Khanchit Khirisutchalual

The desire for gold is the most universal and deeply rooted commercial instinct of the human race – Gerald M. Loeb

ESG-themed investing has had its fair share of naysayers over the years, and whilst I’m not too inclined to take any sides with the ESG debate, I have previously explored the associated corollaries of this form of investing. As noted in a YouTube video of The Lead-Lag Report, I’ve raised questions over whether this could be an underappreciated driver of inflation over time. If that is indeed something that could transpire, that would make the focus ETF of this article – The Sprott ESG Gold ETF (SESG) – a somewhat curious case.

As you may have inferred from the title of the product, this is an ETF that tracks physical gold that meets certain ESG criteria; put another way, the gold that SESG focuses on will be physically indistinguishable from other gold, but it has to be sourced and produced under certain ESG standards for it to be considered by SESG. Wouldn’t the enhanced standards lead to encumbrances in sourcing this, which in turn only contributes to more inflation? SESG admits to this in their prospectus where they go on to say – “An investment in Sprott ESG Approved Gold requires expensive and sometimes complicated arrangements in connection with the assay, transportation, handling, storage and insurance of the metal as well as determining whether the gold meets the ESG Criteria.“

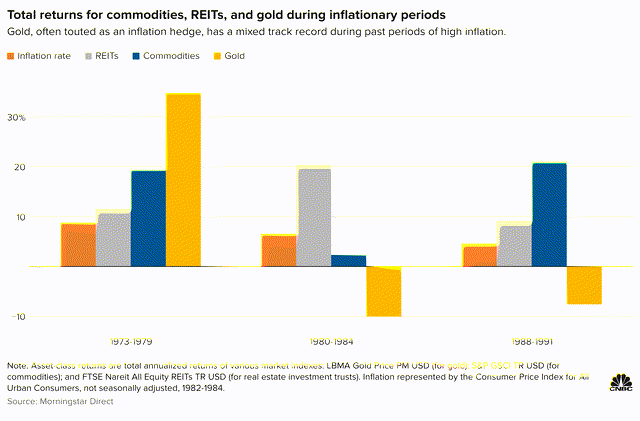

Now investors have different motivations for holding gold, and whilst it is not the primary driver, there is a cohort of investors who pursue the yellow metal as an inflation hedge of sorts, even though, as evidenced from the image below, the yellow metal has had a mixed track record over previous decades.

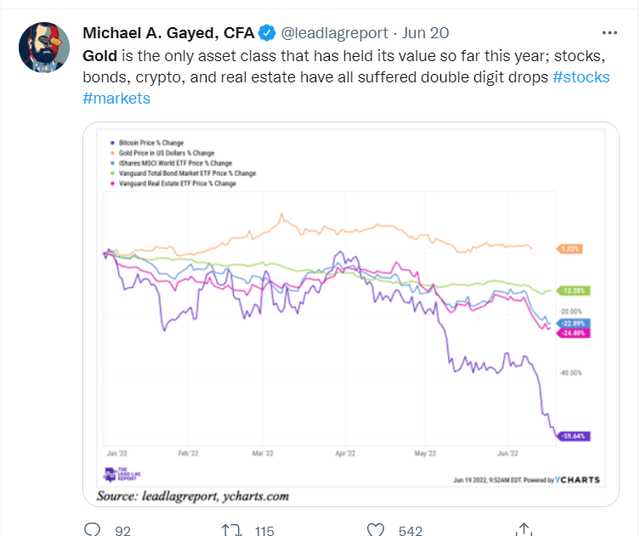

Conversely, this year, when inflation has been at multi-decade highs for much of 2022, gold has actually fared reasonably well; as mentioned in The Lead-Lag Report, whilst most other asset classes have faced some brutal drawdowns, the yellow metal has held its own during H1-22 and delivered positive returns.

Now, if gold does indeed have some utilitarian qualities as an inflation hedge (as the purchasing power of fiat currencies become less valuable in an era of inflation, perhaps there is some merit in owning gold), how does one reconcile that with owning an ESG themed product that will inevitably lead to some form of inflation over time?

You could also be forgiven for viewing this product as just another paragon of marketing noise. Indeed, the SESG prospectus goes on to admit that they do also hold “unallocated gold” or gold that does not have to clear the ESG standards at certain points in time, whilst also confirming that there “isn’t any minimum amount” of Sprott ESG Approved Gold that will be required to be held by the holding entity. What then is the point of the ETF?

I would also argue that if you’re keen to drive an ESG fueled propaganda, Gold is probably not the most pressing avenue to direct your attention towards; as far as GHG emissions are concerned, gold mining’s contribution is anyway quite minuscule.

Conclusion

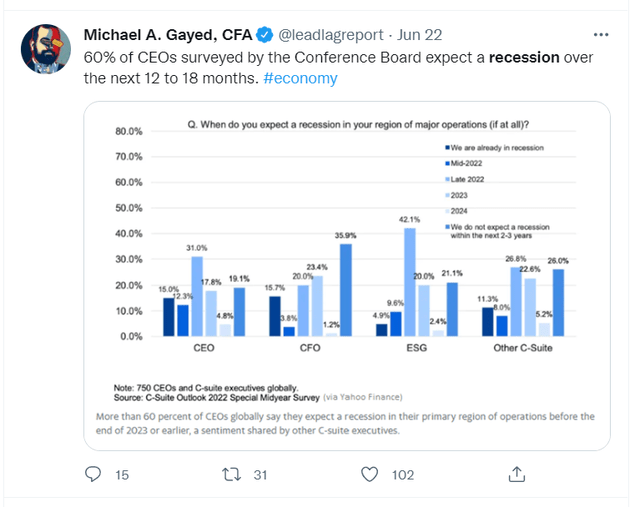

Whilst I am not gung-ho about SESG as a prospective investment vehicle, I do believe there is some merit in owning gold at this juncture and much of this is dictated by the notion that we are on the cusp of shifting from an inflationary-driven environment to that of a recessionary driven environment.

Gold may have fared a lot better, if not for the stellar performance of the dollar this year, which in turn has reacted to the aggressive positioning of the Fed with regards to the interest rates. If you’ve been keeping track of developments in The Lead-Lag Report, you’d note that I wrote about how treasuries are beginning to exhibit their classic risk-off behavior. During a week when inflation came in at record highs, the 10-year yield saw a contraction of 15bps, reflecting the growing risks of recession as a result of aggressive tightening in a slowing environment. I have previously expressed my reservations about the ability of the Fed to ensure a soft landing and it looks all but likely that they will have to shift focus in 2023 and cut rates to diminish the growing after-effects of a slowing economy. A cut in rates could diminish the allure of the dollar, the currency in which gold is priced. Growing recessionary conditions could also see Gold attract plenty of capital on account of its safe haven status. To conclude I can see the merits of owning gold but SESG? Not quite.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment