Cindy Ord

We are still bearish and remain sell-rated on Spotify (NYSE:SPOT). Consistent with our bearish April piece, Spotify is trading at about $87, dropping 71% below its 52-week high and 43% below when we first wrote about it. While Spotify built an excellent music business, we believe the company won’t be able to generate profits soon. We believe Spotify has to deal with churn due to inflationary pressures, turbulence in Europe and Asia, and currency issues. We also don’t believe the company has the balance sheet to keep up with the competition meaningfully. We believe the company must spend heavily to keep up with the competition, and profits will likely remain elusive in the near term. Therefore, investors should use any rally in the shares to exit their positions

Subscription growth remains challenging

Despite Spotify’s better-than-expected 2Q22 report, we still recommend investors sell shares. For 2Q22, Spotify reported a total of 433M users across both its ad-supported and premium accounts – an 11 million increase compared to its 422M in 1Q22. While subscription growth this quarter seems like a major win compared to the subscription slowdown in 1Q22, we do not believe the positive momentum could last.

Spotify also guided higher for 3Q22. While we share the company’s belief that subscribers will grow, we believe this growth will NOT offset materially higher spending in 3Q22. We don’t believe it is a question of whether Spotify will be able to increase subscriber growth; instead, we believe it is a question of whether the company can generate lasting profitability.

Given the macro and currency headwinds, we expect Spotify churn to remain elevated and possibly increase over the next few months. We do not expect Spotify to generate meaningful profits soon, making the stock very difficult to own.

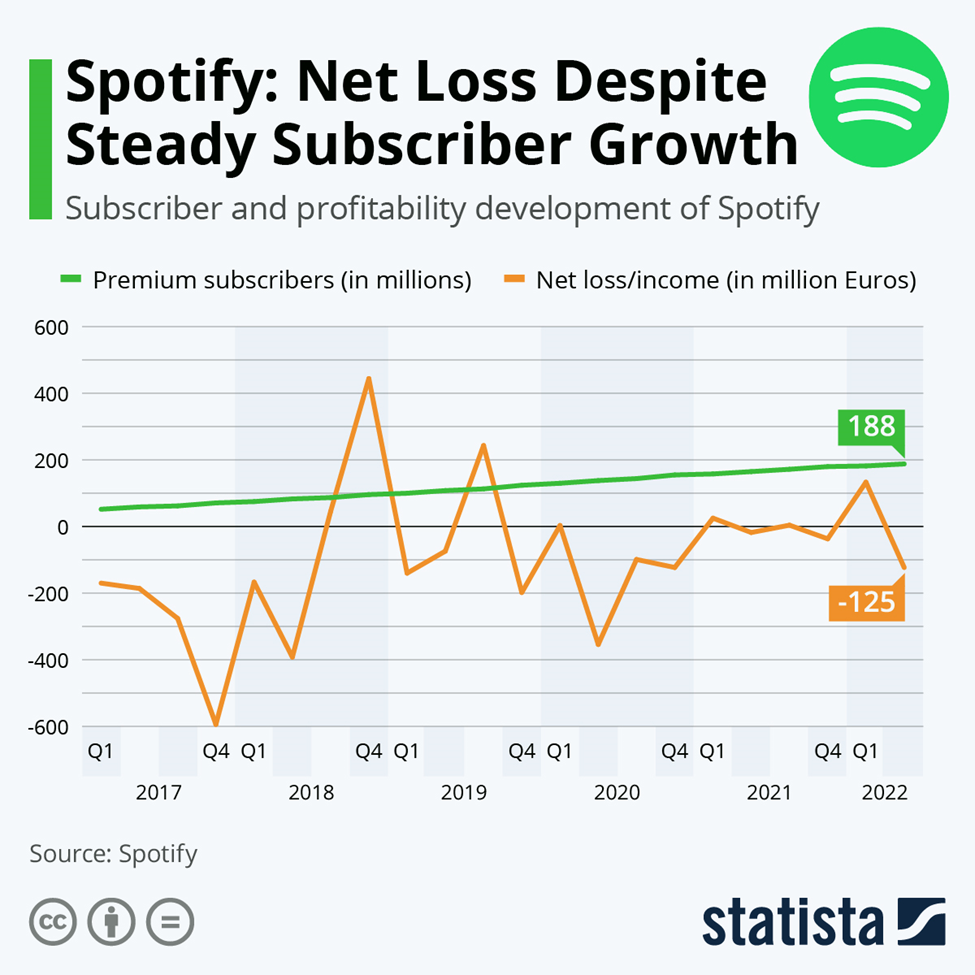

The following graph outlines Spotify’s net losses despite steady subscriber growth.

Spotify

We believe Spotify is stuck in a cycle of needing to spend money to see growth, while its competition is not. Spotify spent $391M on sales and marketing, amounting to 14% of total revenue.

