Say-Cheese/iStock via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on August 1st, 2022.

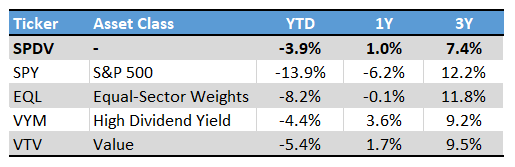

The AAM S&P 500 High Dividend Value ETF (NYSEARCA:SPDV) is an equal-weighted U.S. equity index fund, focusing on stocks with high dividend and free cash flow yields. SPDV’s strategy was unsuccessful in prior years, leading to moderate underperformance. Performance has improved these past few months, with the fund outperforming for the past year or so. SPDV’s above-average 3.4% yield and cheap valuation make the fund a buy.

SPDV – Basics

- Investment Manager: Advisors Asset Management

- Dividend Yield: 3.48%

- Expense Ratio: 0.29%

- Total Returns CAGR (Inception): 6.76%

SPDV – Overview

SPDV is a U.S. equity index ETF, tracking the S&P 500 Dividend & Free Cash Flow Yield Index. Said index differs from the broader S&P 500 index in three key ways:

- Sectors and securities are equally weighted, reducing tech exposure, while increasing exposure to old-economy industries like energy, materials, and real estate

- Focuses on stocks with above-average yields, resulting in a fund with an above-average 3.5% yield

- Focuses on stocks with high free cash flow yields, resulting in a fund with a comparatively cheap valuation, and hence greater potential capital gains

SPDV, as a fund and as an investment opportunity, is defined by the three points above. As such, let’s have a closer look at each of these.

Equal-Weight Sectors

SPDV invests in five different U.S. stocks from each relevant industry segment, subject to a basic set of liquidity, trading, size, turnover, etc., criteria. There are eleven different industry segments, so the fund is generally invested in 55 different securities, barring short-term positions during rebalancings and the like. SPDV’s diversified industry exposures and significant number of holdings make it a reasonably well-diversified fund, but diversification is definitely lower than average for a U.S. equity index fund, most of which invest in hundreds of holdings.

