (MSFT), all of them experience the effects of monetary tightening. As a consequence of consuming a greater portion of the remaining EBITDA, increased interest expenses will reduce the margin. Now consider the other firms in the S&P 500. There are numerous firms with substantially worse financial sheets than these giants. Increases in interest payments by these corporations will accelerate the decline in EPS.

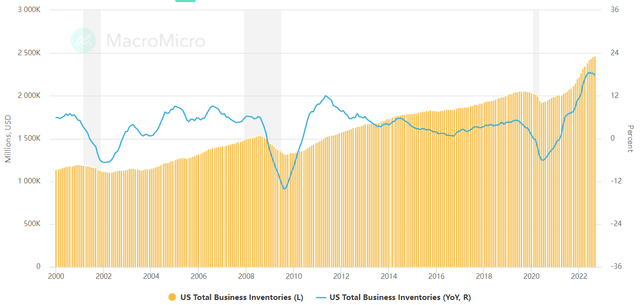

These assumptions continue to be a component of the narrative of a “soft landing” that the market is now pricing in. However, a rise in sales is possible in 2023 due to nominal pricing that account for inflation. In spite of this, I believe that such sales projections can be lowered and could even become somewhat negative (at nominal pricing) due to large inventory levels. In order to minimize the inventories on their balance sheets, businesses must provide discounts on their items. Despite how absurd that may sound, it can produce deflationary pressure. With this setup, even the predicted 2.4% increase in sales might be exceeded.

US Total Business Inventories (Macromicro.me)

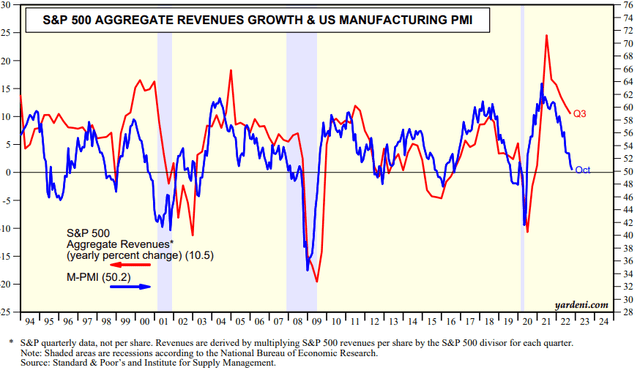

In light of the present macroeconomic environment, I believe it is far more likely that S&P 500’s sales and earnings per share will decline than rise. This judgment is based on leading indicators that continue to deteriorate. In November, the ISM Manufacturing PMI finalized at 49 and continues to decline.

Very similar approach, but with different variable – not EPS, but revenue growth from Yardeni.

S&P 500 Aggregate revenues growth & US manufacturing PMI (Yardeni, S&P, Institute to Supply Management)

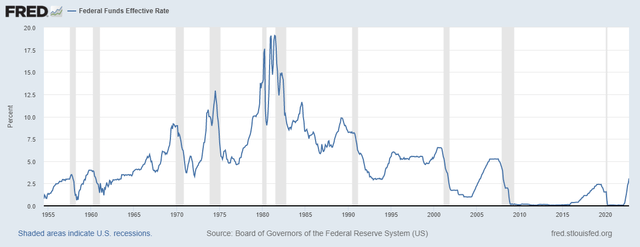

If a recession occurs, the Fed will change course

The history of the Fed Funds rate indicates that whenever a recession arose, the Fed shifted policy. We can readily verify this from the graph below, which highlights recessionary regions. From this perspective, it is probable that the Fed could pivot if only a serious recession arrived in 2023. When this is not the case, we can speak of a “soft landing,” with the potential of rates being close to or below the FOMC objective. However, I believe it won’t be required since inflation might fall more quickly than many anticipate.

Fed Funds Rate (FRED)

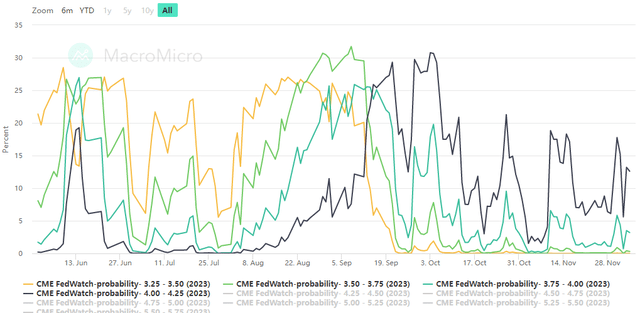

As previously said, if a recession materialized, rate decreases would follow. We can simply determine if the market is pricing in a recession using CME probabilities. Simply put, if the probability of much lower interest rates (than currently) is high and growing, the market will begin to price in a recession or a cooling of inflationary pressures. The first scenario could drive only bond prices, but the second one might drive both equity and bond prices up.

According to the CME dataset via MacroMicro, the following rates are likely to be at the end of 2023:

- at 4.00 – 4.25% by 12.6% (2023),

- at 3.75 – 4.00% by 3.2% (2023),

- at 3.50 – 3.75% by 0.3% (2023),

- at 3.25 – 3.50% by 0.0% (2023).

