3283197d_273/iStock via Getty Images

Thesis: Can’t Get No Respect

Spirit Realty Capital (SRC) is a diversified net lease real estate investment trust (“REIT”) that has undergone a massive transformation over the last several years.

SRC used to be a low-quality REIT that took excessive (and, frankly, stupid) risk, such as keeping Shopko as its largest tenant even long after the problems with the retailer became apparent. It wasn’t that big of a surprise when, in early 2019, Shopko went bankrupt – again, still as SRC’s largest tenant. Shopko closed all stores by the summer of 2019.

The old Spirit Realty was a dumpster fire. No argument there.

But after spinning off and subsequently selling its undesired properties, resetting the dividend at a sustainable (lower) level, appointing a new management team, strengthening the balance sheet, and acquiring $2.1 billion of net lease properties over the last two years, the old Spirit Realty is gone.

The new SRC, led by CEO Jackson Hsieh, is a new creation, practically a three-year-old REIT. It has taken all the right steps, but the market is still giving it the cold shoulder.

SRC’s current stock price is sitting at around 13.8x 2021 AFFO and 12.8x estimated 2022 AFFO. In case you couldn’t tell from the AFFO multiple differential from 2021 to 2022, SRC has guided for ~8% AFFO/share growth this year. SRC just can’t get no respect.

What more do you want, Mr. Market?

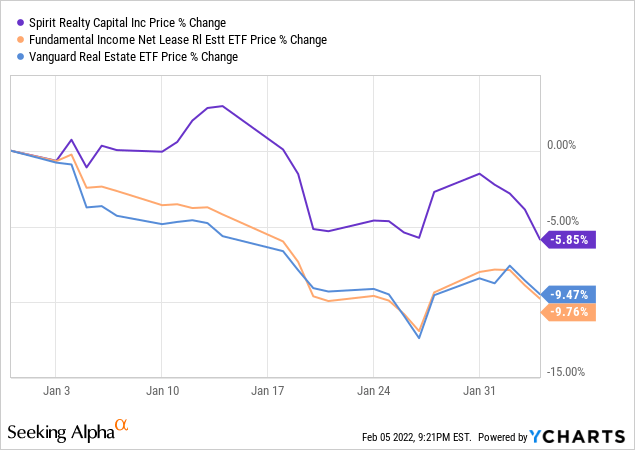

The good news is that SRC has sold off less than the net lease REIT index (NETL) and broader REIT index (VNQ) during the current selloff:

Does this mean anything? Have SRC’s fortunes turned around?

Candidly, I’m not convinced yet. I am starting to believe that SRC could master Vivaldi on the violin, publish peer-reviewed papers on quantum mechanics, and discover a cure for cancer, and the market would still be unimpressed.

I’m exaggerating, but only a little bit. Based on 2021 numbers, SRC’s AFFO yield (AFFO / market cap) is 7.25%, and its dividend yield is 5.6%. This is a punishingly high cost of equity that limits the kind of properties SRC can acquire accretively.

Granted, perceptions are reality, and the perception of SRC as a low-quality REIT has lifted its cost of equity and thereby pushed the REIT out on the risk curve in order to find profitable investments.

That said, in the case of SRC, I continue to believe that reality will eventually become the market’s perception, and that SRC will earn the higher AFFO multiple (and lower cost of equity) that the REIT deserves. Until then, shareholders’ woes can be soothed by the generous dividend.

Why SRC Is A Top Net Lease Pick In 2022

I’ve written about SRC multiple times in the last year, and the point of this article is not to rehash previous information. In my November 24th article on SRC, I argued that the REIT is “Unfairly Maligned By The Market” and pointed out that:

- SRC’s dividend was raised by 2% in the third quarter

- Q3 AFFO per share rose 16.7% year-over-year

- Rent leakage (the amount of contractual rent permanently uncollected) sat at 0.1%

- Occupancy sits at 99.7%

- SRC continues to source appropriately priced acquisition opportunities, most recently country clubs operated by ClubCorp

- Industrial properties make up 17.5% of SRC’s portfolio by base rent

- Nearly 44% of properties operate under a master lease, and the weighted average rent escalation sits at 1.8%

- Net debt to EBITDA is comfortable at 5.0x, and there are no material debt maturities until 2026

- SRC has investment grade (BBB/Baa2) credit ratings and a weighted average interest rate on debt of ~3.2%

The point of this article is to show why SRC is a top pick for 2022, given all the above data, including the fact that the market continues to give the REIT the cold shoulder.