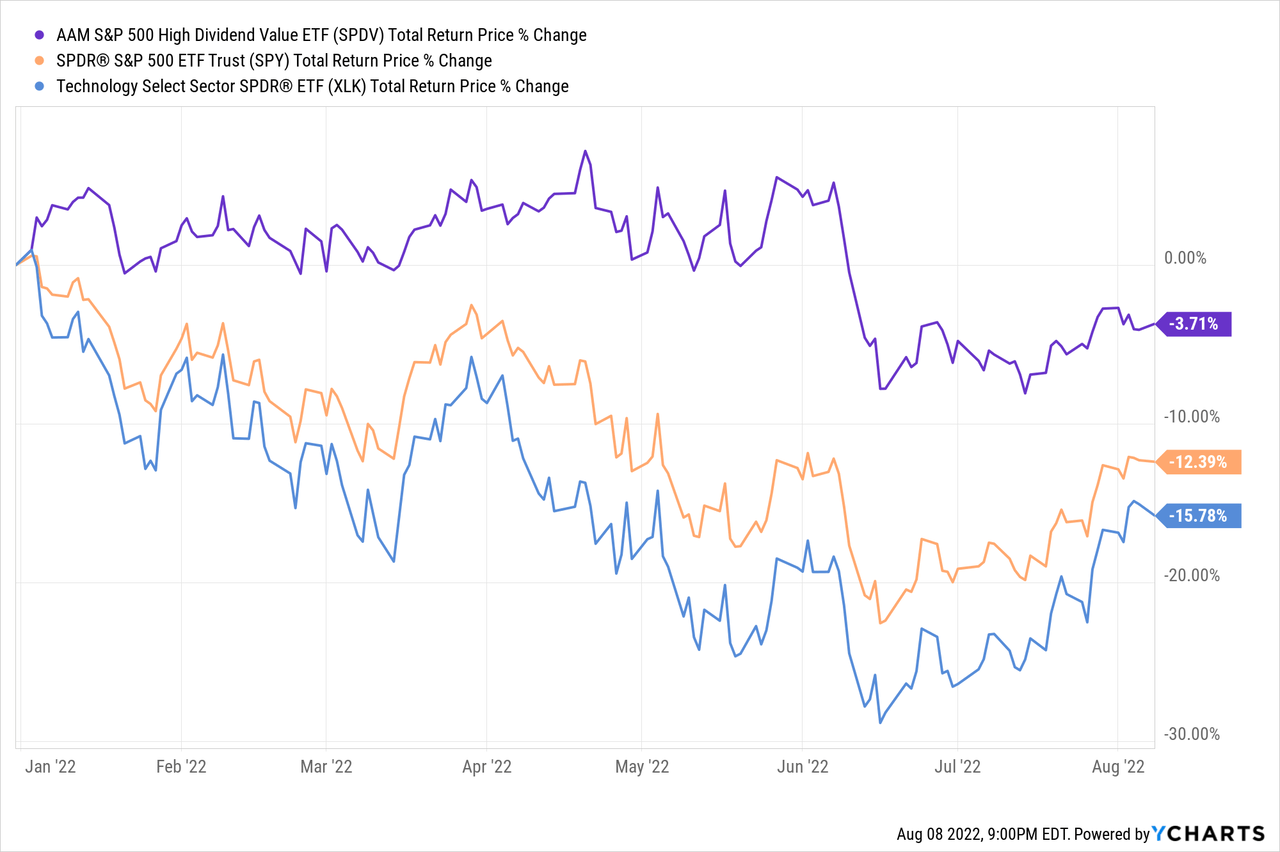

SPDV’s sectors are equal-weighted. Most equity indexes, including the S&P 500, are market-cap weighted, which has important implications for investors. The S&P 500 is massively overweight tech, due to the outsized influence of mega-cap tech companies, including Microsoft (MSFT) and Apple (AAPL). On the flipside, the S&P 500 tends to be underweight certain smaller, old-economy industries, including energy, materials, and real estate. SPDV’s industry weights are all the same, so the fund’s performance can sometimes materially differ from that of the S&P 500. SPDV tends to significantly outperform when tech underperforms, as has been the case YTD, during which tech valuations have (started) to normalize.

SPDV’s industry weights are quite different from those of the S&P 500 / most equity indexes, an important fact for investors to consider.

SPDV’s holdings are also equal-weighted, so the fund invests more heavily in mid-cap sector relative to the S&P 500.

SPDV’s holdings include most large, well-known non-tech companies, including Exxon (XOM), Pfizer (PFE), and Altria (MO). At the same time, the fund excludes most mega-cap tech companies, including Microsoft, Amazon (AMZN), and Google (GOOG), with the fund investing in smaller tech companies like Cisco (CSCO) and IBM (IBM) instead. SPDV’s exclusion of the mega-cap tech companies reduces diversification, at least relative to the S&P 500 and similar indexes. Excluding these companies is quite rare for a U.S. equity index fund, and important for investors to consider. Investors looking for significant diversification, exposure to the high-growth tech industry, or to these specific companies, should probably consider other funds.

