thad

In recent weeks I’ve spent some time covering the Sprott physical bullion funds. My late September piece covered the Sprott Physical Gold Trust (PHYS) and focused on both dollar strength and the possibility of a dovish pivot from the Federal Reserve. My early October piece covered the Sprott Physical Silver Trust (PSLV) and shared some of the same general themes but laid out additional rationale for why Silver specifically would outperform.

In the time since those articles, shares of each trust are slightly lower than where they were at the time of publishing. Despite that, I believe the setups for both remain terrific. Investors who want exposure to Gold and Silver without having to pick between the two may find that the combination Sprott Physical Gold and Silver Trust (NYSEARCA:CEF) is the better buy right now.

NAV Discount & Holdings

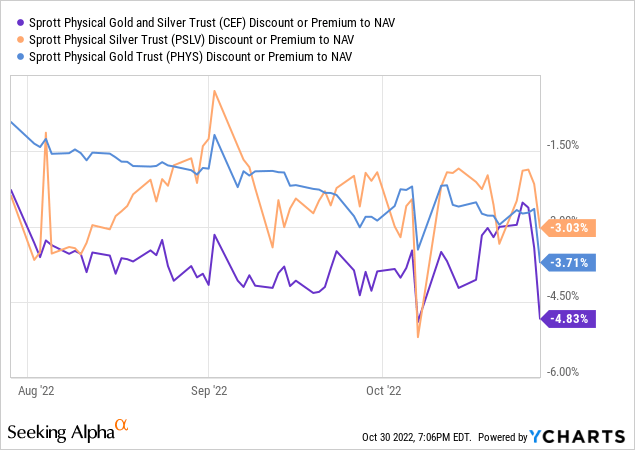

One of the important reasons I like the Sprott funds is because they often trade at discounts to the net asset value, or NAV. While both PSLV and PHYS are trading at discounts to the underlying value of the assets, CEF actually presents the best arbitrage spread of the three funds after all three discounts took massive dives lower to close out the week:

At a 4.83% discount to the Gold and Silver under custody, CEF shares offer the cheapest entry to Sprott’s precious metal offerings of the three funds. As of September 30th, 68.1% of the fund is allocated to Gold with the remaining 31.9% allocated to Silver.

| Fund | Expense Ratio |

|---|---|

| PSLV | 0.60% |

| PHYS | 0.41% |

| CEF | 0.49% |

| (SPPP) | 0.95% |

Source: Sprott

Additionally, compared to Sprott’s other precious metal funds, CEF has one of the lowest expense ratios at 0.49%. Point is, CEF is both cheap and undervalued compared to other bullion fund offerings from Sprott.

The Dollar Setup

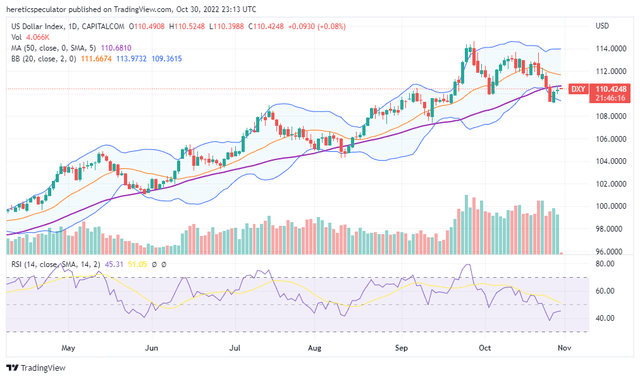

In my September article covering the Gold fund, I detailed how the US dollar was serving as a large headwind to risk assets broadly speaking. Stocks, metals, cryptos, and other commodities priced in dollars would theoretically have a hard time rising with continued dollar strength against foreign currencies. We’re now seeing the bullish bias in the DXY chart looks much less convincing:

Looking at the daily chart of the dollar index, we can see what was previous support in the 20 day moving average has now flipped to resistance. In addition, the 50 day moving average is now also acting as resistance. Monday could be an important day for the dollar as it is currently the fourth consecutive day under the 50 DMA. The DXY hasn’t closed under the 50 DMA for 4 consecutive sessions since February when geopolitical risk intensified with Russia’s invasion of Ukraine.

Furthermore, given the rising volume and the declining RSI strength, I think the technical setup for the DXY is much less bullish than it was just a few days ago. While the dollar index has come back down from highs, that recent weakness hasn’t impacted the metals to this point.

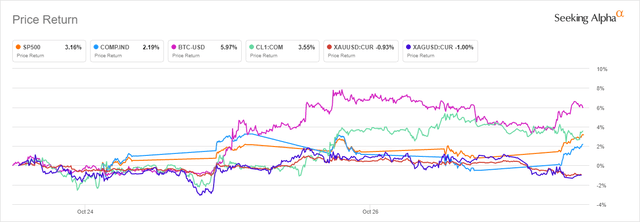

5 day performance (Seeking Alpha)

Last week equities, oil, and crypto all rallied. It seems every other risk asset has received the memo that the dollar may be finally weakening except the metals; each of which are down 1% over the last week. It is my view that Gold and Silver have catching up to do.