In case you need more evidence that the market views SRC as a low-quality REIT, here’s how SRC’s dividend yield compares to other net lease REITs with BBB credit ratings, listed from lowest to highest:

- Agree Realty Corporation (ADC) – 4.3%

- Broadstone Net Lease (BNL) – 4.8%

- STORE Capital (STOR) – 5.1%

- W. P. Carey (WPC) – 5.6%

- Spirit Realty Capital (SRC) – 5.62%

SRC has the highest dividend yield (and highest cost of equity more broadly) among its fellow BBB rated net lease REITs. Does SRC deserve it? No. Let me show you why.

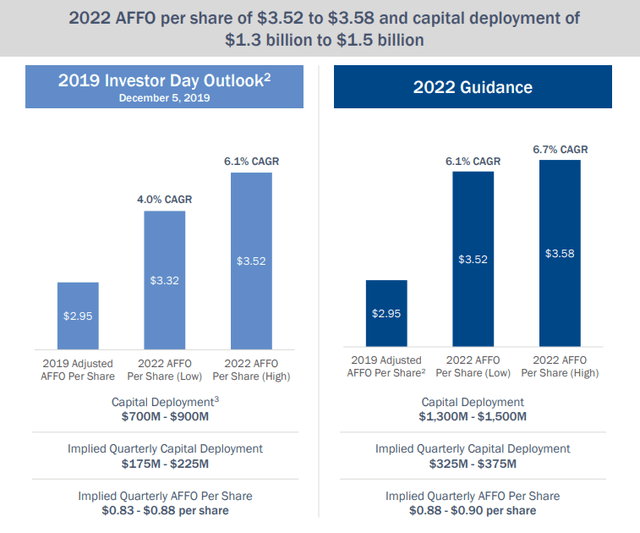

First off, note that SRC is growing. REITs priced at AFFO multiples of 13-14x AFFO tend to struggle with growth, but this is not the case with SRC. In fact, SRC has performed even better than management thought it would back in December 2019.

Guidance for 2022 has been lifted, as rent collections have surprised to the upside and attractive acquisition opportunities have presented themselves.

If a chart is worth a thousand words, the following image is worth four thousand words.

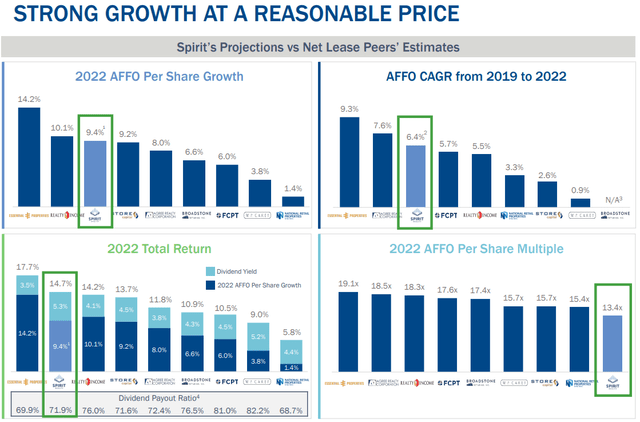

Notice some important points about the above image:

- According to FactSet consensus data, SRC boasts the third highest expected AFFO/share growth among its net lease peers, behind only Essential Properties Realty Trust (EPRT) and Realty Income (O). But EPRT is much smaller than SRC, and O is enjoying a one-time bump from the acquisition of Vereit.

- The top right chart shows that 2022 is not an outlier year of growth for SRC. From 2019 through 2022, SRC’s compound annual growth rate is expected to be the third highest among net lease REITs, behind EPRT and Agree Realty Corporation.

- Considering both dividend yield and AFFO/share growth, SRC’s “total return” for 2022 is the second highest among peers, behind only EPRT.

- And yet, SRC’s AFFO multiple is the lowest among its net lease peers. How does this make sense?

Unrelated to SRC, I’m taken aback by FactSet’s estimate of 14.2% 2022 AFFO/share growth for EPRT. The stock price drop has rendered a dividend yield over 4% for EPRT, making it a very attractive investment opportunity.

But the market seems to know about EPRT’s ability to grow. On the other hand, the market is sleeping on SRC.