At the time of writing this assessment, the market values just a 16.1% chance of a tail effect of rate decreases (compared to previous FOMC projections), regardless of whether it is a result of the recession or a large slowing of inflation (thus, customized monetary policy). However, the tail event would be more likely to involve large rate cuts (150-300 bps or more). If there were such odds, the increase in CME probabilities at such low rates would climb significantly and bonds would trade higher. One could argue that while everyone is discussing the recession, the likelihood of a Fed reversal should increase, as it does whenever a recession occurs. However, we mostly saw a rising odds only for the slowdown of tightening cycle to “4.0 to 4.25 percent, so any significant rate cuts are not priced in. The moderate cuts against earlier FOMC estimates with a small increase in probabilities have been realized. In my opinion, this can only be explained by a decline in inflation or hopes that the Federal Reserve will adopt a more cautious approach.

2023 Fed Interest Rates Projections at Yearend (MacroMicro and CME)

If the Fed does not quit tightening, I believe the risk of recession will climb dramatically. The primary objective is to minimize inflation, even if it causes a recession. It is far simpler to reduce inflation during a recession than outside of one. Obviously, the Fed can change direction, but only if inflation falls considerably, which I expect will ultimately occur. It will be hard to calm it down without increasing unemployment (due to wage pressures). If this is done, monetary policy might undergo a significant shift. It does not matter what I believe about the recession; I might be wrong or correct. It is essential to create scenarios for every possible circumstance.

The market currently does not price any tail occurrences, only a weak probability of customizing monetary policy. It might cause a reduction in interest rates. The scenario of a recession is still very probable, in my opinion, because numerous leading indications, which have been accurate in the past, are growing more persuaded and indicating that it will occur. Let’s dig in.

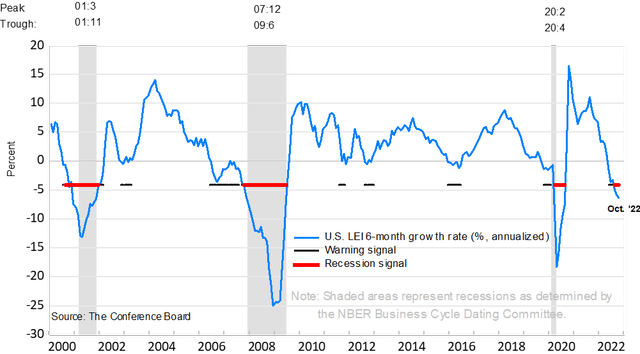

Leading Economic Index (“LEI”) plunged

In October, LEI, one of the most reliable leading indicators for predicting recession, dropped into recession territory. The LEI lags the economy by almost seven months, therefore according to this index, the downturn should begin through May 2023. It is one of the top indexes and has a track record of success. When a recession signal is valid (as it is today), the economy nearly always undergoes a downturn. It also includes other excellent leading indicators, like consumer expectations for business conditions, interest rate spreads, ISM new orders, and others.

According to Ataman Ozyildirim, Senior Director, Economics, at The Conference Board:

The US LEI fell for an eighth consecutive month, suggesting the economy is possibly in a recession. The downturn in the LEI reflects consumers’ worsening outlook amid high inflation and rising interest rates, as well as declining prospects for housing construction and manufacturing. The Conference Board forecasts real GDP growth will be 1.8 percent year-over-year in 2022, and a recession is likely to start around yearend and last through mid-2023.

The LEI diffusion index (The Conference Board)

Strategy, risks and summary

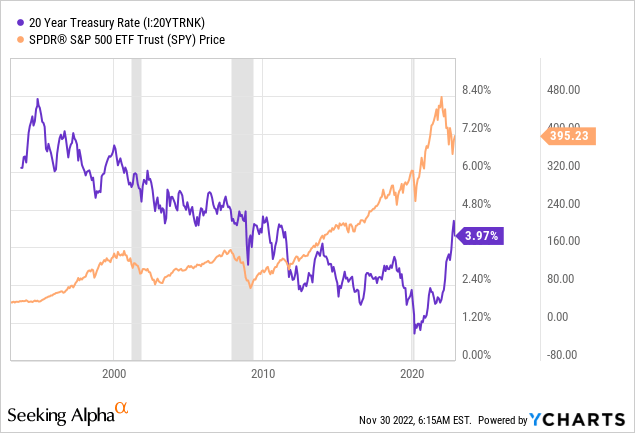

However, we are all aware that 2021 and 2022 were difficult bond years despite their length. Although iShares 20+ Year Treasury Bond ETF (TLT) has lost about 49% of its value, I believe now is an excellent moment to pair it with a bearish wager on SPY. A sharp increase in interest rates precipitated a substantial decline in bond prices. Such a severe decline was an anomaly that had never occurred before. The purpose of this game is straightforward. While long-term yields are affected by GDP, interest rates, and long-term inflation expectations, the situation with stocks is a bit more complex.

