SpringWorks Therapeutics (SWTX) (‘the company’) is based in Stamford, CT.

Catalysts:

– Phase 3 data for Nirogacestat (‘Niro’ in treating desmoid tumors, interim update in the second half this year and full data in Q2-Q3, 2021.

– Phase 1b update for Mirdametinib (‘Mirda’) and Lifirafenib in treating RAS/RAF mutant solid tumors in the first half of 2020.

– Phase 2b update for Mirda in treating neurofibromatosis in Q4 this year or Q1, 2021.

_______________

Review of the R&D pipeline

Niro is a gamma-secretase inhibitor. It has FDA Breakthrough Therapy, Orphan drug and Fast Track designations in treating desmoid tumors.

Desmoid tumors are soft tissue tumors seen on upper extremities, lower extremities, abdominal wall, head, and neck, etc. They are disfiguring and associated with severe pain, internal bleeding, decreased range of motion and increased mortality. They are usually seen in the age-group of 15-60 years, more common in women and are usually diagnosed in the 30-60 years age group. They are usually due to mutations in catenin beta-1 gene (more common) or APC gene. Currently, surgical resection is the most common treatment and off-label drugs like chemotherapy or tyrosine kinase inhibitors. The estimated prevalence is approx. 5500-7000 patients and another 1000-1500 new cases every year in the U.S.

In a Phase 2 trial in heavily pretreated (median 4 prior lines of therapy) 17 patients with desmoid tumors, Niro showed ORR of 29.4% and median progression-free survival, PFS was not reached. The median duration of treatment was 25 months. Only one patient stopped the treatment due to adverse events.

A Phase 3, randomized, placebo-controlled DeFi trial is ongoing in treatment-naive as well as treatment-refractory patients. The comparator is a placebo and the primary endpoint is PFS. An interim update is expected in the second half of this year. This could be $600M/year revenue opportunity just in the U.S. (considering one-third of all desmoid tumors are refractory and $300K/year price estimate).

Niro is also being developed as a combination therapy with BCMA-targeted multiple myeloma, MM like cell therapies (including CAR-T) and antibody-drug conjugates, ADCs. BCMA is an antigen that is expressed in the majority of MM. Gamma secretase cleaves membrane-bound BCMA and causes BCMA shedding, resulting in resistance to BCMA-targeted therapies in MM. By blocking gamma-secretase, Niro has shown a synergistic action in combination with BCMA-targeted therapies in preclinical studies and early clinical studies.

Big Pharma has recognized the potential of Niro in this indication. GlaxoSmithKline (GSK) has partnered with SpringWorks to develop Niro in combination with its BCMA-targeted ADC in MM (preclinical data presented at ASH 2019 was promising). Allogene (ALLO), the latest venture by the former founder/CEO of Kite Pharmaceuticals (acquired by Gilead (NASDAQ:GILD)), has signed a partnership to develop Niro in combination with its BCMA-targeted allogeneic CAR-T in MM (clinical studies to start in the second half this year).

I expect Niro to become a standard of care combination therapy with BCMA-targeted therapies. Approx. 27,000 new cases of multiple myeloma are diagnosed in the U.S. every year (approx. 13,000 deaths in the U.S. every year). This indication could be approx. $2 billion/year revenue opportunity for SpringWorks in the U.S. alone and thus, a big future revenue driver.

Another molecule in the pipeline is Mirdametinib, an oral, small molecule, MEK 1/2 inhibitor which is being developed in treating plexiform neurofibromas, NF1-PN and RAS/RAF mutant solid tumors. It has a differentiated profile than other MEK inhibitors based on potency and safety. NF1-PN are disfiguring tumors that grow along the nerves and cause significant pain. The estimated prevalence is approx. 30,000-50,000 patients in the U.S. Surgical resection is difficult and off-label oncology drugs are not very effective. Approx. 25%-30% of NF1-PN patients develop a malignant condition called malignant peripheral sheath tumors, MPST which has a 12-month survival of below 50%.

