stockcam

Thesis

The technology sector has been hit hard during the 2022 stock market downturn. Especially, Internet-focused, fast-growth stocks like Spotify Technology S.A. (NYSE:SPOT) have seen their market capitalization retreating by more than 60% YTD. While growth prospects for the company appear more moderate, they are still attractive. However, Spotify is accumulating losses and is not expected to show a positive bottom line in the short term. In this analysis, the financial performance of Spotify is examined, while a more thorough look is aimed at the company’s valuation attractiveness.

Growing the Business

The United States music streaming industry has seen accelerated growth and has tripled in size since 2016, reaching over $12B in 2021. Streaming currently accounts for over 80% of music revenue. Source.

Over the past years, Spotify has maintained a market leader (app. 33% share) position in music and podcast streaming despite facing intense competition. The technology giants Apple (AAPL) and Amazon (AMZN) trail Spotify in terms of market share. Other competitors include YouTube, Tidal, SoundCloud, and others. Competitive pressures are only expected to intensify going forward.

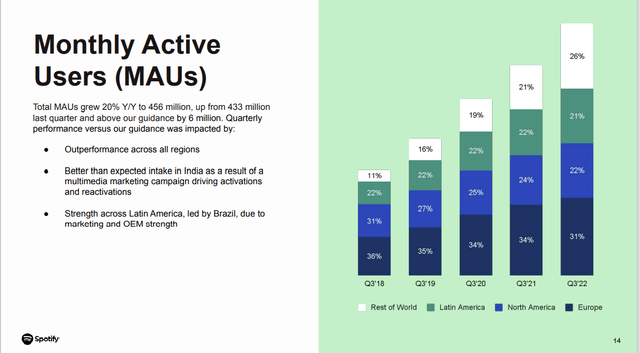

Spotify has also seen the greatest subscriber growth since 2016. Geographically, the company has also achieved great user diversification, with 31% of users originating in Europe (Spotify’s largest market), 22% in North America, 21% in Latin America, and 26% for the rest of the world. In Q3, 2022 SPOT recorded 20% annual user growth, slightly exceeding expectations.

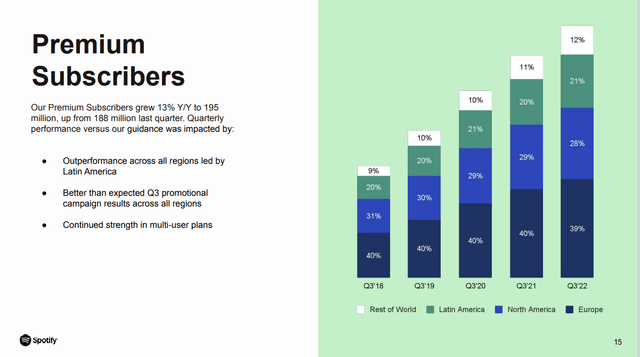

Premium (paying) subscribers are also increasing at a fast pace. As of the last quarter, Spotify recorded 13% YoY growth, outperforming across all geographic segments. The largest growth opportunity ahead, remains in developing countries, especially in Asia. Paying subscribers provide the recurring revenue streams the company counts on to improve profitability and deliver strong margins and shareholder returns. For Q4 2022, the company expects to add 23M new users and 7M new premium subscribers.

Financial Performance

Spotify’s business model relies on ad revenue from non-paying subscribers and subscription revenue from premium users. Revenue has grown at a 20.6% CAGR over the past few years, with growth expected to moderate going forward. Profitability remains the largest concern for the company, as gross margins stand below most tech competitors at 25%. SPOT continues to record operating losses, with SG&A and R&D expenses remaining disproportionately high compared to revenue. The foreign exchange rates impact (negative) has also been significant over the past year, as the company collects a large amount of revenue outside the United States.

On the balance sheet side, Spotify maintains a large cash & equivalents balance of $3.6B (around 25% of market cap), which coupled with a current ratio of 1.3x reassures that there are no liquidity concerns. The company also has a relatively low long-term debt balance of $1.2B. One concern that arises when looking into SPOT’s financials is the increasing number of shares outstanding. More specifically, the company has added to its share count more than 40M shares since 2016 (193M shares outstanding as of the last filing), essentially diluting current stockholders.

