Avid Photographer. Travel the world to capture moments and beautiful photos. Sony Alpha User/iStock Editorial via Getty Images

Spotify (NYSE:SPOT) is the largest global audio streaming platform with 422 million monthly active users (MAUs) and 182 million paid subscribers, as of 31st March 2022. I’ve published several articles on Seeking Alpha in 2022 explaining why I bought shares in Spotify and why I thought the market was overreacting to their Q4 2021 results. Since these articles were published, Spotify shares have continued to fall and are down a whopping 58% so far in 2022. Some of this fall can be attributed to the broader market sell-off in tech stocks, but Spotify has been hit especially hard due to four main factors: (1) concerns about brand impairment and a potential mass exodus of subscribers following the Joe Rogan COVID-19 misinformation scandal, (2) an absence of significant gross margin expansion in the past 12-24 months, (3) lack of GAAP profitability, and (4) removal of annual guidance, leading to speculation of weak 2022 results. I believe all of these concerns are temporary (as an example, when was the last time you heard Joe Rogan and Spotify mentioned in the same sentence?) and that Spotify will demonstrate significant gross and operating margin expansion in the coming 18-24 months. As such, despite the steep fall in share price, I remain extremely bullish on Spotify’s long-term prospects and will continue to average down over the coming quarters.

On 8th June 2022, Spotify hosted their second investor day since entering the public markets and provided some much-needed clarity on their long-term vision for the business. In this article, I’ve outlined my six key takeaways from their investor day presentation.

Daniel Ek (Spotify – For the Record)

1) Increasing engagement with podcasts, particularly originals/exclusives

During their investor day, Spotify management disclosed several metrics demonstrating the phenomenal growth of their podcast segment. At the time of their direct listing in April 2018, Spotify had virtually no presence in podcasts, but has rapidly grown to surpass Apple Podcasts (AAPL) in late-2021 as the most popular podcast platform in the US market.

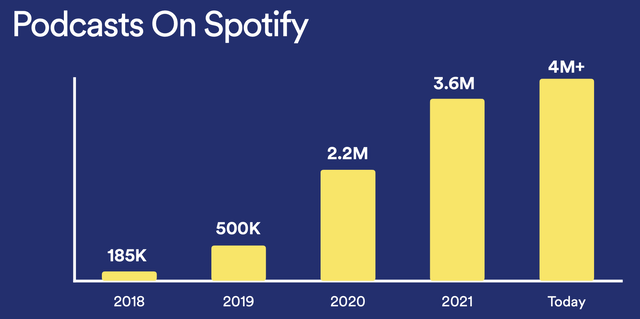

Indeed, the total number of podcast episodes on Spotify has grown from less than 500,000 in 2019 to more than 4 million through the first six months of 2022 and 75% of podcast uploads are now powered by Anchor, Spotify’s podcasting production software.

Spotify Podcast Episodes (Spotify Investor Day Presentation)

But it’s not just the number of podcasts that are growing on Spotify’s platform; it’s also user engagement with podcasts. While only 7% of Spotify users listened to a podcast in 2018, more than 30% of Spotify users listened to a podcast so far in 2022. As an avid consumer of podcasts, this 30% penetration number still feels lower than I would’ve expected and shows how much more room for penetration there is within Spotify’s massive base of 422 million MAUs.

A core driver of Spotify’s growth in podcast engagement has been their investments in original/exclusive content. Spotify disclosed that of the top 10 most popular podcasts available on Spotify, six are originals/exclusives. Of the top 100, 15 are originals/exclusives. Such investments help to attract new users to Spotify’s platform who might have otherwise been users of a competing podcast platform, such as Apple Podcasts or Stitcher.

When carefully managed, these investments also help Spotify exert scale economies over their competitors as fixed costs to develop original/exclusive content can be distributed across a larger subscriber base than competitors with a smaller subscriber base also investing in content production. However, this argument of scale economies becomes less persuasive when considering that three of Spotify’s largest competitors in the podcast market: Apple, Amazon (NASDAQ:AMZN), and YouTube (NASDAQ:GOOGL) each have more cash on their balance sheet than Spotify’s entire market cap.

