Just_Super

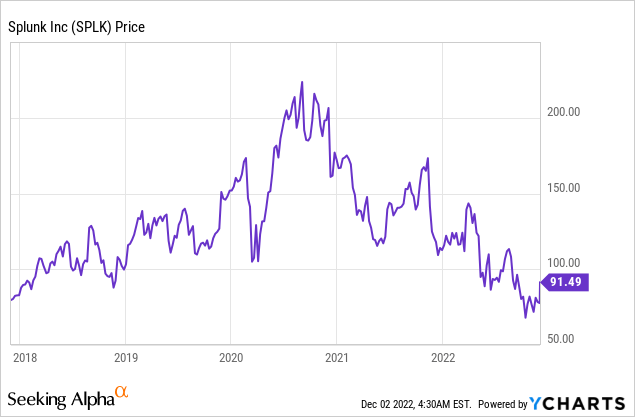

Splunk (NASDAQ:SPLK) is a leader in IT Oberservability for hybrid cloud environments. The company is poised to benefit from secular growth trends across Big Data, Hybrid Cloud, Cybersecurity and more. The Big Data industry alone was valued at $163 billion in 2021 and is forecasted to grow at a rapid 11% compounded annual growth rate to $273.3 billion by 2026. With many connected devices and “exabytes” of data being produced, analyzing it all is necessary and that’s where Splunk’s platform helps. The company produced strong financial results for the third quarter of fiscal year 2023, as it beat both revenue and earnings growth estimates. In this post I’m going to break down these financial results in granular detail, let’s dive in.

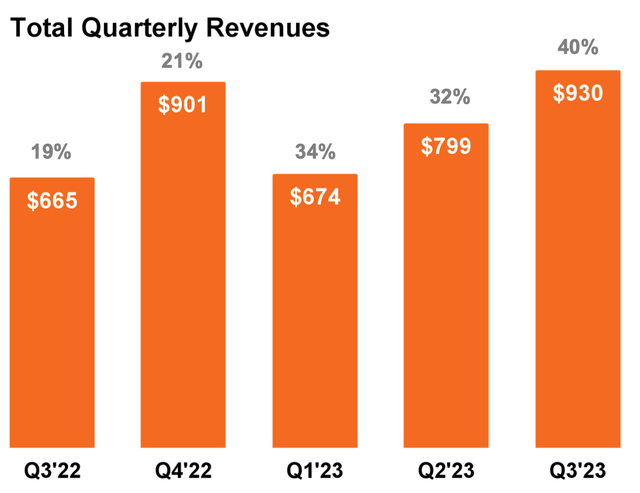

Strong Third Quarter Financials

Splunk reported strong financial results for the third quarter of fiscal year 2023. Revenue was $930 million which increased by a rapid 40% year over year and beat analyst expectations by $83 million.

This revenue growth was driven by strong term license demand from existing customers, which resulted in account expansion to Splunk’s larger platform, which I will discuss next.

Cybersecurity Expansion

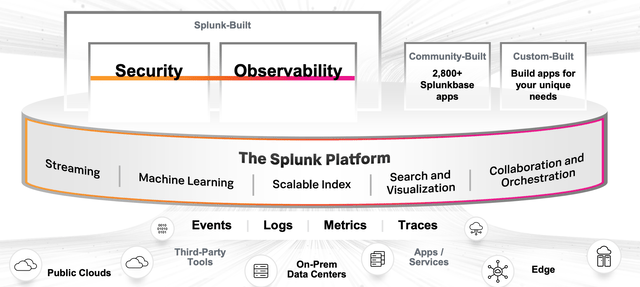

Splunk is a Gartner Magic Quadrant leader in Security Information and Event Management (SIEM) category. The platform is basically used to monitor, analyze and search through data produced by IT systems. Data is often produced in silos across public cloud providers, on-premises data centers, and Internet of Things [IoT] devices. Splunk’s mission is to turn this “data into doing”, via two main functions “Observability” with its dashboards and “Security”. Splunk was ranked number one in IDC market share rating for IT operation and analytics software. The company has also expanded the security product of the business which now includes the ability to use machine learning to track the “security posture” of cybersecurity companies and help to stop threats.

Over the past couple of years, Splunk has gradually transformed its business model from a premium “ingest base” pricing model to a workload-based, pay-as-you-use model. In the legacy model, all data was charged at the same rate, and thus even low-value data can cost a business customer lots of money. However, in a workload-based model, the pricing is tailored to specific use cases. I believe this is a positive change as tailored consumption-based models are popular with customers and rapidly growing technology providers such as Amazon (AMZN) Web Services [AWS]. In related news, Splunk has also announced a five-year extension of its collaboration agreement with the world’s largest cloud infrastructure provider AWS.