In a Phase 2 trial, Mirda resulted in a responder rate (20% or higher tumor reduction by course 12) of 42%, which was a significant improvement over a 4.1% responder rate in age-matched controls. The drug has Fast Track designation in this indication. A Phase 2b trial is ongoing and results are expected in Q4 this year or Q1, 2021. The trial could be potentially registrational and the primary endpoint is ORR. With an estimate of 25% of NF1-PN patients as candidates for the therapy and $300K/year price, this could be approx. $2 billion/year revenue opportunity in the U.S. alone.

Mirda is also being developed in treating RAS/RAF mutant solid tumors in combination with BeiGene’s (BGNE) RAF dimer inhibitor Lifirafenib, which has a potential best-in-class profile vs. competition. The target market for these mutations is approx. 25% of all solid tumors. An update from the dose-escalation part of the ongoing Phase 1b trial is expected in the first half of this year. The data from early clinical studies for Lifirafenib as monotherapy is promising and the combination has shown synergy in preclinical studies.

The third molecule in the pipeline is BGB-3245, BRAF inhibitor which is being developed in a partnership with BeiGene. It has shown activity in tumors resistant to BRAF V600 inhibitors. A Phase 1 trial in treating advanced/refractory solid tumors was initiated in Q1 this year.

The CEO was Chief Business Officer at Moderna (MRNA) and Executive VP/ Chief Strategy and Portfolio Officer at Alexion Pharmaceuticals (ALXN). Cash reserves are estimated at $332M in Q4, 2019 with no debt. The operating cash burn is approx. $11M/quarter. I don’t expect a capital raise for the next 12 months.

Institutions holding a stake in the company include Perceptive Advisors ($128M), Orbimed Advisors ($243M), Bain Capital ($239M), Biotechnology Value Fund ($109M), Deerfield ($28.7M), etc. Earlier this year, the Biotechnology Value Fund raised its stake to 7.2% and Pfizer (NYSE:PFE) opened a new 10.7% stake. Insider transactions are positive ($15M of stock bought in September 2019) and no recent selling.

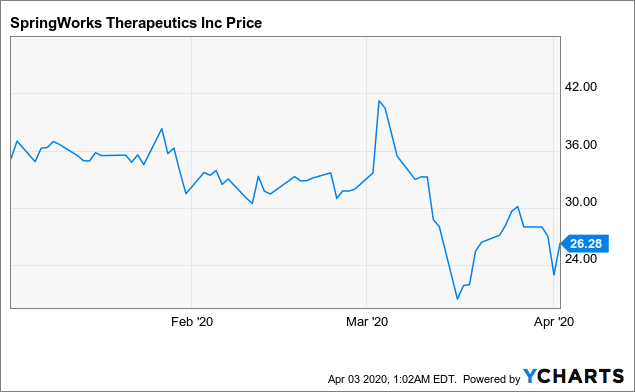

The mean sell-side analyst price target on the stock is $40 (1-year 22% upside potential). Recently, HC Wainwright’s analyst (5-star ranked) issued a Buy rating and $40 PT last month after the company’s partnership with Allogene was announced. Cowen also has a Buy rating on the stock. The current market cap of the company is $1.1 billion (Market cap/peak sales ratio for biotech companies in the buy-out scenario is mean 6-7). The stock has a significant upside with a 1-2 year time frame just based on the orphan indications like desmoid tumors and NF1-PN. The stock has also pulled back from its recent high due to the bear market and is rebounding now ahead of the catalysts.

Rating Buy, first price target = $40 (1-year time frame).

Data by YCharts

Data by YChartsRisks in the investment include disappointing data, unexpected side effects, etc., which could cause the stock to fall. Investors are suggested to diversify their biotech/pharma portfolio in at least 25-30 holdings to reduce the risk.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in SWTX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The content in this article represents my own opinion and is not a substitute for professional investment advice. It does not represent a solicitation to buy or sell any security. Investors should do their own research and consult their financial advisor before making any investment. Investing in equities, especially biotech stocks has the risk of significant losses and may not be suitable for all investors. While the sources of information and data in this article have been checked, their accuracy cannot be completely guaranteed.

Be the first to comment