High Dividend Yield

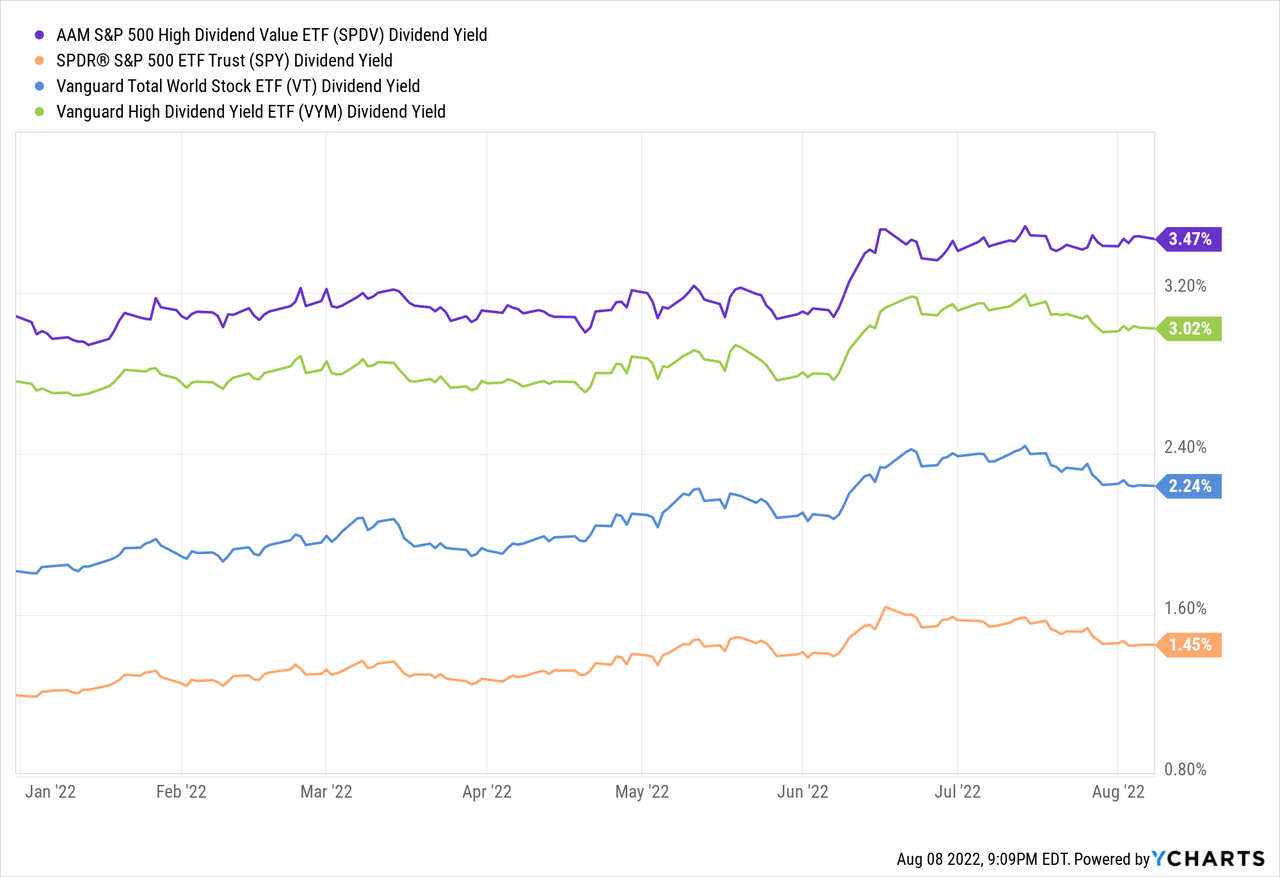

SPDV focuses on stocks with above-average dividend yields, leading to an above-average 3.5% yield for the fund. Although it is not a fantastic yield by any means, it is higher than average, and a benefit for SPDV and its investors.

