zorandimzr/iStock via Getty Images

Spire (NYSE:SR) is the fifth largest U.S. gas utility, serving 1.7m residences and businesses. It is a fairly straightforward gas utility with a stable business model of utilities and some marketing activities. While it has periods of under- and over-valuation, the current price levels suggest relatively low rates of return in the near term, suggesting that risk-averse investors might simply hold this stock and not add to their positions at this price, as there is no margin of safety at these prices.

The company has two primary segments: Gas Utility and Gas Marketing. The Gas Utility segment includes the crucial regulated distribution operations through five gas utilities throughout Alabama, Mississippi, and Missouri. It contributed about 15x more revenue than the Gas Marketing segment, which operates across the entire U.S.

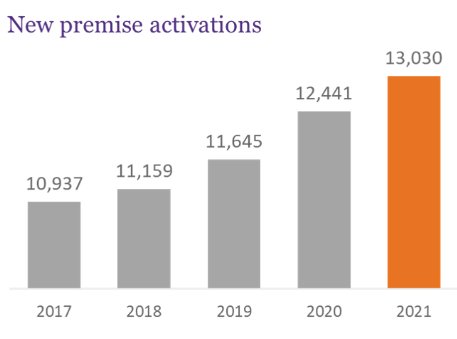

One of the favorable points about the mix of segments is that most of the business, about 90%, operates in the regulated market. This means that there will never be excessive profits but, instead, we might expect slow and steady growth, as exemplified by new premise activations (Figure 1).

Figure 1. New premise connections from 2017 to 2021 show strong growth (Spire Energy Investor Relations)

Reasons to like Spire

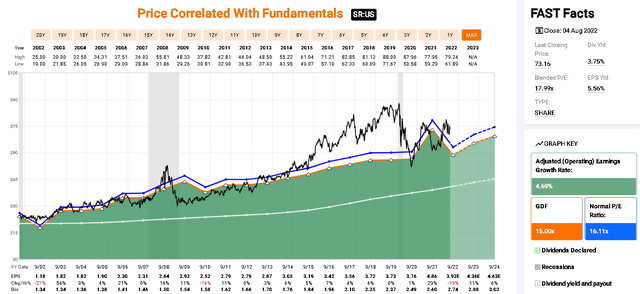

Spire Energy has a long history of dividend payments to shareholders, a long history of increasing earnings, and relative stability (Figure 5).

They focus on 5-7% long-term EPS growth.

They have a commitment to organic growth.

There is a long-standing commitment to enhanced governance, with greater representation at senior levels of the company that will more accurately reflect the wider society they operate in (Figure 2).

Figure 2. Governance changes (Spire 2021 Sustainability Report)

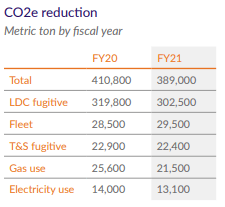

Besides a strong concern for communities, ESG concerns remain a focus. When considering environmental issues, this is also ‘good business’ for a firm like Spire, as it will reduce costs and waste. For example, they have made efforts to decrease carbon dioxide (CO2) emissions from 2020 to 2021 (Figure 3) and we might expect to see further decreases in time.

Figure 3. CO2 reduction efforts (Spire 2021 Sustainability Report)

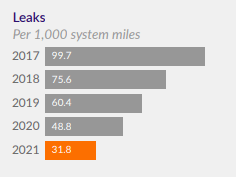

Leaks on the pipe network are also an important business and environmental issue. We can see from Figure 4 that from 2017 to 2021, the prevalence of leaks has decreased by about two-thirds. This is a good effort that will reduce waste for the firm which should, with time, contribute to stronger earnings.

Figure 4. Leak reductions (Spire 2021 Sustainability Report)

Points about Spire that make me wary

There are two points of caution for me as I look at the company. The first point has been the Spire STL Pipeline, running 65 miles (105 kilometers).

The U.S. Supreme Court had declined to hear the Spire Energy appeal in April this year, forcing Spire to seek further approval. The Federal Energy Regulatory Commission (FERC) issued a positive Environmental Impact Statement (EIS) on June 16 this year.

While this is an important point, it is a relatively small component of the overall Spire Energy portfolio.

The second consideration is debt. They noted in the Q3 2022 results that there was $709.2 million in short-term debt on June 30, 2022, up from $461.0 million a year ago. However, on the whole, Spire appears able to service the debt, but this is certainly something for investors to consider as we continue to see higher inflation and rising interest rates. In particular, over the last decade, they have taken on increasing amounts of debt, with the total debt rising from $404.5 million in September 2012 to $3,727 million in September 2021.

Valuation

When I think about investing in utilities, I like to see slow and steady growth over the years, with gradual increases in earnings and dividends. From Figure 5, we can see that Spire Energy exemplifies the type of relationships I like to see over time. The prices have never been too far out of sync with earnings, fluctuating from about 11x PE in 2009 to 23x in 2019.