Financials Continued

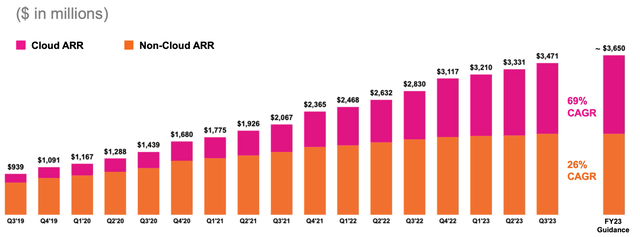

Back to the Financials, Splunk reported Cloud Annual Recurring Revenue [ARR] of $3.5 billion at a rapid 69% compounded annual growth rate. Splunk has positioned itself as a key partner for companies such as the Nasdaq which are transforming to the cloud. The beauty of Splunk’s platform is it secures companies that operate with a hybrid cloud model extremely well. This is great news given one study indicates that 96% of enterprises are pursuing a hybrid cloud model for digital transformation.

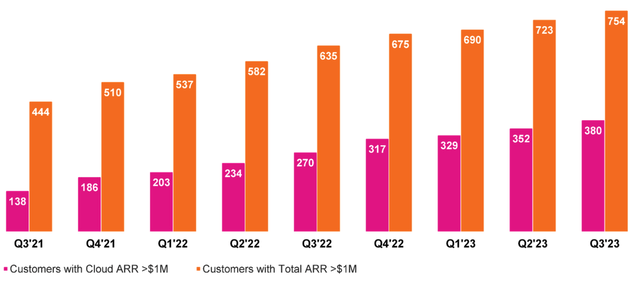

The company has also continued to grow “upmarket” as it increased its Customers with ARR over $1 million by 19% YoY to 754. A notable win was a 3-year multimillion-dollar contract with a department of the U.S federal government, related to national defense. Splunk’s Annual Government Summit each year in Washington D.C as the business focuses on drumming up new government customers.

In the third quarter, Splunk also signed a multimillion-dollar renewal and expansion agreement with a major telecommunications company based in Japan. In addition, the company expanded its account with a top Fortune 100 retailer.

Customers with ARR over $1 million (Q3,FY23 report)

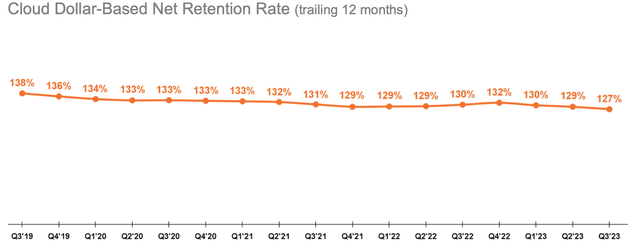

Splunk has a super high dollar-based net retention rate of 127% which means its customers are finding the platform “sticky” and spending more.

Retention Rate (Q3,FY23 report)

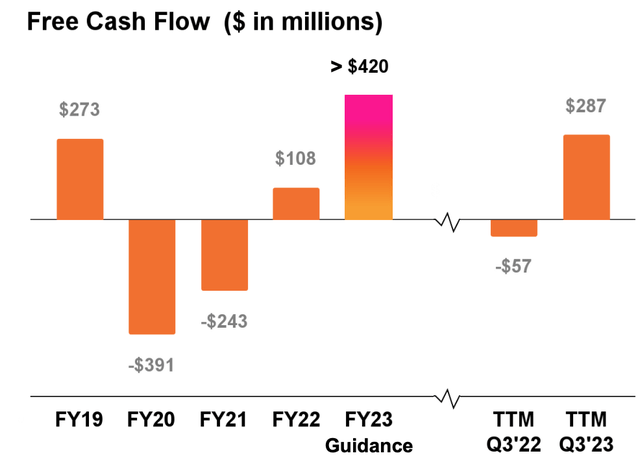

The company also reported solid free cash flow of $287 million in the trailing 12 months, up substantially from the negative $57 million reported in the prior year.

This free cash flow was driven by strong revenue growth and expense reductions. In Q3, FY23 Splunk reported a super high Gross margin of 82% which has increased from 76.6% in the prior year. This was driven by ongoing efficiency improvements with its cloud infrastructure partners such as AWS.