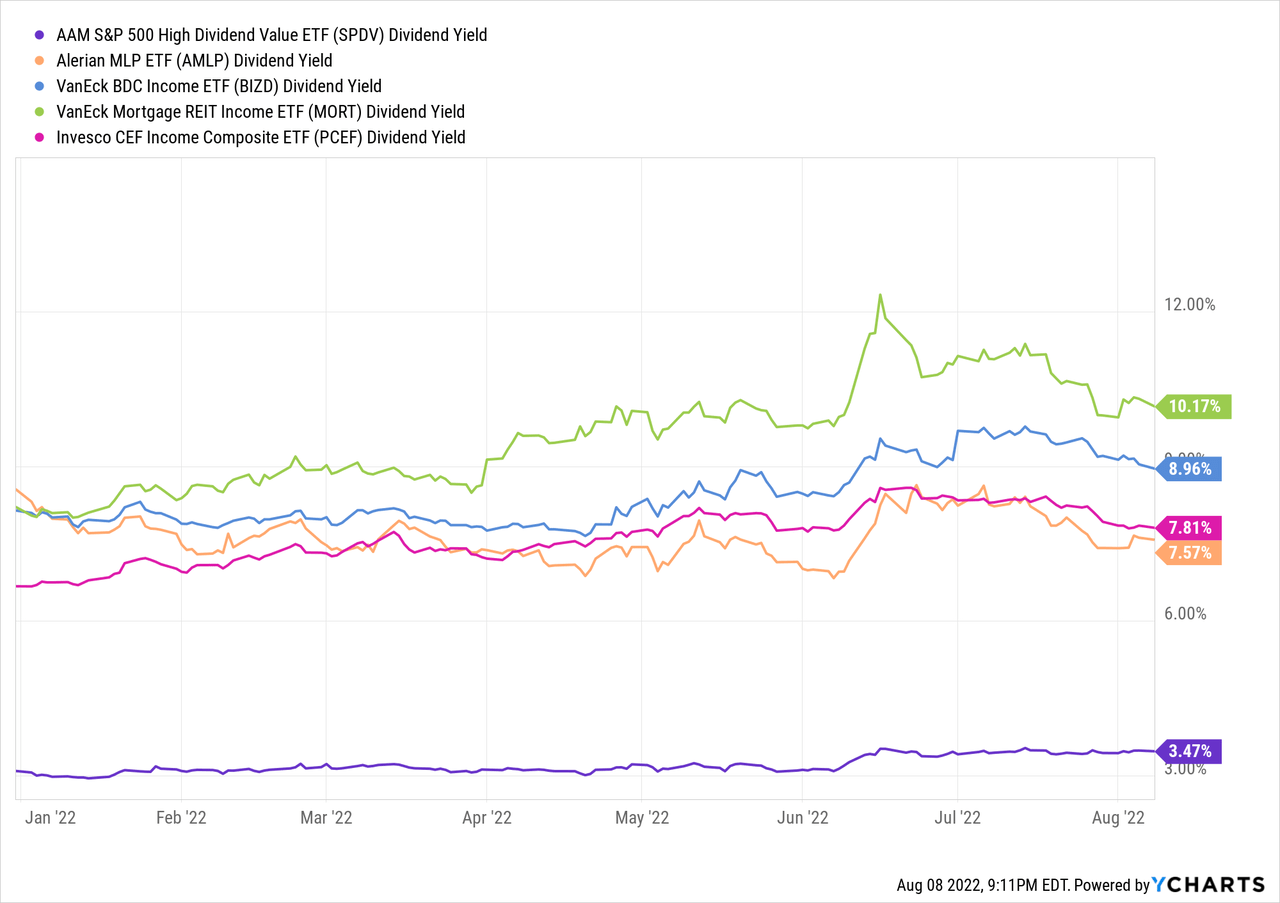

Although the fund’s dividends are higher than average, they are significantly lower than those offered by the highest-yielding asset classes and funds. MLPs, BDCs, mREITs, and most CEFs, yield quite a bit more than 3.4%, and might be more appropriate choices for more income-seeking investors.

High Free Cash Flow Yields

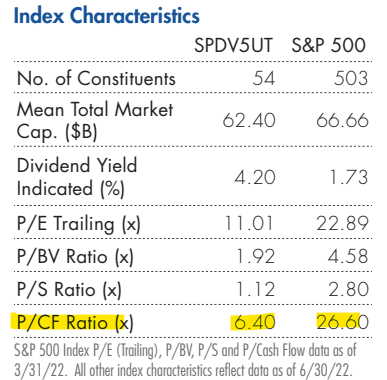

SPDV focuses on stocks with above-average free cash flow yields, a key valuation metric. Focusing on these stocks results in a fund with a comparatively cheap valuation, especially in the targeted metric, as one would expect. SPDV’s valuation metrics, in comparison to the S&P 500, are as follows.

SPDV

SPDV’s comparatively cheap valuation provides two key benefits for investors.