The reason for the decline in many companies is that they traded at absurd values, which were bolstered by negative real rates. As real rates increased, values began to normalize, and many tech (and cyclical) firms lowered their outlook. On the stock market, additional considerations are necessary. To put it simply, two or three major factors drive the markets: firstly, the liquidity from monetary and fiscal policy, which should continue to decline as QT and tightening continue. In the current environment, fiscal policy is difficult to forecast. Secondly, real and nominal interest rates, which grew quite fast, had a detrimental influence on the worth of many enterprises. WACC modeling underpins DCF (impacted by cost of capital and cost of debt). The higher the interest rates, the greater the WACC, and the lower the FCF-based valuation. We witnessed barely a little normalization of valuations.

The final and most significant aspect is earnings, which have just recently begun to decline. and still not substantially. If there will be a recession and the leading indications are accurate, the EPS decline will come with lag. When EPS begins to decline below expectations, stock prices will follow suit. This element has no direct influence on bond prices, but rather on stock prices. This is also the reason why, during a recession, rates tend to fall (and bond prices tend to climb), but stock prices generally decline.

Let’s consider three scenarios, each with my personal odds and potential impact on the chosen strategy:

- 60% of allocation in long TLT

- 25% of allocation in short SPY

- 15% of allocation in cash (short-term notes with solid yield)

1. Soft-landing and handling the inflation

As there are no negative EPS predictions among the consensus, the market is currently more optimistic about a soft landing. This is further backed by extremely low likelihood predictions on below-consensus rate cuts in 2023. In general, the market expects the Fed’s course correction (from FOMC projection in September) to cut interest rates by 0.6 – 0.35 % from the current expectation with odds of 12.6%. I am more certain than ever that the Fed will contain inflation, regardless of the condition of the economy. Without recession, it will be more difficult but still manageable. Oil is down, commodities are down, inventories are up, rates are up, shipping rates are down, and rents are beginning to decline (but shelter, the most lagged item in the CPI print, is still very positive). However, much depends on ongoing expenditures. Therefore, there is opportunity for slowdown in subsequent Core CPI readings. If this is the case, rates would likely decline somewhat, which will be favorable for TLT, but earnings are likely to stay static. With the allocation described above, the portfolio with the specified allocation should have a positive return. A probable reduction in long-term inflation expectations would result in lower rates, which would be overwhelmingly favorable for TLT. My own probability that this scenario will be accurate is 45%.

2. Recession

There is substantial evidence that during a recession, inflation falls significantly more rapidly than in non-recessionary times. Examining the historical facts shown below, it is evident that recessions with the shadow line are typically followed by a decline in the CPI (but not always). In such a scenario, the strategy suggested above would become extremely profitable. My point of view is that the recession is considerably more likely than the market presently estimates.

It is supported not just by the LEI described previously, which provided a favorable recession warning, but also by the yield curve inversion. Consequently, the stock market might be grossly mispriced at this time. The historical evidence of yield curve inversion in the bond market shows that the recession scenario is quite probable after the yield curve inverts and subsequently steepens. Perhaps it will be a false indication, but perhaps not. However, the probability of pricing in a tail event is not as large as the consensus would predict. During a recession, the bond market greatly outperforms the stock market, thus TLT might be an excellent choice, but a short position on SPY owing to the possibility of earnings declines could also be a viable bet if the recession scenario comes out. From this perspective, a basic portfolio allocation would be extremely beneficial in the recession scenario. My likelihood of such an occurrence is 40%.

3. With the inflation spiral in full swing, the Fed continues to tighten more than expected

Positive inflation shocks would mostly result in asset revaluation. The first effects of such a scenario might be more severe. Despite the fact that the TLT might decrease as long as the Fed stays extremely hawkish, this would, in my opinion, deepen the inversion. It’s straightforward, since with each successive tightening, which the market does not anticipate, the odds of a recession would increase. As a result, there should be a minor and brief downward reversal of long-term bonds, but the cost of debt would increase the pressure on the firms. Higher WACC (as an input for DCF modeling) would reduce the stock’s value to more realistic levels, but monetary policy would harm the company’s profitability. Even if there were extremely short-term harm to TLT prices, SPY would decrease substantially, and the portfolio may come close to breakeven. However, the situation would be transitory. I feel this situation to be unlikely, and my own odds of it occurring are 15%. We should not rule out the possibility, but given the present macroeconomic climate and warming indicators, it is currently less likely in my view.

Final thoughts

It is impossible to forecast with certainty whether or not a recession will occur in 2023. I believe the market grossly underestimates the likelihood of such a move, given that EPS forecasts are excessively optimistic and the CME probability of a rate cut is very low. The allocation of the strategy is well-suited for both a soft landing (and decelerating inflation) and a recession scenario. However, the second one might provide a portfolio appreciation in double digits. However, it is difficult to predict the end point because everything depends on the business cycle, market pricing, valuation, and monetary policy. Being long TLT makes sense for investors with a medium to long-term perspective, but I believe that being long SPY makes sense exclusively for long-term investors at this moment. More suffering is anticipated in the medium term. This portfolio allocation makes sense one to five months in advance, given the risk/reward profile. Please be aware that this analysis is based solely on my opinion and should not be considered as investment advice.

Be the first to comment