Figure 5. Spire Energy past stock price and PE ratios (Historical graph – Copyright © 2022, F.A.S.T. Graphs)

The company has the type of profile and historical record that I appreciate as a cautious investor.

Dividends and growth

Spire Energy is rightly proud of its track record of 19 years of dividend growth. The present yield of 3.7% is not, by itself, sufficient for me to get excited about. But, coupled with their history of dividend increases, it is important to recognize that this is a good vehicle for investors looking for income.

Coupled with the moderate current yield, SR offers a reasonable 5-year DGR of 5.5%. This is solid and despite slightly higher dividend increases in 2017 and 2018 of about 7%, the DGR has dropped to about 4 to 5% per year in recent years.

An investment of $10,000 in 2002, into both SPY and SR would have given approximately the same CAGR of 7.54% for SR and 7.14% for SPY, while SR substantially out-performed SPY in terms of dividends, returning $15,351 compared to the $6,092 in dividends from SPY (Source: FAST Graphs calculator). This suggests that SR is a solid compounder that would now give a 10.7% yield on cost.

Analyst estimates and valuation

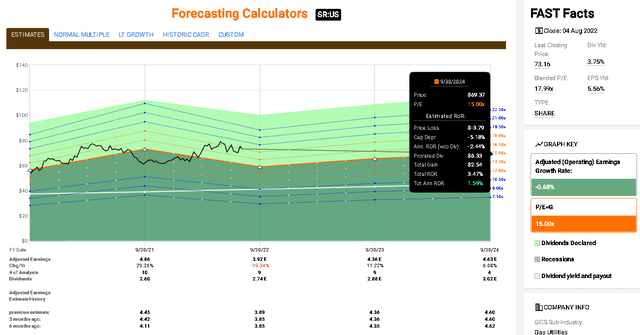

As we can see in Figure 5, there is a long history of steady growth with plans for future organic growth. While the prices were high relative to earnings from 2015 to 2020 (as shown by the black price line in Figure 5 exceeding the orange 15x PE line during this period), there are also periods of lower PE multiples, such as 2009 to 2012, even reaching as low as 11x or 12x compared to the blended PE now of 18x (Figure 6, FAST Facts).

I like to assess firms in the near term based on the relationship between stock prices and earnings. I assume that the PE ratio will revert to a more normal/reasonable range, either with prices declining to 15x or increasing to 15x if they are too low. Very often, I will use a 15x PE as a target with a higher multiple for high-growth stocks and a lower multiple for those facing challenges or, in particular, industries facing challenges or uncertainty.

Considering the valuation method, then, there are two questions. The first is what is the estimate of the future earnings and are these reasonable? The analysts have a very good handle on earnings estimates, with the FactSet analysts having a perfect one- and a two-year record of earnings estimates (Source: FAST Graphs). In Figure 6, we can also look at the analyst earnings revisions over time. We can see that they are reasonably stable or with revisions upwards, more so than I have seen in many other firms. Therefore, I have confidence in these earnings estimates for 2024.

The next question is, what is an appropriate PE ratio? While I know that many of the U.S. utility firms are trading at higher multiples, SR is trading at an approximately 18x blended PE multiple. This is not egregiously excessive, in my mind, but it is also higher than the 15x that I would want to see for a slow and steady compounder like this. Indeed, with the orange line on Figure 6 being the 15x reference point, the black lines were below this multiple for the late 2021 and early 2022 months, suggesting that would have been an ideal time to buy. The dangers of buying at this admittedly small premium of 18x PE ratio are illustrated with the black calculation box in Figure 6, showing that if the prices shift back to a 15x relationship with the forecast earnings in 2024, then the total annualized rate of return will be only 1.59%, which includes the dividends.

Figure 6. Spire Energy’s PE ratios and price forecasts to 2024 (Historical graph – Copyright © 2022, F.A.S.T. Graphs)

From these price levels, therefore, we can assess that there is no meaningful margin of safety. Price declines could occur, taking the price back to a 15x PE and leading to a reasonable loss of capital.

As a further check on the valuation, we can look at a dividend discount model. Starting with annual dividends of $2.76, a 5% DGR for the first ten years, and then 4% thereafter, with a 10% target rate of return for this investment, and I get a buy-now below $51.60.

Verdict and closing thoughts

I like Spire Energy – it has many fine attributes and still many years of strong growth ahead. However, while I think this is a fine and stable company with good prospects, I feel that the present price is slightly too rich for an entry.

As a result, I would rate this as a hold and might look for an entry if prices decline to about 15x in the coming months, at a level of around $60 per share. From this price, I would expect a reasonable opportunity for my investment in Spire to grow with the business earnings over time, without as much risk to the downside that I see in the business at the moment.

Be the first to comment