All evidence I’ve seen points to podcasts becoming a larger and larger piece of the global audio market over the coming decade and Spotify is well placed to capitalise on this trend as the dominant market leader. Spotify also continues to upgrade their product experience, such as adding video podcasts and interactive Q&A (to directly compete with YouTube), which should further increase user engagement and bolster their leadership position.

2) Future guidance on podcasting gross margins

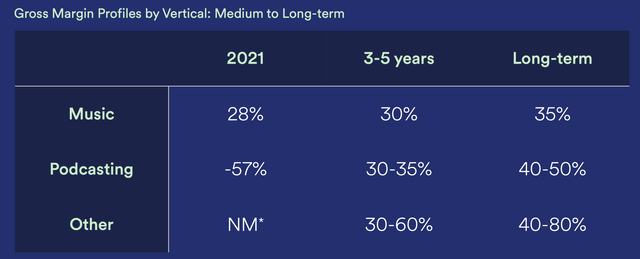

Arguably the most anticipated part of Spotify’s investor day was their commentary on podcasting gross margins which, to date, have dragged down consolidated gross margins as Spotify continues to invest aggressively in building out their podcast infrastructure. As a reminder, Spotify’s premium gross margin (primarily relates to music) in Q1 2022 was 28.4%, while their ad-supported gross margin (which includes content costs related to podcast investments) was actually negative at (1.5)%.

In this investor day presentation, management again re-iterated their expectations for podcasting gross margins to reach 30% over the next 3-5 years, with the potential for podcasting gross margins to expand to 40-50% over the long term. See the below comment from CFO Paul Vogel:

We believe 2022 will be the peak in terms of the negative impact of our [podcast] investments on gross margins, and we expect podcasting gross margin to turn profitable over the next one to two years and on a meaningful ramp from that point onward.

As a result of this expected stepwise growth in podcasting gross margins, management expects Spotify’s consolidated gross margins to reach 30% in the intermediate term (currently hovering between 25-28% depending on the quarter), with a long-term expectation for 40% consolidated gross margins. While the path to meaningful gross margin expansion has taken longer than many investors expected (myself included), these upfront investments to build out their podcast infrastructure have greatly strengthened Spotify’s competitive position and cemented their brand as the go-to audio platform, rather than a sole distributor of music.

Spotify Gross Margin Targets (Spotify Investor Day Presentation)

There wasn’t much on specifics in this investor day presentation on the drivers of podcasting gross margin expansion (other than increased efficiency and utilisation of podcast advertisements), but I expect management to continue to provide greater clarity over the coming quarters. It’s clear that CEO Daniel Ek recognises that a large portion of the pessimism surrounding the stock price comes down to their failure to clearly explain the rationale behind their long-term investments.

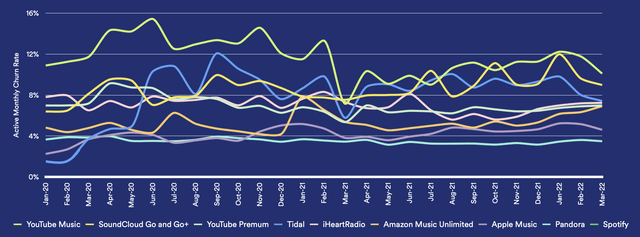

3) Greater clarity on churn

CFO Paul Vogel put forth several statistics in this investor update which demonstrate Spotify’s impressive churn rates for a direct-to-consumer (D2C) business. These include:

- Premium subscriber churn decreased from 5.5% in 2017 to 3.9% in 2021 (and 2.4% in developed markets).

- Ad-supported user retention increased over 650 basis points from 2017 to 2021.

96% gross retention in paid subscribers is almost unheard of for a D2C business, particularly one as large as Spotify, highlighting the stickiness of their platform and the value proposition for premium subscribers. For a subscription fee ranging from $6-19 per month (note: prices in USD), subscribers gain access to the largest global library of music and podcasts, with audiobooks soon to be added to the mix.

Spotify Churn vs. Competitors (Spotify Investor Day Presentation)

4) Expansion into audiobooks is coming very soon

Following their acquisition of Findaway in November 2021, Spotify will be making a concerted push in 2022 to integrate audiobooks into their platform. As a result, Spotify users will be able to listen to music, podcasts, and audiobooks, all within the one app.

