AntonioGuillem/iStock via Getty Images

By Rob Isbitts.

Summary

In the 1986 movie Ferris Bueller’s Day Off, the title character played by Matthew Broderick famously said, “Life moves pretty fast. If you don’t stop and look around once in a while, you could miss it.” That summarizes the predicament facing investors who seek elevated dividend yields from Short-Term Bond ETFs (exchange-traded funds), but have to peel back the proverbial onion a few layers to confirm they have found what they are looking for. It shouldn’t be this way, but 2022 has been that kind of year.

So, let’s crack the code to unveil some pretty decent short-term yield from one such fund, SPDR Portfolio Short Term Treasury ETF (NYSEARCA:SPTS). At the end of this little scavenger hunt, the yield level I find is the basis for my Buy rating.

Strategy

SPTS, from the giant ETF provider State Street, invests in U.S. Treasury securities with maturities from one year out to three years. It aims to track the movement of the Bloomberg 1-3 Year U.S. Treasury Index. The fund is reconstituted each month, which means the portfolio managers adjust the holdings to bring it back in line with that target index.

Proprietary ETF Grades

-

Offense/Defense: Defense

-

Segment: Bonds/Cash

-

Sub-Segment: U.S. Treasury Short-Term

-

Correlation (vs. S&P 500): Very Low

-

Expected Volatility (vs. S&P 500): Very Low.

Holding Analysis

SPTS pursues its target index in a highly-diversified fashion. It invests in U.S. Treasury Notes, and owned over 90 different securities as of this writing. Considering that short-term U.S. Treasury securities are generally perceived by the market as being as low-risk as any investment type, this added diversification is notable.

Strengths

It also allows the fund to get access to many different micro-patterns in short-term yields. Rather than simply buying, say bonds maturing in 1 year, 2 years and 3 years, it invests along much of that short-term Treasury curve. This is also why having the fund managers revisit the holdings and adjust as needed is a helpful feature.

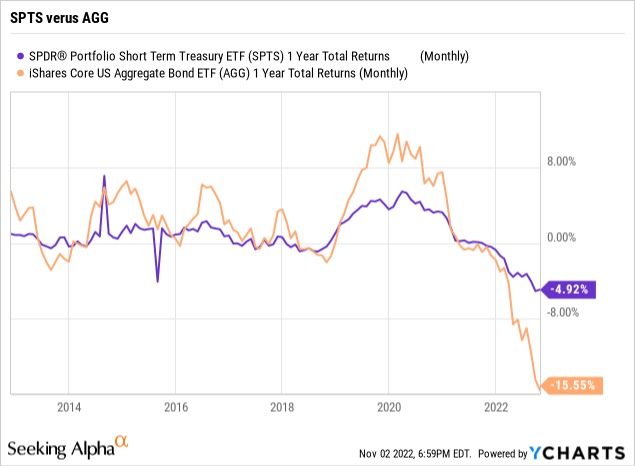

By targeting short-term maturities, funds like SPTS take a very low level of principal risk. As shown here, its range of historical outcomes over a 1-year period have ranged between about +7% and -5%. This compares to the wider range of the popular aggregate bond benchmark iShares Core U.S. Aggregate Bond ETF (AGG), whose 1-year total return range has been around +11.5% and -15.5%.

Weaknesses

Short-term Treasury funds like SPTS will compete with the returns of equities when equities are going well. And, during extended periods of low interest rates, which we have had more often than not the past few decades, their total return and income yield can be highly uncompetitive. 2022 has reversed much of that inherent weakness, thanks to four consecutive increases of 0.75% in short-term rates by the U.S. Federal Reserve.