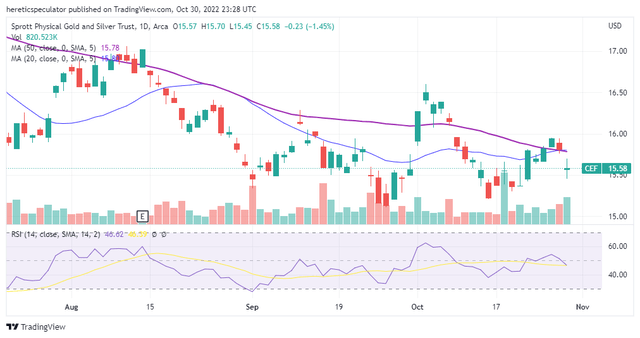

CEF Chart

Keeping those same 20 and 50 day moving averages in mind from the DXY chart, we can see a very interesting breakdown in the CEF chart on Friday:

The 20 day and the 50 day have just converged in CEF. Importantly, the 20 day has been moving up while the 50 day has been moving down – indicating the bears are losing steam. Even though CEF gapped down dramatically on Friday, bulls put up a heck of a fight and were able to get a close above the open while generating the second largest volume day of the month.

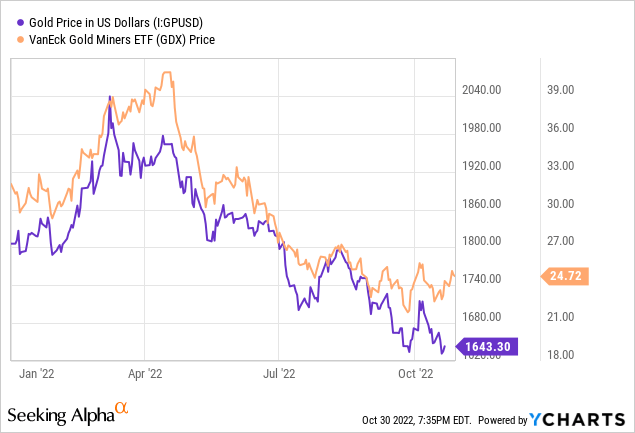

Despite the oscillation of CEF’s pricing to NAV, the Sprott funds are usually very correlated to the price of Gold and Silver. Interestingly, over the last few sessions, the VanEck Gold Miners ETF (GDX) has been decoupled from Gold entirely.

While the spot metals market action was less than impressive last week, the metal miners closed at a 7 week high. This would seem to indicate that Gold equity investors don’t necessarily believe the action they’re seeing in the metals pricing.

The Real World Price

In each of my last Sprott articles, I also talked about how physical metal requires a premium price over spot. Despite the declines in the paper price of each metal in recent sessions, the premiums from physical bullion dealers have actually increased since my PHYS article one month ago. These are the 1-9 unit wire prices of standard 1 oz Gold bars:

| Dealer | Premium 9/30 | Premium 10/30 |

|---|---|---|

| SD Bullion | 4.71% | 5.15% |

| JD Bullion | 5.59% | 6.22% |

| APMEX | 5.61% | 6.59% |

Source: company websites

The premiums in Silver from each of these dealers are higher than they were a month ago as well. According to SD Bullion’s website, every 1 oz bar option is currently sold out. This reiterates the idea that the paper metal price, and by extension CEF, isn’t moving with the real market for the metal. I think it makes sense to buy the dislocation from reality in pricing.

Risks

It’s possible the dollar rally is not over and there could be further pressure on the metals market. It’s also possible the charade that is paper pricing could continue to put pressure on CEF shares even as the market for physical metal shows higher premiums than just a month ago. The paper metals market currently appears to behaving irrationally as evidenced by both the market for physical bullion and metal equities. That irrationality in paper could continue for longer.

Summary

Sometimes the market behaves in a way that doesn’t make sense. To me, the action in metals last week didn’t make any sense. With speculators potentially sniffing out a change in sentiment for the dollar, we saw broad rallies in risk markets. Equities, crypto, and oil all responded with green weeks yet somehow metal didn’t play. The asset class that has historically been associated with hedging currency weakness somehow isn’t responding to the dollar’s support flipping to resistance while other asset classes are rallying.

Not only did the metals lag, but the Sprott bullion funds were all punched down even more on the week. For CEF, the discount to NAV is now nearly 5%. This action suggests either the rally in risk assets has been a fake out or the metals have some serious catching up to do. If, as I suspect, it’s the latter, CEF is arguably the best buy of the bunch. I bought the dip in CEF on Friday. These price declines are a gift.

Be the first to comment