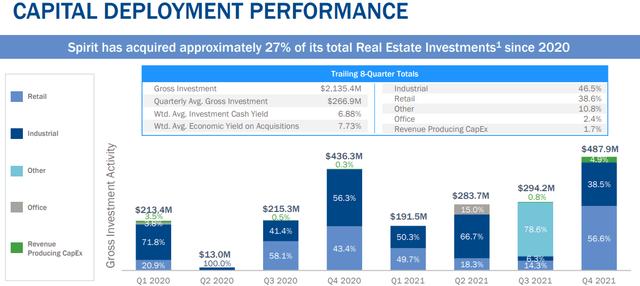

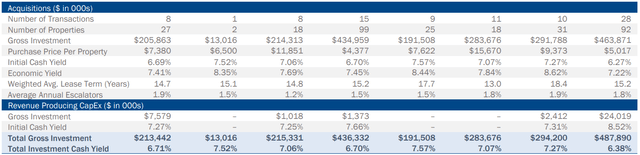

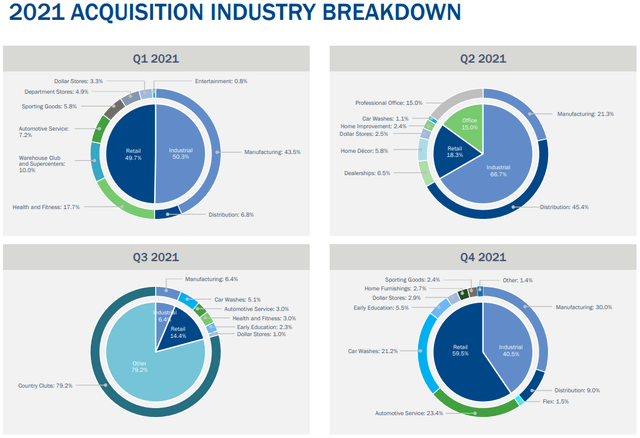

Just take a look at SRC’s impressive investment volume in 2021, totaling ~$1.26 billion with a large chunk of that closing in the fourth quarter.

Notice also in the above image that almost half (46.5%) of acquisitions over the past two years have been of industrial properties. These are not the average industrial net lease property with a cap rate of 5.25%, and they are certainly not prime industrial net lease properties priced at an average 4.4% cap rate.

In Q4, SRC’s ~$464 million of acquisitions across 92 properties averaged an initial cash cap rate of 6.27%, a lease term of 15.2 years, and an annual rent escalation of 1.8%.

Notice also that the average initial cap rate (and “economic yield” incorporating future rent increases) compressed meaningfully in the fourth quarter. The initial cap rate declined a full percentage point quarter-over-quarter. This could mean that SRC raised its acquisition quality, or it could indicate something broader about cap rate compression.

This average annual rent escalation of 1.8% is one of the highest in the net lease REIT sector, and it’s interesting to note that, as of Q3 2021, 16.5% of SRC’s leases featured CPI-related rent escalations. Only around 10% of leases are flat (no rent escalations). This affords SRC at least some inflation protection.

When looking at Q4 acquisitions, we find it split roughly 60% retail and 40% industrial.

Most of Q4 retail acquisitions were of automotive care and car wash properties, while most industrial acquisitions were of manufacturing facilities.

To my mind, SRC’s acquisitions seem reminiscent of the tenant industries prominent in the portfolios of EPRT, STOR, and National Retail Properties (NNN), all of which target non-investment grade tenants in order to generate higher yields.

In mid-January, SRC secured a fortuitously timed forward equity agreement for 8.2 million shares locked in at $47.60 per share for gross proceeds of $390.3 million. This price represents a cash cost of equity of 5.36%. If SRC combined that with some new debt with around a 3.2% interest rate, the REIT’s weighted average cash cost of capital (“WACC”) would be around 4.6%. That marks a spread of about 1.7 points between Q4 cap rates and the current cash WACC.

Bottom Line

From my perspective, SRC is doing everything right. It is acquiring quality properties that fit its investment criteria in a rapid yet disciplined way. It is maintaining a strong balance sheet. It is increasing its portfolio exposure to the hot industrial sector. It is increasing its exposure to master leases and also raising its portfolio-wide annual rent escalation.

And these efforts are bearing fruit. AFFO per share growth has been strong in recent years and should remain strong in 2022. SRC is a cash flow machine that should continue to produce both organic and external growth for years to come.

Management have proven their ability to generate strong returns even with one hand tied behind their backs, so to speak. SRC’s cost of capital disadvantage is a continued frustration, though management has made do with what they have.

If the market comes to recognize SRC’s quality and rewards the REIT with a commensurate valuation, then shareholder returns will be fantastic for buyers around today’s price.

Be the first to comment