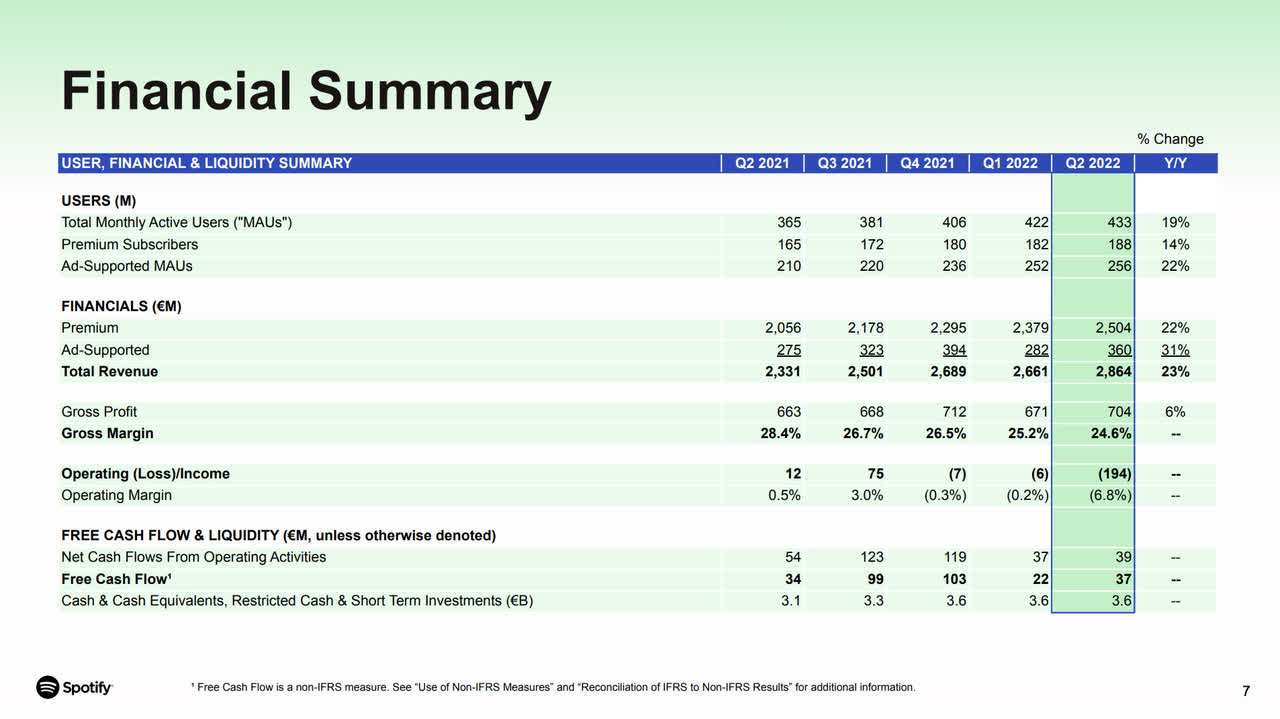

The following table from 2Q22 outlines Spotify’s operating losses this past quarter.

Spotify

Competition remains intense

Spotify operates in a highly competitive market. Spotify is in a difficult position as it lacks a competitive advantage. Spotify’s competition includes YouTube (GOOG) (GOOGL), Amazon Music (AMZN), Apple Music (AAPL), and a host of smaller players in several countries. Spotify’s larger competitors are not as focused on generating profits in their music streaming business as Spotify is and can spend heavily to acquire content and subscribers. We remain concerned about Spotify’s market share as its main competitors have the advantage of other revenue streams to fall back on, while Spotify does not. Competition, including Apple and Amazon, can bundle their music and audio content with their other services. Spotify does not own the content it streams; hence, the company struggles to make money without content over a longer period and a consistent edge to leverage subscribers. We see Spotify ramping up spending to maintain subscription growth, while competition is not necessarily sharing that struggle.

In addition, Spotify faces specifically heated competition in the podcast field with Apple Podcasts, Google Podcasts (including YouTube), Deezer (EPA: DEEZR), and Audible. Apple’s collection of 90 million labels is the largest in the industry. Michelle and Barack Obama left Spotify podcasts in April for Spotify’s competitor Audible, and only last month, the final episode of Reply All, one of Spotify’s most popular podcasts, aired. Spotify offers a total of 82M tracks, which include 4.4 million podcasts. We believe Spotify needs to bring its A-game to keep up with the competition.

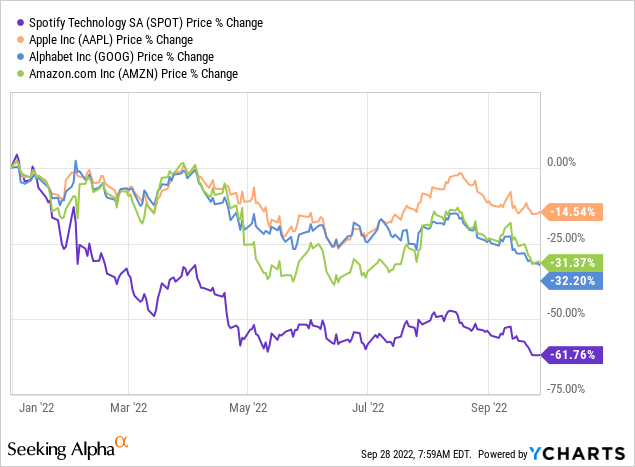

While both Spotify and its competition are down YTD, Spotify still underperforms more than others. YTD, Apple stock declined around -20%, Amazon -30%, Alphabet -32% while Spotify dropped about -62%. We expect Spotify’s competition, including YouTube, Apple Music, and Amazon Music, to continue outperforming the company as they have YTD. The following chart shows Spotify’s performance YTD among competitors