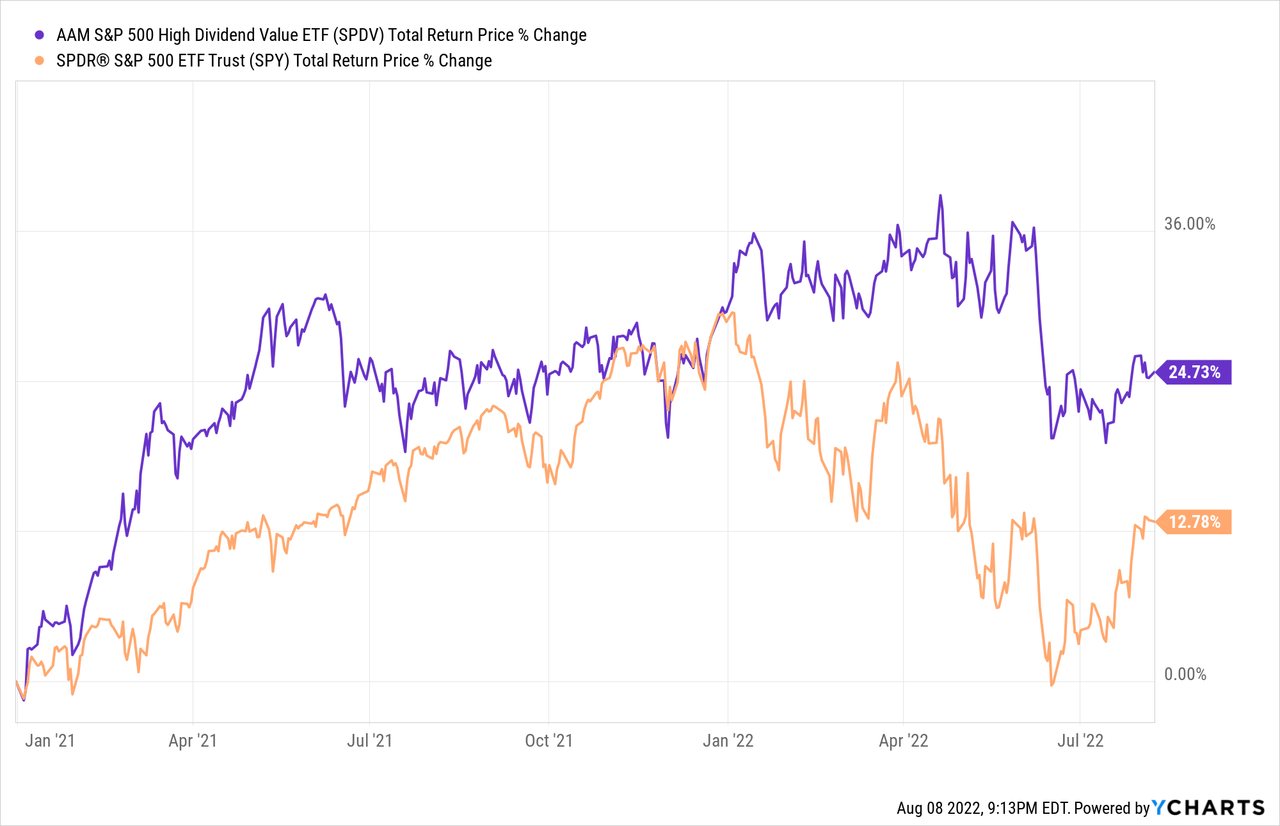

First, cheap valuations can always normalize, leading to significant capital gains and market-beating returns. Valuations have started to normalize since at least early 2021, with some volatility, and some reversals. SPDV has outperformed since, as expected. SPDV remains cheap, so further gains are likely, in my opinion at least.

Second, SPDV’s cheap valuation means the fund’s investors are entitled to a lot of assets, earnings, and cash, regardless of market conditions. As an example, SPDV sports a free cash flow yield of 15.7%, versus an S&P 500 FCF yield of 3.8%. SPDV’s underlying holdings generate a lot of cash, independent of market conditions, investor sentiment, or share price movements. Said cash can be used to buttress an investment’s price and returns, through dividends, buybacks, strategic investments, and the like. Investing in an asset that generates 15.7% in cash will net you returns of around 15.7%, sooner or later. At least assuming that cash flow generation remains strong.

A corollary to the above is that cheap valuations can also, in certain circumstances, reduce risk. In the event of a bear market, companies with free cash flow yields of 15.7% can pay massive dividends or engage in significant buyback programs with ease. These initiatives would increase investor demand for company stock, increasing returns / reducing bear market losses. Companies with free cash flow yields of 3.8%, so the average S&P 500 company, don’t generate sufficient cash to fund significant dividends or buybacks, and so would bear the full brunt of any downturn.

In any case, SPDV’s cheap valuation could potentially lead to significant capital gains and market-beating returns, a benefit for the fund and its shareholders.

SPDV – Performance Analysis

Finally, a quick note on the fund’s performance.