Opportunities

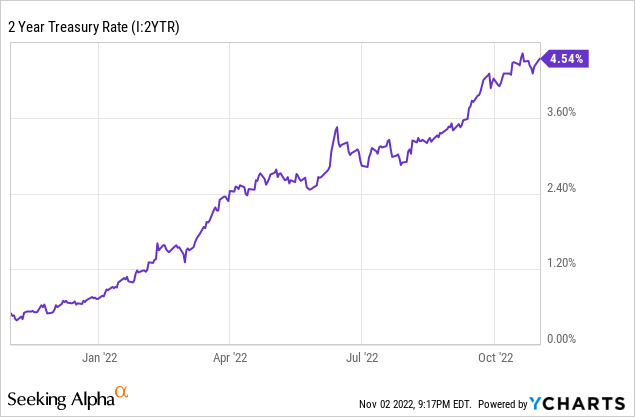

It is not an exaggeration to say that SPTS and similar ETFs are as attractive as they have been, that happens to be a “sweet spot” on the yield curve these days. As shown below, the 2-Year U.S. Treasury yield is well above 4%, and at a level not seen since 2007. Sure, inflation is running much higher, for now. But for the first time in a while, you can “hide out” in the 4% range instead of at a zero return.

Yet the biggest opportunity I see in SPTS right now is the one I alluded to in the title of this article. If you look up the yield on this ETF, you may see it quoted at under 1% in snapshot form. But, as hockey legend Wayne Gretzky said about why he was a cut above the rest of the league, if investors skip past where the “puck is” in this situation and “go to where the puck is going,” a nice surprise develops.

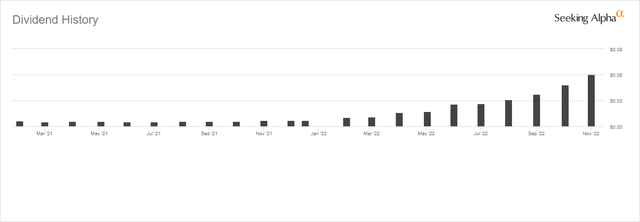

SPTS yield trend (SeekingAlpha.com)

As shown above, the yield on this month-pay ETF has gone from just over zero to $0.05 last month. The dividend per share that SPTS will pay out over the next several months is likely to be closer to or above that last monthly level. Barring a total, immediate collapse in Treasury yields, it will not soon be paying zero or $0.01 a month. That most recent dividend pushes the yield on SPTS over 2%.

As those annoying TV commercials say, “but wait, there’s more.” If you are wondering why SPTS pays in the 2%+ range when 1-3 Year Treasuries are paying about double that, remember that this ETF holds a wide variety of Treasury securities. Some of those were issued back when coupon yields were near zero. The average coupon is 1.75%. But the average price of a bond in this portfolio is around $95. If the fund holds those bonds, they will mature at $100. That means there’s a good chunk of price appreciation on tap for an investor who owns SPTS if rates hang around this 4-5% level. Even some additional increases in rates will still retain some of this advantage.

Threats

The tricky thing about short-term bonds is that their yield levels can be fleeting. You trade off the lower price volatility for the potential for the spike in 1-3 Year Treasury yields to reverse themselves. However, if an investor happens to be holding an ETF like SPTS and those short-term rates crash, there’s a side benefit, which has not been around much lately. That is, you can profit from the positive impact that decline in rates has on the prices of the bonds SPTS holds. So, your total return experience potential can be quite high if rates stabilize or fall anywhere around this level.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Buy

-

Long-Term Rating (next 12 months): Buy

Conclusions

ETF Quality Opinion

I can’t remember the last time I was actually a little excited to write about short-term Treasury ETFs. But this is that time. And it is an ETF, so you can swap it out for a different maturity, an equity fund, an inverse ETF, or any number of other investment styles at a moment’s notice, thanks to the intraday liquidity of ETFs. This is not the price-stability of a money market fund or CD, or even an individual bond. But in the ETF world, other than funds that buy only T-bills, this is about the low end of the risk spectrum.

ETF Investment Opinion

As part of a larger total return portfolio, it is a good time to get more familiar funds like SPTS at what is, for it, a rare moment in time. It is not a cure-all for the bear market, but they check a lot of boxes, so to speak. They are not junk debt, so you are not “reaching for yield.” Their total return potential could end up in the 4-5% area over the next year or two, if yields behave following this year’s four big Fed hikes. That’s why SPTS gets a Buy rating here.

Be the first to comment