baona/iStock via Getty Images

This morning Spectrum Brands (NYSE:SPB) announced that Assa Abloy (OTCPK:ASAZY) has agreed to divest several assets which should facilitate the completion of the sale of Spectrum’s HHI business. HHI is a residential locks business in the US which Spectrum agreed to sell to Assa in 4Q21 for $4.3 billion (~$3.5 billion net to Spectrum after fees & taxes). The transaction has been challenged in a lawsuit by the DOJ which sought to halt the deal due to competition concerns.

In its lawsuit the DOJ stated that in combining HHI with Assa’s existing business, the merger would limit competition in

– smart-locks

– premium mechanical door locks

In today’s announcement Assa announced a proposed sale of several assets to Fortune Brands (FBHS) of its Smart Residential locks business (Yale and August brands) in the US and Canada as well as its premium Emtek and Schaub brands. This transaction appears to assuage the DOJ’s competition concerns and should facilitate the closing of HHI to Assa resulting in net proceeds to Spectrum of ~$3.5 billion.

What could Spectrum be worth if the deal closes?

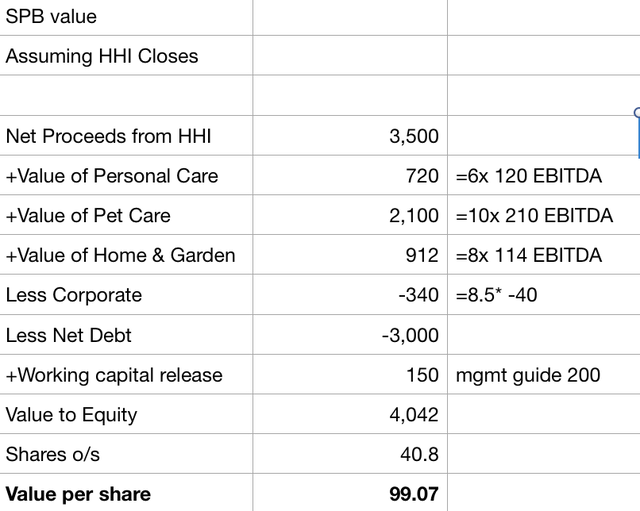

In my previous piece on Spectrum, I valued the company assuming that it was unable to complete the sale of HHI. In light of Assa’s divestiture plan, I now believe that the transaction is very likely to close. Here is my sum of the parts estimate assuming Spectrum receives net proceeds for $3.5 billion for HHI: I use the same segmental EBITDA estimates for the Personal Care, Pet Care, and Home & Garden businesses that I used last month. I have applied just a 6x EBITDA multiple to the Personal Care business which consists of the Remington, George Foreman, and Tristar brands (acquired earlier this year for $325 million).

Spectrum Sum of the Parts (Author Estimates)

Spectrum is looking to divest or spin-off this segment. Personal Care is the lowest quality business of the remaining three segments – it faces more competitive pressure, is more susceptible to input cost inflation, and has greater variability in end market demand (more discretionary).

The Pet Care business is the best of Spectrum’s remaining assets. Pet Care consists of leading brands in dog chews (Dingo, SmartBones, DreamBone), stain/odor removal (Nature’s Miracle), grooming (Furminator) as well as aquatics (Tetra). 80% of the business is consumables creating a stable revenue and EBITDA profile. With leading brands and stable and growing revenue/profitability, I see this segment being worth 9-11x EBITDA (I used the midpoint of 10x in the valuation above).

The Home & Garden segment consists of branded insect repellant (Cutter), insect control (Black Flag & Hotshot brand) and cleaning products (Rejuvinate brand). Earnings here are less stable than for the PetCare business – I ascribe an EBITDA multiple of 8x to the segment.

After adding the proceeds from the expected sale of HHI to the business units, adjusting for corporate expenses and working capital, I get a value of $99/ share for Spectrum which is 65% above the current (pre-market) price of $60 per share.

Conclusion

Assa’s divestitures are great news for Spectrum shareholders. As shown above, I see a near-term path to 65% upside if the deal closes. Even if the deal is somehow scuttled (unlikely in my view), as mentioned in my previous piece, I see $7/share in free cash flow which indicates 25-30% upside from the current price. This makes Spectrum a highly asymmetric investment.

Be the first to comment