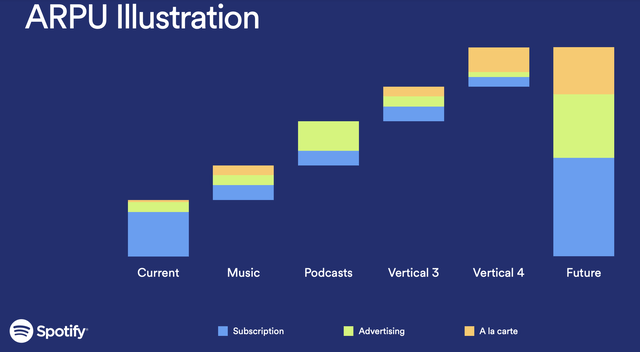

The aggregation of these three audio content sources is a very important strategic step for Spotify because it affords Spotify greater pricing power and increased monetization opportunities, which both serve to increase customer lifetime value (LTV) and average revenue per user (ARPU). Moreover, it results in a more seamless customer experience. Just consider the rapid decline in customer experience for video streaming as the industry has become over-saturated and consumers have been forced to juggle multiple separate subscriptions at once to watch their favourite TV shows and movies.

ARPU Illustration (Spotify Investor Day Presentation)

As Spotify expands into audiobooks, there is clear scope to take market share from the dominant incumbent, Audible, which was acquired by Amazon in 2008. Audible charges a fixed subscription fee, with the option to purchase additional audiobooks each month. If Spotify is able to integrate a broad range of audiobooks into their platform at no cost for premium subscribers (or even a comparable cost to Audible), I would expect to see a significant number of Audible subscribers switch to Spotify, given that many of these subscribers will likely already be using Spotify to listen to music and/or podcasts.

In short, Spotify’s foray into audiobooks remains highly uncertain (including their exact pricing structure) but given their stellar execution to become the global dominant player in the music and podcast market, I would expect them to apply lessons learned and take significant market share from Audible (and other competitors) over the coming 3-5 years.

5) Continued product innovation

Spotify is an innovative company. At the time of their IPO in 2018, they were essentially a sole distributor of music content, but have since expanded to become the global leader in podcasts, while incorporating other monetization opportunities like Spotify Audience Network and Spotify Open Access.

These product innovations are long overdue for artists. One of the major criticisms of Spotify (and other big platforms) has been that few artists were able to make a living wage solely from ‘pay-per-stream’ income. I empathise with this criticism, but note that this is not necessarily the fault of Spotify, but more so lies within the agreements made between the artists and the major record labels, such as Universal Music Group (AMS:UMG) or Warner Music Group (NASDAQ:WMG). Artists who represent themselves without a record label earn significantly more per stream on Spotify, but often struggle to reach a critical mass of fans without the promotion of record labels. A bit of a chicken and the egg situation for artists.

To address this problem, Spotify has announced a series of initiatives to enable artists to directly monetize their audience through Spotify and thus diversify their revenue away from the simple ‘pay-per-stream’ model. For example, artists can now sell merchandise or concert tickets through Spotify, with Spotify acting as the intermediary connecting artists with their fans (for a small fee, of course).

Spotify has also recently begun to roll out their Fans First program which identifies the most passionate fans of a given artist and provides exclusive offers to them, such as early access to concert tickets, access to invite-only events, or unique merchandise. Such an initiative provides more opportunities for artists to engage with and monetize their audience, while also acts as an incentive for users to remain highly active and locked into Spotify’s ecosystem. With each transaction, Spotify should take a small clip of the ticket, generating incremental high-margin revenue and boosting consolidated gross margins.

Another notable product innovation released in April 2021 was paid podcast subscriptions, which enables podcasters to make some episodes only available for paid subscribers (a similar model to Substack but for audio content). To date, Spotify has already rolled out paid podcast subscriptions in 34 markets. To increase uptake among podcasters, Spotify will not be taking any cut of subscription revenue until 2023, after which they will take 5% of subscription fees. Over time, this could become a material source of high-margin revenue for Spotify, particularly if extremely popular original/exclusive podcasts begin offering paid podcast subscriptions.

6) Very ambitious long-term guidance

Towards the end of the investor day presentation, CEO Daniel Ek dropped a bombshell, outlining Spotify’s guidance for the next decade:

From everything I see, I believe that over the next decade, we will be a company that generates $100 billion in revenue annually and achieves a 40% gross margin and a 20% operating margin.