YCharts

Stock performance

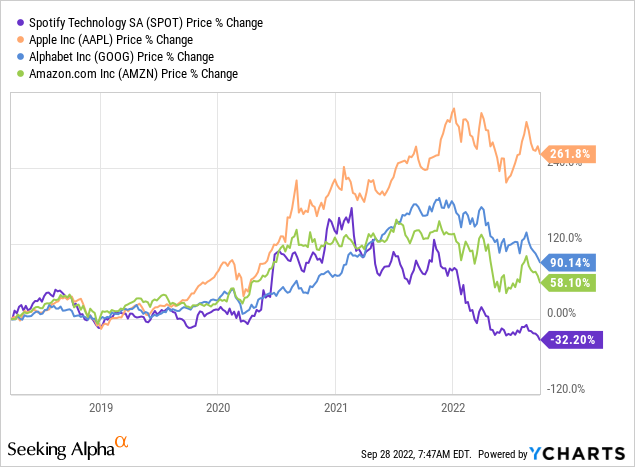

Spotify has been down almost 33% over the past five years. Aside from underperforming peers on YTD and five-year metrics, Spotify declined 61% over the last year, underperforming the S&P 500 Index (SPY), which dropped 18%. We believe the stock will continue to drop as we see no clear growth catalysts in the near term. YTD, the stock is down by around 62%. Spotify is approaching its 52-week-low of around $88, down 71% from its high of $306. We would not be surprised if Spotify goes below $75 over the next few months on worsening macro, churn, and intensifying competition.

The following charts show Spotify’s performance over the past five years among competitors and during the last year.

YCharts YCharts

Valuation

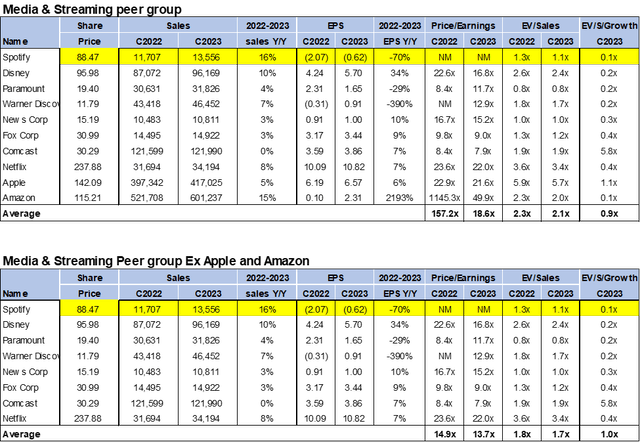

Spotify is relatively cheap, but we don’t recommend buying the stock on weakness. On a P/E basis, the company has negative earnings; hence, the P/E metric cannot be used for valuation. On the EV/Sales basis, Spotify is trading 1.1x EV/Sales on C2023 revenue versus the peer group average of 2.1x. Spotify needs to find a way to become profitable quickly. Until then, we believe the company is at the mercy of the markets. We recommend investors sell the stock at current levels.

The following chart illustrates Spotify’s valuation relative to its peer group.

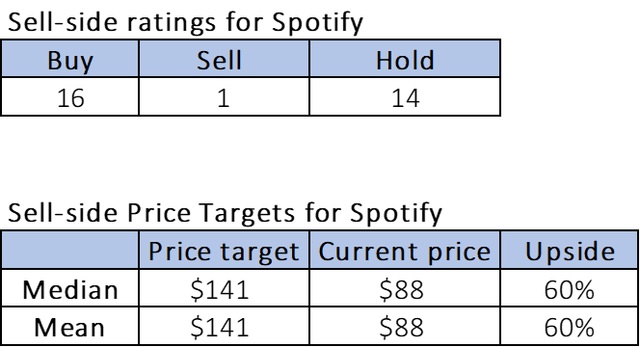

Word on Wall Street

Out of 31 analysts covering the stock, 16 are buy-rated, 14 are hold-rated, and the remaining are sell-rated. Spotify is trading around $88, consistent with our April prediction that the stock would drop below the $100 mark. Median and mean sell-side price targets are $141, with a potential upside of about 60%. The following charts illustrate the sell-side ratings and price targets for Spotify.

What to do with the stock:

We continue to view Spotify as a challenged business. Spotify continues to face enormous headwinds, particularly associated with the macro and intense competition in various countries. With the world in turmoil and the advertising business challenge, we believe Spotify stock is at the risk of continued sell-off. We believe Spotify is still under pressure from the global macroeconomic environment and intense competition in developed and emerging economies. While we believe the company can achieve subscription growth in 3Q22, we are not optimistic about Spotify’s ability to generate meaningful and lasting profitability. We do not see the stock recovering meaningfully in the near term. We recommend investors exit the stock at current levels.

Be the first to comment