The Current Valuation Case

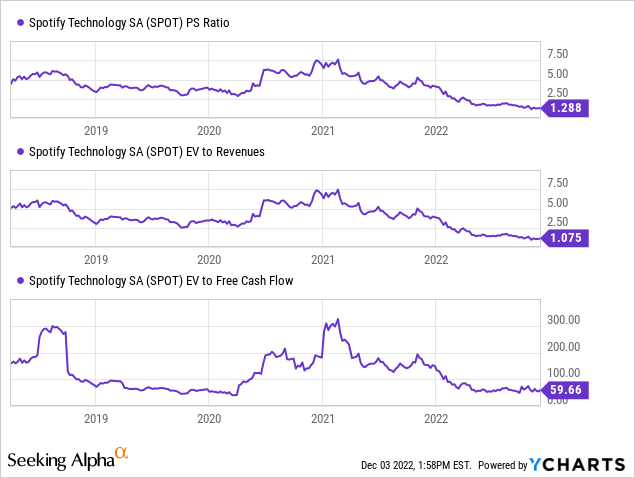

Given the company’s lack of net profits and very low operating income, valuing Spotify on a multiple basis becomes increasingly hard. Moreover, the company produces very little Free Cash Flow (“FCF”), and as a result, exhibits very high P/FCF and EV/FCF ratios that are effectively unreliable valuation indicators. On a more reliable, P/S ratio basis, Spotify has become relatively inexpensive compared to five-year average multiples. SPOT currently trades at a 1.3x P/S multiple, when just a year ago the stock was valued at around 6x P/S. Of course, the stock’s massive decline in 2022 has inevitably led to this valuation contraction. It remains to be seen whether multiples across the technology sector are bound to remain lower as the stock markets struggle to recover.

Forward Look at Valuation

Despite Spotify’s significant valuation multiple declines, it is important to aim the focus towards the future. Given the company’s growth prospects and current financial position, the Price/Sales ratio was selected to conduct a forward valuation analysis.

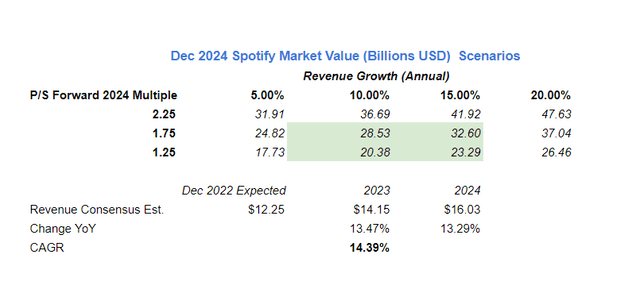

Focusing on the Prices/Sales ratio, I will attempt to project potential upside for the stock through the end of 2024, by employing a scenario-analysis, in an effort to embrace the uncertainty that surrounds the company. Both multiple expansion and contraction were embedded into the scenarios. Spotify currently trades at a 1.3x forward Price/Sales multiple, with a $15.34B Market Cap. Revenue growth, as shown below, represents average annual growth estimates for 2023 and 2024.

Author’s research, Seeking Alpha (estimates)

- Bullish Case: The company beats growth expectations and grows Revenue at 15-20% per annum rate. In a best-case scenario that the P/S ratio expands to 2.25x, the company will be trading at a $40-47B Market cap by the end of 2024, representing a total 170-200% upside. If the P/S multiple stays at a more conservative 1.75x, Spotify will maintain a $32-37B Market cap, still implying a total expected 125% upside.

- Base Case: Spotify meets growth expectations and grows revenue at a 10-15% per annum rate. With a market valuation that will range between 20 and 32B, Spotify’s upside is still attractive, especially if the company somewhat expands its current valuation multiples. Maximum potential upside, assuming a 1.75x multiple sits at 105%, while a lower forward multiple of 1.25x at the end of the period, offers a respectable, minimum expected 35% potential upside.

- Bearish Case: The company fails to meet growth expectations, but still grows revenue at 5-10% annually. In this case, at a 1.75x or even a 1.25x P/S multiple in 2023 there is still some room for gains, while at lower multiples, downside potential starts creeping in. It is important to mention that in the case that P/S multiples deteriorate further downside for Spotify looks much worse.

To summarize, assuming that Spotify’s P/S ratio stays at current levels or even rise, if the company manages to meet growth expectations, there is significant potential upside for investors. Although current revenue estimates do not seem exaggerated and shouldn’t be terribly hard to achieve, still the company would have to show a clearer path towards profitability in order to gain investors’ trust.

Some Important Risk Factors

Slowing subscriber growth is a major risk factor for Spotify. As competition intensifies, so does the fight for market share. Stalled subscriber growth translates directly into revenue stagnation, making the path towards sustainable profitability more difficult. Especially when considering the platforms and companies that Spotify competes with (Apple, Amazon, YouTube, and others), it is easy to see a scenario where the company just fails to fend off its competitors.

Consumer spending on apps like Spotify is highly discretionary and cyclical in nature, and as many analysts expect a recession in 2023, Spotify’s subscriber and revenue growth is once again at risk.

The operating risk is also high for Spotify, as the company continues to increase expenses and fails to reach profitability. On a long-term basis, valid sustainability concerns also arise.

Final Thoughts

After all things are considered, the massive stock price retraction for Spotify in 2022 has presented potential investors with an interesting opportunity. That said, in my view, SPOT also represents a high-risk choice given the profitability struggles the company is facing and other risk factors as well. For this reason, I would rate the stock as a hold.

Be the first to comment