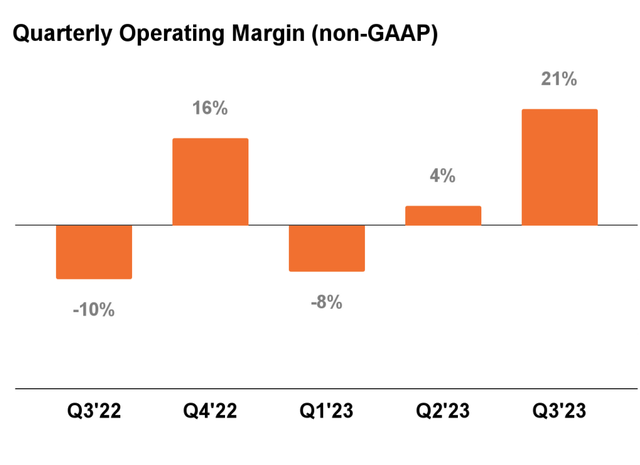

The business also reported a solid Non-GAAP operating margin of 21% which has increased substantially from the negative 10% reported in the prior year. Non-GAAP EPS was $0.83 which beat analyst estimates by $0.58. So far the business has reported a $30 million sequential decrease in total Operating expenses and a year-over-year decrease of 2%. This was driven by a reduction in customer-facing travel, hiring efficiency improvements, and office space consolidation.

Splunk has a robust balance sheet with $1.757 billion in cash and short-term investments. The company does have fairly high long-term debt of ~$3 billion but just $775 million of this is short-term debt.

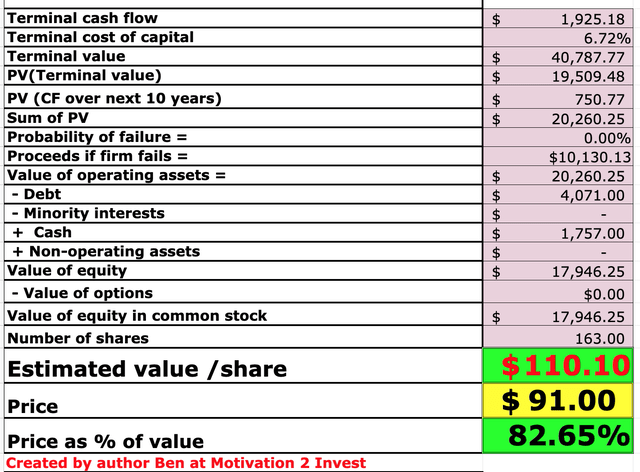

Advanced Valuation

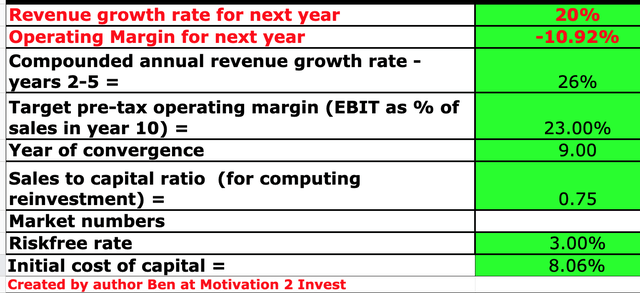

In order to value Splunk I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a conservative 20% revenue growth for next year, which is slower than the prior growth rate of 40%. I am being prudent with this estimate given the macroeconomic environment and the number of account expansion wins as opposed to new customer wins in the quarter. However, in years 2 to 5, I have forecasted revenue growth to accelerate to 26% per year.

Splunk stock valuation 1 (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation I have capitalized R&D expenses which has lifted net income. In addition, I have forecasted growth in the operating margin to 23% over the next 9 years.

Splunk stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $110 per share, the stock is trading at $91 per share and thus is 17% undervalued.

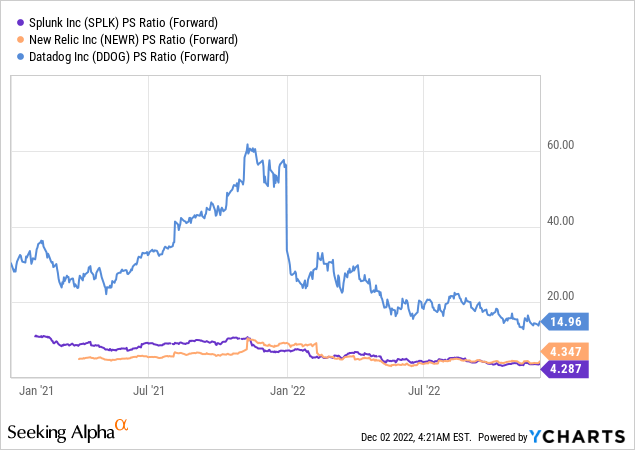

As an extra data point Splunk trades at a Price to Sales ratio = 4.29 which is 51% cheaper than its 5-year average. The stock trades at a similar valuation to close competitor New Relic (NEWR), but is substantially cheaper than industry peer Datadog (DDOG).

Risks

Longer Sales Cycles/Recession

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. Therefore I am expecting longer sales cycles as business decision-makers become more cautious and budgets are slashed.

Final Thoughts

Splunk is a tremendous company that has continued to produce solid financial results despite the macroeconomic headwinds. The platform is poised to benefit from the growth in the cybersecurity industry and the stock appears undervalued intrinsically.

Be the first to comment