To my knowledge, there are only a handful of companies in the world which boast the above metrics, including behemoths like Apple, Alphabet, Microsoft (NASDAQ:MSFT), Meta Platforms (META), and Verizon Communications (NYSE:VZ). So, Spotify would be reaching an exclusive club if they were able to achieve these stated milestones, although it is worth considering that in another decade, the number of companies on this list is likely to be much greater than five.

The headline that captured the most attention (99% of which was negative or satirical) was Spotify’s revenue guidance for $100 billion annual revenue. Let’s break down this revenue assumption in a bit more depth.

As of Q1 2022, Spotify had €10.1 billion in LTM revenue, which equates to around $10.7 billion USD at current exchange rates. If we assume that Spotify meets their revenue guidance, that would imply a 25% revenue compound annual growth rate (CAGR), roughly in line with their 5-year trailing revenue CAGR of 26%.

Underpinning this assumption is a belief that Spotify will reach an audience of 1 billion MAUs over the next decade, representing a 9% CAGR from their current base of 422 MAUs. Not impossible, but we’ve recently seen from Netflix (NASDAQ:NFLX) that continued subscriber growth as the market leader can be hard to come by at scale. Nonetheless, I’m comforted by two points: (1) audio streaming is significantly less saturated than video streaming and (2) audio (e.g., music, radio, podcasts, audiobooks) plays a much more ubiquitous role than video streaming in the lives of most people and should thus have a larger TAM.

But getting back to the point. 9% CAGR in MAUs isn’t enough to generate Spotify’s expected 25% revenue CAGR, so they’re clearly a substantial increase in ARPU over time, driven by growth within new verticals (e.g., audiobooks), higher subscription fees (due to price increases), a dramatic increase in ad-supported revenue, and significant traction within new product initiatives.

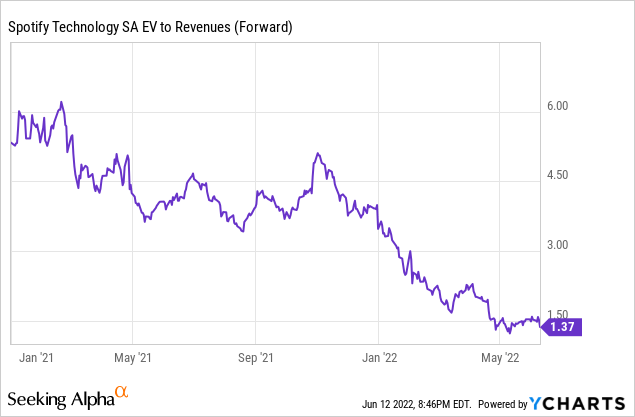

Overall, Spotify’s revenue guidance seems aggressive, but it’s worth keeping in mind that management has met or exceeded their quarterly guidance greater than 90% of the time since their direct listing in 2018. Even if Spotify fell well short of their stated long-term guidance, it would still result in revenues and gross profits many multiples above their LTM numbers. At around 1.4x forward revenue and 5.4x forward gross profit, it’s hard to imagine significantly more multiple compression from here, so share price returns should approximately mirror growth in revenues and profits.

Conclusion

Spotify has had a tough time in the public markets so far in 2022. While few investors question the strength of Spotify’s brand or their enormous base of loyal MAUs, there remains incredible scepticism about their ability to generate significant gross margin expansion and GAAP profits at scale.

While investors are becoming increasingly pessimistic, Spotify management (led by visionary CEO Daniel Ek) appears increasingly optimistic about the long-term trajectory of the business. While many will scoff at their revenue projections for $100 billion annualised revenue over by 2032, I’m hesitant to bet against a man who is arguably the person most responsible over the past 15 years for revitalising the music industry. Even more so when he recently invested a further $50 million into the company, adding to his already multi-billion dollar stake in the business.

Spotify has enormous growth ahead of them and is cementing their dominant leadership position with each passing day, yet shares trade at their cheapest valuation since IPO. We haven’t even discussed future growth levers like meditation apps and online education courses, or their share repurchase program designed to capitalise on the weak share price. I may look foolish continuing to average down over the coming months, but it’s a price I’m willing to pay for long-term rewards.

Be the first to comment