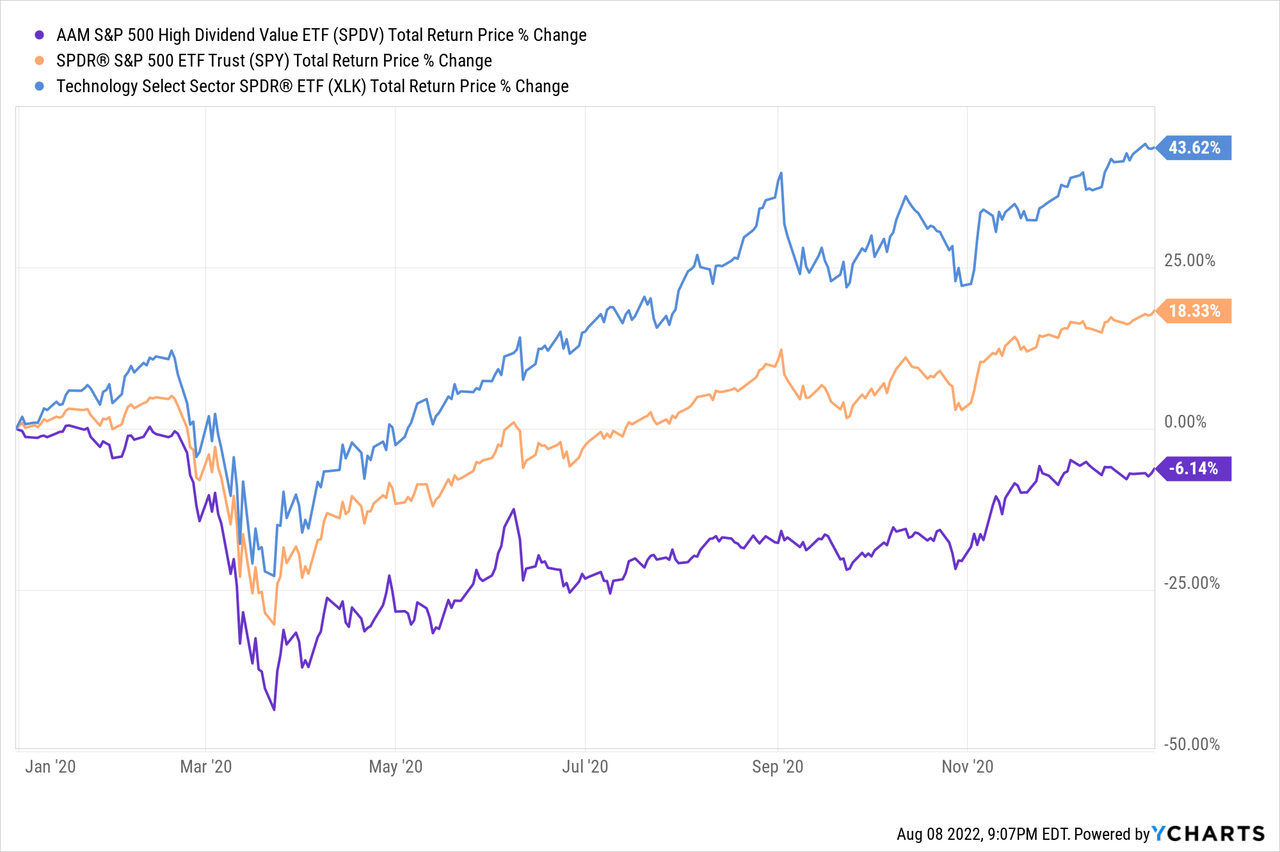

SPDV’s performance track-record is quite simple. The fund differs from its index in three key ways: equal-weighted sectors, focus on high dividend yield stocks, focus on high free cash flow yield stocks. The fund outperforms when these three strategies outperform, as has been the case YTD. The fund underperforms when said strategies underperform, as was the case before 2022 / during the past three years. SPDV’s performance is as follows, I’ve included data for the S&P 500, and several funds tracking each of SPDV’s individual strategies, for reference.

Seeking Alpha – Chart by author

Conclusion – Buy

SPDV’s above-average 3.5% yield and cheap valuation make the fund a buy.

Be the first to comment